-

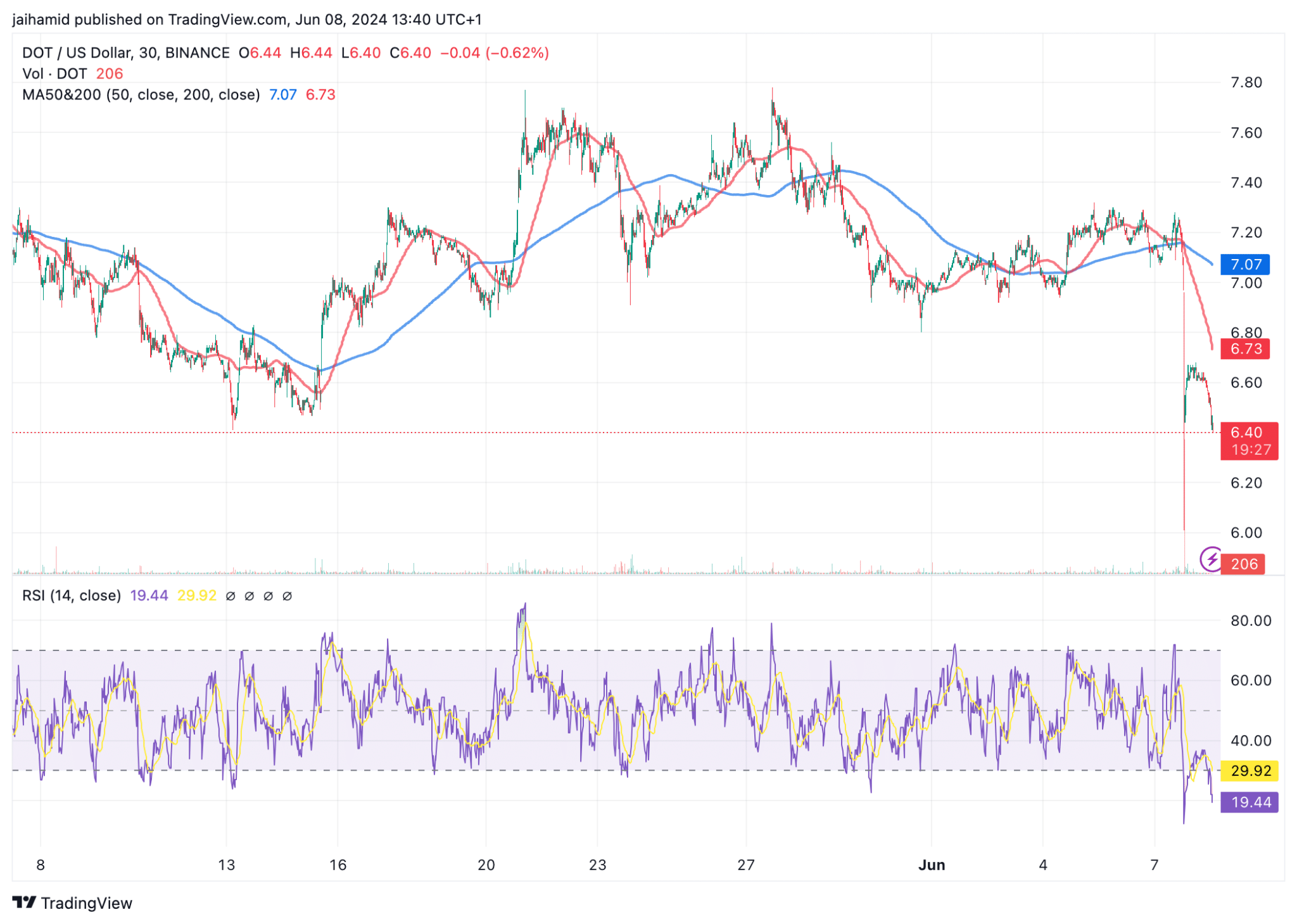

DOT continued to trend below the 200-period moving average.

