- DOT was on the brink of a bullish breakout as it approached two critical support levels.

- However, the strength of the rebound at this support level will dictate how far DOT can rally.

As a seasoned researcher who has weathered numerous market cycles, I find myself cautiously optimistic about Polkadot’s [DOT] potential rally. The approach of two critical support levels and the bullish sentiment in the overall market have piqued my interest. However, it is important to remember that the crypto market is known for its volatility – it can be as unpredictable as a rollercoaster ride at an amusement park!

For the last thirty days, the price of Polkadot (DOT) has been on a downward trajectory, experiencing a drop of approximately 2.73%. Over the past day, this decline has continued, with a further decrease of 3.74% observed within the last twenty-four hours.

Despite a small decrease from its present level being plausible, conditions seem favorable for an upcoming surge.

AMBCrypto has examined the reasons behind this expected shift and what investors need to keep an eye on.

DOT set for major rally as key support levels near

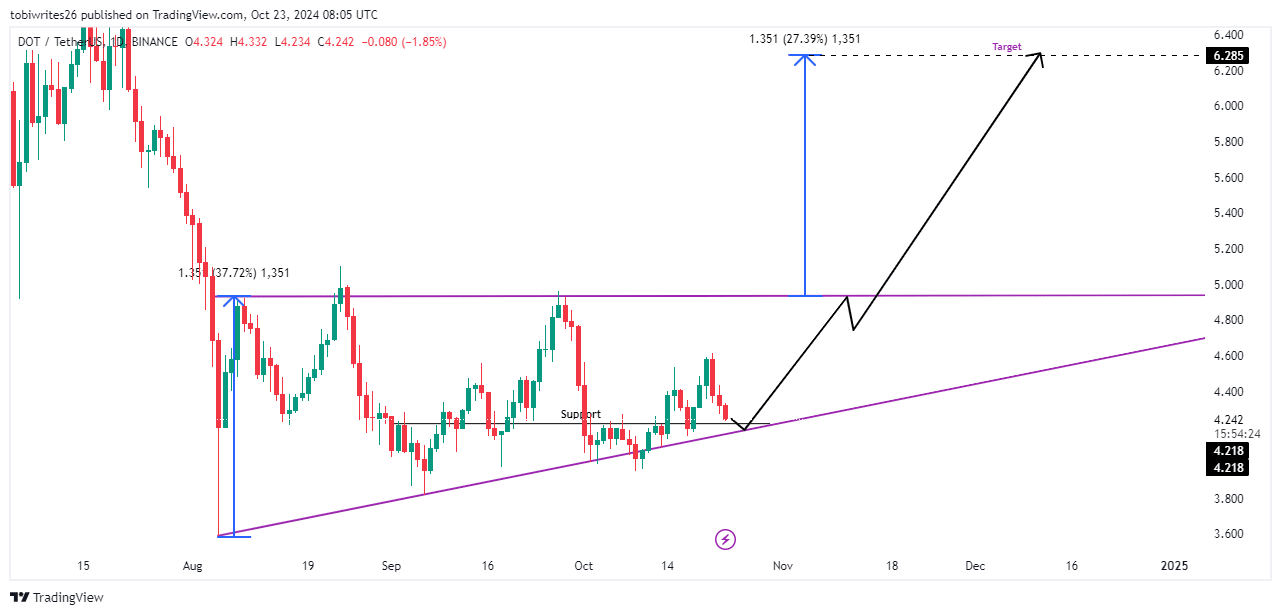

As DOT gets near two crucial points that could provide support, it sets itself up for a possible substantial surge in price. The primary support can be found at approximately $4.218, whereas the secondary one is formed by the diagonal line representing the upward-sloping channel.

If the initial backup (highlighted in black) responds favorably, it might initiate a small upward trend. But if DOT rebounds from the foundation of the bullish structure, it’s more probable that it will initially rise to around $4.93 first.

