- dogwifhat’s price doth continue to plummet, as esteemed analysts predict further misfortunes. 📉

- Controversy over a tardy Las Vegas advertisement adds to WIF‘s growing market tumult. 🎭

dogwifhat [WIF] hath recently garnered much attention in the marketplace, but alas, not in the anticipated fashion. Following a precipitous decline of 19% within but a single day, the anxiety concerning its immediate course hath reached its apex.

Adding fuel to this already roaring fire, the reputable analyst Ali Martinez didst recently share a prognostication, suggesting that WIF might well be destined for even further losses, potentially descending unto $0.51, owing to the manifestation of a bearish flag pattern. 🔮

Meanwhile, this fabled memecoin hath also found itself embroiled in controversy surrounding a crowdfunded campaign aimed at the illustrious Las Vegas Sphere. 🎲

Despite the ardent assertions from the dogwifhat faction regarding ongoing parleys for this high-tech advertisement, a representative from the esteemed venue did deny any such agreement, leaving the faithful community even more disheartened.

With the market in a disordered state and WIF enduring significant sell-side pressure, one must ponder whether this current scenario presents a splendid buying opportunity, or if the worst is yet to emerge on the horizon? 🤔

A Bearish Flag Prognostication

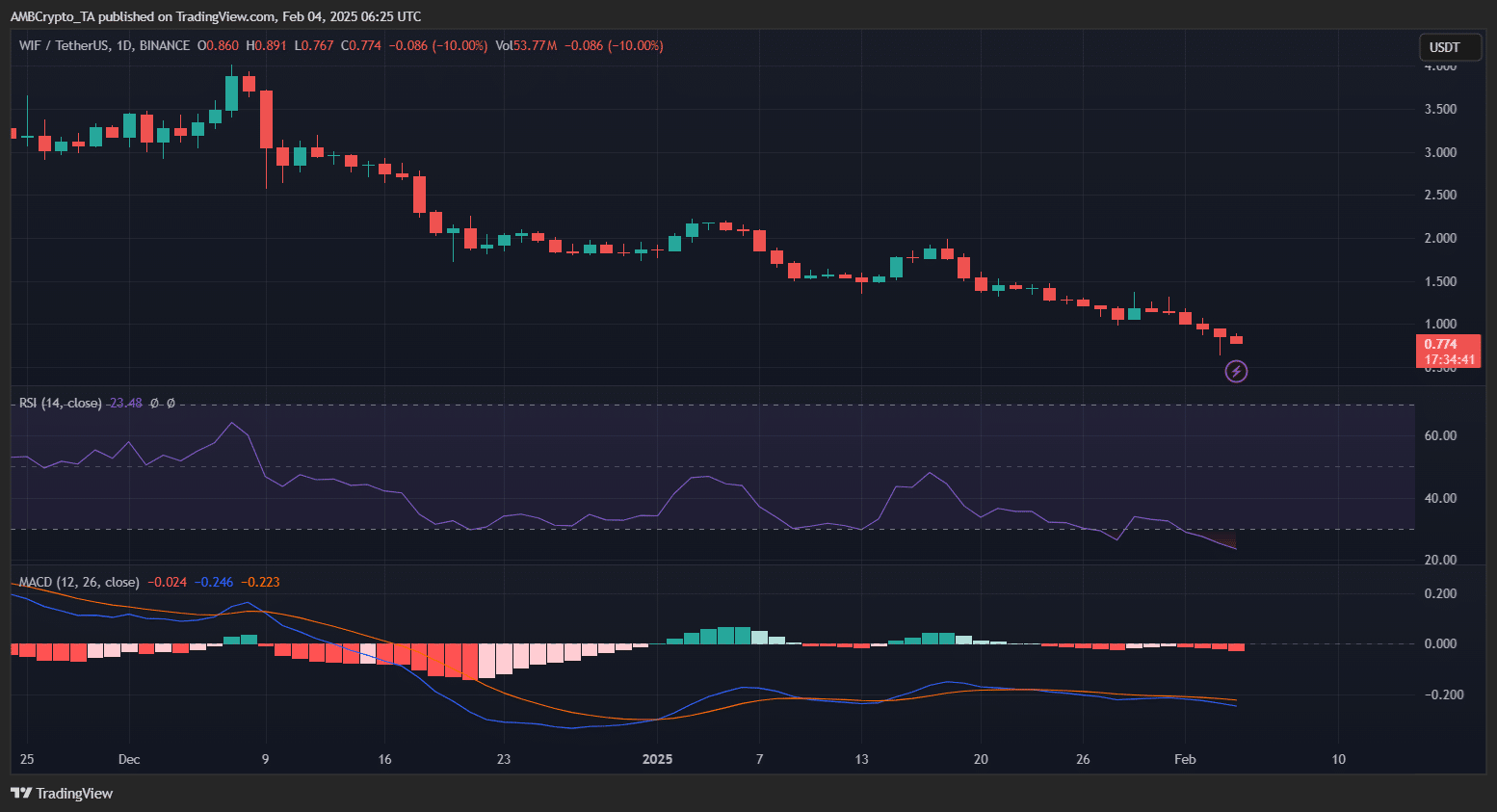

Analyst Ali Martinez’s recent oracle foretold a classic bearish flag formation upon WIF’s chart.

Having suffered a steep 19% depreciation, WIF hath been consolidating within a narrow range, forming a rectangular pattern — a hallmark of potential continuation to the downside. 🚩

The resistance level at approximately $0.78 hath recurrently curtailed price action, whilst support lingered nigh unto $0.70.

Should this pattern fulfill its ominous promise, the predicted decline could steer dogwifhat towards Martinez’s portentous target of $0.51, aligning with the measured move principle of such flag patterns. 🚀

However, a pronounced breakout above the resistance might dash such forebodings, rendering the subsequent movements of paramount interest to traders monitoring WIF’s traversal.

Further Decline or Potential Resurgence?

WIF’s downward spiral doth persist, trading at $0.774 at the time of this quill’s endeavor — a notable 9.88% decline daily. The RSI hath plummeted to 23.50, deep into the oversold realm, signaling an extreme bearish vigor. 🚨

Historically, such diminished RSI levels may hint at a potential short-term recovery, yet sustained selling pressure might prolong this descent. ⏳

The MACD remains irrevocably bearish, with the signal line well above the MACD line, fortifying negative momentum. Additionally, the histogram bars continue to expand in the crimson, displaying no immediate signs of a bullish reversal. 📉

Realistic or not, behold WIF’s market cap in BTC‘s terms

Immediate support lies at approximately $0.70, a breakdown below this could validate the $0.51 target. Conversely, resistance resided at $0.86, requiring a decisive breach to signal potential recovery. 🚪

Though oversold conditions might whisper of a possible relief rally, the prevailing trend remains bearish unless the buying volume substantiates significantly.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-02-04 22:35