- Market sentiment around the token looked bearish.

- Derivatives metrics hinted at a possible price rise soon.

As a seasoned researcher with years of experience in the ever-evolving crypto market, I find myself at a fascinating crossroads with Polkadot (DOT). The recent price drop has been a significant event, but the story doesn’t end there. The token is testing a critical support zone, which could potentially trigger a new bull rally towards the analyst’s predicted $30 mid-term target.

Last week, Polkadot’s [DOT] market capitalization experienced a significant decrease, with its value dipping by double-digits. Yet, there’s more to this tale: The token may be gearing up for a significant resurgence as it approached a crucial support level.

Polkadot at a crossroad!

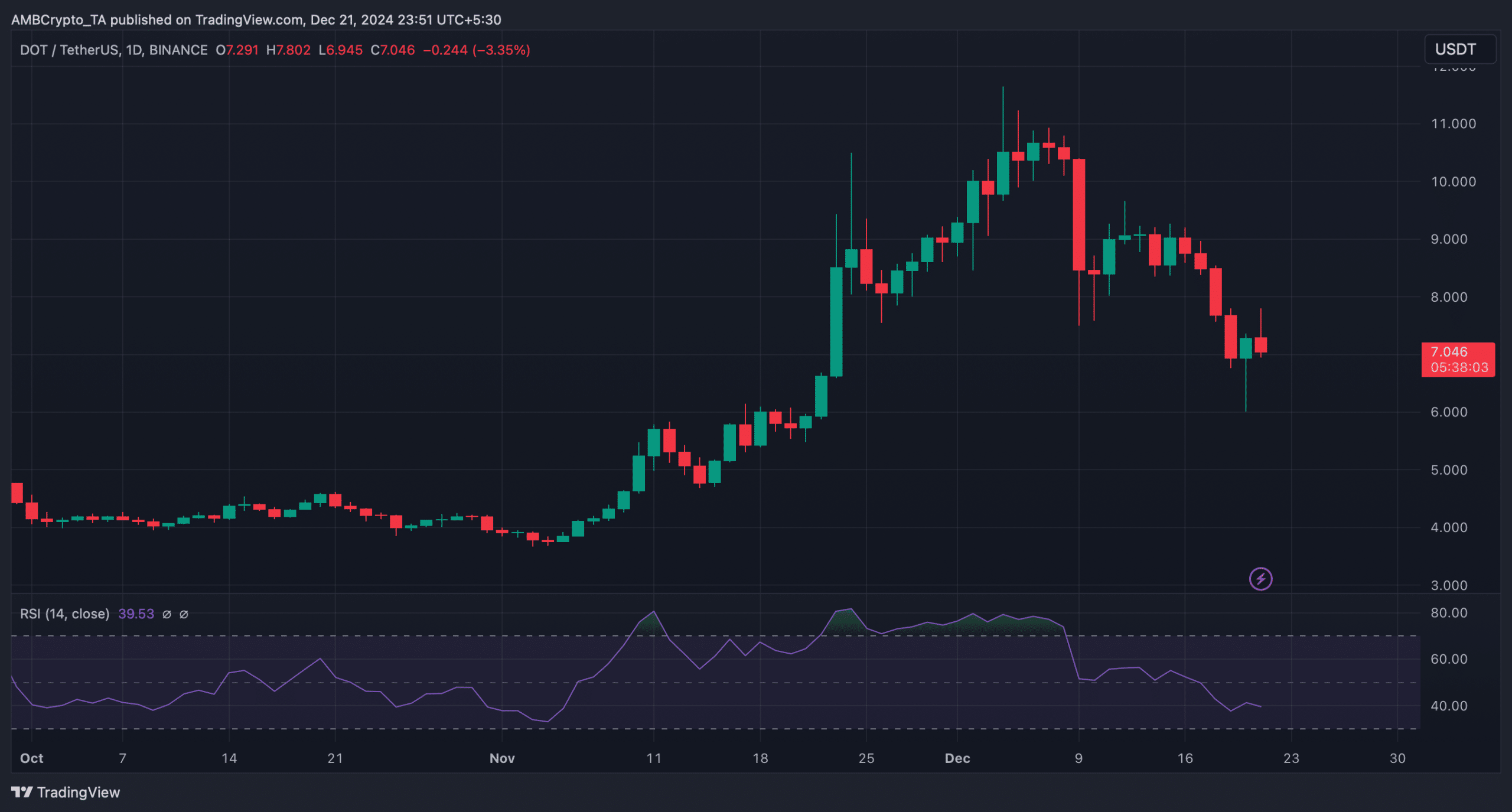

According to CoinMarketCap’s findings, Polkadot (DOT) witnessed a decrease in value exceeding 17% during the past week. Currently, it is being traded at approximately $7.08, and its total market capitalization surpasses $10 billion.

