-

DOT faces a critical juncture and is challenged by a significant resistance zone at $4.463.

Emerging evidence suggests that DOT is primed for a rebound.

As a researcher with a knack for deciphering market trends and patterns, I find myself intrigued by the current state of Polkadot (DOT). Despite the temporary setback at the resistance zone of $4.463, emerging evidence points towards a promising rebound for DOT.

Regardless of the recent setbacks, such as a 7.86% drop from one month to the next, the examination of current figures and technical trends suggests a robust momentum that may soon catapult Polkadot [DOT] forward.

Technical analysis indicates a potential major upswing for DOT

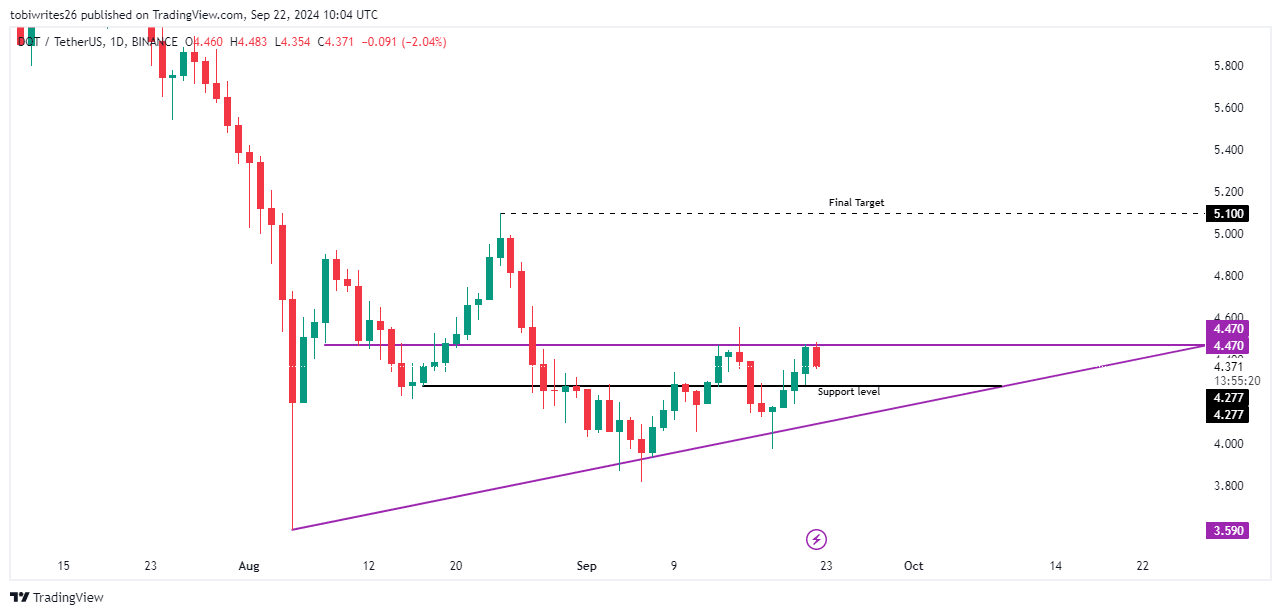

From a technical perspective, it appears that Polkadot (DOT) could potentially surge into higher price regions in the near future. At present, DOT is being traded within an uptrend channel, which is commonly recognized as a sign of an upcoming strong upward movement.

Despite a recent dip following its encounter with an upward resistance level, this trend is predicted to continue falling until it hits the upcoming support level of $4.277 within the pattern.

At this level, sufficient buying power is anticipated to potentially breach the resistance.

If this breakthrough happens, I’m expecting the next price target for DOT to be around $5.1. On the flip side, if we see a reversal, the price might slide back down towards the base of the ascending triangle pattern.

