- PNUT would present a better buying opportunity around the $1 mark.

- The RSI and the OBV showed rising seller dominance in the lower timeframe charts.

As a seasoned researcher with a knack for deciphering market trends, I find myself intrigued by Peanut the Squirrel [PNUT]. The rapid surge earlier this month was undeniably impressive, but the recent contraction has piqued my interest.

Earlier this month, Peanut the Squirrel [PNUT] saw an exceptionally rapid recovery, but over the last week, it’s been gradually shrinking. For traders, the psychological thresholds of $1.5 and $1 are crucial – with $1.5 having surrendered its role as a support level.

The general feeling towards cryptocurrencies was very optimistic since Bitcoin [BTC] was close to $100k, only a small jump away at $97k. However, there might be more increases for Bitcoin, but this could lead to Peanut the Squirrel experiencing a period of decline in the near future.

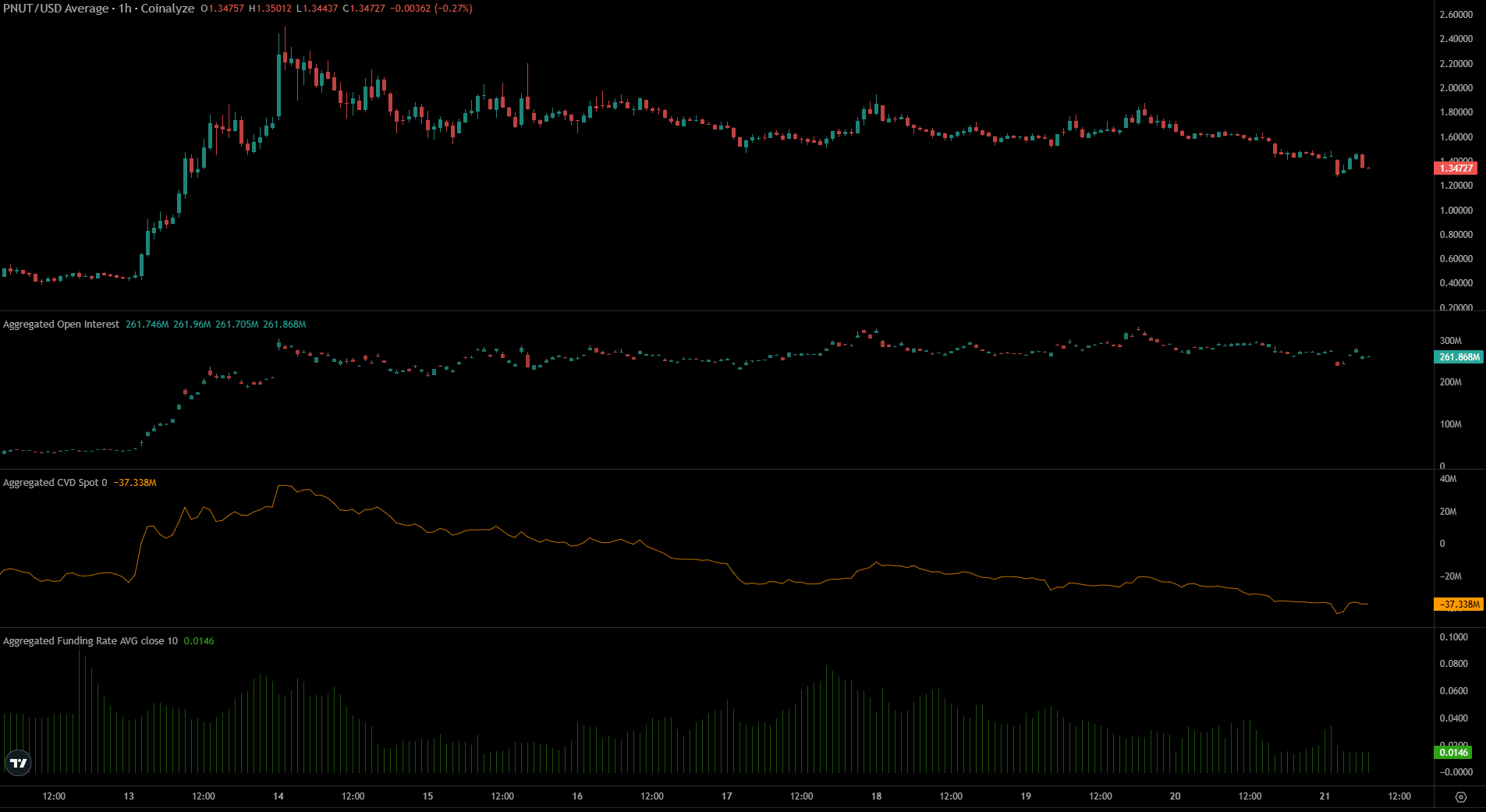

PNUT falls to the 50% retracement level

On the 4-hour timeframe, the momentum of PNUT appeared to be waning. For over a week, the bulls had been courageously guarding the $1.5 region since November 14th. However, the bears’ persistent attack eventually managed to drive the prices lower.

$1.29, $1, and $0.6. On a 4-hour chart, the Relative Strength Index (RSI) dipped below 50, indicating that the bears have an advantage in terms of market momentum.

The trend may indicate a potential drop to around $1, and potentially even as low as $0.6. This prediction aligns with the On-Balance Volume (OBV) analysis. Unfortunately, the OBV has been unable to maintain levels above the previous week’s lows, suggesting an increase in selling activity. This decrease in OBV could signal a higher likelihood of a pullback or correction toward $1.

Speculative markets faced short-term bearishness

Over the past week, I’ve noticed a downturn in the spot Cardiovascular Disease (CVD) sector, which seems to indicate a softening in the spot market demand. This observation aligns with the trends suggested by the On Balance Volume (OBV), as it points towards a short-term bias favoring sellers.

Over the last four days, the funding rate has decreased significantly, while the total value of open contracts has gradually dropped from approximately $318 million to around $261 million.

Read Peanut the Squirrel’s [PNUT] Price Prediction 2024-25

Collectively, they demonstrated a decrease in positive sentiment towards buying in the shorter periods. Gradual losses in PNUT suggested that speculators remained hesitant to invest, despite Bitcoin nearing the $100k value threshold.

Read More

2024-11-22 01:11