-

PEPE pulled back to retest a significant support level before a potential price reversal

Key metrics highlighted PEPE’s resilience and possible bullish trends in the future

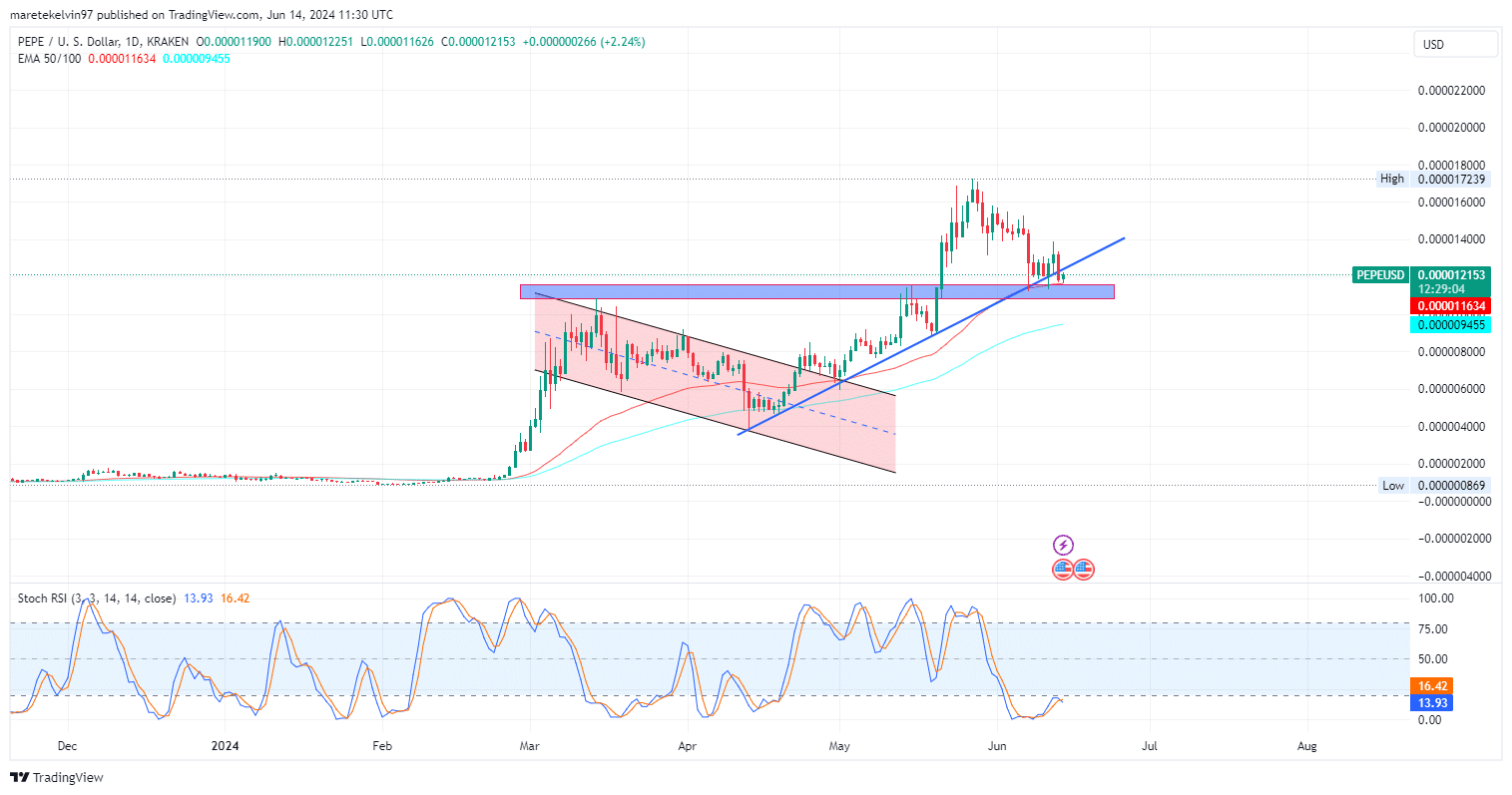

As a researcher with extensive experience in analyzing cryptocurrency markets, I find PEPE‘s recent price action intriguing. The token has pulled back to test a significant support level at $0.000015 before potentially experiencing a price reversal. This move could be the catalyst for a major rally on the charts if PEPE’s bullish trends continue.

PEPE has piqued the interest of investors recently, particularly when it approached a robust support line, hinting at a potential price reversal and the start of a significant upward trend if its emerging bullish trend gains momentum enough to cause a substantial price increase. Such a development could lead to a powerful rally on the charts.

