- PNUT now seeks demand zone to push forward.

- Technical indicators point toward a slight pullback, allowing the asset to stabilize before any further gains.

After closely observing the performance and technical indicators of PNUT over the past few weeks, I must admit that my fascination with this meme token has grown exponentially. However, as a seasoned researcher, I’ve learned to respect market trends rather than chase them blindly.

In the last few weeks, the meme token PNUT has been among the top-yielding investments. It has experienced an astounding 1,610.05% rise during the past month alone, a 561.21% upward trend in the last week, and a swift 60% jump even within the past day.

According to fresh findings from AMBCrypto, there’s a possibility that PNUT might experience a phase of stabilization, temporarily halting its climb as it prepares for another surge in its price increase.

Bearish shift in PNUT with doji formation

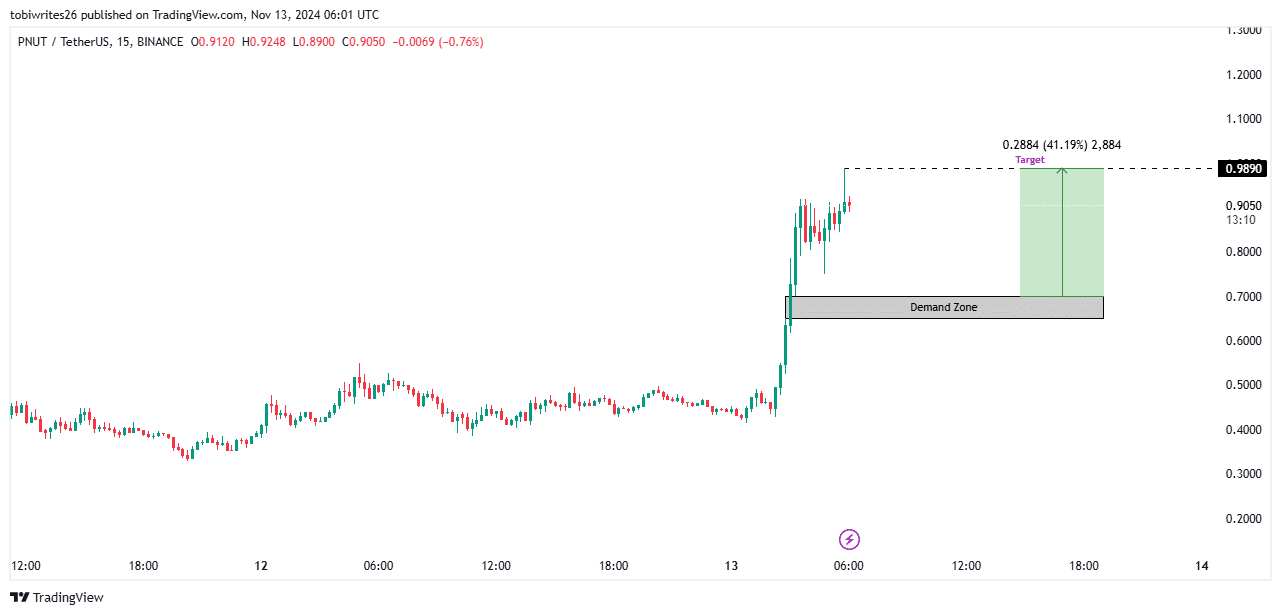

At present, it appears that PNUT could be experiencing a downturn based on recent developments in its 15-minute chart. A bearish Doji candlestick has emerged, suggesting a possible reversal or continuation of the price trend moving lower.

A Doji candlestick that appears at a high price point and is bearish in nature often indicates growing selling forces within the market, as investors anticipate the possibility of buying again at reduced costs. This pattern hints that traders could be on the lookout for a chance to lower prices towards a significant support area.

The projected decline might lead PNUT to a demand area ranging from 0.7010 to 0.6499, where there may be enough market activity to foster an upturn. If PNUT falls to this point, it could subsequently increase by approximately 41.19%.

