In Breif

- Pi Coin (PI) is consolidating below $0.65 and nearing a critical support level at $0.60.

- Technical indicators, including RSI, MACD, and the Ichimoku Cloud, are signaling increasing downside pressure.

- Daily trading volume has dropped by over 90% since May, with on-chain engagement stalling.

- Scalping opportunities may still exist on the 4-hour timeframe, though broader sentiment remains cautious.

- All eyes are on Pi Day 2 (June 28), which is expected to determine the token’s short-term trajectory.

Technical Indicators Suggest Weakness

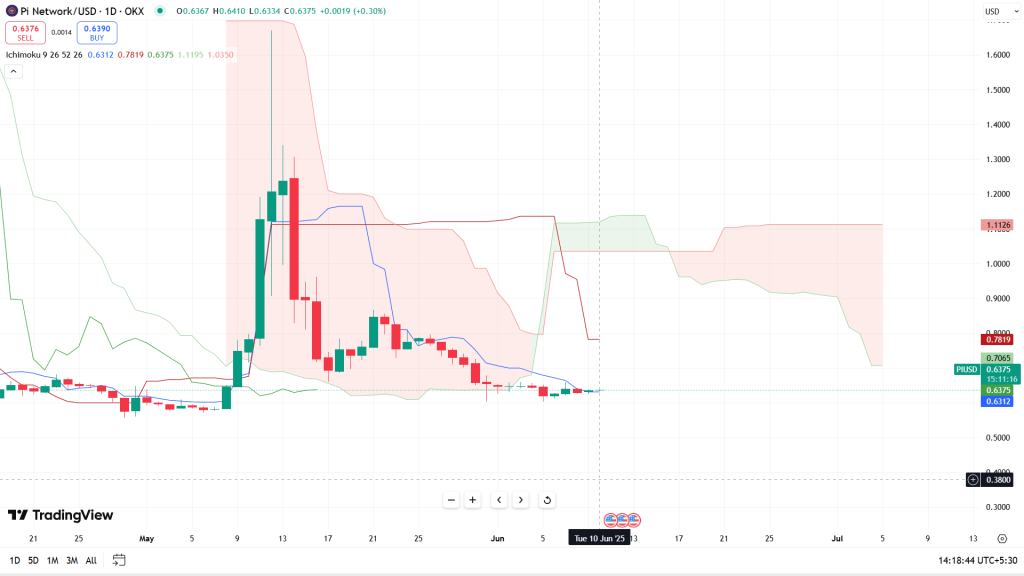

Currently, Pi Coin is hovering slightly above a significant support point at approximately $0.60. On the daily chart, its price movement appears to be shaping like a traditional descending triangle, which is often interpreted as a bearish trend continuation pattern.

As an analyst, I’m observing that the Relative Strength Index (RSI), which measures the speed and change of market movement, is currently below 45 and showing a downward trend. This suggests that the bullish strength in the market is lacking at the moment. Additionally, the Moving Average Convergence Divergence (MACD) is consistently printing red histogram bars, signaling the persistence of bearish momentum.

According to the Ichimoku Cloud analysis, the current trend is supported as the price lies beneath the cloud, and the Chikou Span indicates a delay, hinting at ongoing bearish or downward pressure.

If Pi doesn’t climb significantly over the downward trendline around $0.75, the technical indications point towards a possible drop below $0.60. The significant support level in this case lies at $0.38.