PEPE’s price dropped 33.53% from May 28 to touch the support at $0.000015. For the last six days, PEPE has been hovering around this support level, with buying pressure gradually gaining strength. The trendline pointing upwards indicates a bullish trend in price action.

In simpler terms, the EMAs of 50 and 100 days for PEPE appeared to strengthen its position since the 50-day EMA trend was higher than the 100-day one, with PEPE’s price trading above both moving averages.

The stochastic RSI indicated that the market was slightly overbought, implying that PEPE could continue its upward trend following a brief period of consolidation. The alignment of this technical signal with PEPE’s support levels makes it an intriguing prospect for investors considering long positions.

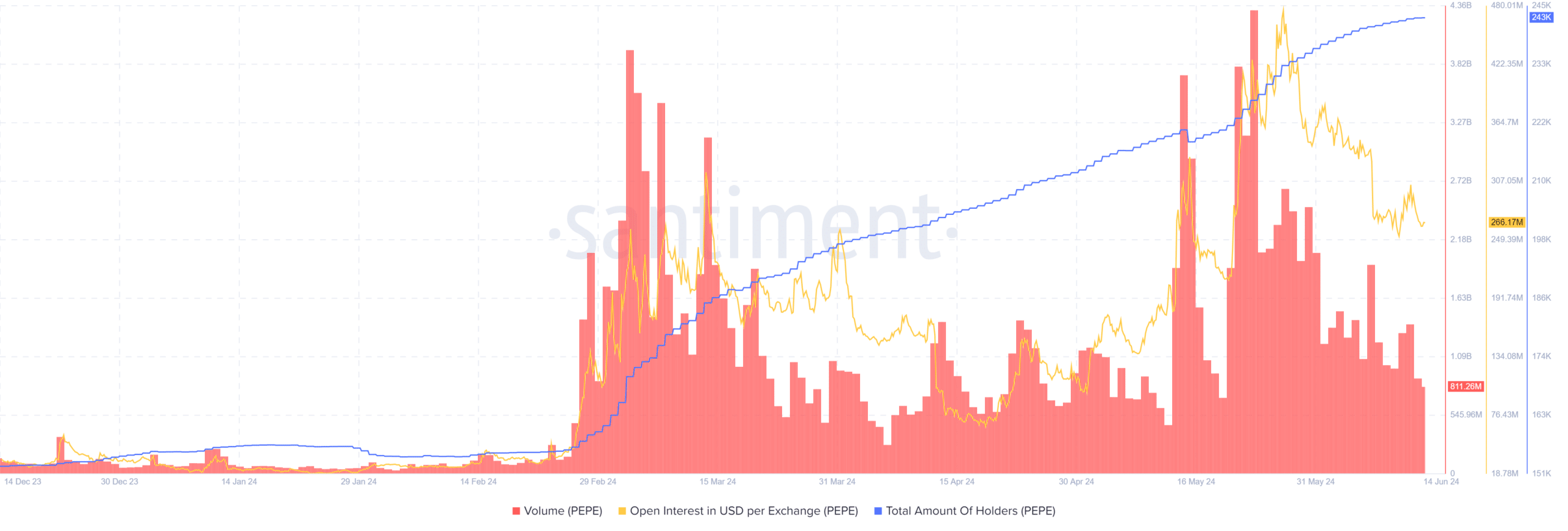

PEPE volume, open interest on USD exchanges flash bullish signals

In examining the data from AMBCrypto, it was noted that the volume and open interest for USD exchange of PEPE displayed notable increases. These spikes in volume suggested a heightened level of trading activity, which in turn attracted more investors as indicated by the rising open interest. This correlation underscores the growing interest and attention towards PEPE at this significant support level.

The collection of individuals holding PEPE tokens continued to expand at a consistent pace, mirroring increasing investor trust and the growth of token hoards. Given the prevailing market optimism, this significant support level could serve as a formidable bastion for the bullish forces.

What do liquidity dynamics have to add?

The difference in the total liquidity of buy and sell orders around the key support level showed that more buy orders were being placed than sell orders – a sign of increasing buyer interest. This imbalance in liquidity allowed buyers to prepare to protect the support level from potential price drops, leading to a bullish market outlook.

Is PEPE positioned for a reversal?

In simpler terms, the technical signs of increasing buyer interest, rising holder numbers, and favorable liquidity conditions suggest a optimistic market trend for PEPE. It’s recommended that investors monitor PEPE closely as it hovers near its support level, with a likely price increase anticipated in the future.

However, if the price falls past the support level, a retest of $0.000009 will be imminent.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-06-15 11:03