-

After a rise in April, Polkadot’s network activity started to decline in May.

Most market indicators looked bearish on DOT.

As a seasoned crypto investor, I’ve seen my fair share of market ups and downs. April was a rollercoaster ride for Polkadot [DOT], with its price taking a significant hit, causing concern among investors. The network activity, however, told a different story as it reached new heights.

From my perspective as an analyst, Polkadot’s [DOT] performance over the past month was less than ideal, with significant losses in token value. Nevertheless, I find it noteworthy that despite the price downturn, the network activity on the Polkadot blockchain reached new heights during this period.

Polkadot in April

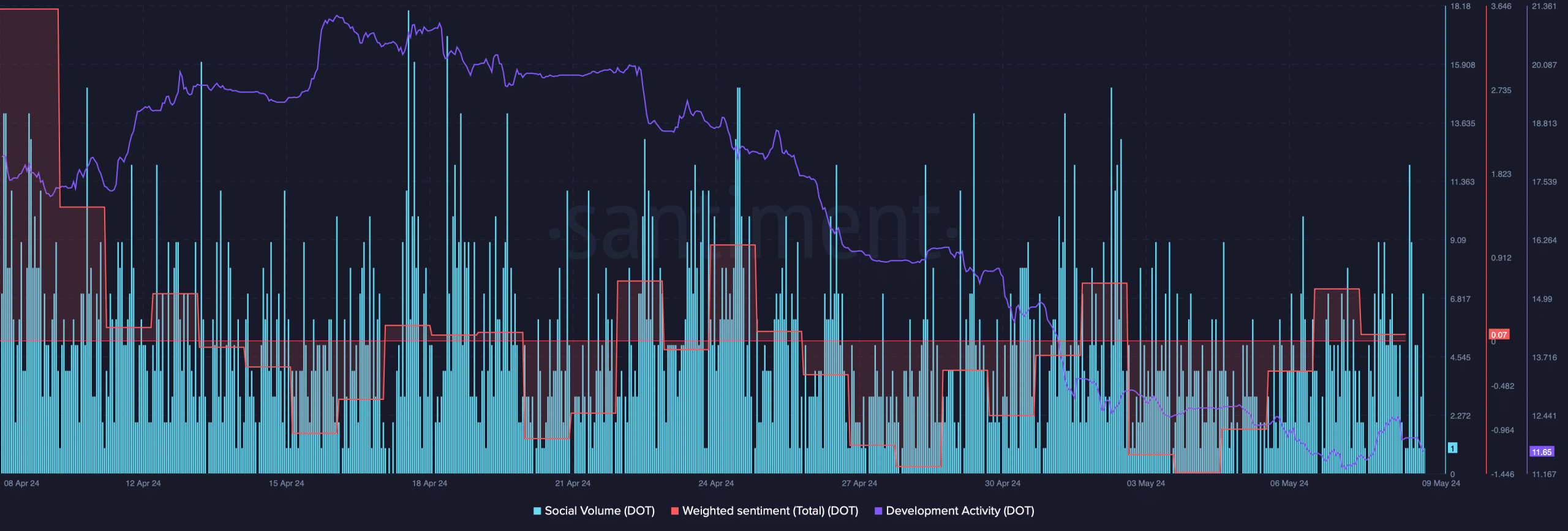

Based on data from CoinMarketCap, the price of DOT plummeted by over 22% in April, resulting in a noticeable decline in the token’s social media activity and engagement.

Last month, I observed a predominantly bearish market sentiment based on its low Weighted Sentiment indicator. Additionally, there was a minor decrease in Social Volume.

In addition, it was unexpected to observe a significant decrease in Polkadot’s development activity, which is typically quite robust.

Last month, there was continued robustness in the network activity of blockchains, as evidenced by Polkadot’s announcement of an increase in their active user base through a recent tweet.

Since the initiation of parachains in early 2022, the number of monthly active accounts on the blockchain has hit a fresh all-time high.

As a data analyst, I’ve observed that among all the parachains, my analysis reveals that Moonbeam was the leading contributor with the most active accounts. DOT came in second place, exhibiting a significant number of active accounts as well.

The trend changed in May

During the month of April, April’s network activity showed no signs of letting up. However, a shift occurred in May, prompting AMBCrypto to examine Artemis’ data and forecast potential developments for Polkadot.

Based on our examination, there was a decrease in the number of active addresses on the DOT blockchain over the past week. Consequently, the network experienced a reduction in its daily transaction volume.

At the current moment, there were approximately 5,400 daily active addresses on the DOT network, accompanied by around 40,000 daily transactions. The situation regarding captured value was also unfavorable. This trend became apparent as both DOT’s transaction fees and revenue experienced a decrease.

As a researcher examining the DeFi landscape, I’ve noticed an incongruity with the blockchain’s performance. Although there was a significant surge in Total Value Locked (TVL) on the 6th of May, the blockchain has since fallen short in maintaining this momentum.

