- Polkadot bears have dominated this year but the bulls may soon have a chance to shift the outcome.

- Demand remains low but Polkadot’s DeFi hub TVL growth signals long-term optimism.

As a seasoned researcher with years of experience in the ever-evolving world of cryptocurrencies, I have seen my fair share of bull runs and bear markets. The year 2024 has been an interesting one for Polkadot [DOT], to say the least.

🚨 RED ALERT: EUR/USD Forecast Shattered by Trump’s Moves!

Markets react violently to tariff news — stay ahead of the shockwaves!

View Urgent Forecast2024 saw the native cryptocurrency of Polkadot (DOT) functioning as a magnet for bearish market trends. Despite starting the year on a positive, bullish note, it has generally trended downwards throughout the year.

Recent observations suggest that the tables are about to turn for DOT.

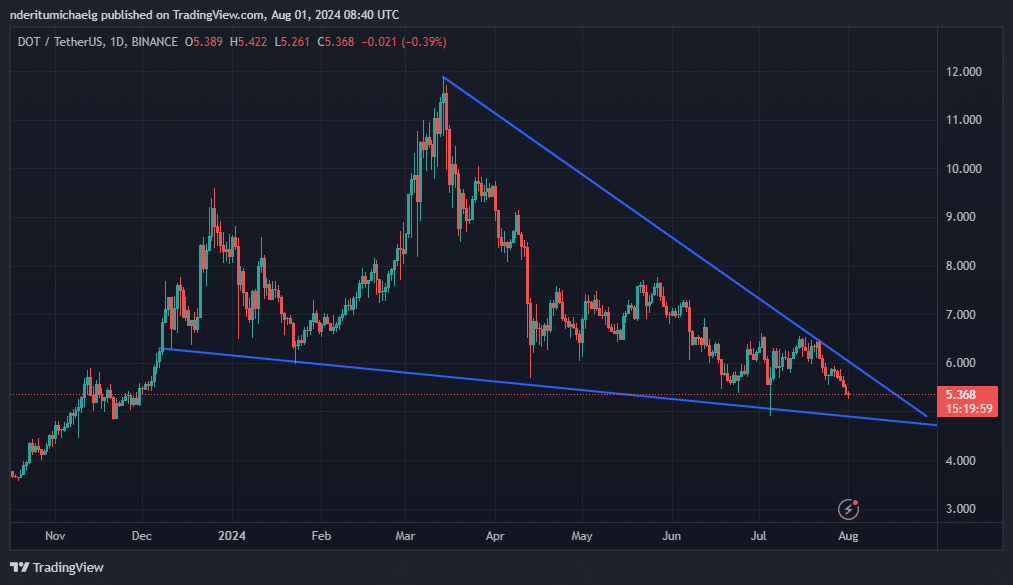

Over a prolonged period, the value of DOT followed a pattern known as a “falling wedge,” which started at its peak in mid-March. Since late 2023, it has formed lower price levels compared to previous periods.

A downward encounter with its gradually decreasing resistance line, which took place around late July, sparked additional selling activity. At that moment, the stock was priced at $5.37, representing a 7% decline since it approached its next potential support level.

As a researcher, I’ve observed that the Dow Jones Organic Token (DOT) seems to be in a compressed phase, characterized by its falling wedge pattern. This area is often where accumulation occurs. However, the question remains: Will this compression result in a breakout?

Assessing DOT bullish breakout possibility

Enlarging the scope of DOT‘s graph showed that the price was situated in an area of historical accumulation. Additionally, the wedge-like structure suggested a greater likelihood of a break in this pattern.

As a crypto investor, I’ve noticed that the significant price drop over the past few months has increased the likelihood of a bullish trend. Consequently, the recent prolonged dip in price could be seen by many traders as an enticing opportunity to enter the market.

Based on the present trend, DOT traders might want to prepare for potential robust support around $4.9 if the market keeps falling. Yet, this doesn’t automatically mean that the price won’t drop even further.

