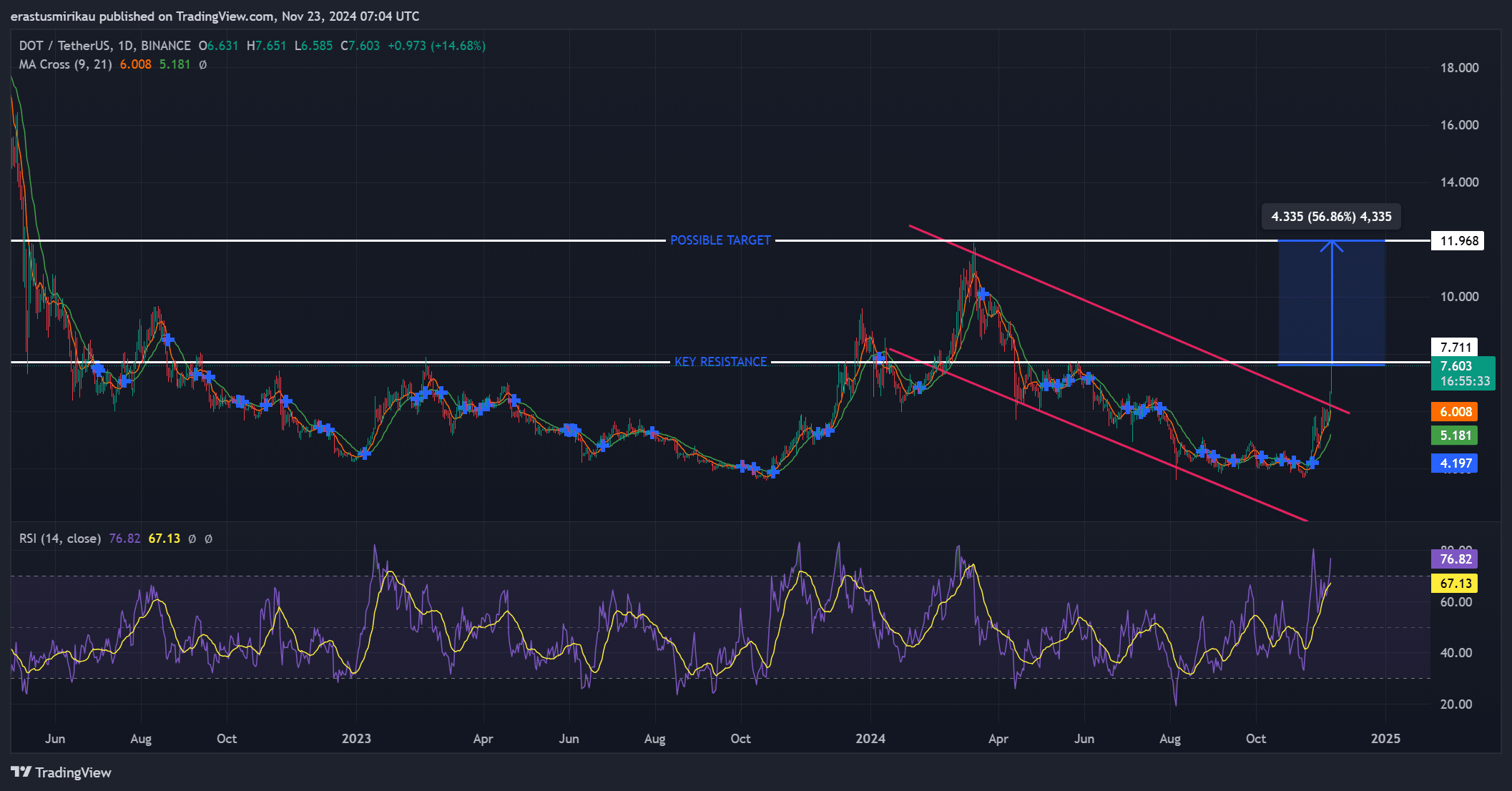

- Polkadot’s breakout above the descending channel highlighted a potential 56.86% upside to $11.96.