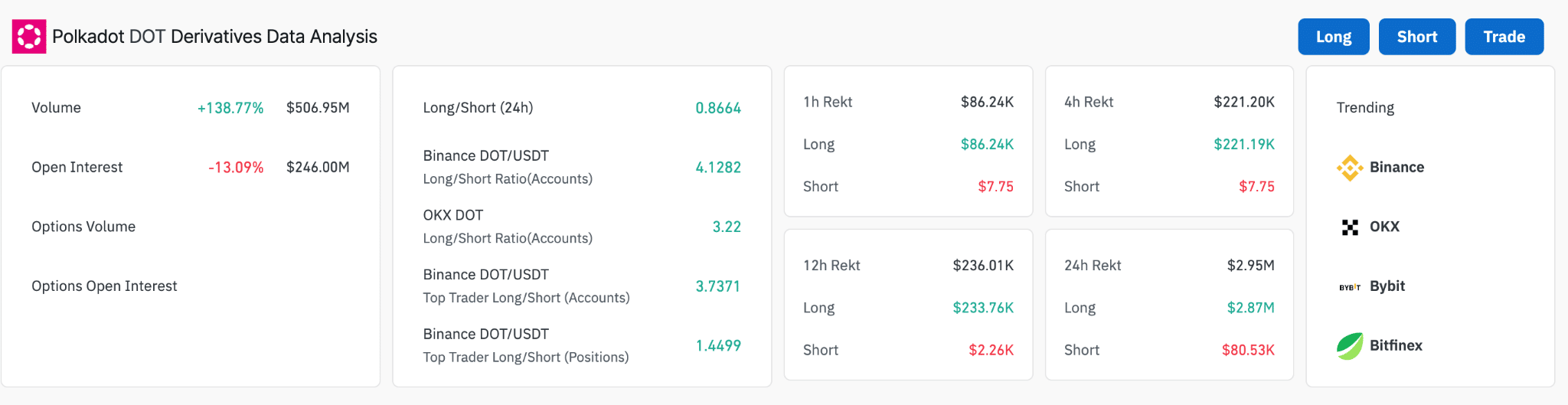

Despite the market’s ‘Extreme Fear’ sentiment, a dramatic 138.77% surge in trading volume indicated growing trader interest.

As a researcher with extensive experience in the cryptocurrency market, I’ve observed Polkadot’s [DOT] disappointing performance this year. The persistent decrease in DOT’s price, even amid market rallies and ETF hype, has been disheartening for investors. However, I believe there could be some promising signs hidden beneath the surface.

Despite the market upswings and ETF buzz, Polkadot [DOT] has underperformed significantly this year.

As a crypto investor, I’ve noticed that the eighteenth-largest cryptocurrency has been on a downward trend without much indication of recovery. However, it’s important to keep an open mind and consider the possibility that better days may be ahead.

Using a technical analysis perspective, the blue line representing the 50-day moving average intersects with the red line indicating the 200-day moving average at certain points.

As a crypto investor, I’ve noticed that even though there have been some exciting crossovers in the market, the price hasn’t managed to maintain any significant bull run. Instead, it has lingered below the 200-day moving average for extended periods, suggesting a bearish trend.

The Relative Strength Index (RSI) sat around 19 at press time, well into the oversold territory.

The heavy selling of DOT stocks might have led to an oversold condition. Such situations can pave the way for price adjustments or even reversals if investors perceive value in the shares at reduced prices.

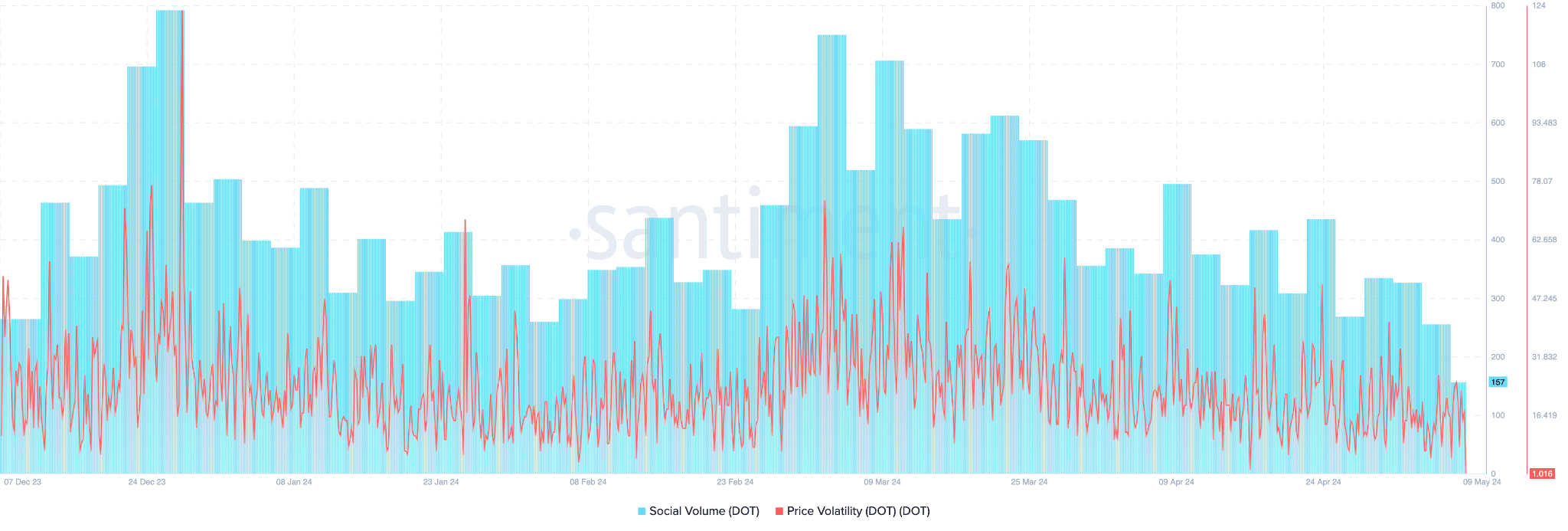

As a researcher examining DOT‘s social media presence and market trends, I’ve noticed a consistent decrease in social volume over the last two months. This downturn aligns with the ongoing price reduction trend for DOT.

