- Polkadot showed a bearish structure but the CMF signaled buying pressure.

- The $4 and $4.6 support and resistance zone from the VRVP tool would likely be respected in the coming weeks.

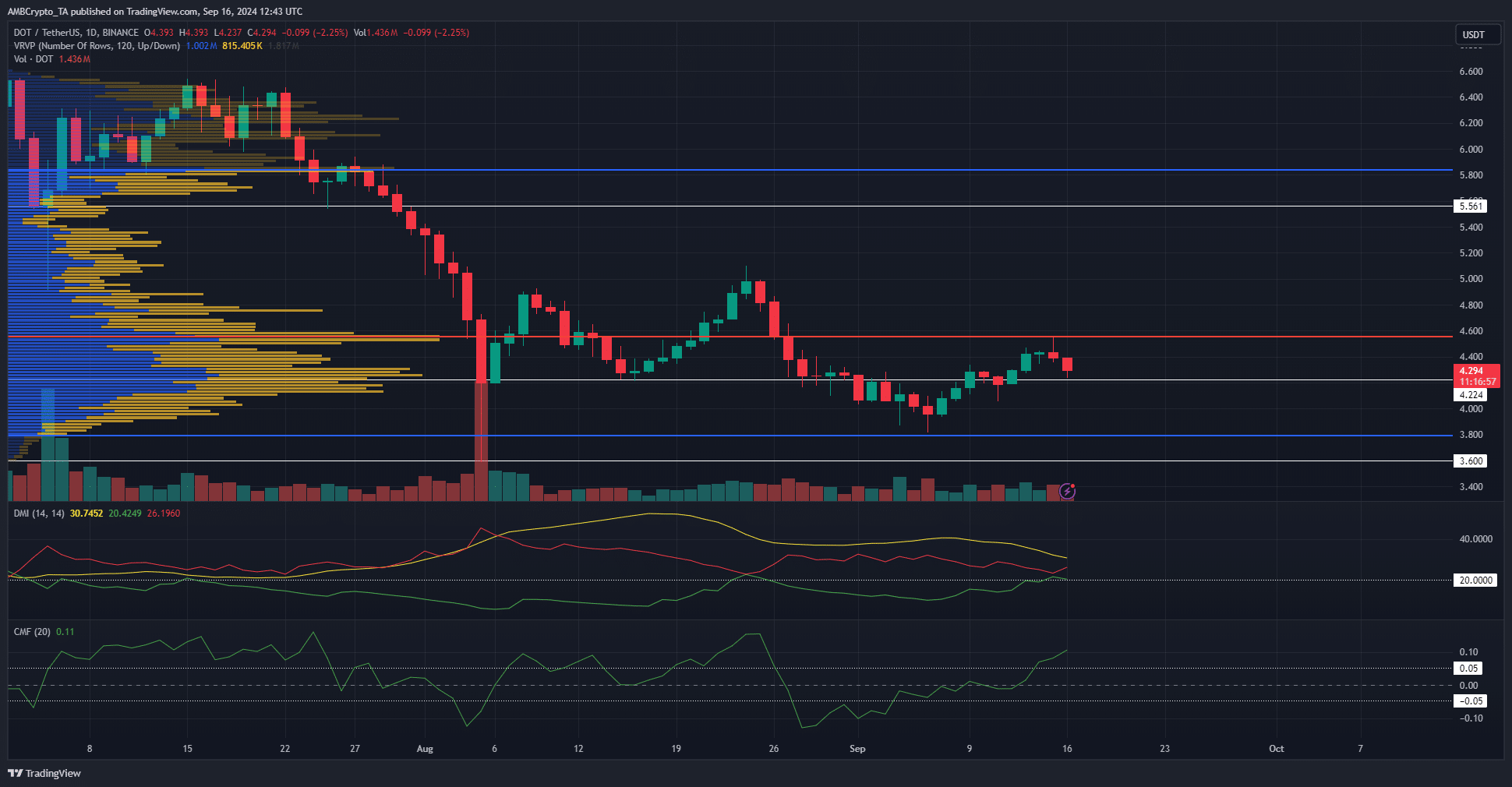

As a seasoned crypto investor who has weathered multiple market cycles, I find myself intrigued by Polkadot [DOT]’s current position. The chart suggests a bearish structure, with DOT seemingly headed back towards its $4 support zone. However, the Chaikin Money Flow (CMF) is signaling buying pressure, which piques my interest.

Earlier this month, Polkadot (DOT) managed to rebound from the $4 support level, but its progress has slowed down significantly in recent days. Currently, it seems to be trending back towards that same support level.

