-

MATIC whales have accumulated 70% of the total circulating supply, with one address holding 3.6 billion tokens.

How could this whale accumulation prove to be both beneficial and detrimental?

As a seasoned researcher with years of experience tracking cryptocurrency market trends and analyzing the intricacies of blockchain technology, I find myself constantly amazed by the enigmatic nature of MATIC whales and their impact on the Polygon ecosystem.

Over the past week, the cryptocurrency Polygon (MATIC) could potentially close out August on a downward trend. This is due to a significant drop of approximately 20%, with its current value standing at $0.4255 as we speak, amidst broader fluctuations in the market.

Intriguingly, I observed a robust upward surge in MATIC‘s price around mid-August, defying a two-month period of consolidation, despite Bitcoin facing challenges with weak bullish support.

Based on AMBCrypto’s assessment, a significant surge in ‘whale’ activity might have propelled MATIC‘s upward trend in mid-August, attempting to break through the $0.58 resistance barrier.

Yet again, it wasn’t just the first occasion that whales intervened to help MATIC. Could there be an underlying pattern at play here?

Whales hold a dominant share of MATIC supply

It’s not surprising that Bitcoin’s price volatility frequently influences the movement of other cryptocurrencies, thereby determining their worth.

In contrast to what many people think, MATIC‘s price tends to deviate quite often from the general market trends.

In an effort to understand this unusual occurrence, AMBCrypto looked into the actions of significant investors to see if underlying strategies could explain the discrepancy.

Source : CoinMarketCap

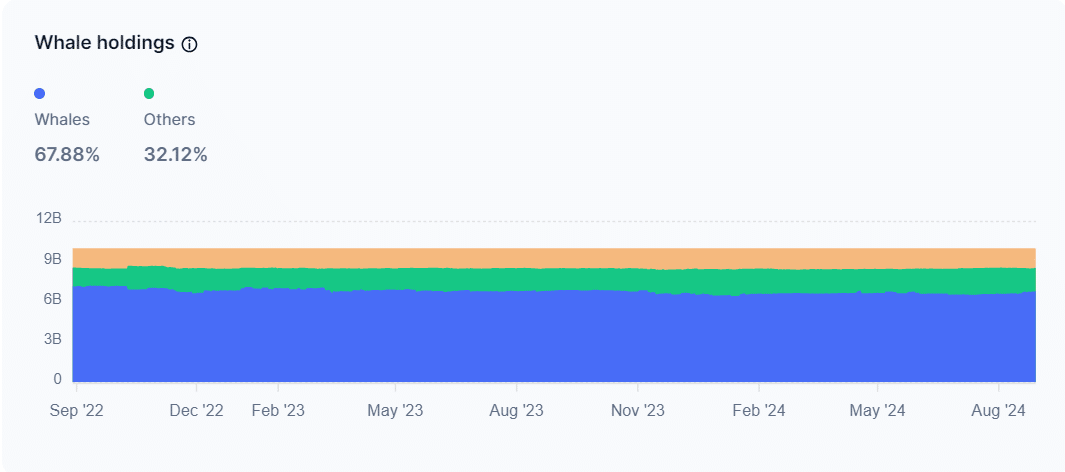

It’s not surprising that a significant portion of the circulating supply of Matic, amounting to 9.9 billion, is held by major stakeholders.

The graph shows that whales control more than 6 billion units, making up about 70% of the entire supply.

This concentration of holdings significantly impacts the token’s market dynamics — So, has it?

