Picture this: the graciously glamorous Pi coin, teetering at the edge of collapse! The mob’s in hysterics, shorts are stacked higher than a debutante’s beehive at Ascot. Yet, wait—behind the curtain, a deliciously sly divergence whispers: things may not be quite so dire after all. 🎩

While exchange inflows swell most alarmingly and traders hurl themselves at short positions with the zeal of a dowager at closing time, an inconspicuous reversal tiptoes about, brewing up a potential plot twist for the ages.

Exchange-Based Caution Remains High (And So Do Heart Rates!)

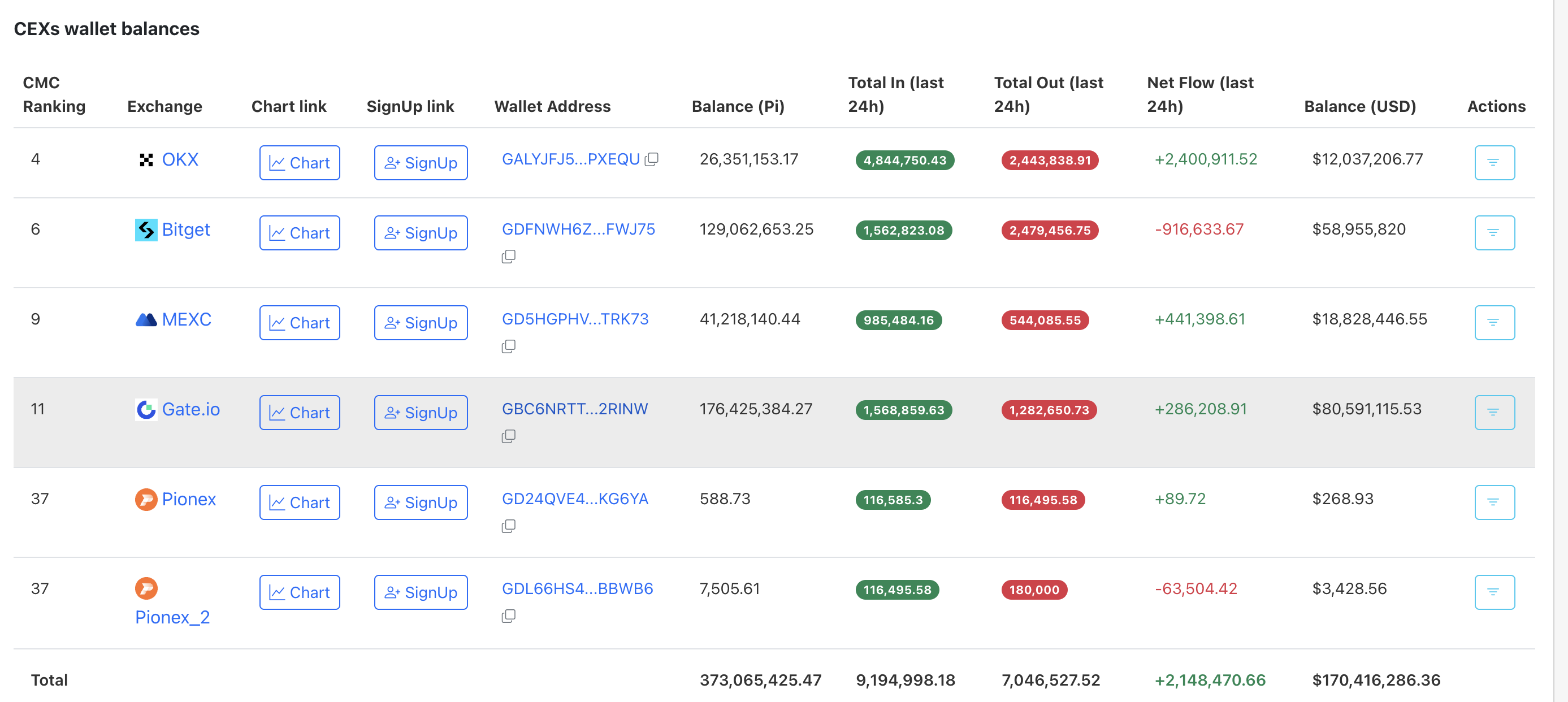

Oh, the agony! For two whole months, Pi coin’s exchange reserves have ballooned like a soufflé on too much sherry. Recent spikes show everyone nudging their coins to the dance floor—more sellers, apparently, than an antique shop after a royal bankruptcy.