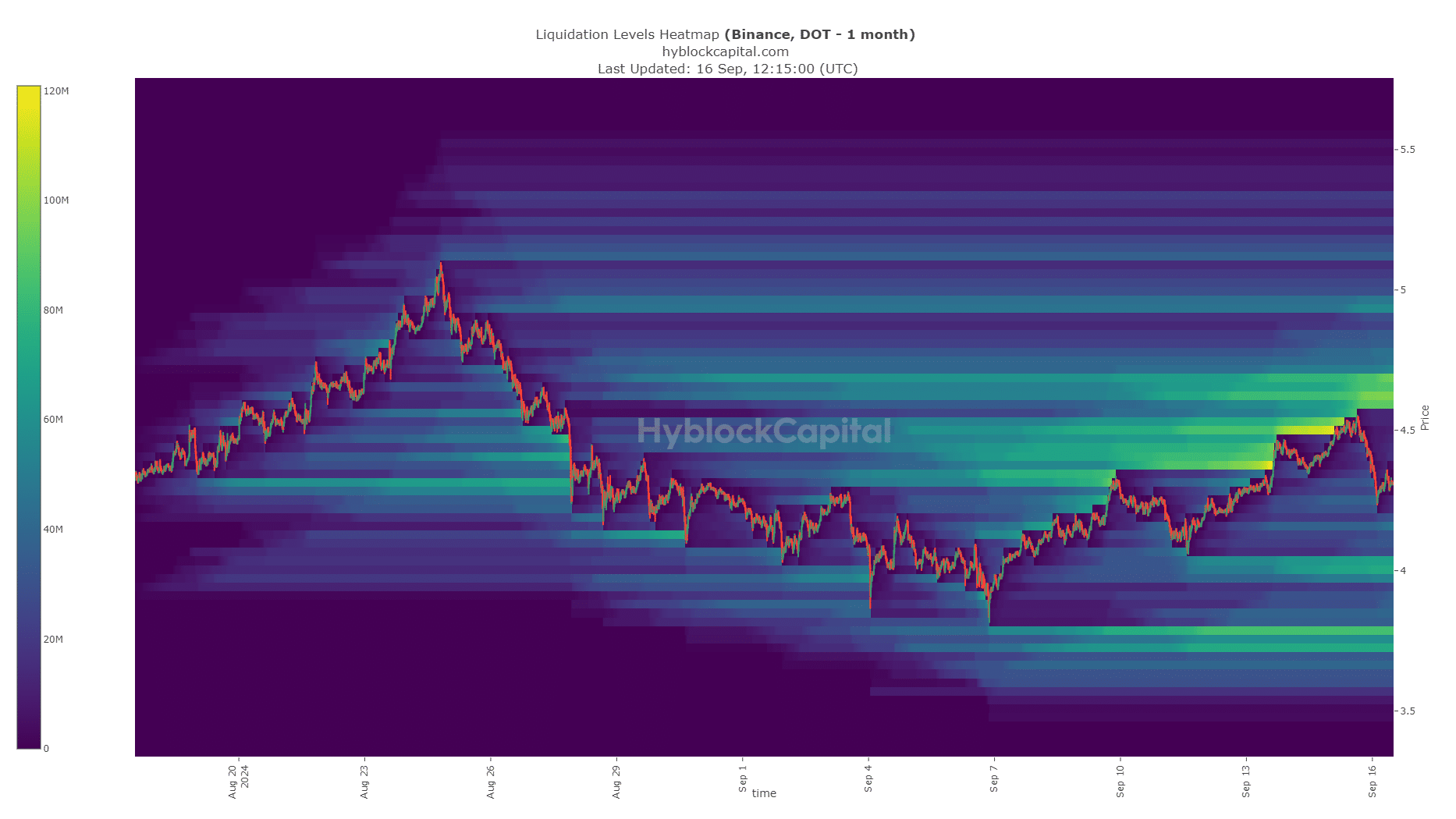

The liquidity graph suggests that there could be a swift increase in the price of DOT, aiming to capture liquidity prior to a potential reversal. In this scenario, traders might question whether to buy (go long) immediately or wait for a rise to sell short.

Volume profile shows DOT is under resistance zone

From late May up until early July, the DOT volume profile revealed that the key resistance level was around $4.556. Yesterday, the price tried to break through this level but was met with rejection and has since been trending downwards towards the next significant support point at approximately $4.224.

According to the Directional Movement Index, both the -DI (represented in red) and ADX (yellow) exceeded 20, suggesting a robust downward trend that is currently underway. Additionally, the price movement has been indicative of an ongoing downtrend since June, as DOT has consistently formed lower peaks and troughs.

Despite going against the flow of trend and momentum signals, the Capital Movement Factor (CMF) stood at a positive 0.11, indicating substantial investment into the market. This upward surge in demand was an optimistic indication.

Magnetic zones could lead to range formation

AMBCrypto analyzed the 1-month liquidation heatmap of Polkadot and found two liquidity clusters of interest. The closest and largest band of liquidity was at $4.6-$4.7, and the other one was at the $4 support zone.

Read Polkadot’s [DOT] Price Prediction 2024-25

To the north, the pocket appears reinforced and may pull prices towards it prior to a possible price shift towards the $4 liquidity pool. In the upcoming weeks, this scenario might cause Polkadot’s price range to stabilize between approximately $4 and $4.7.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-17 08:39