- DOT surged by 3.7% over the past week.

- Market indicators showed Polkadot was experiencing strong positive market sentiment.

As a seasoned crypto investor who has witnessed the volatile yet exhilarating world of digital assets for more than half a decade now, I find myself optimistic about Polkadot (DOT) at the moment. With its recent surge and the strong positive market sentiment surrounding it, DOT seems to be following a familiar pattern that we saw back in 2020.

🔥 Trump Tariffs Shock Incoming! EUR/USD in the Crosshairs!

Massive forex shifts expected — don't miss the crucial insights now unfolding!

View Urgent ForecastOver the past month, Polkadot (DOT) has been thriving under positive market circumstances. Consequently, its price has shown modest increases on its graphs, bouncing back from a recent low of $3.8.

Currently, as I’m typing this, Polkadot is being traded at approximately $4.253. This represents a 2.83% increase over the past month, and an additional 3.70% growth has been observed in the last week, continuing the bullish trend.

Although it has made some progress, DOT’s current value remains significantly lower compared to its recent peak of $6.477, representing around 92.27% decrease from its all-time high of $55.

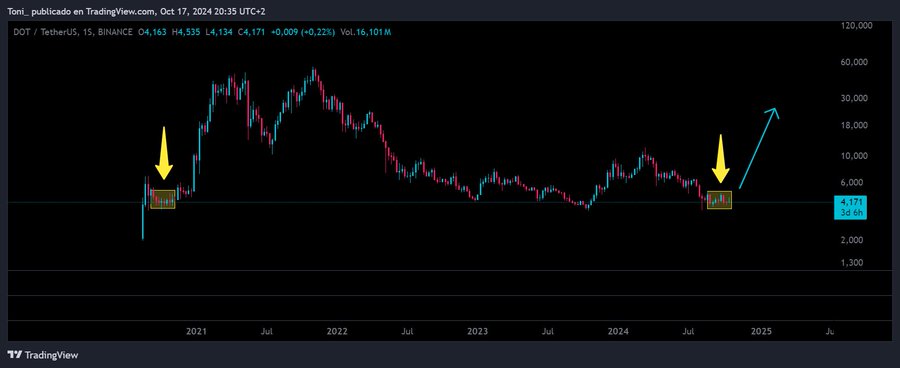

Just as anticipated, the latest advancements in the altcoin’s value have sparked discussions among financial analysts about its future path. Among them is well-known cryptocurrency analyst Toni Bitcoin, who proposes that DOT is following a similar trend to what was observed in 2020.

What market sentiment says

According to Toni’s interpretation, Polkadot appears to be following the pattern of the accumulation phase experienced in October 2020.

During the span of several months beginning from October 2020, the value of Polkadot’s token (DOT) witnessed an extraordinary upward trend, resembling a parabola.

During this timeframe, the buildup led to a significant increase in DOT’s value. The price of the altcoin climbed from $3.5 to $6.093.

After escaping from this stage, DOT experienced a significant rise that took it up to $42.361, achieving an all-time high (ATH) several months later. This extraordinary surge represented a tremendous increase of approximately 730.59%.

What DOT charts suggest…

If DOT repeats the 2020 pattern, the altcoin will see a historical surge.

As an analyst, I find Toni’s perspective quite optimistic, but it’s crucial for me to delve deeper into other market signals to validate this viewpoint and ensure a comprehensive understanding of the current market trends.