Why, the latest data table is simply brimming with net inflows, absolutely trouncing outflows at every major exchange. If you’re bullish, you might consider taking up yoga. Or knitting. Far less nerve-wracking. 🧘♀️

Funding Rates: Negative and Neglected

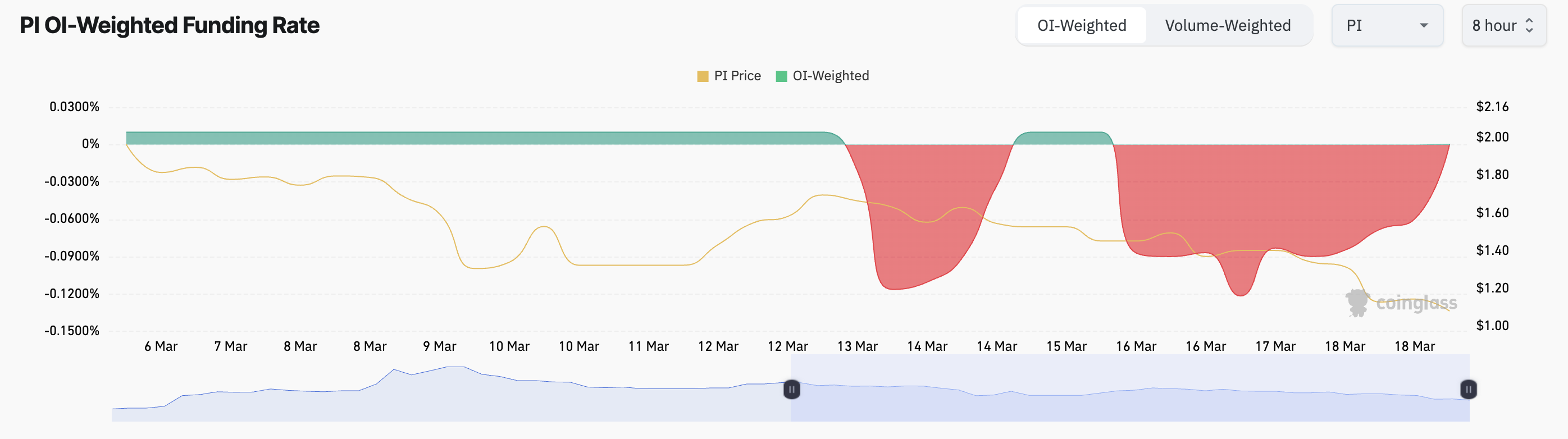

The funding rates? Still so negative, they make a dowager’s opinion of modern art sound positively flattering. Anyone holding longs is quietly pocketing payouts from the hordes circling with short contracts—a clear sign most expect Pi to drop faster than gossip at a garden party.

The Funding Rate, for the uninitiated, is the fee spectacle between those rooting for disaster (shorts) and those who’d rather not speak of unpleasantness (longs). All this negativity screams “bearish conviction,” though no one has fainted yet.

Listless Bulls: Is This the Boxing Day of Cryptocurrency?

