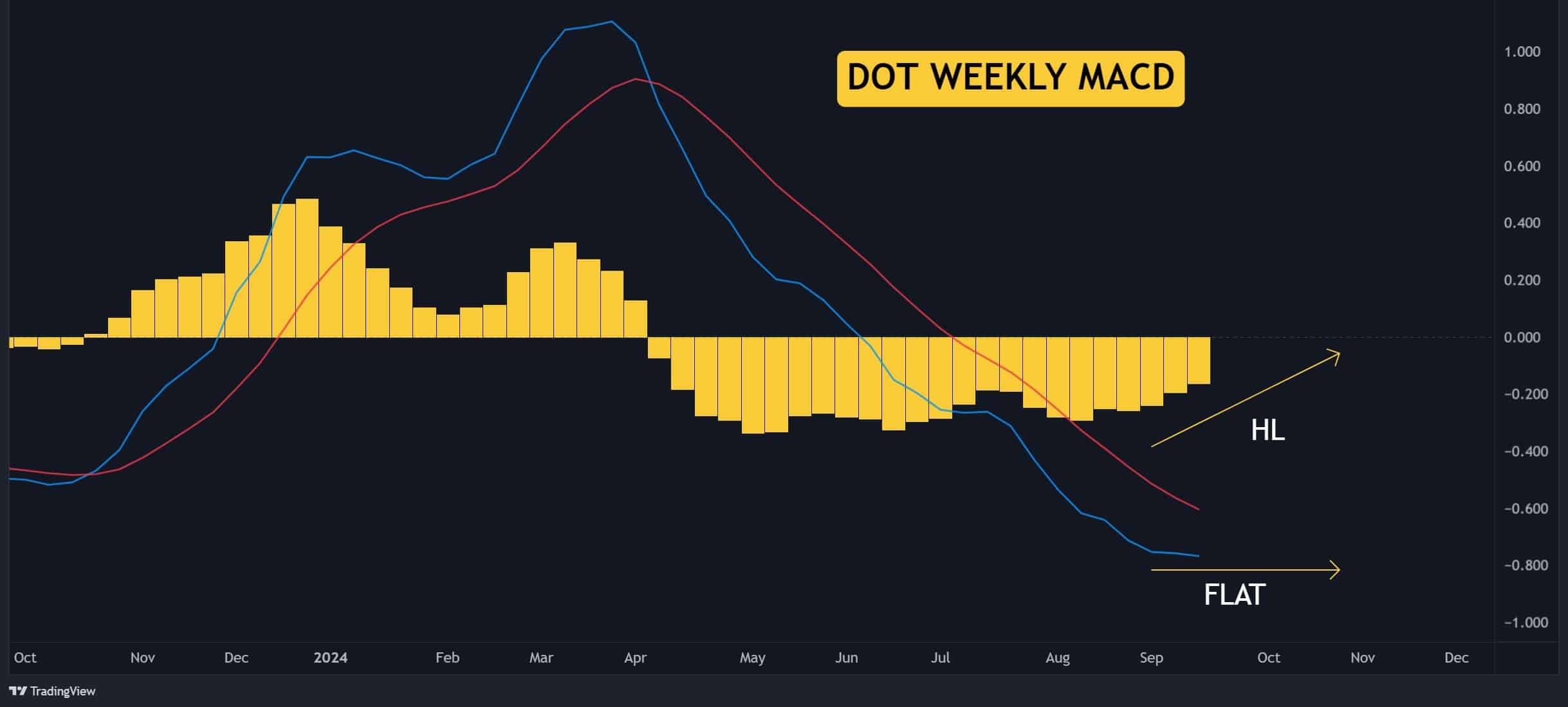

- MACD shows higher lows as moving averages flatten for Polkadot.

- Percentage of longs rising in conducive liquidity changes.

As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I can confidently say that the recent developments surrounding Polkadot (DOT) are quite promising. While the crypto winter has certainly tested our resolve, the resilience displayed by DOT in the face of adversity is nothing short of impressive.

In the realm of Web3, Polkadot (DOT) appears to be steadily building up speed. This surge could be attributed to a recent update that has sparked considerable interest among developers.

Just like many other digital currencies, DOT has experienced downward trends lately. Yet, some encouraging indications suggest that a possible floor might be setting up, fueling hope for an upturn in the last three months of 2024.

