- POL has surged by 17.17% over the past month.

- An analysts eyes a “hated rally” citing three key factors.

As a seasoned researcher with over two decades of experience in the crypto market, I have witnessed numerous bull and bear cycles. The recent surge in Polygon (POL) has caught my attention, especially given the analyst’s prediction of a “hated rally.

For about a month now, Polygon‘s [POL] price movement has been on an upward trajectory. This trend has pushed its value to reach a peak of $0.4778 over the past three months, as previously mentioned by AMBCrypto.

Yet, over these days, the POL market has shown significant fluctuations, plunging as much as 12.52% within a span of just three days. Such instability indicates that the prices have seen ups and downs.

Currently, when this text is being penned down, POL was being exchanged at around $0.4375. This represents a rise of 1.65% in the past day. Furthermore, it has seen a growth of 14.26% and 17.17% over the last week and month respectively on the altcoin market.

The persistent upward movement in this cryptocurrency has sparked discussions among financial experts regarding its potential path forward. One such expert, Ali Martinez, has posited that POL might experience a ‘scorned surge’, based on three significant reasons.

3 reasons why POL could see a hated rally

According to Martinez’s assessment, despite a prevailing negative outlook in the market, optimistic indicators seem to be accumulating steadily.

As he explains, there are three crucial indicators suggesting an upcoming rally. Initially, Polygon’s price has rebounded from the triangle’s base. Typically, a rebound from the X-axis of the triangle implies that investors are entering the market, which can prevent any further decline. Furthermore, this rebound supports the importance of an upward trend, hinting at the possibility of a breakout.

Additionally, it’s worth noting that Stoch has now moved into a bullish position. This happens when the K line intersects above the D line, suggesting a possible change in direction or an increasing momentum moving upward.

In simple terms, within the next two weeks, the MACD (Moving Average Convergence Divergence) is expected to show a bullish sign, where the MACD line will cross over its signal line, suggesting the start of an upward trend.

On the other hand, the analyst suggests this could be a “disliked rally,” meaning some traders may hold back their participation due to skepticism, potentially missing the initial phases of the market’s surge. It’s important to note that in history, markets tend to move counter to popular sentiment.

Can POL finally rally?

Based on my analysis, I’ve noticed that the market conditions for POL are quite advantageous, potentially setting the stage for further price increases on its chart.

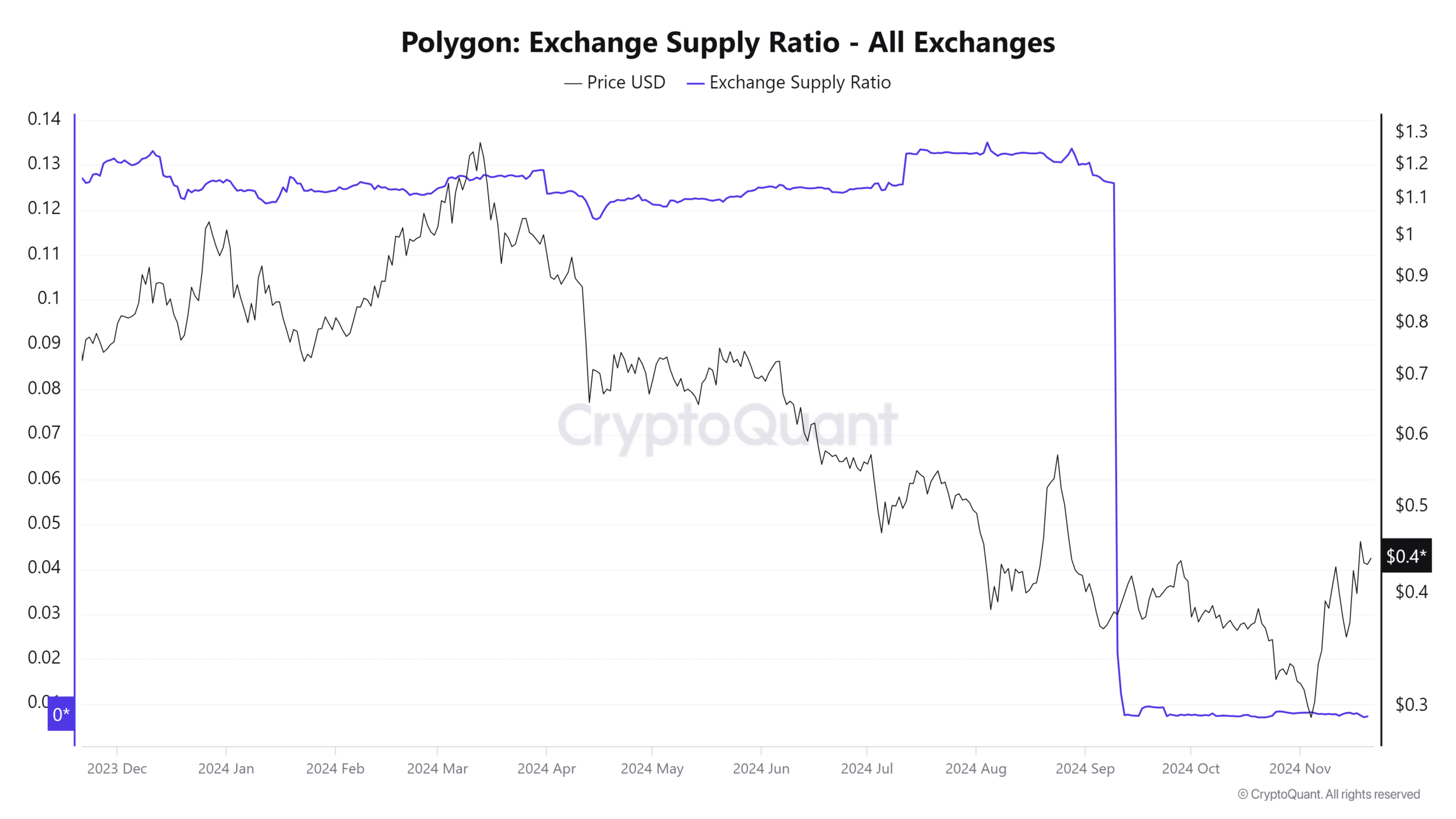

Initially, the Supply Ratio of Polygon’s Exchange has dropped from its previous level to reach 0.0072 over the last month. This decrease in exchange supply implies that investors may be choosing to hold their POL tokens in offline storage or personal wallets instead.

This suggests that investors are bullish and anticipate prices to rise.

As a seasoned crypto investor, I’ve noticed a significant shift in the market dynamics, particularly amongst the large holders or “whales.” The Large Holders’ Netflow to Exchange Netflow Ratio, which I closely monitor, has seen a dramatic change. It has plummeted from an impressive 3917% to a more reserved -55%. This indicates that these large holders are increasingly holding onto their cryptocurrencies rather than selling them on exchanges, suggesting a growing bullish sentiment among this group.

When the movement of whales’ funds becomes more outbound, it suggests they could be transferring their funds away from exchanges. This pattern is consistent with a strategy typically associated with buying large quantities of an asset for future use, often referred to as accumulating or hoarding in market terms.

To put it simply, Polygon (POL) is experiencing a significant change in its trend direction, which suggests a possible upward swing due to favorable market circumstances. This might lead to further increases in the value of Polygon as seen on various price graphs.

If this event transpires, there’s a possibility that the value of POL could regain the $0.46 barrier. Beyond this point, the digital currency may encounter a substantial resistance at approximately $0.57, a level where it has previously been rejected on several occasions.

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Quick Guide: Finding Garlic in Oblivion Remastered

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

2024-11-21 19:04