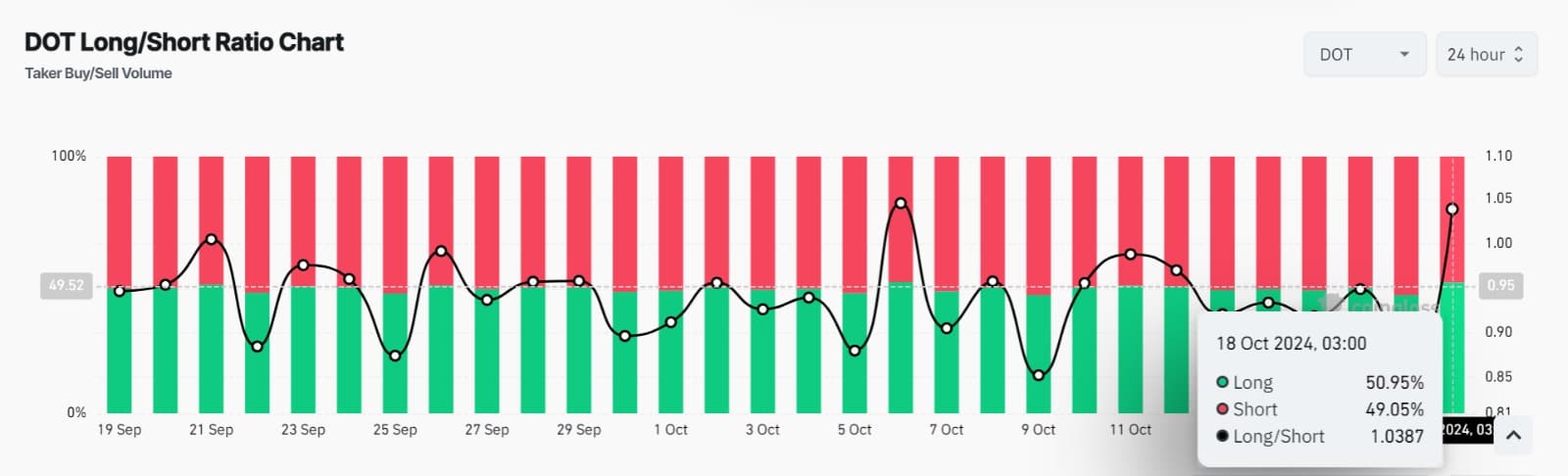

Over the last 24 hours, Polkadot’s Long-to-Short Ratio has been greater than 1. This implies that a larger number of investors have been opting for long positions, thereby indicating that long trades are predominant in the current market scenario.