Technical indicators shows temporary decline in PNUT

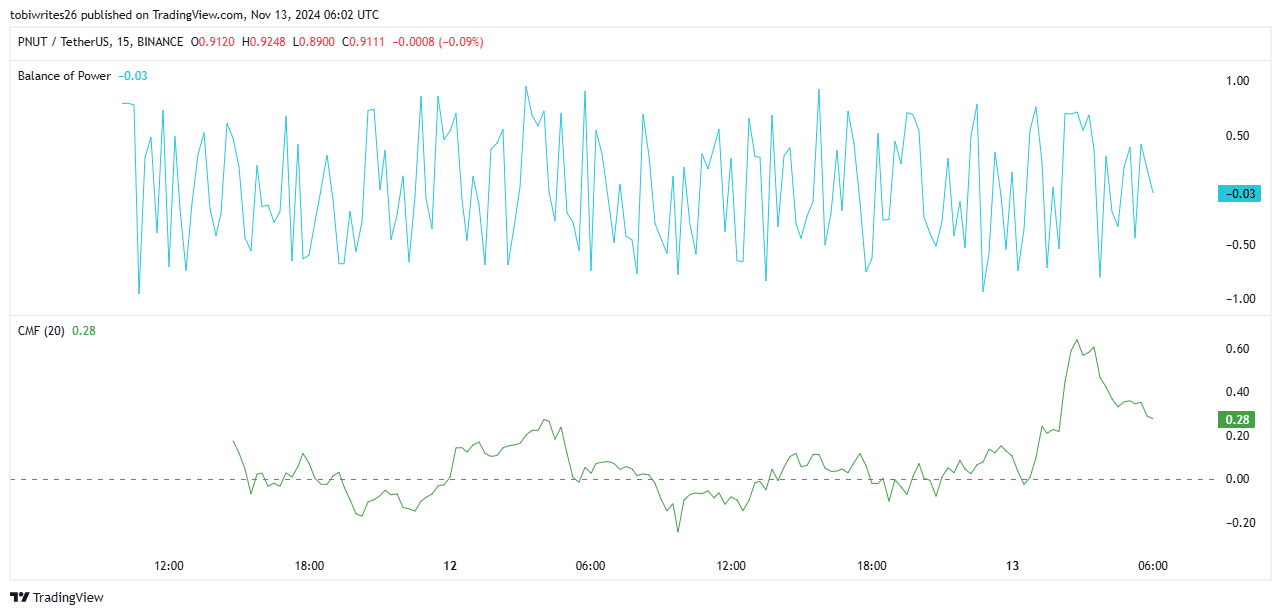

Based on current market indicators, there seems to be a temporary decline in the price movement of PNUT. At present, the Balance of Power (BoP) and Chaikin Money Flow (CMF) are signaling bearish tendencies.

Currently, the Balance of Power (BoP) indicator, a tool used by traders to assess the dominance in the market between buyers and sellers, is positively tilted but exhibiting a slight decrease.

The modest drop indicates that although there’s still optimism, the price could fall further if the current downtrend continues, possibly approaching the earlier noted resistance point for demand.

In a similar manner, the Chaikin Money Flow (CMF) signifies a decrease in funds flowing into PNut, reflecting less liquidity. This lack of liquidity might result in increased price strain before any prospective recovery.

Bearish sentiment rises among PNUT market participants

According to data from Coinglass, there’s an increasing negative outlook on PNUT as the number of short trades exceeds the number of long trades at this moment.

Currently, the long-to-short ratio is approximately 0.987, indicating a slight edge for bearish traders, but the gap in contract numbers remains relatively small.

It seems that technical indicators are generally indicating a weakening of the buying pressure for PNUT, suggesting a decrease in demand. This could potentially lead to further decreases in the stock’s price in the near future.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-14 04:07