In simpler terms, the MACD (Moving Average Convergence Divergence) on a weekly basis suggests that DOT may soon experience an upward trend due to its lower highs becoming higher again. Additionally, its moving averages are leveling out, which could mean that as the market recovers and stabilizes, DOT is gearing up for a bullish move.

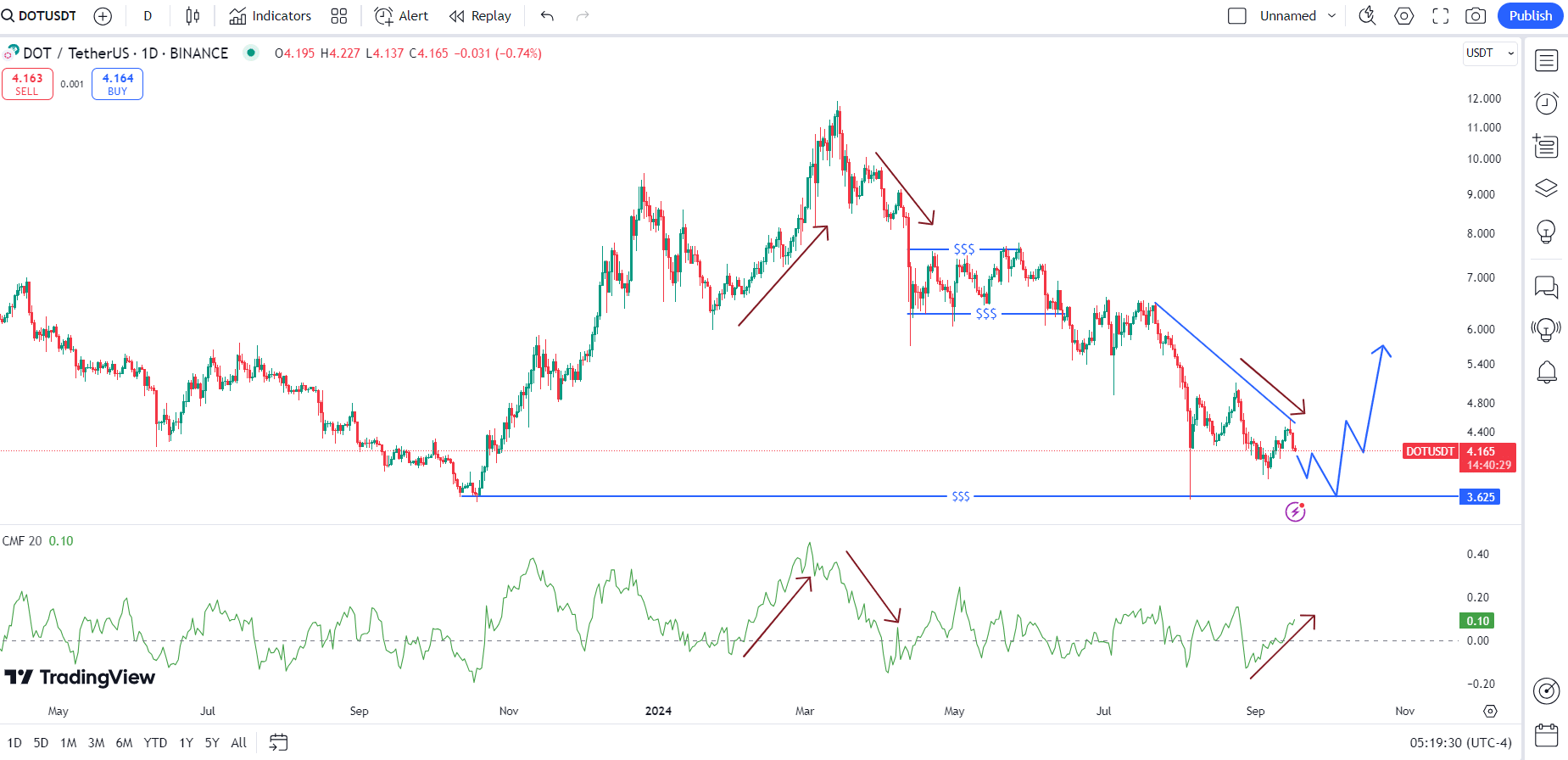

As a researcher, I’ve noticed that Polkadot’s price action aligns with my initial outlook. Despite the DOT/USDT pair experiencing a significant dip, it has demonstrated remarkable resilience by not falling below the low it reached in October 2023. This dip preceded a bull run that peaked in March, indicating a potential for a similar upward trend in the future.

