- POL slips into its lowest ever price point after failing to find a bullish footing.

- Assessing whether this could be a good opportunity to buy in.

As a seasoned crypto investor with a knack for spotting undervalued assets, I find myself intrigued by the current state of POL (formerly MATIC). The price plunge into uncharted territory is indeed disheartening, but as they say, every cloud has a silver lining.

As an analyst, I find myself reflecting on the recent tumultuous journey of POL (formerly MATIC). After hitting fresh record lows, it’s hard not to imagine that those who hold this Polygon-native token might feel like they’re throwing shadows instead of punches. However, could this potentially be a golden opportunity for re-entry into the market?

Currently, the Polish Zloty (POL) is hitting record lows, while the majority of leading cryptocurrencies are striving to surpass their old highs or establish new ones.

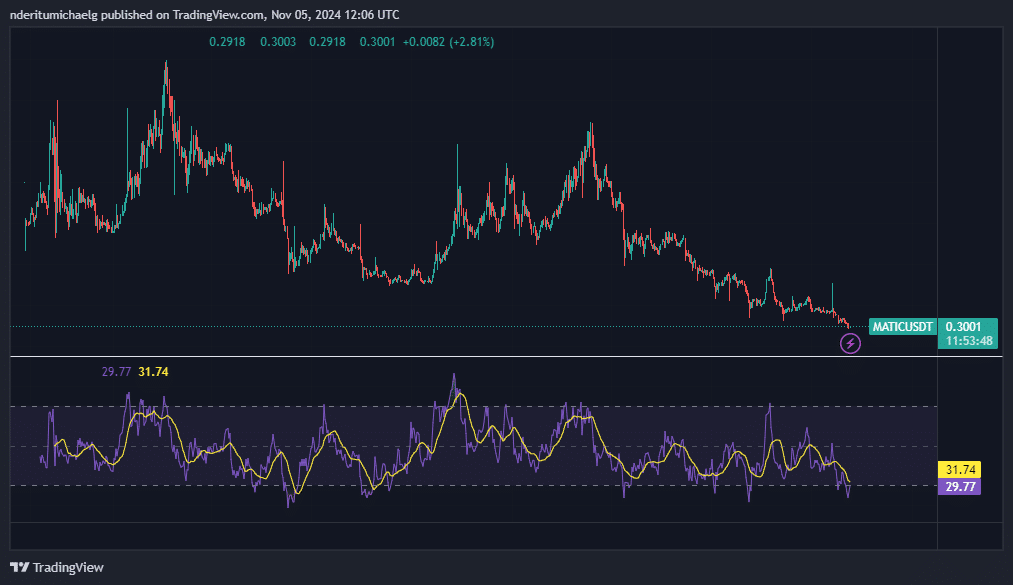

During Monday’s trading, the value of the token dipped down to a record-breaking low of $0.285. This is the lowest price it has ever reached since it began trading.

As an analyst, considering the recent all-time low of MATIC and its heavily oversold status according to the Relative Strength Index (RSI), one might be tempted to view this as an opportunity for investment. However, it’s crucial to remember that while a heavily oversold condition may indicate undervaluation, it doesn’t guarantee immediate price recovery. It would be prudent to analyze other factors such as market trends, fundamental analysis, and potential future developments before making a decision to buy back into MATIC at the current extreme discount.

The persistent disadvantage indicates that MATIC might be one of the less appealing cryptocurrencies this year, which could explain its reduced popularity. Yet, a more detailed examination of the Polygon ecosystem’s progress might provide some optimism for MATIC investors.

Can Polygon metrics breathe new life into POL?

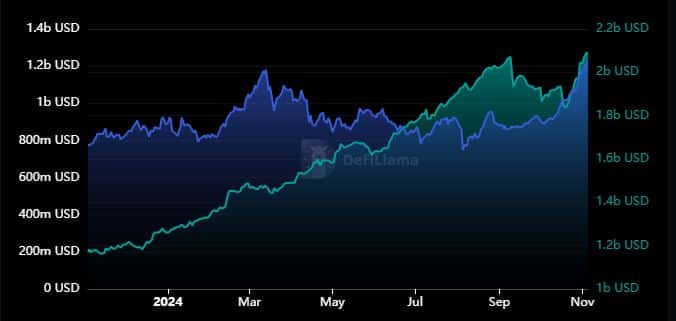

Despite POL experiencing losses over the past 12 months, its associated platform Polygon saw growth in other sectors. For instance, its stablecoin market cap stood at $1.17 billion on November 5th, 2023, which subsequently increased to a staggering $2.08 billion one year later.

During the given timeframe, Polygon’s Total Value Locked (TVL) increased significantly, climbing from $772.4 million to $1.237 billion. This growth indicates that the network is now better equipped and primed for decentralized finance (DeFi) applications than it has been in the past.

