-

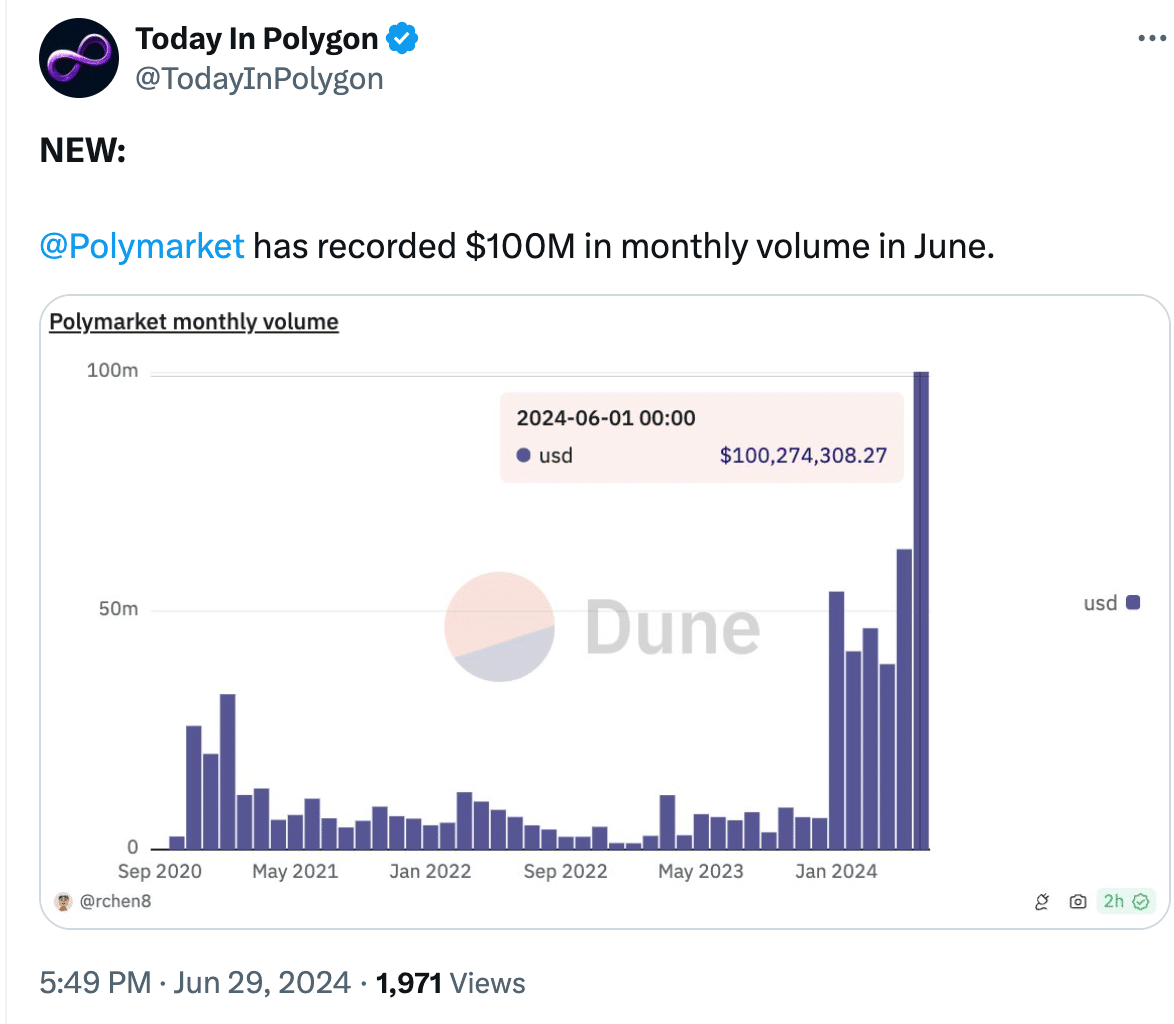

Polygon’s dApp Polymarkets did more than $100 million in terms of volume and also saw a surge in activity.

MATIC’s price and Network Growth declined.

As a researcher with experience in the crypto space, I’m impressed by the significant volume and surge in activity on Polygon’s dApp Polymarkets. With over $100 million in terms of volume, it’s clear that users are drawn to popular applications like this one, leading to increased network activity overall.

The Polygon network associated with MATIC has witnessed substantial activity lately. A significant factor contributing to Polygon’s achievement is the widespread adoption of its decentralized applications (dApps).