After that incident, the price has generally been decreasing. Yet, the lowest point of the August 5th market crash hasn’t been surpassed, implying that buying or accumulation is occurring.

As a crypto investor, I’ve noticed a possible double bottom forming at $3.56, which could suggest a reversal might be on the horizon. Interestingly, when I scrutinize the Chaikin Money Flow (CMF) indicator along with Polkadot’s (DOT) price trend, there seems to be a discrepancy: while the CMF is climbing, DOT’s value has been sliding downward. This divergence could potentially signify that the market sentiment may not fully reflect the actual price movement, and a bullish reversal could be imminent.

Based on my years of trading experience, this divergence appears to indicate a buildup of assets, implying that buying pressure might escalate soon, potentially pushing the price upward. I have seen similar situations before, and when this happens, it often results in increased demand for the asset, causing its price to rise. So, if you’re considering making a purchase, now could be an opportune moment.

Experts at AMBCrypto anticipate that Polkadot (DOT) could potentially reach the $3.56 mark for a significant test, after which it might show a clear upward trend.

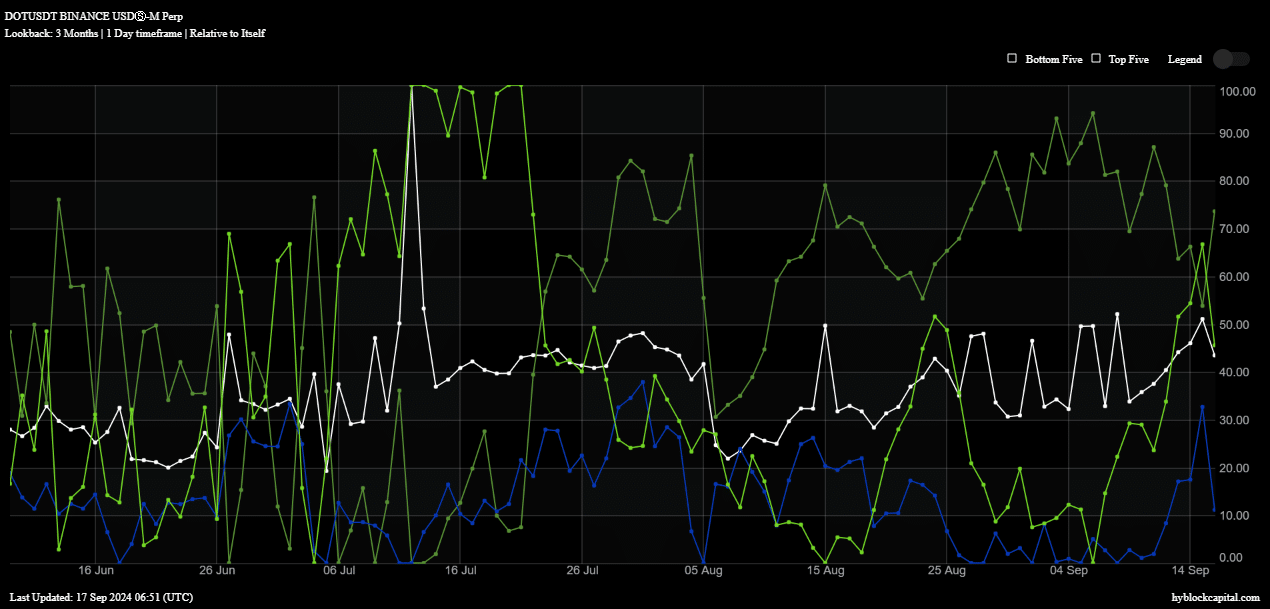

DOT long positions rising…

Moreover, there’s a significant increase in the number of long positions for the Polkadot token, reaching approximately 73% at present.

A significant increase in this figure suggests that large investors, individual traders, and establishments are increasingly optimistic about DOT, and they’re probably stockpiling it in preparation for a potential price rise.

The gap between the price movement of whales (large investors) and retail investors in DOT stands at 46% right now, and this disparity continues to indicate a bullish sentiment, experiencing just a minor decline today, which further strengthens the optimistic perspective on DOT.