On-Chain Data Underscores Demand Drop

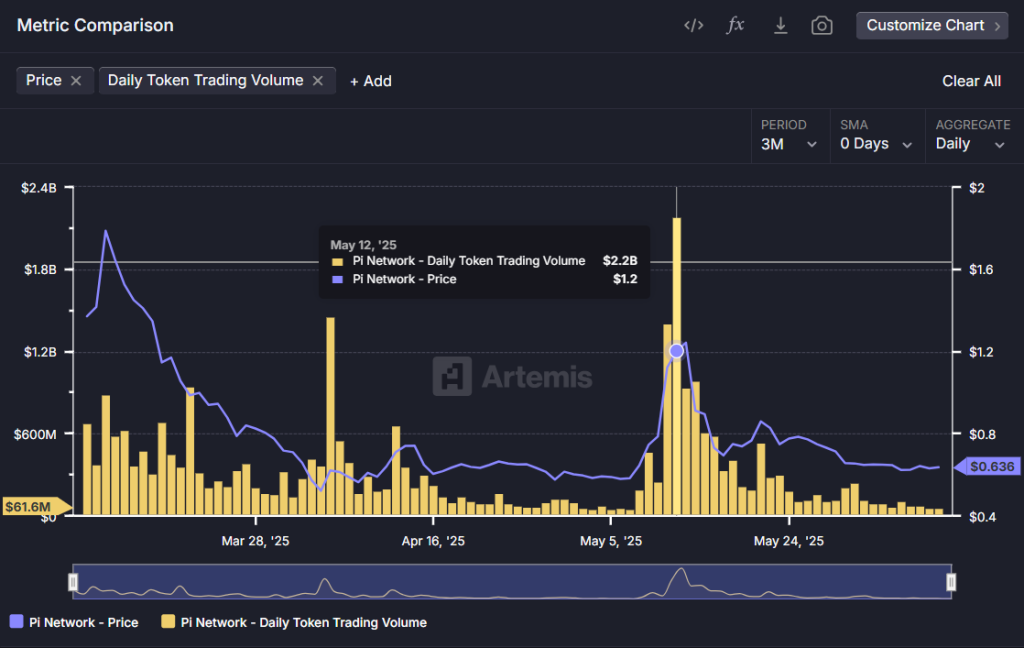

On-chain metrics reinforce the bearish outlook. According to Artemis data:

- Daily trading volume has plunged from over $2.2 billion in mid-May to under $62 million by June 10—a decline of more than 97 percent.

- The 24-hour trading volume to fully diluted market cap (FDMC) ratio has fallen to just 0.09 percent, reflecting low liquidity and waning speculative interest.

In my experience as a crypto investor, although a reduction in supply might be beneficial in the long run, it hasn’t managed to counterbalance the absence of demand or positively impact price fluctuations in the current market conditions.

