- The $4.22 support is critical, but is likely to be lost soon

- Negative funding and dwindling Open Interest pointed to short-term bearishness

As a seasoned crypto investor with a knack for recognizing patterns and trends, I must admit that the current state of Polkadot [DOT] leaves me feeling a tad worried. The $4.22 support, while critical, seems increasingly elusive, with a likely loss on the horizon.

At the moment of reporting, Polkadot (DOT) was priced at $4.3. On August 5th, it dipped to a support level of $3.6, which had previously been tested by DOT in October 2020 and October 2023.

To be honest, the consistent decline over the past few months hasn’t given cause for optimism. Despite instances where the overall crypto market showed signs of recovery (an uptrend), supporters of Polkadot failed to leverage the shift in market momentum effectively.

Another Polkadot drop below $4 is likely

In the analysis we previously conducted, we identified a descending triangle or “falling wedge” pattern that hasn’t been contradicted yet. A convincing sign that this pattern will lead to a bullish surge would occur when the price surpasses the resistance level of approximately $5.6.

Currently, at this moment, a shift seems quite distant, but the daily Relative Strength Index (RSI) and the Polkadot (DOT) market structure are indicating significant, sustained bearish momentum. Additionally, the On-Balance Volume (OBV) is declining without any notable uptick in buying pressure.

Therefore, it seemed more plausible for the altcoin to drop down to around $3.6 rather than rebounding to $5.6. If the $5.6 level is challenged again in the future, it may act as a strong barrier or obstacle.

Futures market showed speculators did not believe in recovery

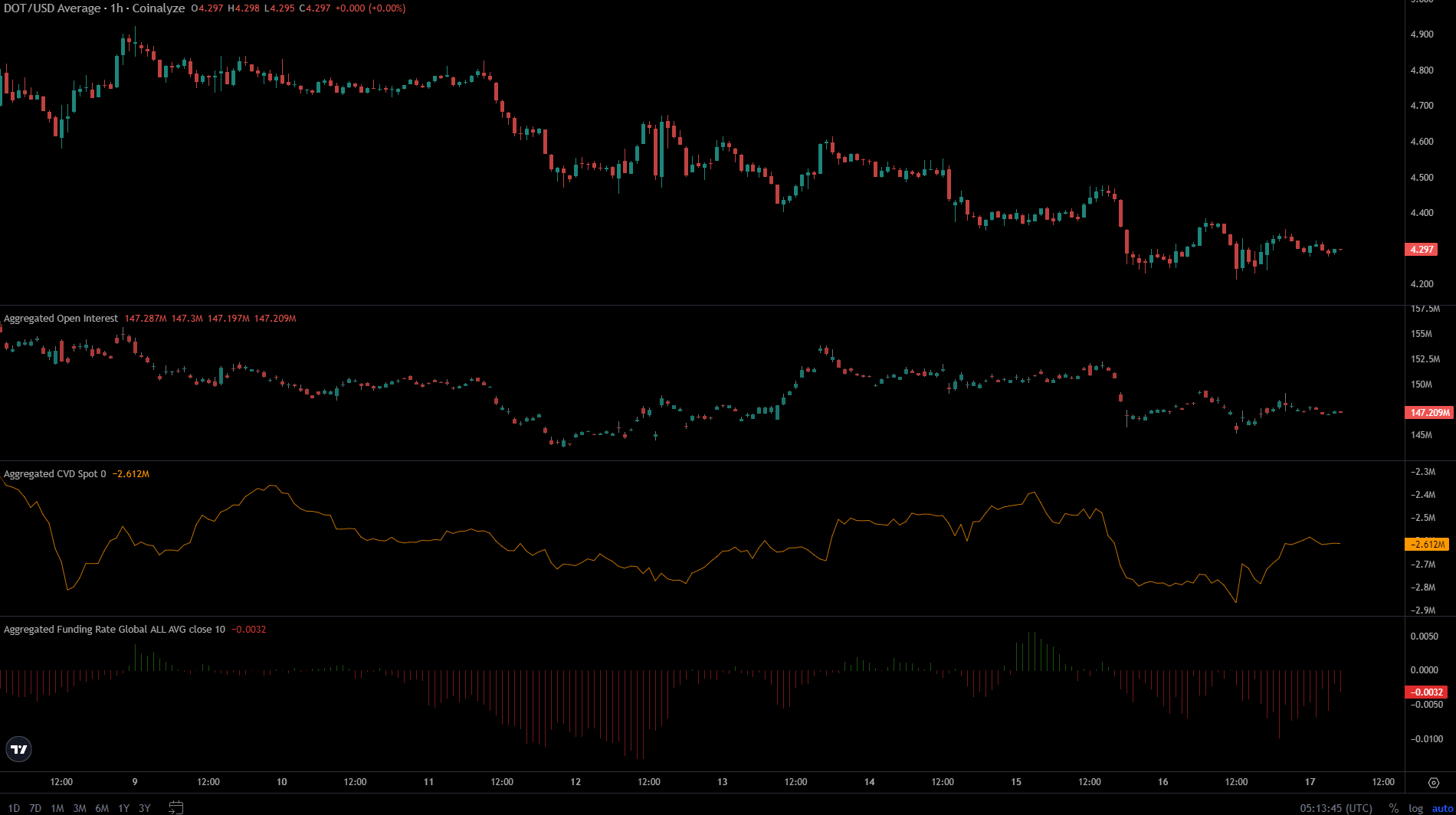

For the last three days, the value of Polkadot has gradually decreased from around $4.6. At the same time, Open Interest dropped, going from approximately $152 million to $147 million. The funding rate indicated a negative figure, suggesting that short positions were more common than long ones.

Read Polkadot’s [DOT] Price Prediction 2024-25

Over the last 24 hours, there’s been a noticeable increase in activity at the specified spot for CVD. However, this uptick doesn’t necessarily imply that bulls will build upon it. In essence, both technical analysis and futures market signals have strengthened the pessimistic outlook suggested by the price trend.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-08-17 16:07