- Peter Schiff criticized MicroStrategy’s stock despite it reaching an all-time high.

- MicroStrategy’s Bitcoin portfolio’s market value boosted to over $40 billion, despite volatility.

As an analyst with over two decades of experience in the financial industry, I find myself intrigued by the ongoing saga between Peter Schiff and MicroStrategy. Schiff’s skepticism towards Bitcoin is well-documented, stemming from his deep-rooted faith in gold as a store of value. His latest critique of MicroStrategy’s stock, despite its impressive run, seems to be an extension of this longstanding perspective.

Once more, Peter Schiff, a well-known critic of cryptocurrencies, has directed his criticism towards the company led by Michael Saylor, MicroStrategy.

In a recent post, Schiff issued a stark warning about MicroStrategy’s stock (MSTR), which has recently reached an all-time high following the company’s ambitious plan to transform it into a trillion-dollar Bitcoin [BTC] bank.

Once more, Schiff’s persistent doubt towards companies heavily involved with cryptocurrencies, particularly Bitcoin, is evident in this case.

On the 22nd of October, he posted on X (formerly Twitter), saying,

$MSTR appears to be the most overpriced stock within the MSCI World Index. When it eventually experiences a downturn, that could lead to a significant market drop.

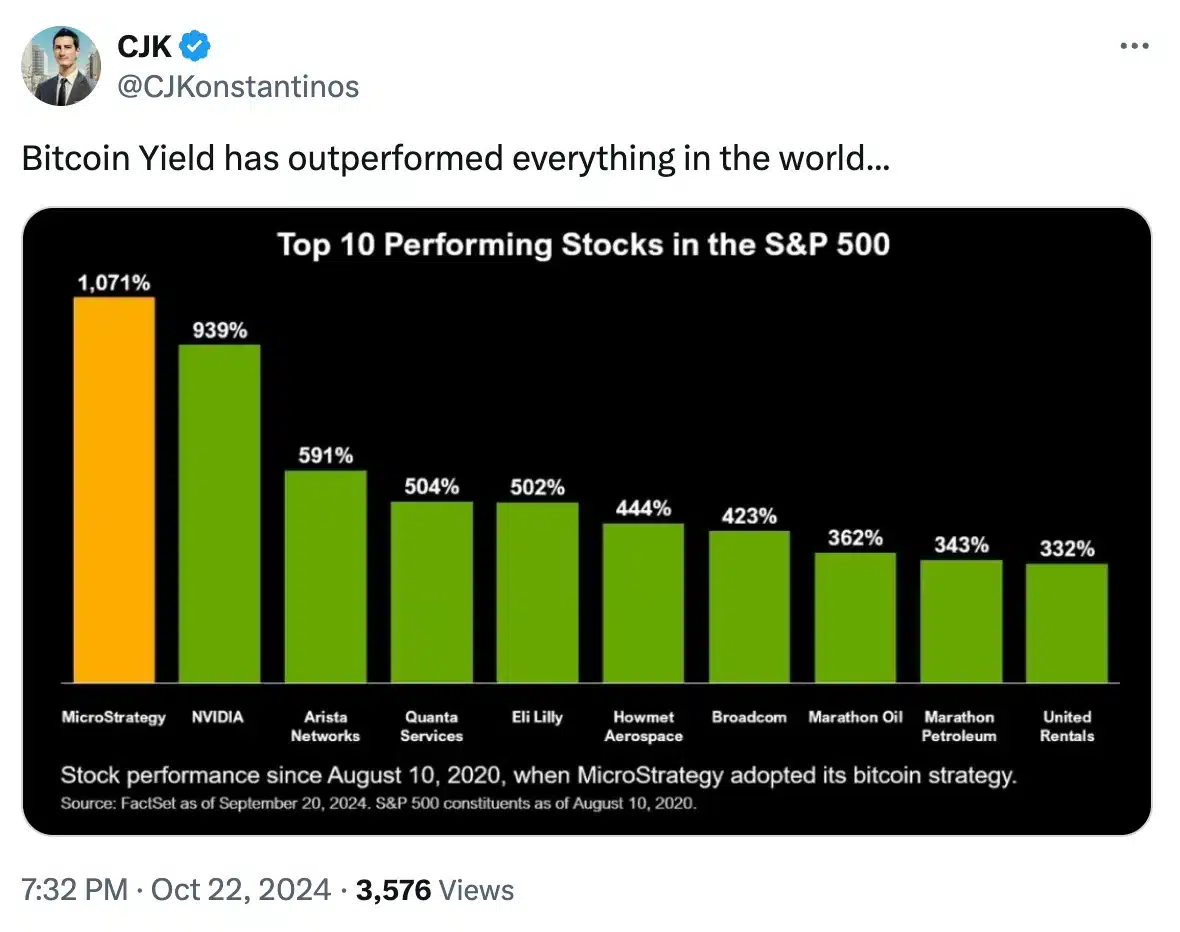

Nevertheless, CJ Konstantinos pointed out in a recent post that the warning was generally viewed with skepticism.

However, Schiff pressed on with his argument, asserting his points and claiming,

Bitcoin does not produce returns or interest like other investments do. Instead, its value can increase over time which results in capital gains when sold. Additionally, options can be written on Bitcoin to generate income. However, Bitcoin itself does not provide a yield. On the downside, owning it within an ETF may come with custody fees.

Why is Schiff against Bitcoin?

Over the years, Schiff – well-known for his support of gold and outspoken critic of digital currencies like Bitcoin – has repeatedly expressed doubts about its validity.

He often contends that Bitcoin (BTC) primarily functions as a speculative asset, devoid of the inherent worth typical of conventional investments such as gold.

Through this, he has become a significant player in the ongoing discussion pitting Bitcoin supporters against traditional finance advocates.

On the other hand, MicroStrategy’s strategic pivot toward BTC has proven to be highly lucrative.

In the last four years, the company’s market worth has soared dramatically from $1.5 billion to more than $40 billion. A significant portion of this increase can be attributed to Michael Saylor’s daring move to invest significantly in Bitcoin.

This move has positioned MicroStrategy as a major Bitcoin player, controlling 252,220 BTC.

Schiff takes a jab at Saylor

Recently, during a conversation centered around Bitcoin that was confiscated from the Silk Road marketplace, Peter Schiff playfully took aim at Michael Saylor.

Schiff jokingly suggested that Saylor might want to take out a loan for $4.3 billion in Bitcoin from the government, which could then be used to increase MicroStrategy’s substantial Bitcoin reserves even more.

This sarcastic remark highlights Schiff’s ongoing criticism of Saylor’s aggressive Bitcoin strategy, while subtly mocking the company’s deep commitment to expanding its cryptocurrency assets.

During these discussions, MicroStrategy’s stock price saw a small rise of 0.30%, climbing up to $219.70. This indicates that investors remain confident about the company’s Bitcoin-centric approach.

Meanwhile, there was a minimal decrease of 0.93% in Bitcoin’s value during the last 24 hours, causing it to be priced at approximately $66,947.37 at the moment, according to CoinMarketCap.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-23 15:36