- DOT saw a bullish moving average crossover as prices catapulted beyond $10.

- The bears began to pull this move back immediately as BTC prices began to slide lower as well.

As a seasoned researcher with years of experience tracking digital assets, I’ve seen my fair share of market swings, and Polkadot [DOT] is no exception. The recent bullish move beyond $10 was a sight to behold, reminding me of a wild mustang finally breaking free from its corral.

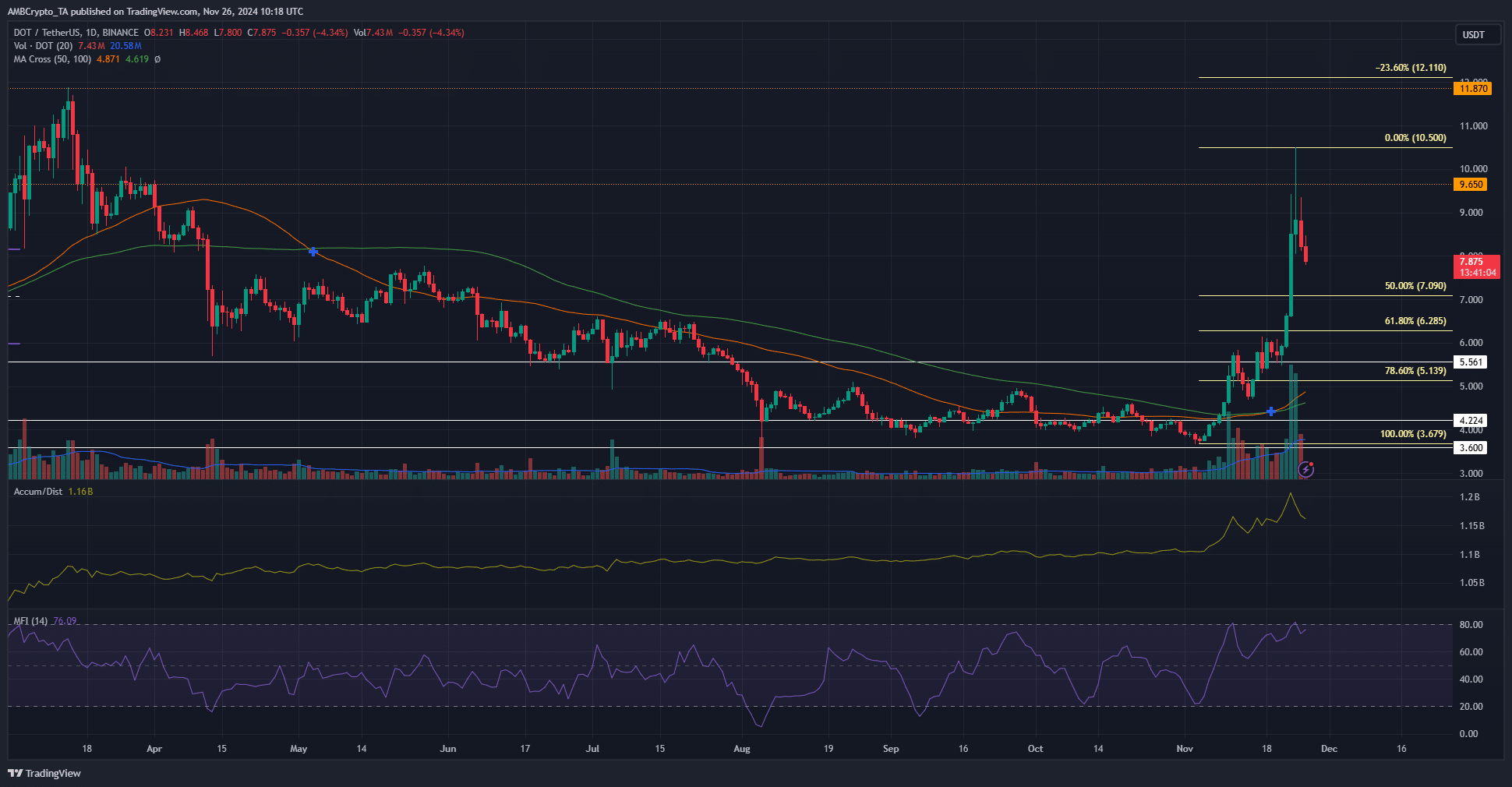

As an analyst, I observed a significant surge in Polkadot (DOT), soaring approximately 185% from its lows recorded at $3.7 on the 4th of November. However, it seems that the token has since retracted some of those gains, hinting at a possible deeper dip ahead.

Starting from mid-March onwards, Polkadot experienced a downward trend which persisted as we moved into November. Despite this, the bulls managed to leverage the rising momentum of Bitcoin [BTC] to stage a recovery for Polkadot.

The support levels for DOT traders to watch are highlighted below.

DOT breaks the $10 mark

As a crypto investor, I witnessed the bullish momentum from early November propel the price of DOT up to around $5.7. Subsequently, a pullback took us down to roughly $4.75 and a period of consolidation under the $6 mark ensued. This gave the bulls time to regroup and prepare for the next surge in the market.

From the 22nd to the 24th of November, DOT rallied by 77%.