Scalping Strategy on the 4-Hour PIUSDT Chart

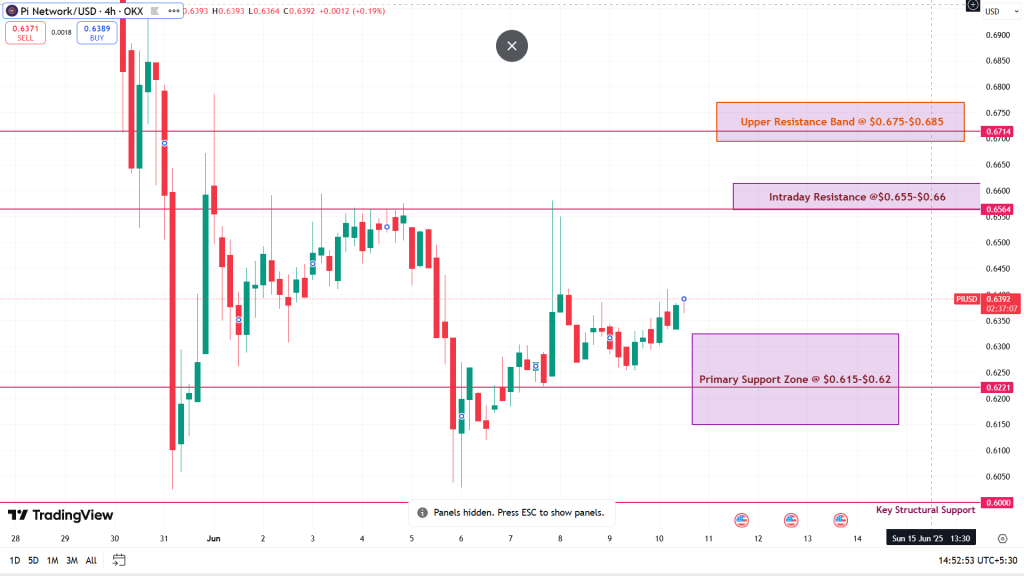

On June 10, 2025, Pi Coin (PI/USDT) is approximately trading at $0.6375. This digital currency has been confined to a narrow price movement between $0.62 and $0.66 over the past four hours on its chart. While short-term indicators point towards a gradual increase in bullish sentiment, the overall trend remains ambiguous.

Right now, the Relative Strength Index (RSI with a period of 14) stands at approximately 53.36, suggesting moderate strength. Meanwhile, the Moving Average Convergence Divergence (MACD) has created a slight bullish crossover, with MACD value being 0.0015 and Signal line at 0.0014. This suggests a possible setup for short-term trading, specifically around clearly defined price ranges.

In a favorable scenario, when RSI drops into the range of 35-40 and starts to rise again, accompanied by a MACD histogram flip to green and an increase in volume surpassing the four-bar average, long setups can become beneficial. An instance of this occurred on May 31, where the price climbed from $0.60 to $0.655 (+9%) following similar conditions.

If the Relative Strength Index (RSI) nears the range of 63-65 and starts to decline, while also observing a MACD bearish crossover along with high-volume rejections, such short setups might be worth considering. This setup was observed on June 4, leading to a decrease in price from $0.665 to $0.625, amounting to approximately a 6% drop.

Scalpers ought to keep their stop-losses relatively close (around 1.5% to 2%) and look for swift exits at nearby resistance or support levels, concentrating on trades within the $0.62 to $0.66 range until a breakout signals a larger shift.

Pi Day 2: A Defining Event

On June 28th, the Pi Day 2 event is predicted to mark a significant milestone for our project. The community is excitedly awaiting three major advancements:

- A clear timeline for the Open Mainnet, which is necessary for centralized exchange listings.

- The unveiling of decentralized applications (DApps) and real-world merchant integrations.

- Official clarification regarding the Global Consensus Value (GCV) of $314.159.

If these projects are successfully completed with solid results, there’s a good chance Pi could make a significant comeback, possibly even reaching or surpassing $1.00. However, if the event turns out to be unclear or only produces vague commitments, its price might weaken, potentially causing a more substantial drop below the current $0.60 level, leading to further corrections.

Analyst Outlook: Short-Term Speculation

In the short run, Pi Coin is at a crucial stage. As technical energy wanes and on-chain actions slow down, it seems probable that there will be a phase of horizontal movement between $0.55 and $0.80. The market is expected to remain uncertain until the Pi Day 2 event provides some direction.

As I delve into my analysis of Pi, I find that while a bullish breakout is plausible, it hinges on a robust and implementable strategy, particularly focusing on mainnet deployment and exchange readiness. If these milestones are achieved, Pi could surge within the $1.00 to $2.50 range. Yet, if the set goals aren’t met or the market sentiment weakens more, a bearish break below $0.60 may ensue, possibly causing the token to plummet toward $0.50 or even $0.30.

Currently, the indications suggest a downtrend. It appears that the market will maintain its current position until more information becomes available from the Core Team.

Pi Coin Prediction: Short-Term Uncertainty Persist

As a crypto investor, I see the long-term potential in Pi Network due to its innovative architecture and mobile-first consensus model, coupled with a massive user base and active community engagement. However, it’s important to acknowledge that short-term challenges remain. Technical glitches, decreased trading volume, and the lack of listing on major exchanges such as Binance could leave Pi Coin exposed to potential risks.

As long as the Pi Core Team does not show substantial advancement, particularly in relation to the Open Mainnet launch and ecosystem expansion, the price of $0.60 will serve as a significant dividing point between potential growth and possible rejection. [source: markets.coinpedia.org/pi/]

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2025-06-10 14:19