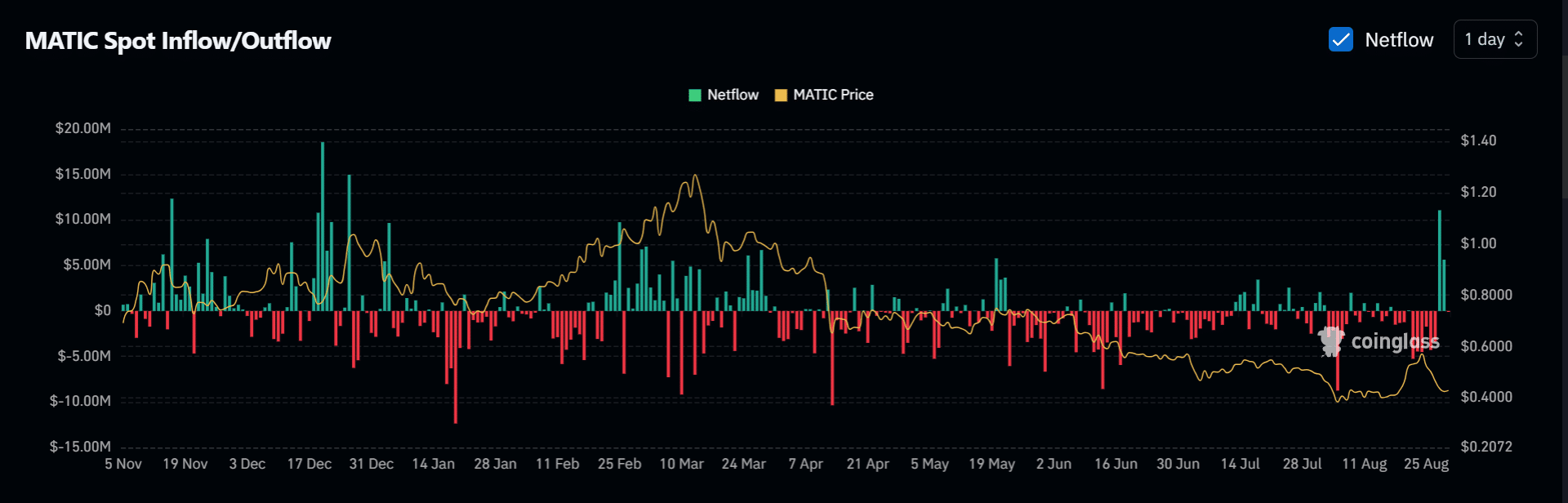

Examining the graph provided, AMBCrypto observed that MATIC experienced an upward trend towards the end of December, reaching nearly the $1 mark as a result of a 26% spike, even though there were $14 million in total inflows.

It seems that MATIC‘s price held firm even amidst the market turmoil caused by Bitcoin’s decline. This could be because large investors, or ‘whales,’ were able to counteract the selling pressure.

Source : Coinglass

Notably, AMBCrypto unveiled an intriguing fact: a significant MATIC wallet is known to hold approximately 36.36% of all available MATIC tokens, amounting to roughly 3.6 billion coins.

This highlighted that a single whale controls a massive portion of MATIC’s supply, potentially influencing its price.

Additionally, the value of MATIC has been decreasing significantly during the last seven days, falling more than 20% from its previous price of $0.58.

According to the graph, a $11 million increase in MATIC moving into exchanges may have played a role in the price decrease, possibly due to Bitcoin dropping below $60K. This influx of MATIC might have been the cause or a contributing factor.

Or alternatively, it might suggest whales are selling off their holdings — which one is it?

Stakeholders doubtful in MATIC’s recovery

Based on AMBCrypto’s assessment, it seems that the ongoing market for MATIC has some reservations about its ability to bounce back. This uncertainty echoes the cautious outlook present within wider market tendencies.

