- A newly identified whale, “0x8f5,” withdrew 280 billion $PEPE tokens worth $5 million from Binance

- Whale accumulation has historically been a bullish precursor, particularly in low-cap tokens

A look at current blockchain information shows an increase in memecoin PEPE being hoarded by significant crypto investors – A hint that these large-scale investors are showing renewed enthusiasm for the well-known memecoin.

As an analyst, I’ve noticed an intriguing development: a new player in our whale watch, known as “0x8f5,” has made a substantial move by withdrawing approximately 280 billion PEPE tokens, valued at around $5 million, from Binance. This transaction stands out as a significant event within the PEPE token’s ecosystem. The strategic timing and size of this withdrawal suggest that a high-net-worth investor may be positioning themselves strategically, possibly in preparation for a potential market rally or significant upcoming event.

Historically, the behavior of whales (large investors) in meme tokens has usually predicted price fluctuations, attracting traders who want to benefit from these shifts. Currently, the mood around PEPE is becoming more optimistic, but traders should exercise caution. This is because whale-led accumulation can also lead to quick sell-offs once their profit targets are reached.

Market performance

As I pen this analysis, it appears that PEPE is showcasing tenacity amidst the turbulent crypto market, hovering around its crucial support level of $0.0000019. The spikes in trading volume hint at increasing attention not just from individual investors but also institutional players as well.

Historically, an increase in whale holdings (whales being large investors) has tended to be a positive sign, especially in tokens with lower market caps. This is because it usually indicates that these big investors have faith in the token’s future prospects.

In simpler terms, the broader conditions in the cryptocurrency market, like Bitcoin‘s stability and the rebound of altcoins, might have played a role in PEPE’s current performance. But it’s crucial to stay alert for any unexpected economic events or regulatory news that could potentially impact the market’s behavior.

For PEPE traders, the main concern revolves around whether the price will hold its current support level or drop lower to approximately $0.0000015 as depicted on the graph.

