- Polkadot’s descending wedge hinted at a bullish reversal, with traders eyeing a potential breakout.

- Whale accumulation and rising volume suggested that Polkadot was gearing up for a significant price movement.

As a seasoned analyst with years of market observation under my belt, I find myself intrigued by Polkadot’s [DOT] current technical setup. The descending wedge pattern hints at a potential bullish reversal, which, if confirmed, could drive the price to new heights.

In simpler terms, it looks like Polkadot (DOT) might be headed upwards based on the trends seen in its technical indicators and overall market behavior, which seems to indicate a change in investor optimism.

Today’s DOT chart showcases a descending wedge formation, which is usually a sign of an upcoming bullish turnaround, suggesting that a potential breakout could be imminent.

The pattern, created by lines that come together and show decreasing peaks and troughs, indicates a lessening of bearish energy. At the moment, DOT is close to the top of this wedge shape, suggesting a potential breakthrough could happen soon.

Key resistance and support levels

At the current moment, the most significant level of opposition to surpass was around $4.50, representing the highest point within the falling trend pattern known as a descending wedge.

As an analyst, I’m noting that surpassing this current level suggests a bullish turnaround, potentially propelling the price towards my anticipated goal around $10.

As someone who has been trading for over a decade, I can confidently say that finding a potential gain of approximately 129.73% from current levels is a significant opportunity that should not be overlooked. This resistance zone is crucial in technical analysis, and ignoring it could lead to missing out on substantial profits. My personal experience has taught me that understanding and respecting these zones can make all the difference between a successful trade and a loss. So, if you’re serious about trading, this resistance zone should be high on your radar.

Maintaining the optimistic trend in the market depends significantly on the $3.911 support level. It’s vital that this area continues to be held; if we can’t keep it, it might call into question the positive perspective and potentially lead to more negative pressure.

Traders are closely monitoring these levels as DOT approaches a critical decision point.

Traders reengage

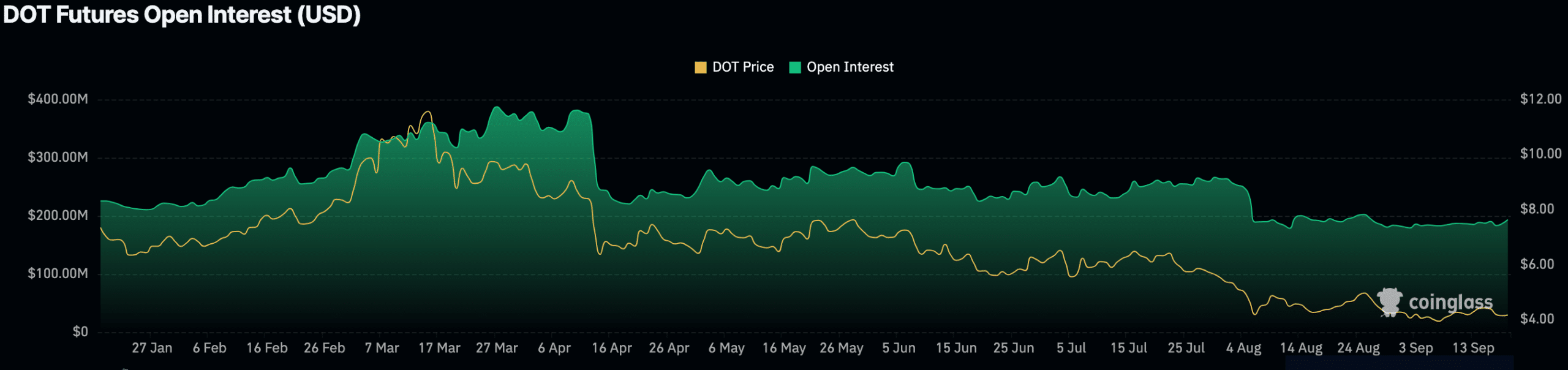

According to the latest Coinglass statistics, there’s been a significant increase in market activity. Trading volume jumped by nearly 30% to an impressive $241.40 million. Moreover, Open Interest has also climbed up by over 11%, now standing at approximately $206.04 million.

These suggestions imply a rise in trader participation and curiosity, a pattern typically observed preceding significant price shifts.

Increased activity and investor attention towards DOT suggest that traders could be preparing for a possible price surge.

Conversely, examining the scope of DOT Futures Open Interest reveals a decrease from highs of approximately $400 million in mid-April to the present range of $150-$200 million.

The decrease in this trend suggests that traders are becoming less active, and the market is adopting a more conservative approach due to the falling prices of DOT.