Overcoming this obstacle might result in a 27.39% increase, potentially pushing the value of DOT up to $6.285.

Delays might happen if the support level of the pattern gets broken, temporarily halting the rise of DOT.

Market sentiment signals a bullish shift

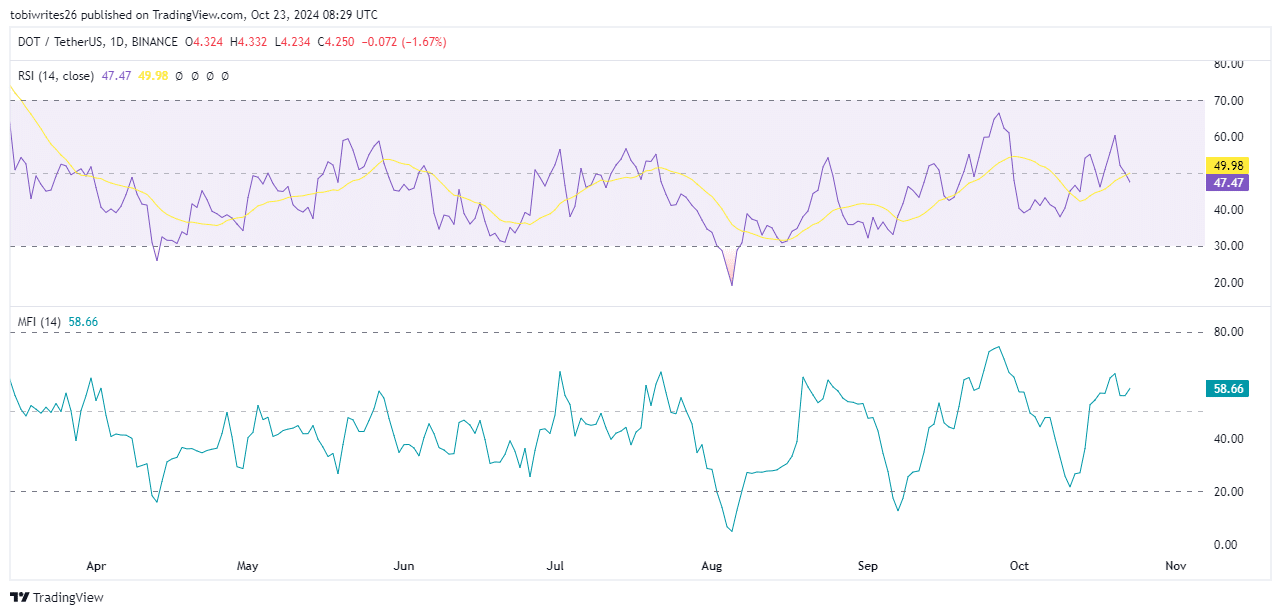

Currently, the Relative Strength Index (RSI) is showing a significant drop, approaching the region close to its neutral level, at about 49.99.

It seems likely that DigitalOcean’s (DOT) price could continue to decrease from its present position, potentially dipping beneath the $4.218 support threshold as it looks to find support from the upper boundary of the ascending channel.

The RSI (Relative Strength Index) quantifies how quickly and intensely the value of an asset like DOT fluctuates, suggesting possible further drops in the near future as it signals momentum in a negative direction.

On the other hand, the Money Flow Index (MFI), which monitors the movement of funds into and out of DOT, indicates a strong influx of money. Should this trend persist, it suggests a possibility of an imminent price surge.

Overall market activity remains bullish

A study of trading patterns based on Coinglass’s Exchange Netflow data indicates a generally optimistic outlook among investors (or traders).

Read Polkadot’s [DOT] Price Prediction 2024–2025

For the last seven days, the Netflow on the Exchange for DOT has been running at a deficit, totaling approximately $3.04 million in DOT being taken off exchanges.

It showed that a higher number of market players preferred to keep their investments secure instead of liquidating them, usually leading to less selling and therefore reduced pressure on prices falling.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-23 23:35