Polymarkets shows promise

As a market analysis expert, I’ve observed that Polymarket, a decentralized application (dApp) specializing in events-based betting, has seen impressive trading volumes surpassing the $100 million mark. Notably, there’s been a noticeable increase in activity on this platform.

An increased number of users drawn to prominent decentralized applications (dApps) such as Polymarket contributes to a larger user base on the Polygon network as a whole.

Polygon’s thriving success stories, such as Polymarket, draw in an increasing number of developers to create dApps on the network. This influx of talent results in a diverse array of applications being developed, adding depth and richness to the Polygon ecosystem.

The use and engagement on the Polygon network, as indicated by heightened adoption and active networking, can lead to an upward trend in the value of MATIC, its native token. As more people engage with decentralized applications (dApps) on the platform, there may be a growing need for MATIC to cover gas fees and other essential functions, thereby potentially boosting its demand and price.

How is MATIC doing?

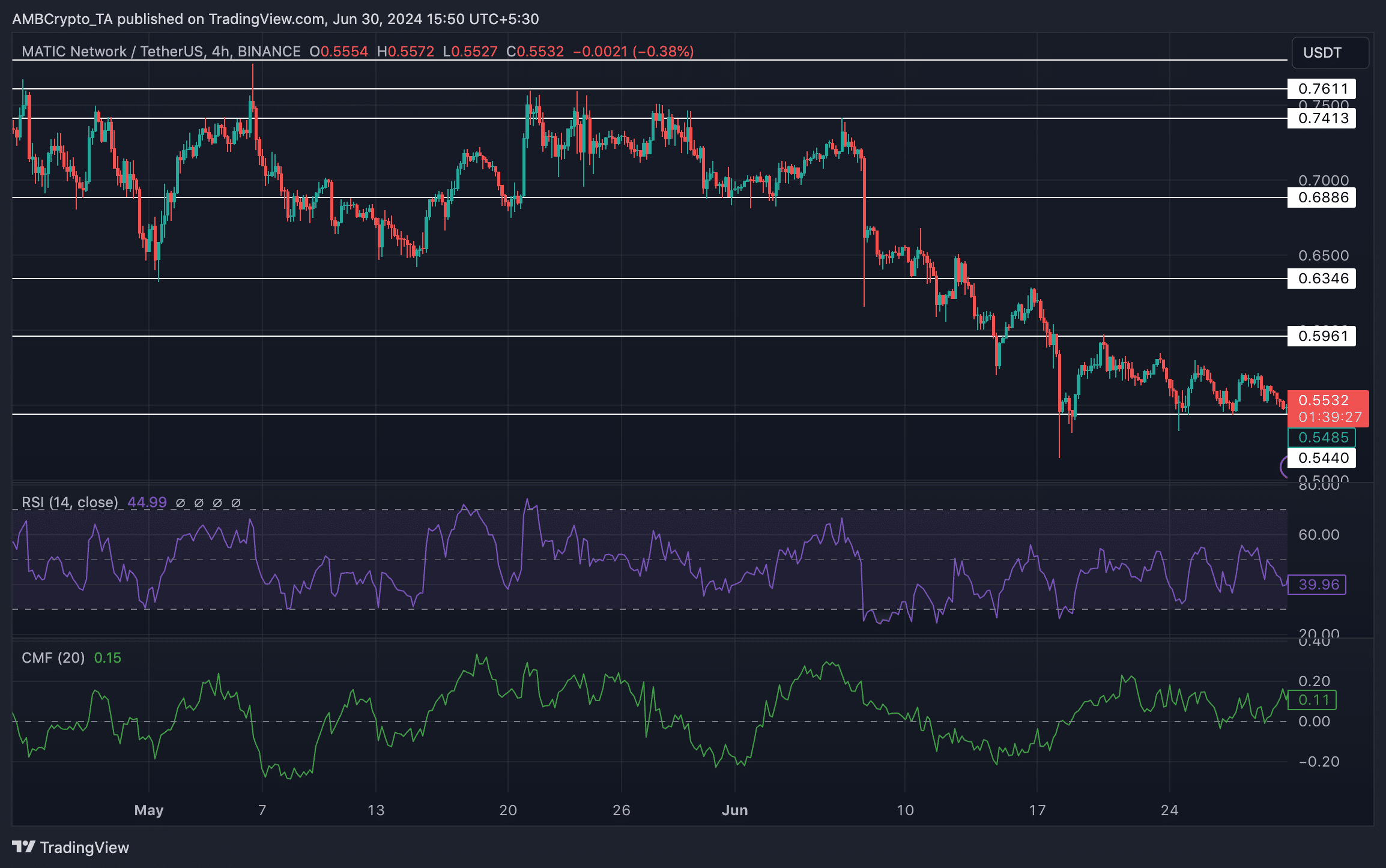

As a crypto investor, I’m observing that at the present moment, MATIC is being traded at a price of $0.5524. In comparison to the previous day, its value has declined by 1.08%. However, this isn’t the first time I’ve noticed a downturn – since the 7th of June, there’s been a significant decrease in MATIC’s price.