In the past week, the value of the DOT token decreased by over 1%, causing disappointment for its investors who were previously anticipating gains.

Currently, DOT is priced at $6.86 during this composition, and its market value exceeds $9.8 billion, positioning it as the fourteen largest cryptocurrency by capitalization.

Read Polkadot’s [DOT] Price Prediction 2024-25

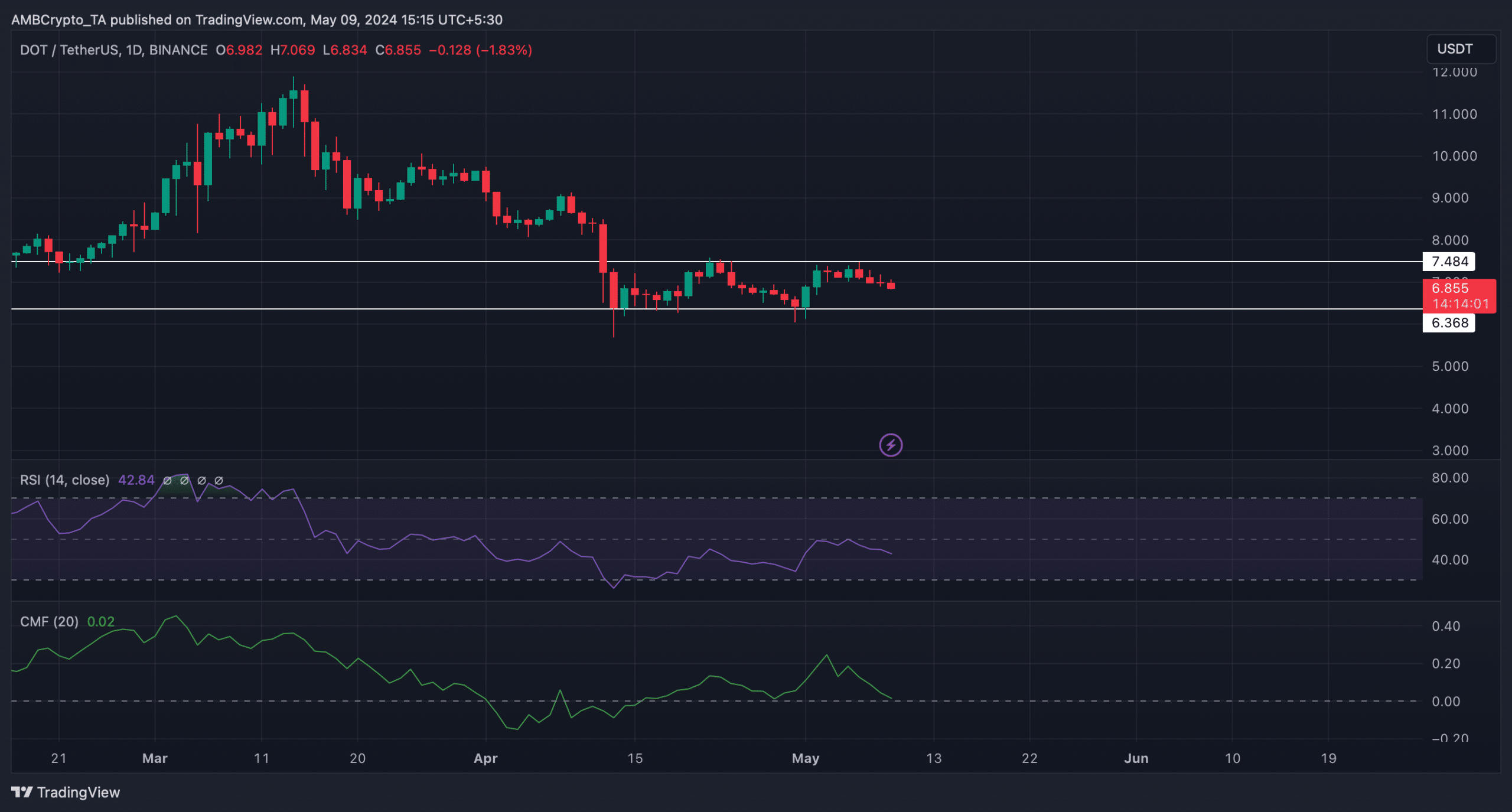

As a researcher at AMBCrypto, I analyzed DOT‘s daily chart to determine its potential direction. I noticed that DOT had repeatedly failed to surpass its resistance of around $7.4 over the past few weeks.

The Chaikin Money Flow (CMF) indicator for DOT experienced a significant decrease, while the Relative Strength Index (RSI) exhibited a comparable trend. This pattern suggests that the probability of DOT’s price continuing to decline is elevated.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

2024-05-10 03:04