- Spot markets are seeing sell pressure, and derivative traders remain optimistic, helping keep POL on a bullish trajectory.

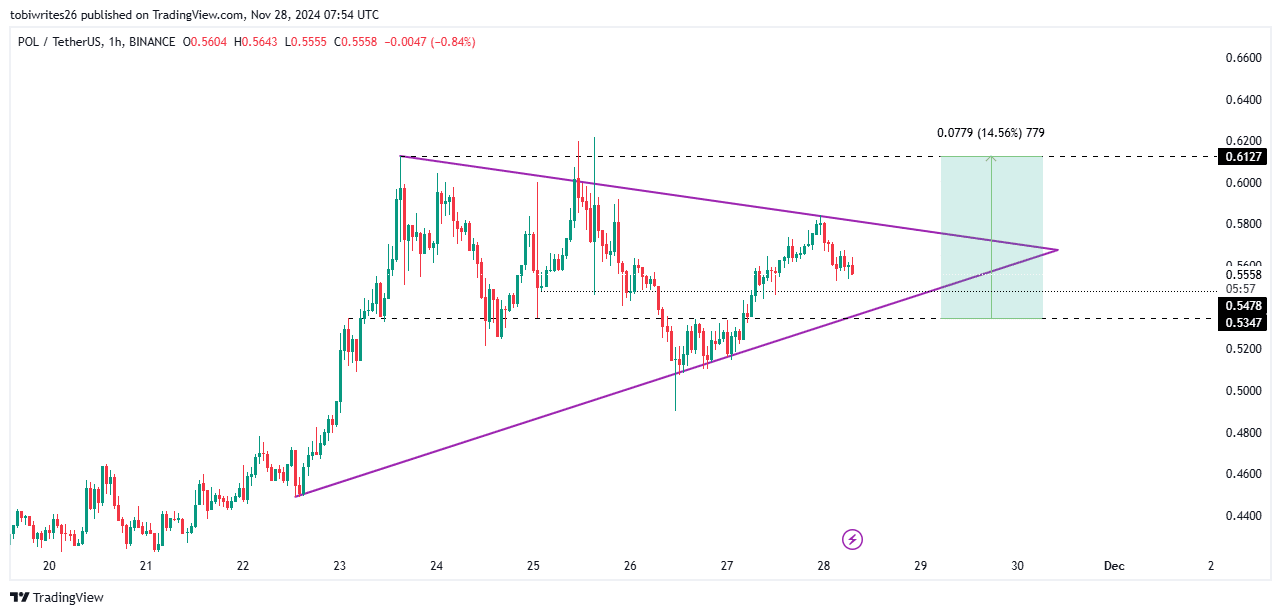

- The technical chart shows that POL is in an accumulation phase, as indicated by the symmetrical triangle pattern.

As a seasoned crypto investor with battle-scarred fingers from navigating through countless market cycles, I find myself cautiously optimistic about Polygon [POL]. The asset has shown impressive performance over the past month, but as the saying goes, “What goes up must come down.

In the last month, the cryptocurrency Polygon (POL) has experienced significant growth, recording a rise of approximately 66.28%. On a weekly basis, it increased by around 27.43%, while on a daily scale, its value went up by about 2.02%.

Based on robust investor optimism and ongoing buying spree, it appears that the price of POL might surpass its present daily growth of 2.02%, sustaining its bullish trend.