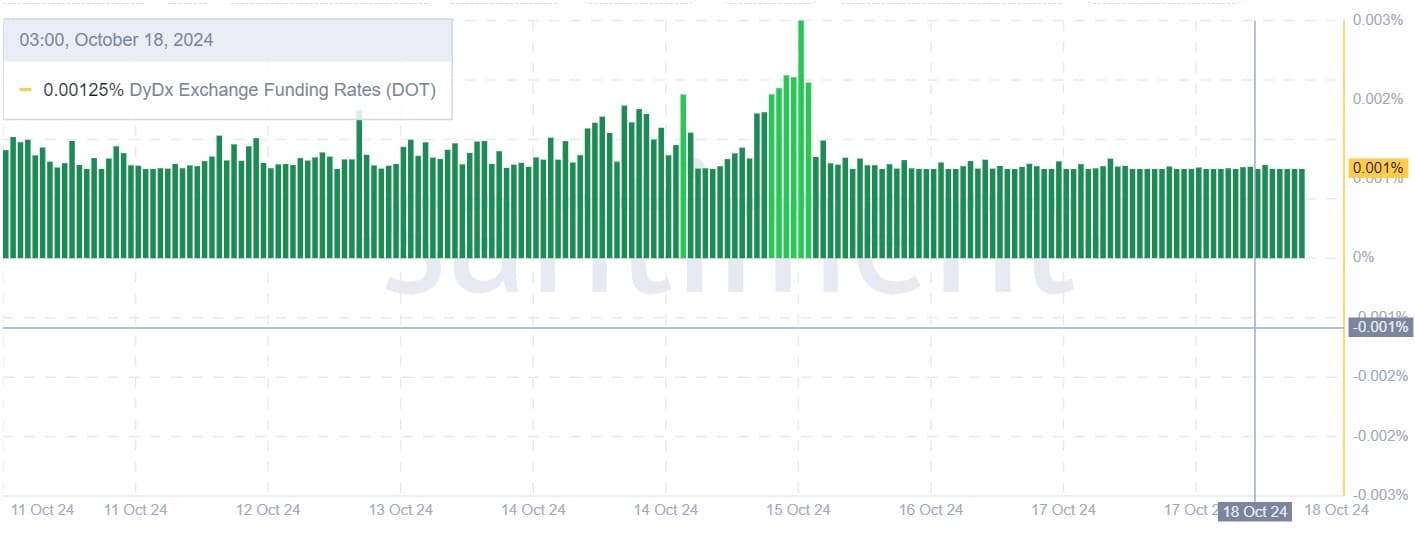

This demand for long positions is further supported by a positive DyDx exchange funding rate.

This indicates that long investors have faith in the market and are prepared to compensate short sellers when market conditions deteriorate, thereby maintaining their positions.

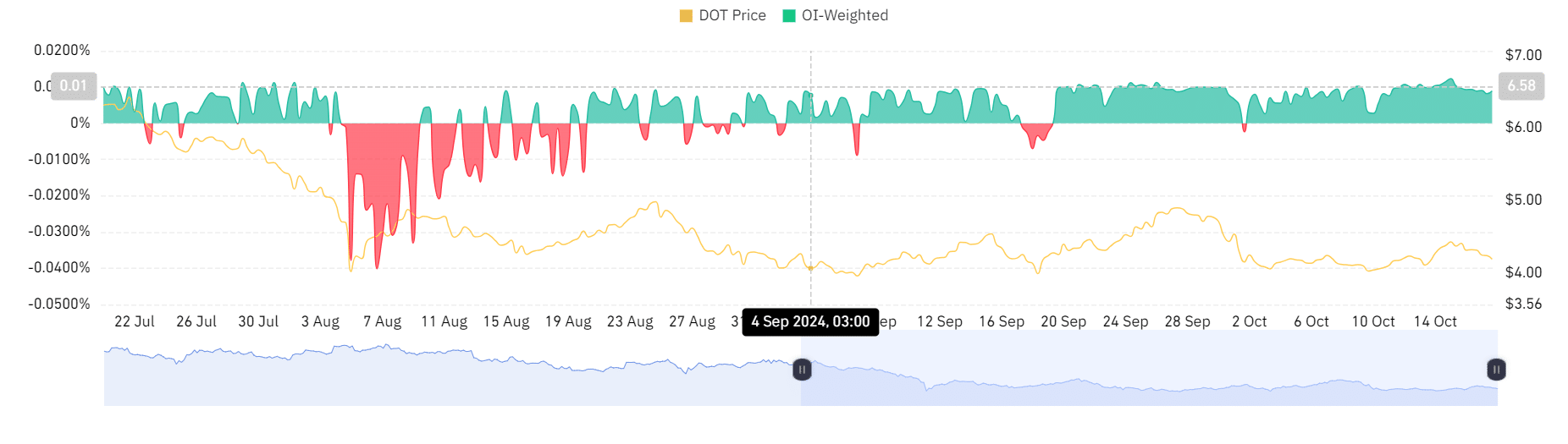

Furthermore, a funding rate favorable to the Overnight Index Swap (OIS) system reinforces our previous notion that there is a strong preference for long positions in the market.

To sum up, there’s been continuous growth in Polkadot’s open interest across exchanges, moving from $47 million to $54.3 million as we speak. This surge indicates a strong preference for long positions, suggesting that the majority of new positions being opened are long ones.

Read Polkadot’s [DOT] Price Prediction 2024-25

Essentially, there’s a lot of optimism and investor appreciation for DOT right now. If this trend continues, DOT could aim for its next significant resistance point at around $5.0. In an optimistic outlook, breaching this level might boost the altcoin further to reach approximately $6.4.

Consequently, the anticipated rally should last about three months, starting from an accumulation phase that begins as early as possible. Historically, such rallies have occurred between January and February in the year 2025.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-19 02:16