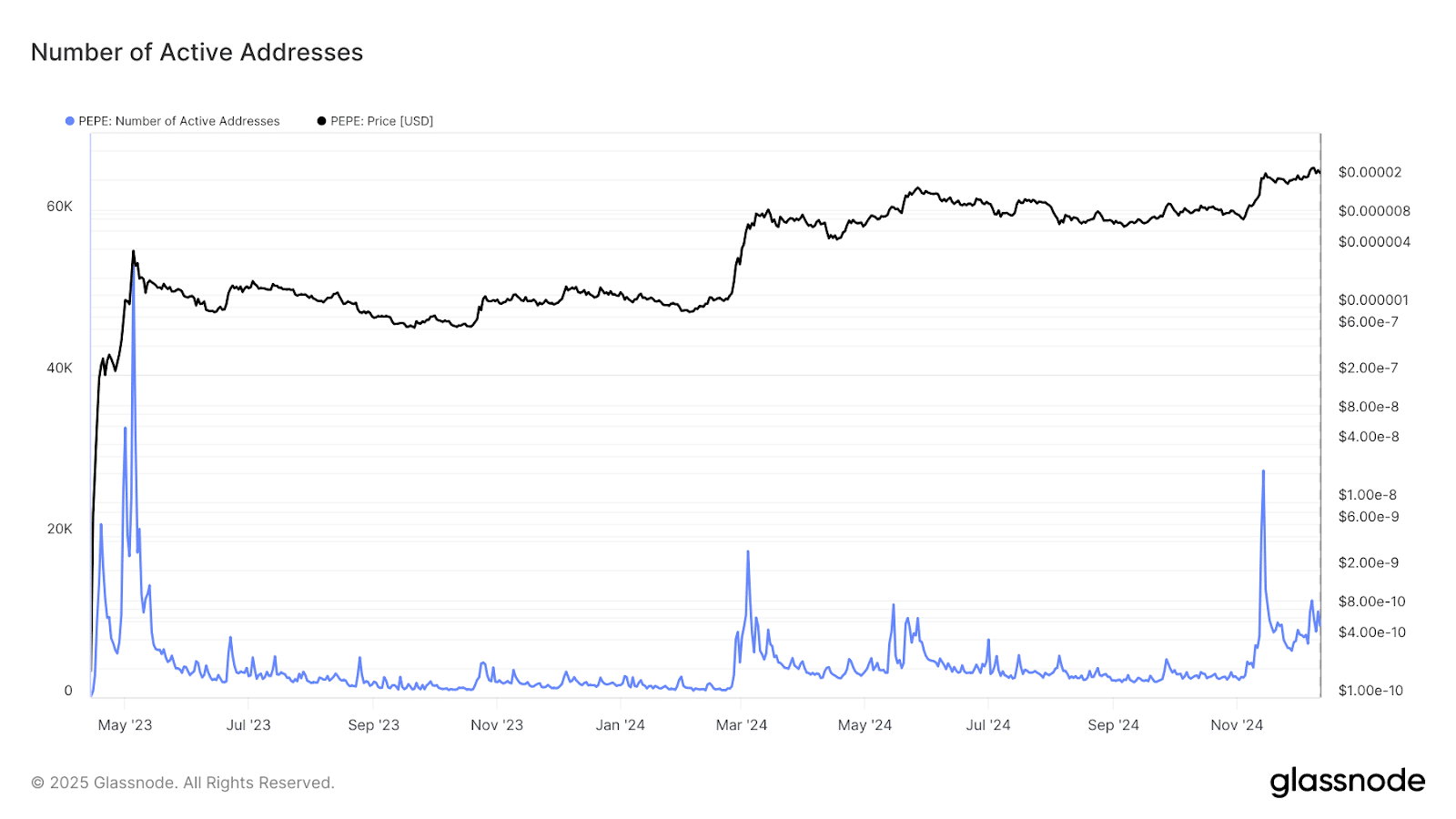

Active address analysis

Data on the blockchain showed an increase of 15% in active user wallets, suggesting growing user involvement. This statistic typically aligns with market volatility because it signals increased activity throughout the market, which can influence price movements.

An extended rise in active users (or addresses) might indicate a positive trend, especially when accompanied by steady transaction volume. Yet, traders must exercise caution, since a surge in active users could possibly signify larger holders transferring their assets to smaller traders, a phenomenon known as distribution.

If people engage in less activity, PEPE might experience a decrease in available funds (liquidity), potentially causing its price movements to trend sideways or downwards on financial charts.

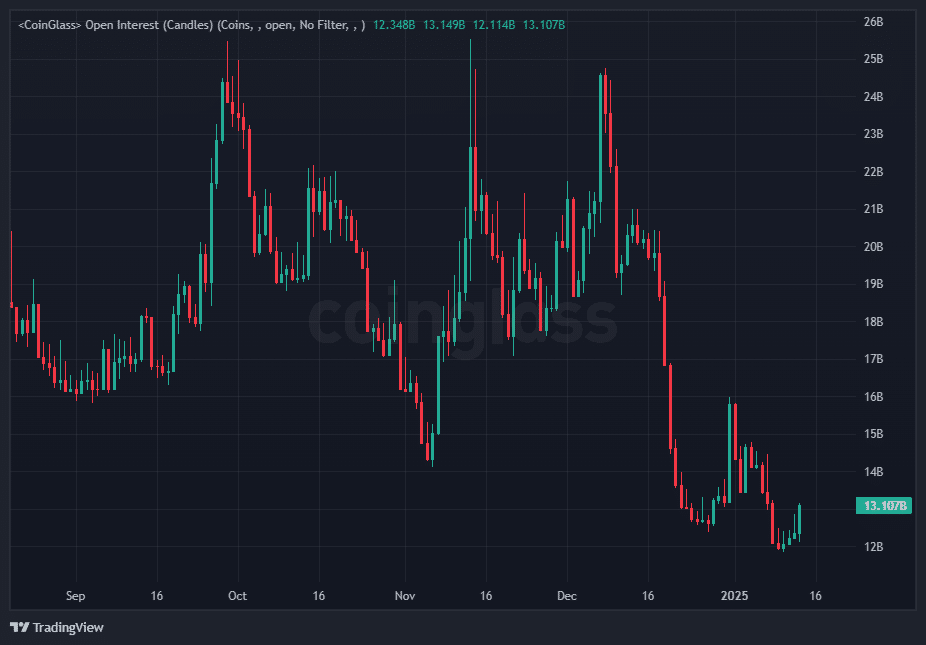

Open Interest analysis

Over the last two days, there’s been a 18% increase in open positions for PEPE Futures agreements. This suggests that there’s been more speculative trading activity recently.