Over the past few days, it has made significant progress in reversing its previous movement and is currently priced at $7.87. At this moment, the report was published. Moreover, the Activity/Demand (A/D) indicator has been steadily increasing, indicating a high level of interest or demand for the token.

Additionally, the Money Flow Index did not signal a bearish divergence.

Given Bitcoin’s approach to the $90k support region, there’s a strong possibility that altcoins may experience a dip. This potential downturn could push Polkadot towards Fibonacci retracement levels marked at approximately $7.09 and $6.285.

Such a dip would be a buying opportunity.

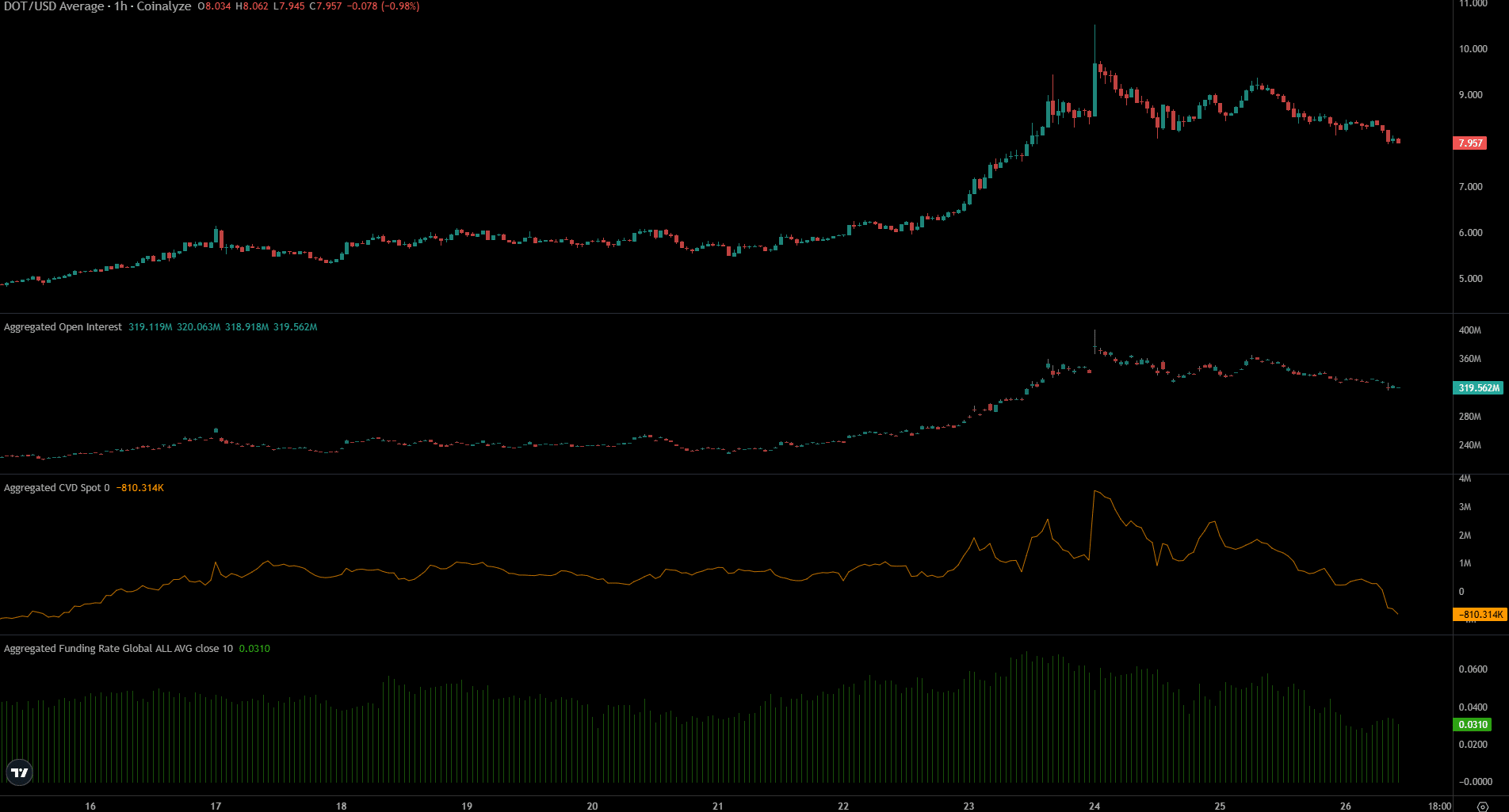

Spot CVD decline hints at weakened demand

On November 24th, Open Interest (OI) reached a high of $399.8 million. Meanwhile, the spot CVD experienced substantial inflows and rose in trend on that same day. However, this pattern started shifting the very next day.

Read Polkadot’s [DOT] Price Prediction 2024-25

As the On-the-Run (OTR) and Certificate of Deposit (CD) market for Contracts for Difference (CFD) started showing a decrease, it indicates less competition in both the immediate trading (spot) and future contract markets.

The dropoff was particularly sharp, indicating significant buying force in shorter periods. However, the funding rate stayed optimistic, suggesting potential losses could occur within the coming days.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-27 03:03