Derivatives traders push POL towards bullish momentum

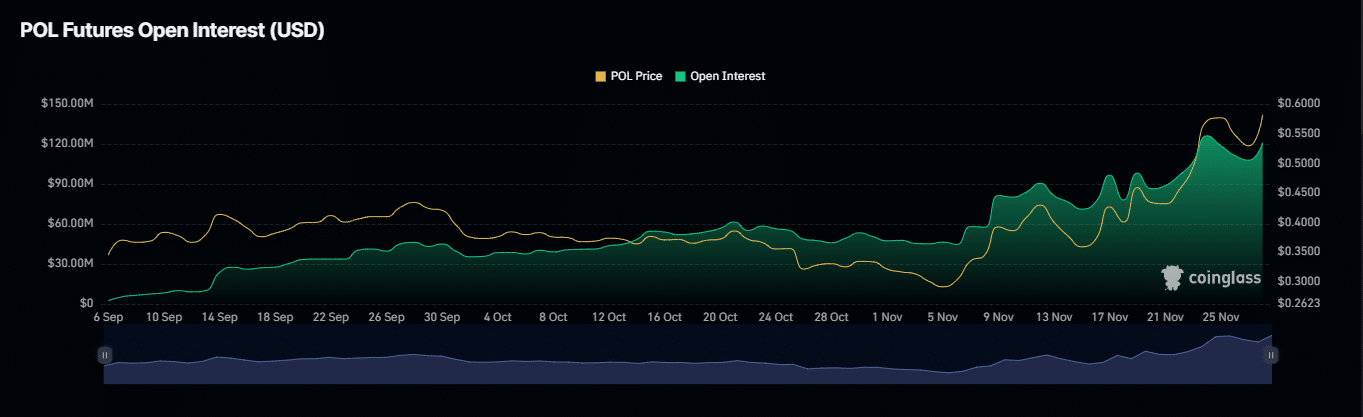

According to data from Coinglass, it appears that investors are not only buying into POL, but derivative traders are jumping on the bandwagon as well.

The quantity of pending future contracts, known as Open Interest (OI), has gone up by 1.82% to reach approximately $115.87 million. This increase suggests a surge of activity within the derivatives market. Moreover, long positions are predominantly driving this trend, and the OI for POL is almost touching its old record high.

The Funding Rate, which calculates costs and potential bias using Open Interest (OI), suggests that the price of Polygon (POL) might increase more following a significant surge, given its current rate of 0.0023%.

As a crypto investor, I’m observing a bullish trend hinted by derivatives traders, while it seems that the spot traders are still in a selling mode, according to AMBCrypto’s insights. This dichotomy could indicate potential shifts in market dynamics, and I find myself eagerly watching the trends unfold.

Can POL withstand selling pressure?

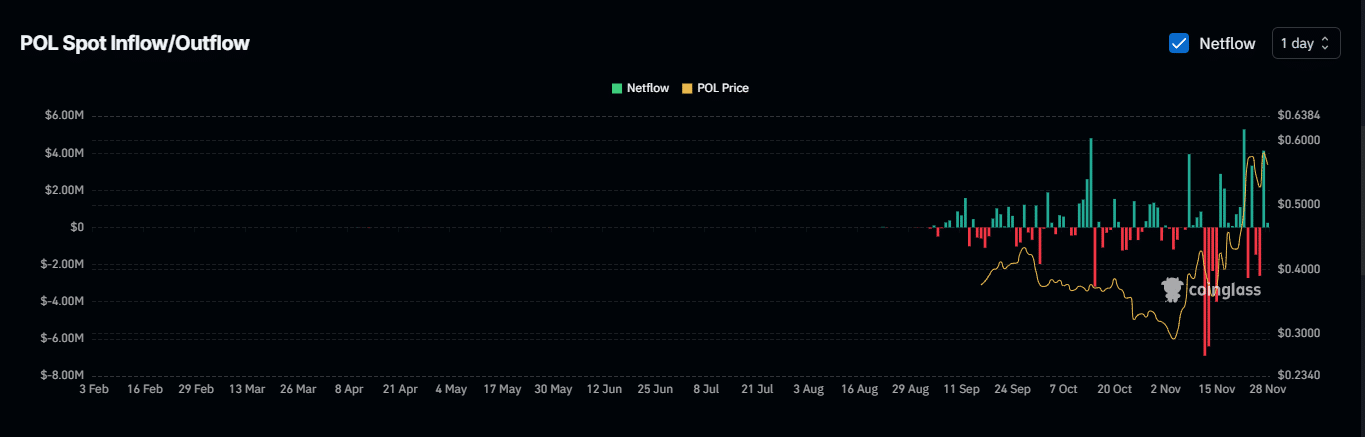

Spot traders have started offloading POL on exchanges, which shows a fading interest in the asset.

In simpler terms, the Netflow data indicates that approximately $4.1 million of POL was transferred to trading platforms over the last day, suggesting possible upcoming sell-offs by traders.

In contrast, AMBCrypto observes a continuous buildup on its technical charts. Should this trend continue, buyers taking advantage of reduced prices might be able to purchase more than usual from market sellers, especially given that the selling pressure appears to be growing stronger.

A drop before a move upward?

According to the chart, there’s a predicted minor dip for POL before it continues its uptrend. This is happening even though it’s within a bullish symmetrical triangle on the 1-hour chart. This dip seems to be caused by increased selling from spot traders.

If the price hits the support level of 0.5478, there’s a chance it might go back up. But if sell orders are processed rapidly, it could dip lower to 0.5347 initially. After that, the trend might resume its upward trajectory, possibly rising by 14.56% and touching a high of 0.6127.

If this stage is reached, it’s possible that the asset will keep rising, particularly if the general market outlook stays optimistic and there’s consistent purchasing from derivative traders.

Read More

2024-11-28 22:15