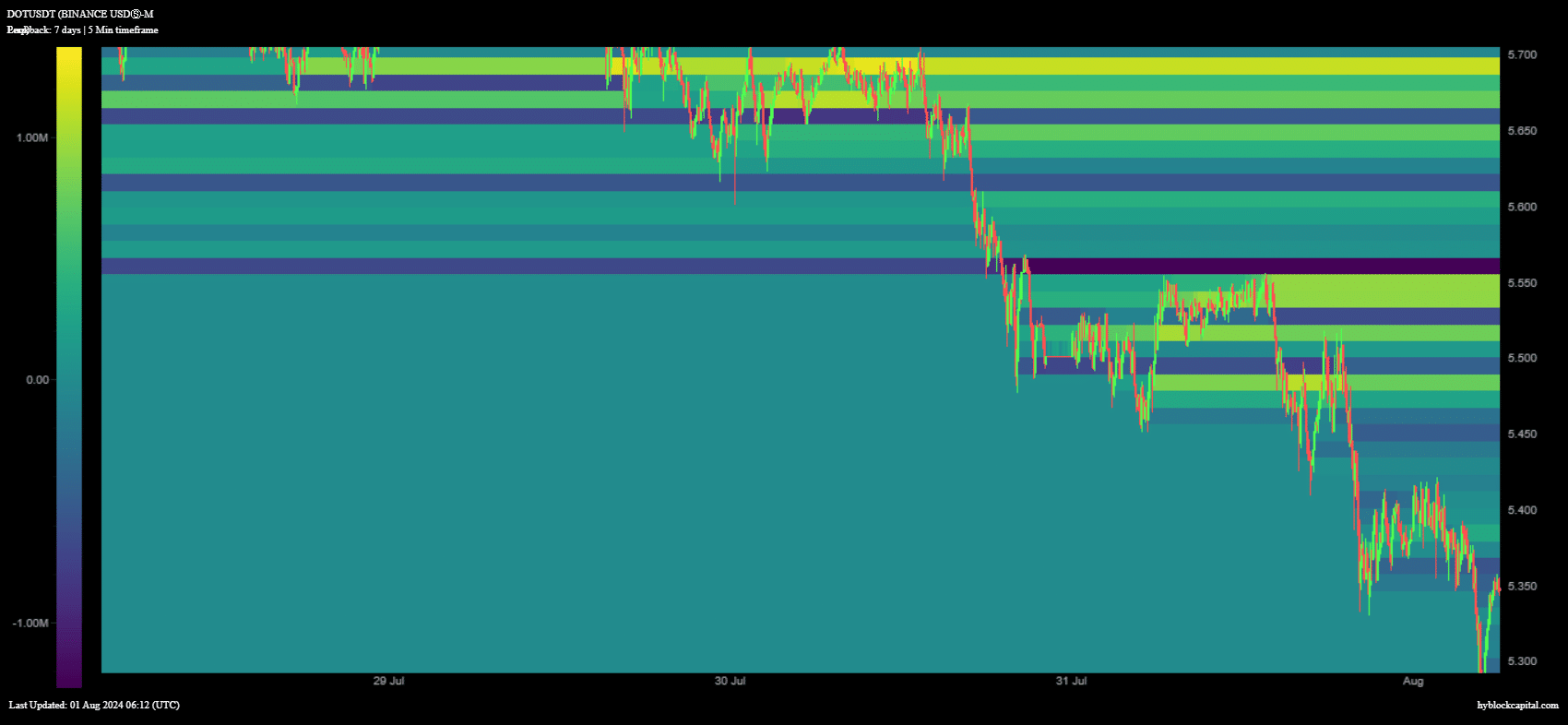

Is there a chance that the bullish trend might regain strength in the near future, given the significant drop in demand we noticed during the last week of July? The steep decline in prices throughout that period suggests this may be the case.

Using a different heatmap from DOT, we’ve made the same observation. Open interest for DOT has been relatively low since July 24th.

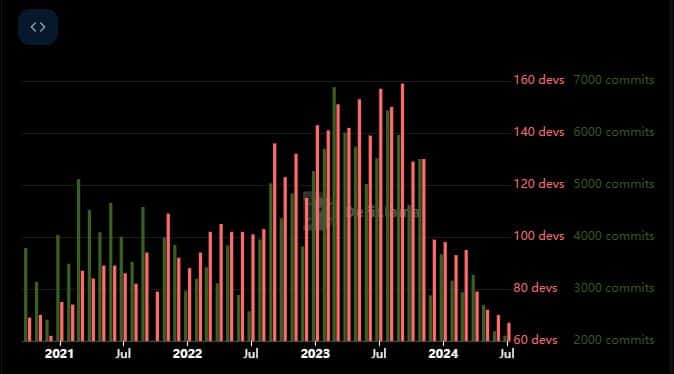

At the point we were looking, DOT was nearly touching a significant area where demand has historically dropped. We’ll keep an eye on this spot to see if it suggests accumulation. However, the falling price could indicate that investors are losing faith in the project. This uncertainty was also reflected in the decrease in developer activity.

It was not all negative news though. Hydration, Polkadot’s decentralized finance recently offered some optimism.

Read Polkadot [DOT] Price Prediction 2024-2025

Previously known as HydraDX, this platform has experienced significant expansion. Its Total Value Locked (TVL) reached an all-time high in July following a remarkable surge in growth since January 2024.

As a researcher, I’ve noticed an impressive surge in the Total Value Locked (TVL) of Hydration’s Omnipool. This growth might suggest that long-term DOT holders are choosing to stake their DOT, indicating a continued optimism towards the potential of this cryptocurrency.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-01 14:15