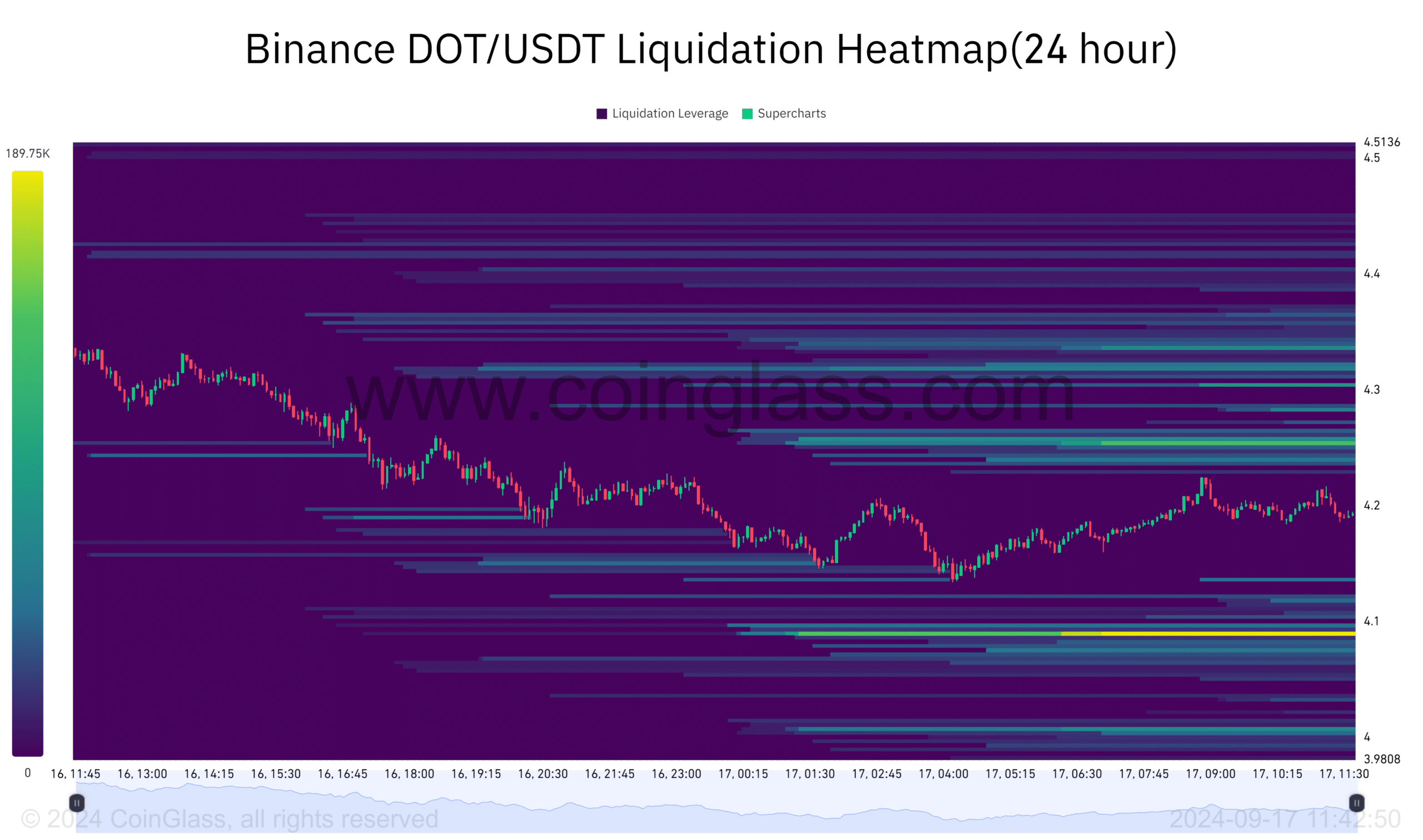

Favorable liquidity dynamics

In simpler terms, the price fluctuations of Polkadot (DOT) are often driven by regions with varying levels of availability of assets for trade, or liquidity. Generally speaking, DOT tends to shift from less-liquid areas towards regions where more assets can be easily bought and sold.

Currently, potential areas where DOT‘s price might increase are nearer to its current trends. This suggests a possible upward movement for DOT, with the next major goal approaching at around $4.25. This level contains about $117,000 worth of open positions that could be liquidated if the price reaches it.

On the other hand, the region with less liquidity at $4.08 shows a total of $189,700 in potential trades being closed, suggesting that a price increase could be more likely.

Read Polkadot’s [DOT] Price Prediction 2024-25

Currently, DOT has managed to gather liquidity at prices lower than its current level. This means that it’s well-positioned to target regions with greater liquidity levels above, which could in turn push its price upward.

Keeping a keen eye, investors anticipate that Polkadot might experience a substantial rise in its value in the upcoming days.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-18 11:36