Retail interest in DOT heightens

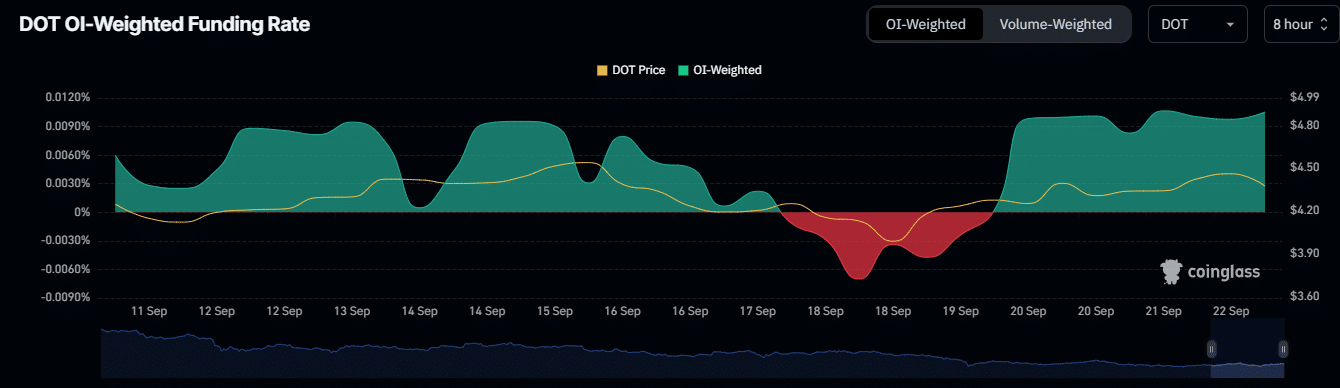

It appears that many retail traders are expressing optimism about DOT potentially rising in value, as suggested by the heavily positive OI-weighted sentiment reported by Coinglass, which suggests a high level of buying enthusiasm among them.

As a crypto investor, I find it insightful to analyze market sentiment using an OI-weighted approach. This method takes into account both the bullish or bearish stance (directional sentiment) and the volume of open options or futures contracts, especially futures in the case of DOT. In simpler terms, it’s like considering not only people’s feelings about a particular cryptocurrency but also how seriously they feel about those feelings, based on their investment in related derivatives.

This approach gives more focus to feelings tied to significant monetary investments, where for DOT, these sentiments tend to be overwhelmingly optimistic or bullish.

Furthermore, significant reductions in short positions have occurred, resulting in traders who wagered on DOT experiencing severe losses amounting to approximately $64,880 since the price hasn’t worked in their advantage.

DOT is in a good spot to rally

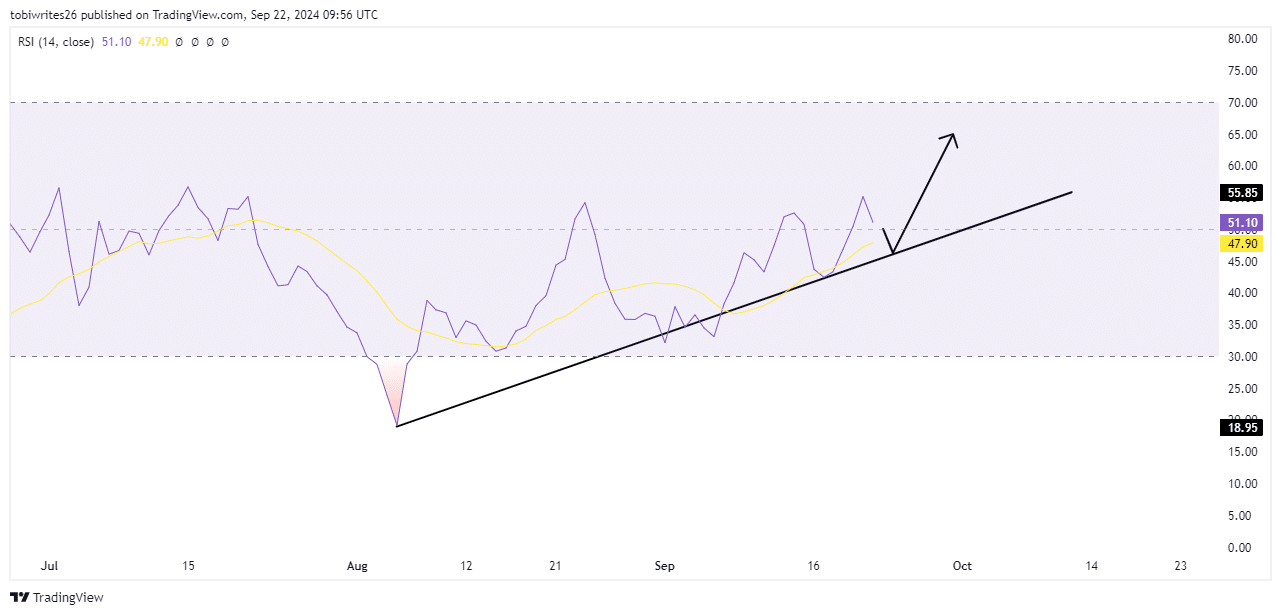

The vigor of the DOT market continues to be strong, with the Relative Strength Index (RSI) pointing upwards and creating higher peaks – suggesting a powerful bullish influence poised to boost DOT’s prices.

Read Polkadot’s [DOT] Price Prediction 2024–2025

Although it appears optimistic, Data On The Move (DOT) may face a temporary decline. This potential drop could line up with the $4.277 support level that was noted through technical analysis.

Looking ahead, it’s anticipated that DOT will embark on a strong surge, possibly touching the notable mark of $5.1 in the forthcoming trading periods.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-23 01:11