- Strong short liquidations and steady social metrics are driving DOT’s bullish momentum.

As an analyst with over two decades of experience in the cryptocurrency market, I have seen my fair share of bull and bear markets. The recent breakout by Polkadot (DOT) has caught my attention, and it’s not every day that we see a coin like DOT breach a long-standing descending channel.

Polkadot’s [DOT] recent breakout from a prolonged downward trend line indicates a potential change in direction, implying a surge in interest and positive movement.

Currently, DOT is being traded at $7.55, representing a 21.94% increase over the last 24 hours. The market capitalization of DOT now stands at $11.49 billion, and the trading volume within the same period has significantly jumped by 102.86%, reaching $1.40 billion.

The current surge in value for DOT finds it nearing an important turning point, close to a significant resistance level priced at around $7.71.

What does the breakout indicate for DOT?

The surge of Polkadot beyond its downward trendline is fueling hope for its continued ascent. For now, the price of DOT confronts an immediate barrier at approximately $7.71; this key level will dictate if its upward momentum persists.

Should this resistance be overcome, the next goal lies at approximately $11.96, which represents a possible increase of around 56.86%.

Looking at the technical standpoint, the latest Moving Average cross served to reinforce the bullish trend. Moreover, the Relative Strength Index stood at 76.8, suggesting a considerable level of buying intensity.

Keep an eye on the Relative Strength Index (RSI), because when it exceeds 70, it typically signals that the asset is approaching overbought territory, potentially causing temporary price drops in the near future.

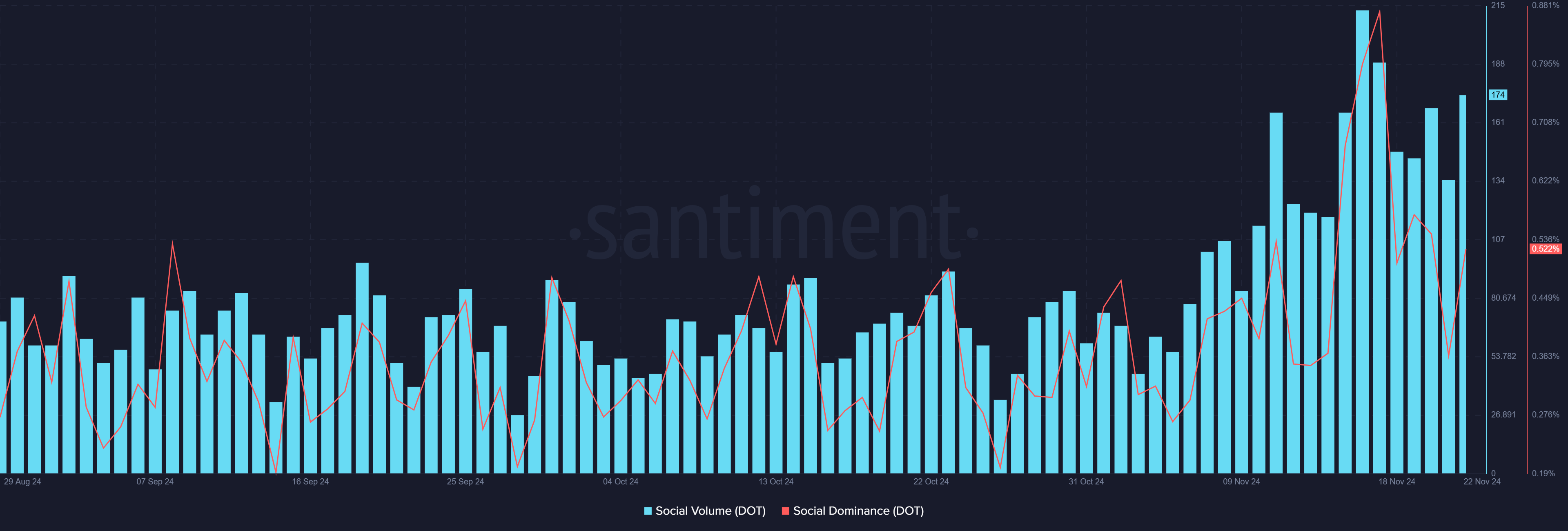

Social engagement and dominance hold steady

Despite the surge in activity surrounding DOT’s price increase, its social engagement levels have remained relatively modest. At the moment of reporting, the Social Volume for Polkadot was 174, and its Social Dominance stood at 0.52%.