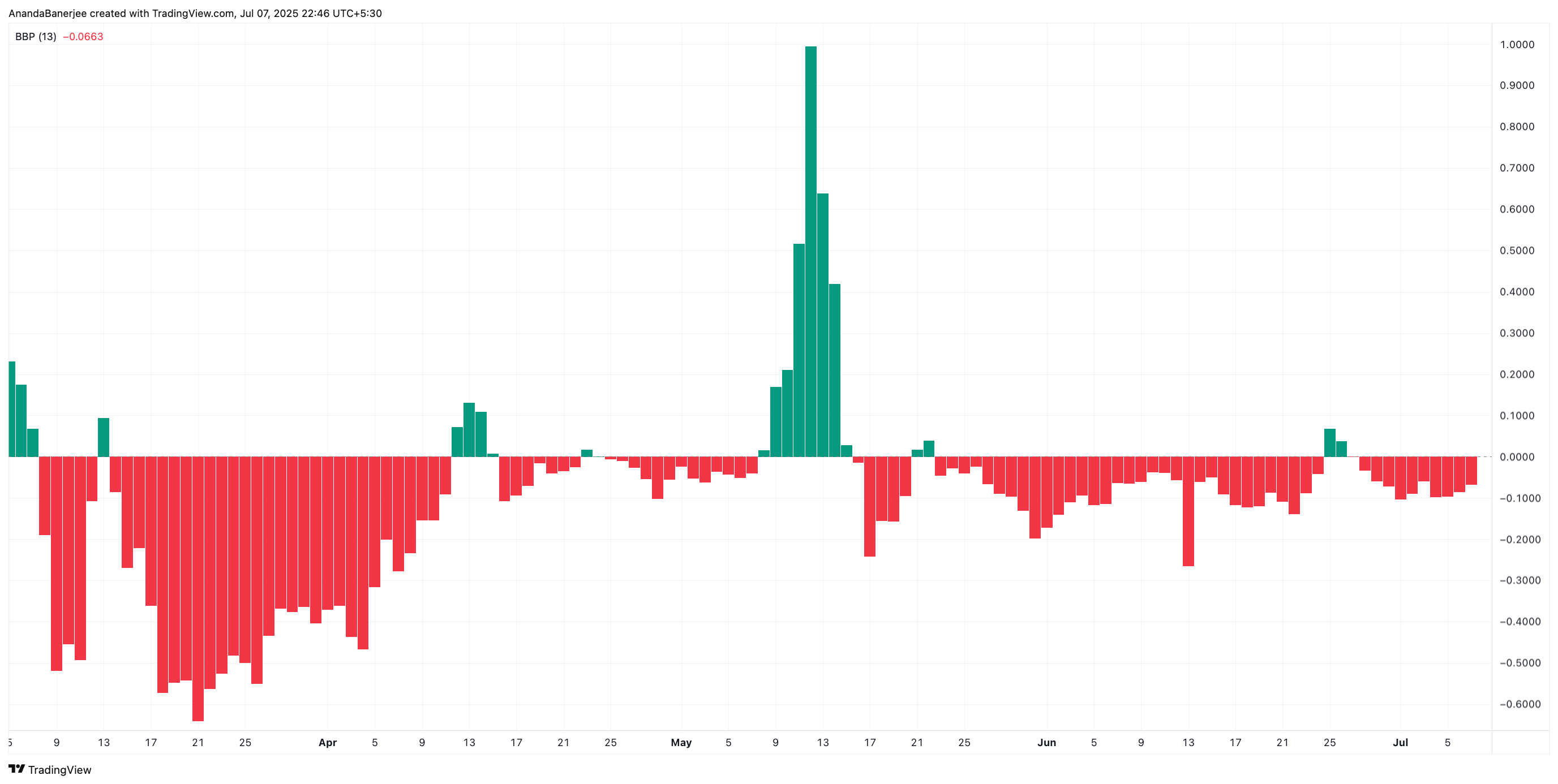

The Elder Ray Index, true to its name, looks positively exhausted. Bulls are as quiet as guests at a dry wedding, and the Bear Power—well, yes, those consistent red bars are there, but fresh drama is notably absent. A lack of new bear chaos? Spiffing. One might even dare to feel peckish for optimism… briefly.

This index, meant to uncover who’s wearing the trousers (buyers or sellers), currently suggests the bulls are struggling to find theirs. Yet all-out surrender appears delightfully unfashionable—for now. 🐂