Currently, a well-known cryptocurrency analyst known as World of Charts shared some insights on DOT through a tweet. According to his post, DOT had already rebounded from an essential trading area and was now evaluating its position at a potential support level.

As an analyst, I am optimistic that a strong rebound from the current support levels could kick-start a fresh bullish trend. This positive momentum might propel DOT prices to unprecedented highs. Based on my analysis, I anticipate a mid-term bull rally that could drive DOT towards $30.

Is a successful test possible, or will DOT fall further?

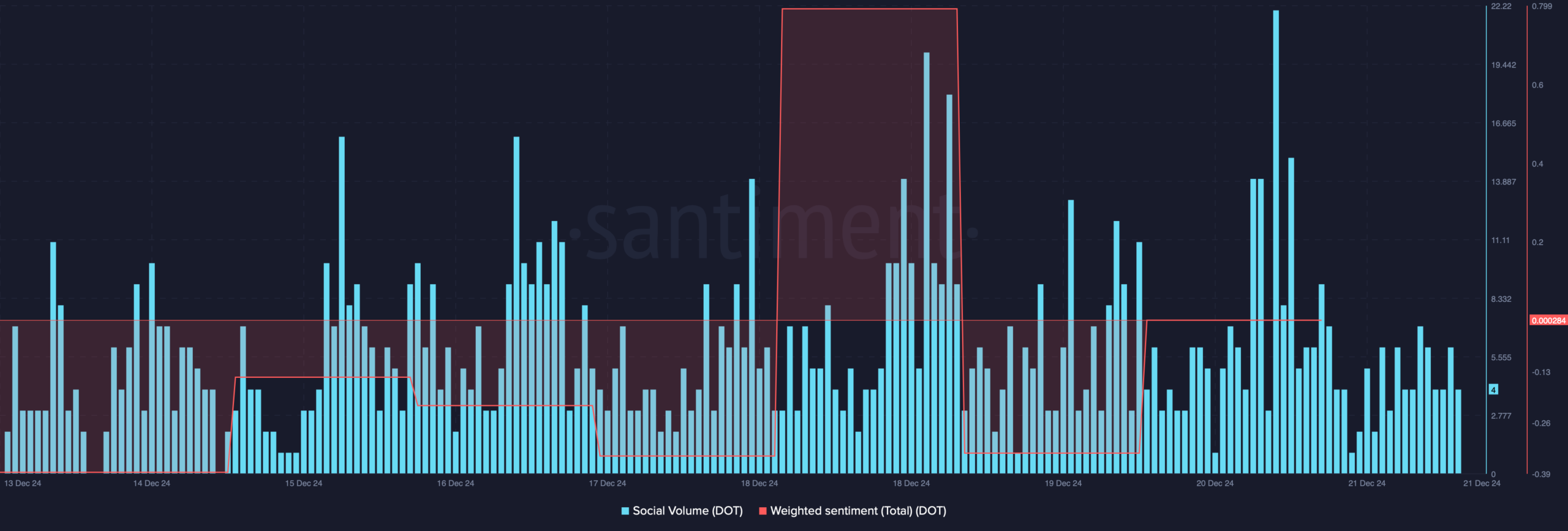

According to AMBCrypto’s examination, although the token’s price took a significant dip due to a correction, its overall sentiment decreased following a surge on the 18th of December.

A decline in the metric indicates rising bearish sentiment around a token in the market. In fact, its social volume spiked during the downtrend, suggesting that investors were talking about Polkadot.

Nonetheless, one of Polkadot’s derivatives metrics looked optimistic, hinting at a successful test of the aforementioned support.

According to information from Coinglass, the balance of long and short positions for DOT (Polkadot) tilted towards long positions over a 4-hour period. Essentially, this indicates that more traders were holding long positions rather than short ones, suggesting an uptick in optimistic outlooks regarding Polkadot.

Remarkably, even though the derivatives measure suggested a passing result, the Relative Strength Index (RSI), a technical indicator, presented a contrasting account. Over the recent days, this indicator has shown a decrease, and at the current moment, it stands at 39.

When the indicator decreases, it typically implies that there’s growing demand for selling the token, usually leading to price adjustments or corrections.

Read Polkadot’s [DOT] Price Prediction 2024-25

A look at Polkadot’s network activity

As a researcher, I’ve observed a challenging period for the token’s price performance, and it’s not just about the fluctuations. Simultaneously, we noticed a decrease in network activity within Polkadot, according to our findings based on Artemis’ data.

In December, there was a significant drop in the number of daily active addresses on the blockchain. This decrease led to a parallel decrease in the number of daily transactions as well.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-12-22 11:03