As an analyst, I’ve observed that during this timeframe, the value of MATIC displayed numerous successive low points both in price and resistance levels, signaling a bearish market condition.

During this timeframe, the RSI (Relative Strength Index) of MATIC experienced a decline, implying that the buying pressure and bullish sentiment surrounding MATIC had weakened.

Additionally, the total trading volume for MATIC had decreased by 30% over the last month.

In recent days, there’s been a notable increase in the Chaikin Money Flow (CMF) for MATIC, signifying a substantial influx of capital into this cryptocurrency.

As an analyst, if the money flow toward MATIC continues to increase significantly, the likelihood of a price reversal becomes more pronounced. However, should MATIC encounter resistance at the $0.5961 mark and fail to hold it, there’s a possibility that the coin could target regaining the $0.7413 level in the future.

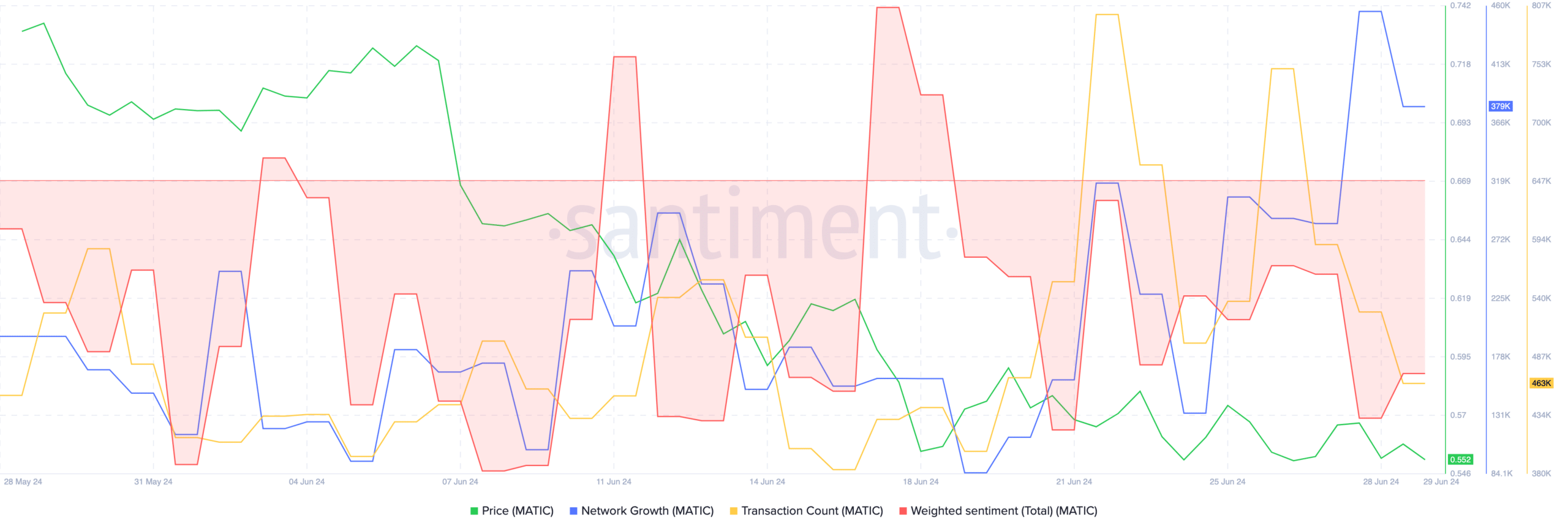

According to AMBCrypto’s interpretation of Santiment’s data, there has been a significant decrease in network growth recently. This finding suggests that the number of new cryptocurrency addresses created has dropped, which may indicate waning interest.

If this trend persists, the chances of a price reversal for MATIC could be severely affected.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-30 21:11