Hidden Hope: The RSI’s Elegant Plot Twist

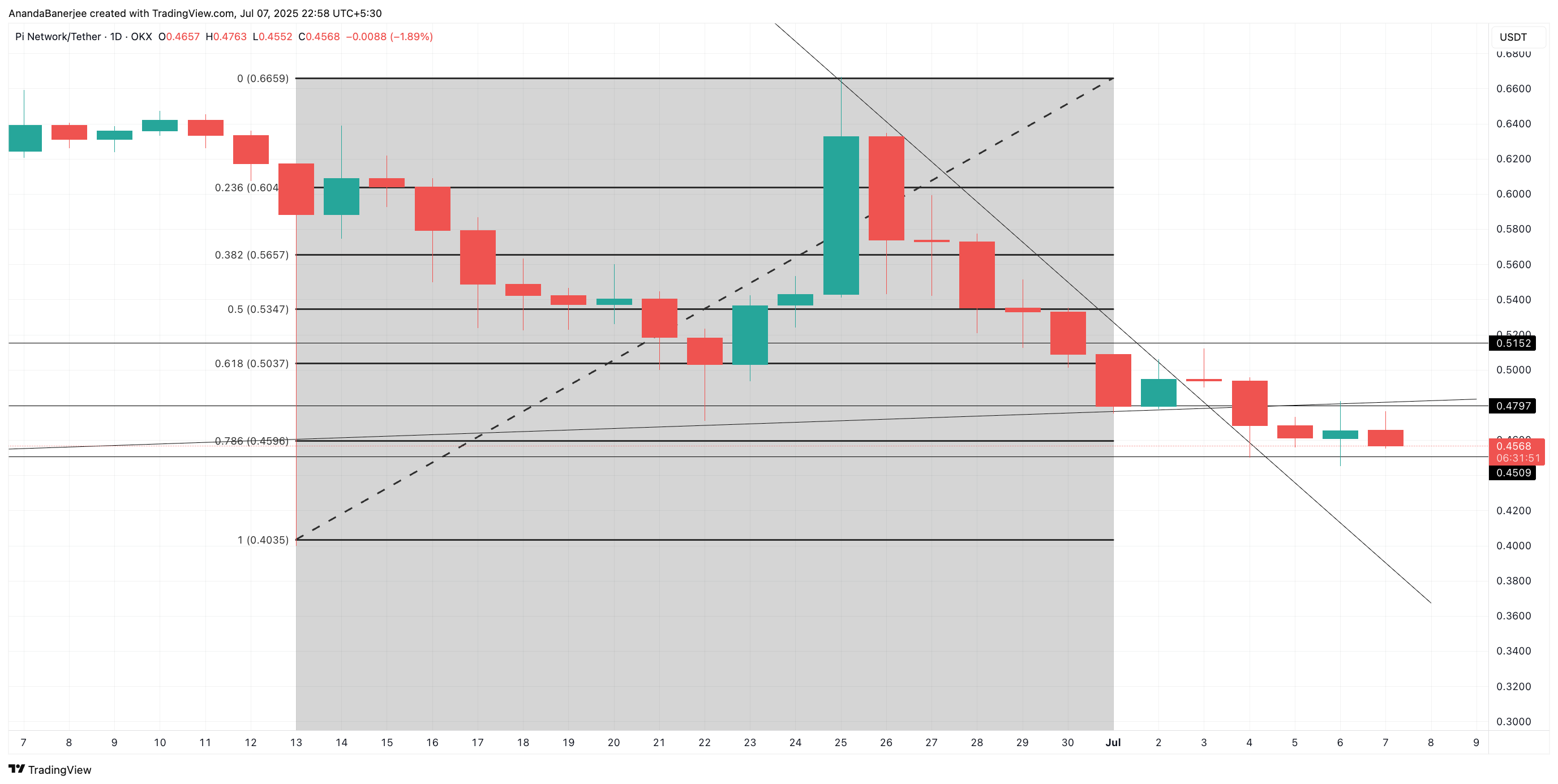

Enter: the RSI, with the subtlety of a martini at breakfast. Despite Pi’s price descending with all the dignity of a pratfall, the RSI is quietly notching higher lows, a sure hallmark of the ever-so-secretive hidden bullish divergence. One might say: it’s not dead—just resting. 🥂

While the price sulks, the RSI whispers conspiracy—a reversal may be afoot, brewing in the background, just waiting to spoil everybody’s doomsday party.

Should this dashing divergence blossom into action, the resistance parade lines up at $0.4797 and $0.5152. Burst through those velvet ropes, and $0.60 beckons alluringly in the distance. The ever-faithful Fibonacci, drawn from one emotional swing to another, offers us still more resistance rondos: $0.5037, $0.5347, and $0.5657—marvellous numbers, if you’re the sort of person who gets excited about percentages and retracements at brunch.

The Fibonacci indicator, ever patient and genteel, marks out possible stopping points should Pi decide to put on a show of support—or resistance, depending which way it wakes up that morning.

But—and there’s always a “but”—should Pi price forsake the $0.4035 support zone, the entire bullish opera takes a nosedive, and we may all be invited to the bears’ lamentable afterparty down below. 🎭

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Gold Rate Forecast

- Best Thanos Comics (September 2025)

- Best Shazam Comics (Updated: September 2025)

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Resident Evil Requiem cast: Full list of voice actors

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- Wicked Recap: 5 Biggest Things To Remember Before Watching Wicked: For Good

2025-07-08 11:41