Whales shift, market awaits move

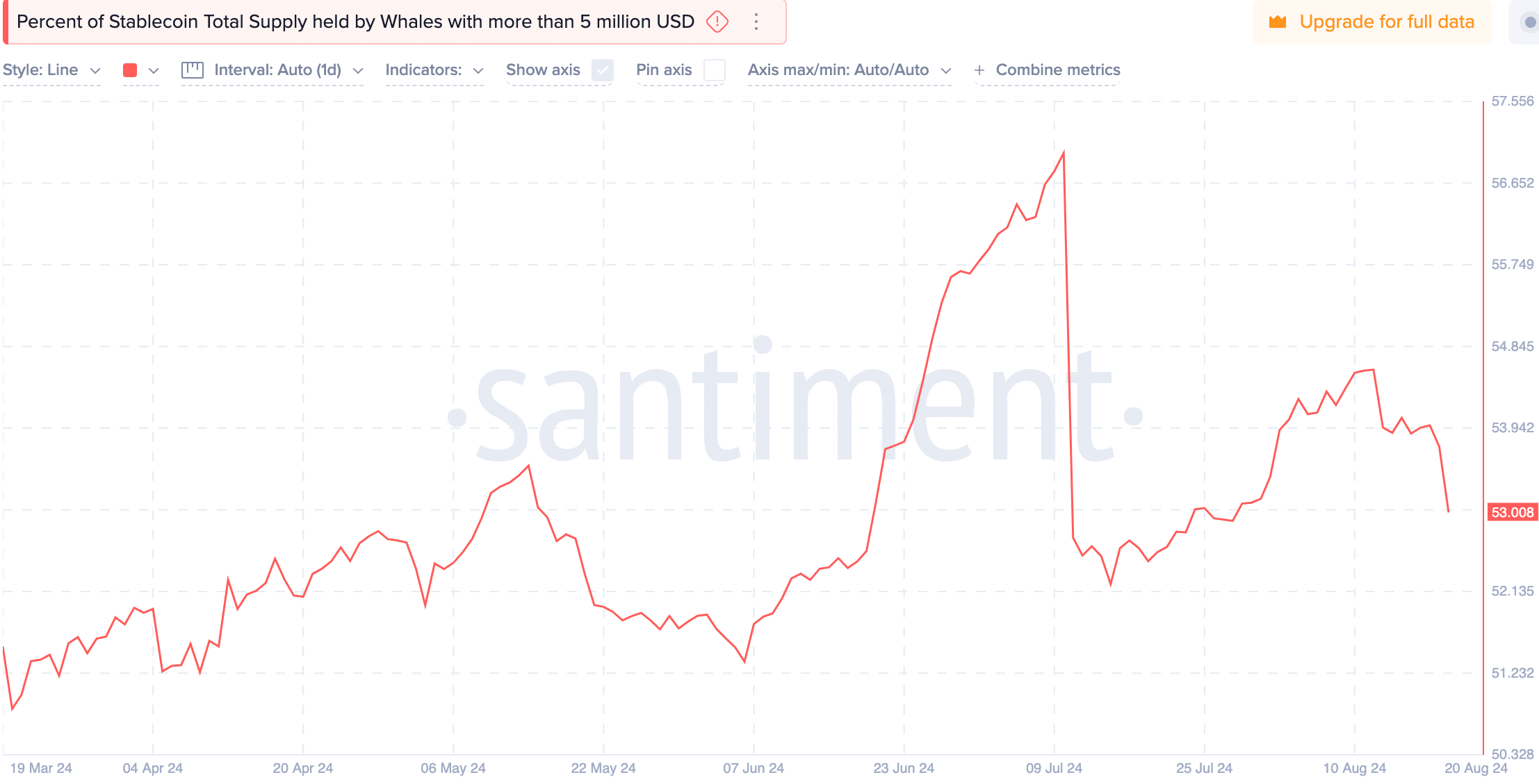

It’s worth mentioning the significant trend observed among major investors. The data indicates a substantial increase in whale holdings of stablecoins valued at more than $5 million between late April and mid-June 2024, notably coinciding with a drop in DOT‘s price.

This pattern implies that whales (large investors) might be planning to invest their funds when the prices are relatively low.

Read Polkadot’s [DOT] Price Prediction 2024–2025

As a crypto investor, I’ve noticed a decrease in whale holdings lately, which might suggest they are exercising caution or taking profits. This points to an uncertain market direction, making it challenging to predict where things are heading next.

In simple terms, it seems like an important turning point for Polkadot, as its technical patterns, trading volumes, and overall market behavior hint towards a potentially major shift coming up soon.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-09-20 13:12