The derivatives data from DOT are currently appealing. It seems these data may signal a potential positive development amidst the prevailing downturn.

Initially, there is a significant jump in trading activity, with a 138.77% rise to $506.95 million, indicating heightened enthusiasm among traders or increased speculation. Concurrently, liquidity appears to have decelerated noticeably over the last week.

There is still a prevailing bearish sentiment among the traders.

The “rekt” data paints a picture of challenging market circumstances for numerous traders, specifically those with long positions, due to a significant imbalance between long and short liquidations.

Read Polkadot’s [DOT] Price Prediction 2024-25

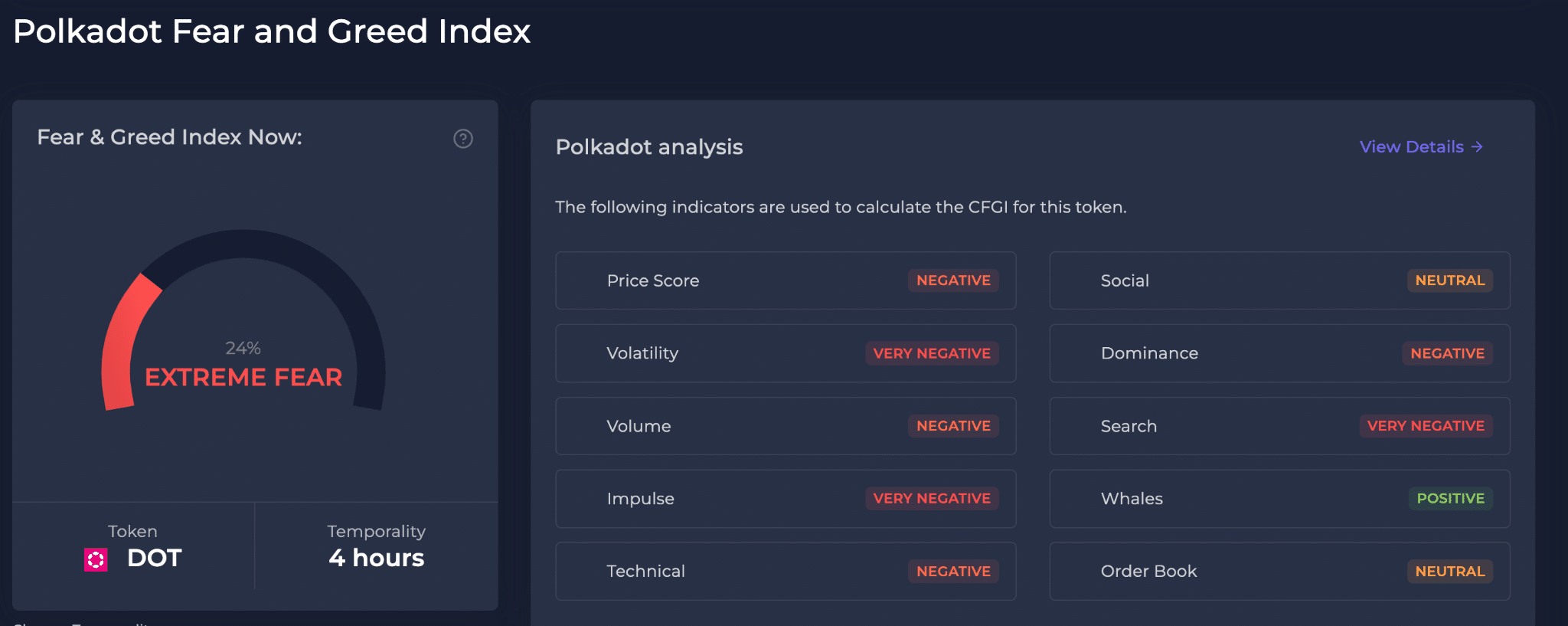

The Polkadot Fear and Greed Index is 24%, signaling “Extreme Fear” among investors.

The market’s caution and apprehension towards further price drops are influenced by several factors. These include concerns over unpredictable price swings and doubts about price stability.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-06-09 13:11