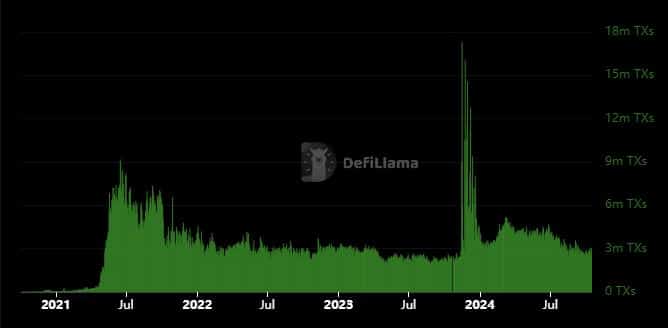

The transaction records show that there were more than 17 million transactions worth over $17 million in November 2023, but this figure has significantly decreased and now hovers around 3 million transactions in November 2024.

Nevertheless, the November 2023 spike as isolated event that does not necessarily reflect on price.

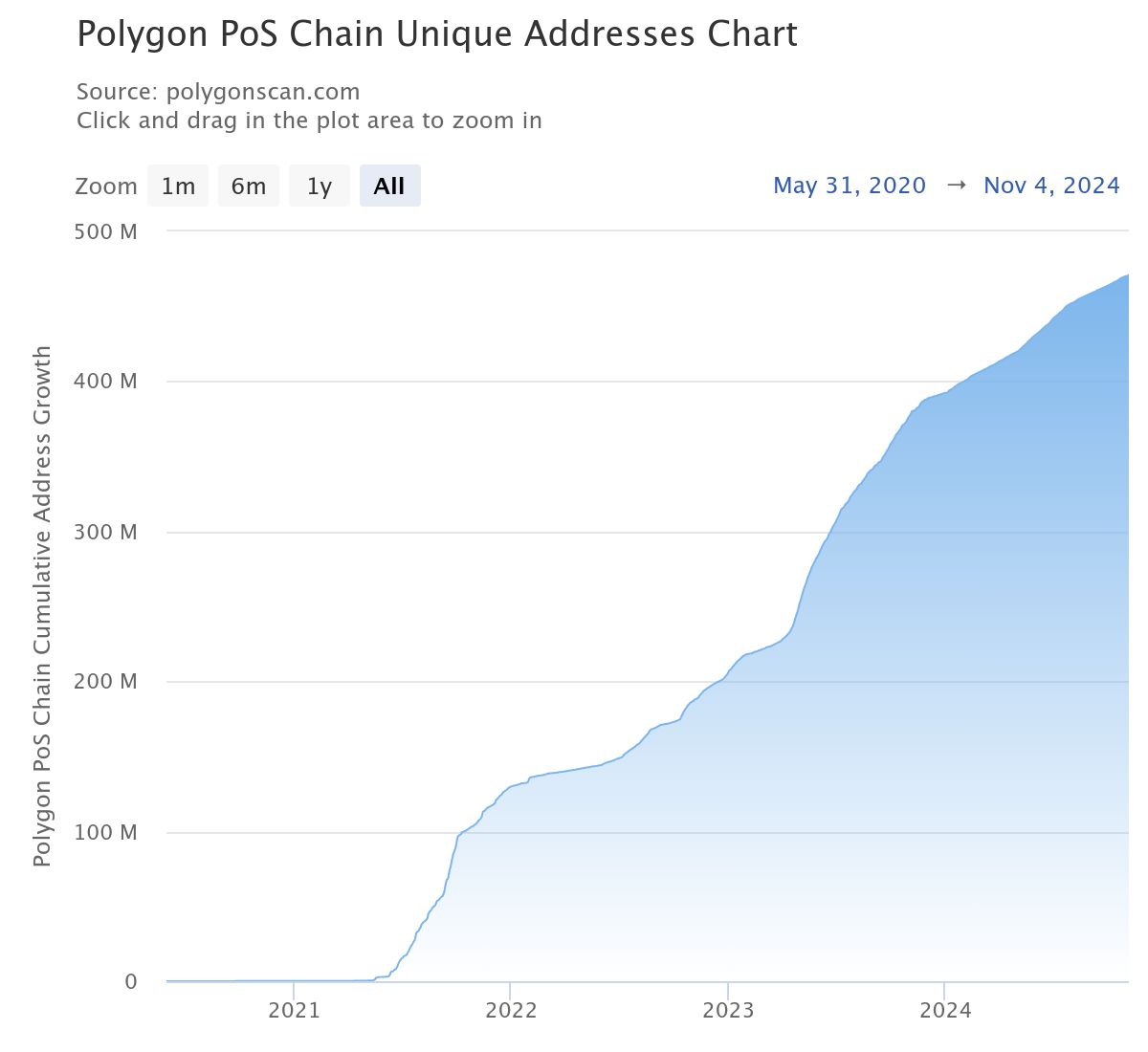

For most periods, transaction data appears quite robust, implying that network activity might not directly relate to POL demand or pricing fluctuations. This assumption is further supported by the fact that Polygon has shown no signs of decreasing in the number of active addresses.

On November 4, 2024, the network contained approximately 379 million distinct addresses. Since then, that number has increased to about 470.9 million MATIC.

In simpler terms, it seems that the market sentiment towards POL has shifted negatively, leading to a period of dissatisfaction. As a result, it’s challenging to predict if the token will regain its appeal again.

Despite this, it presents an exceptionally promising prospect should it return to its all-time highs. Such a surge would equate to a significant gain of over 400%.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- ANKR PREDICTION. ANKR cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- LINK PREDICTION. LINK cryptocurrency

- K-Pop Idols

2024-11-06 11:35