As I pen this down, it appears that long positions are overwhelmingly prevalent in the market, constituting approximately 62% of the total Open Interest, reflecting a strong sense of optimism among the traders.

As a researcher studying the market dynamics of PEPE, I have observed that if PEPE manages to surpass its resistance levels, this could lead to an ongoing increase in Open Interest (OI), possibly igniting a rally. Conversely, should it dip below its support levels, this may initiate long liquidations, thereby intensifying the downward pressure on the market.

As an analyst, I’m observing that neutral funding rates currently suggest a fairly balanced market. However, it’s crucial for traders to stay vigilant, as any changes in these rates could potentially signal the emergence of more bullish or bearish sentiments within the market.

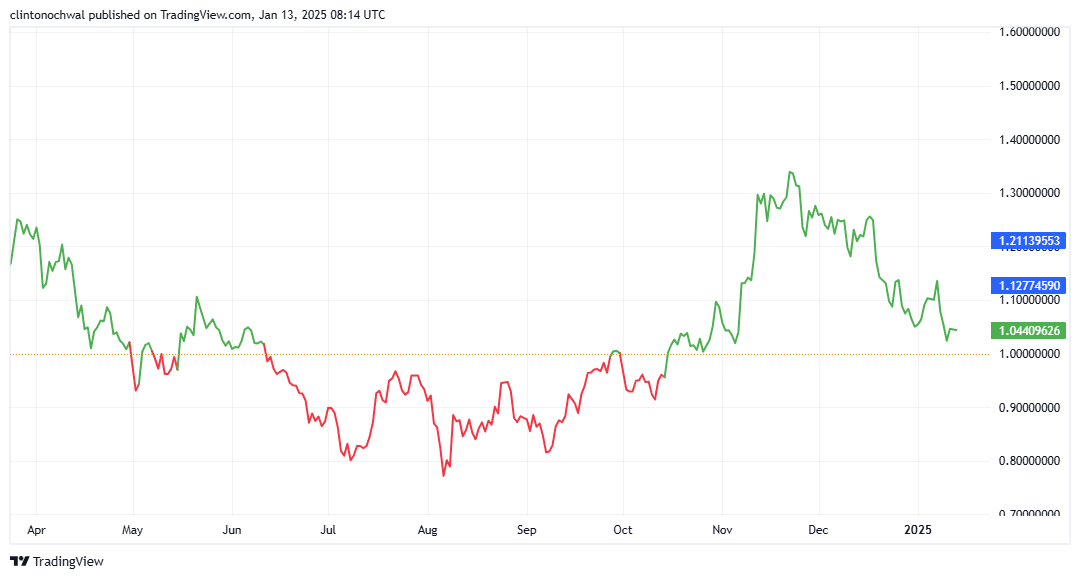

MVRV Analysis

In summary, the MVRV (Market Value to Realized Value) ratio showed a noticeable disparity between short-term and long-term investors. At this moment, short-term investors are experiencing an average loss of -8%, while long-term investors continue to profit at 12%.

This gap suggests that there might be less demand from inexperienced or uncertain sellers, possibly opening up opportunities for an increase in prices.

If the temporary MVRV ratio shifts towards positive values, it may suggest increased buying enthusiasm, potentially causing a price surge. Conversely, falling beneath crucial resistance levels could exacerbate losses for short-term investors, increasing market volatility and potential instability.

Currently, PEPE’s market standing is at a crucial point in time. The buildup of large investors (whales), the rise in active user addresses, and increasing Open Interest suggest that the market is becoming more active. Nonetheless, whether or not the token can hold onto crucial support levels will be decisive for its future direction.

A balanced outlook persists, considering the possibility that positive (bullish) or negative (bearish) trends might unfold, influenced by the ever-changing market conditions and overall cryptocurrency climate.

Read More

2025-01-14 04:08