The data demonstrated consistent involvement, indicating a long-term commitment from the community without significant peaks.

As a researcher, I’ve noticed that consistent involvement in a market seems to foster sustainable, natural price increase instead of brief, sporadic speculation.

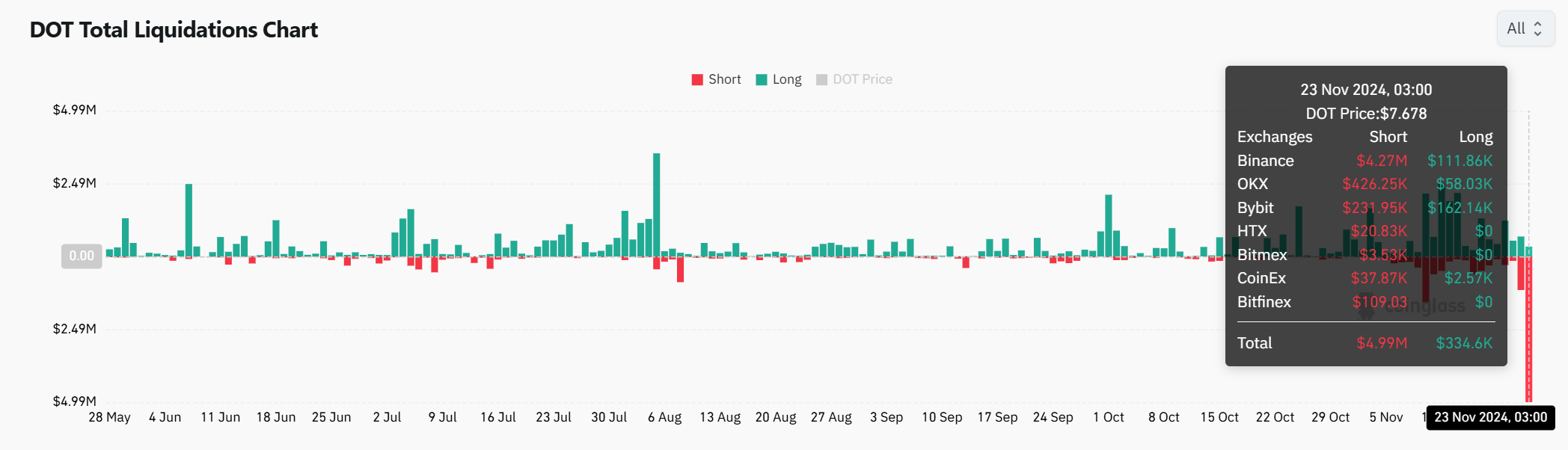

Liquidation data fuels the rally

The surge in Polkadot’s price trend can be largely attributed to a high volume of liquidations. In the last 24 hours, approximately $4.99 million worth of short positions have been liquidated, while only around $334,600 worth of long positions were liquidated.

Due to the unbalanced situation, there’s been a forced buying spree among traders who had bet against DOT (Dot), causing them to exit their negative positions. This, in turn, has significantly boosted the upward trend of DOT’s price.

This has created additional upward pressure, pushing DOT closer to its resistance level.

Read Polkadot [DOT] Price Prediction 2024-2025

Can DOT hit $11.96?

The surge in Polkadot, accompanied by high trading activity, a positive technical configuration, and consistent social indicators, suggests that the coin will maintain its uptrend for an extended period.

As a researcher analyzing market trends, if Polkadot (DOT) manages to surpass the resistance level at $7.71, it significantly increases the likelihood of its price reaching $11.96. In other words, the current indicators hint that Polkadot’s upward momentum is robust and appears primed for continued growth in the short term.

Read More

2024-11-23 17:12