Source : Coinglass

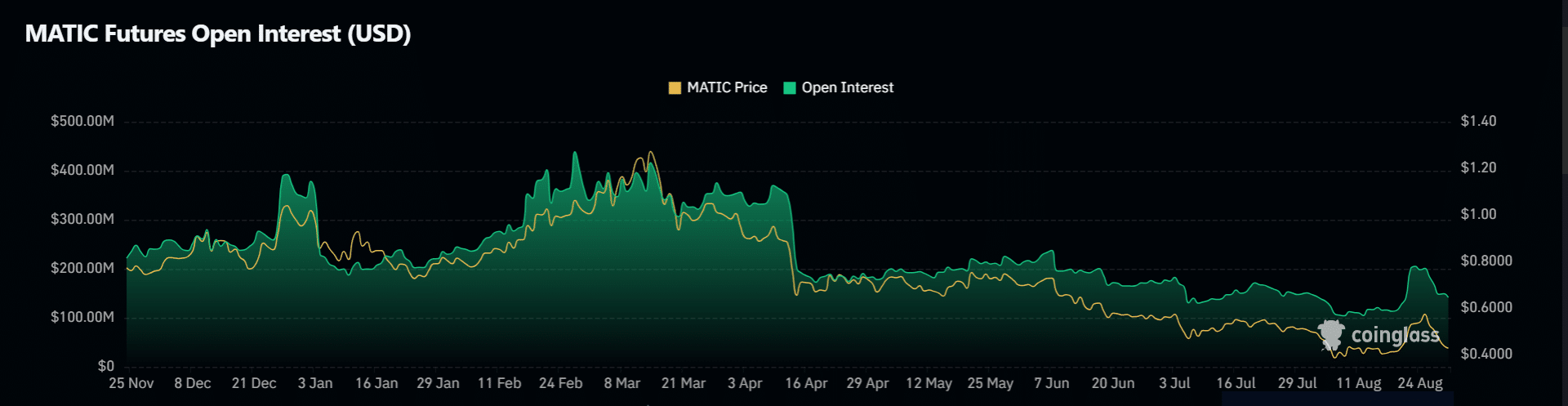

Furthermore, it’s worth noting that the Open Interest for MATIC decreased by approximately 7% over the last 24 hours. After reaching a high of $490 million on the 24th of August, its current value stands at around $420 million.

This trend indicates that, after the wider market turmoil, it seems future traders are wrapping up their trades.

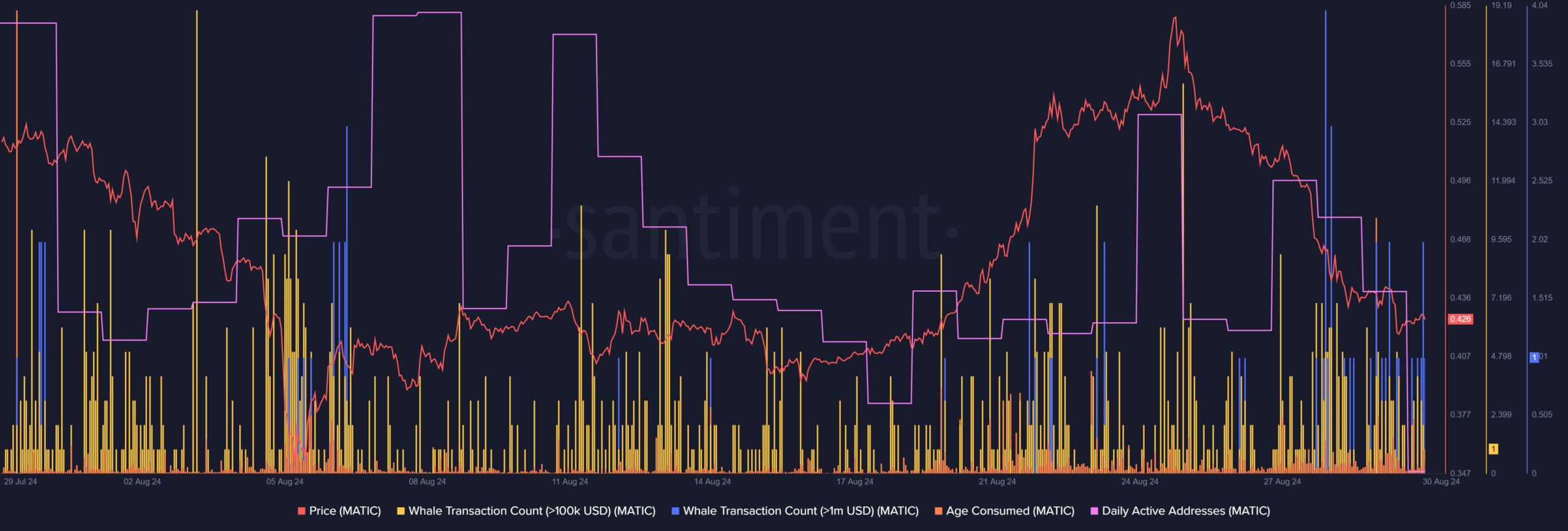

On the other hand, AMBCrypto’s examination of the following chart did not reveal any strong indications of large-scale selling by major MATIC stockholders.

Source : Santiment

On the 29th of August, it was noted that a total of 872 million MATIC were transferred, according to the age of transaction tracking system.

This indicated that a significant portion of previously dormant tokens were transacted.

Realistic or not, here’s MATIC’s market cap in BTC’s terms

As a researcher, I find it intriguing that the number of transactions involving whales has been relatively low compared to the norm. However, pinpointing whether these whales executed large-volume, dormant transfers isn’t straightforward; it poses a significant challenge in my analysis process.

Despite the strong control they have over it, AMBCrypto suggests that MATIC might still experience fluctuations in price as they work towards achieving a fairer distribution of its supply.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-30 17:12