- POL is consolidating within a descending channel, with a bullish sentiment building despite recent price stagnation.

- On-chain metrics like active addresses and stable futures funding rate support the possibility of a breakout.

As a seasoned researcher with years of market analysis under my belt, I find myself intrigued by Polygon’s (POL) current state. The bullish sentiment is palpable, not just from the crowd but also from smart money indicators. However, as they say, “the market can remain irrational longer than you can remain solvent,” so it’s crucial to keep a close eye on the price action.

The cryptocurrency that used to be known as MATIC, now called POL, is showing signs of improved market opinion. Both public and sophisticated investors are expressing increasing optimism based on recent trends.

public sentiment appears to be quite optimistic, scoring 0.95, while the ‘smart money’ stands impressively high at 3.00. Given this bullish trend and the increase in network activity, we might witness a substantial price surge ahead.

On the other hand, the price of Polygon (POL) has not yet surpassed its current holding pattern. As of now, Polygon is being traded at $0.3636, representing a 2.49% decrease. This has left some investors pondering if this favorable outlook will result in a continuous upward trend.

POL technical analysis: Is a breakout imminent?

The price trend of Polygon (POL) is persistently contained within a downward sloping channel, finding it difficult to escape the current period of consolidation between approximately $0.4477 and $0.5761. Additionally, the latest candlestick formation suggests that Polygon is approaching a significant juncture.

Consequently, the upcoming action may decide if we’ll see a surge or continued stabilization. Overcoming the $0.4477 mark is vital for any further growth.

Based on the current Stochastic RSI reading of 32.65, it appears that Pol’s price may be approaching the oversold region, indicating a possible build-up of buying pressure over the coming days.

As a researcher, I find myself observing a neutral MACD signal in our study of POL, characterized by a narrow gap between the MACD line and the signal line. This suggests that POL might be preparing for consolidation, hinting at a potential pause before it makes a clear directional move.

On-chain metrics: Active addresses and transactions on the rise

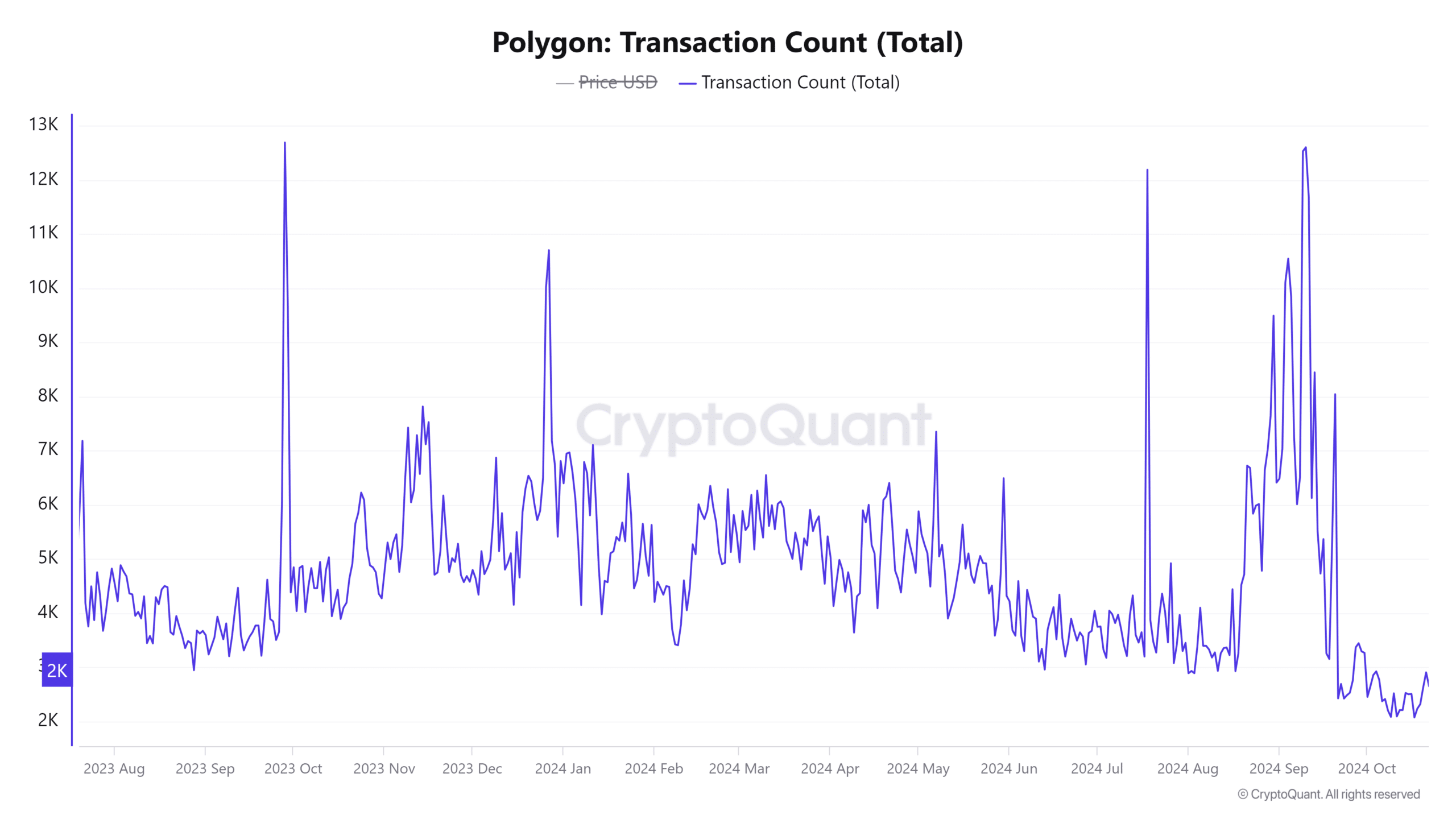

As a researcher, I’ve found it intriguing that Polygon’s on-chain data indicates a consistent growth pattern. Specifically, the number of active addresses within the last 24 hours has seen a slight uptick by approximately 0.96%, while the transaction count has risen by about 0.86% to reach around 2.49K, as per CryproQuant’s data.

These gradual increases in network engagement might indicate a resurgence of user enthusiasm, potentially reinforcing the existing optimistic market perspective.

Yet, if there isn’t a significant increase in prices rising, these gains might not be sufficient to maintain the positive trend over the long haul.

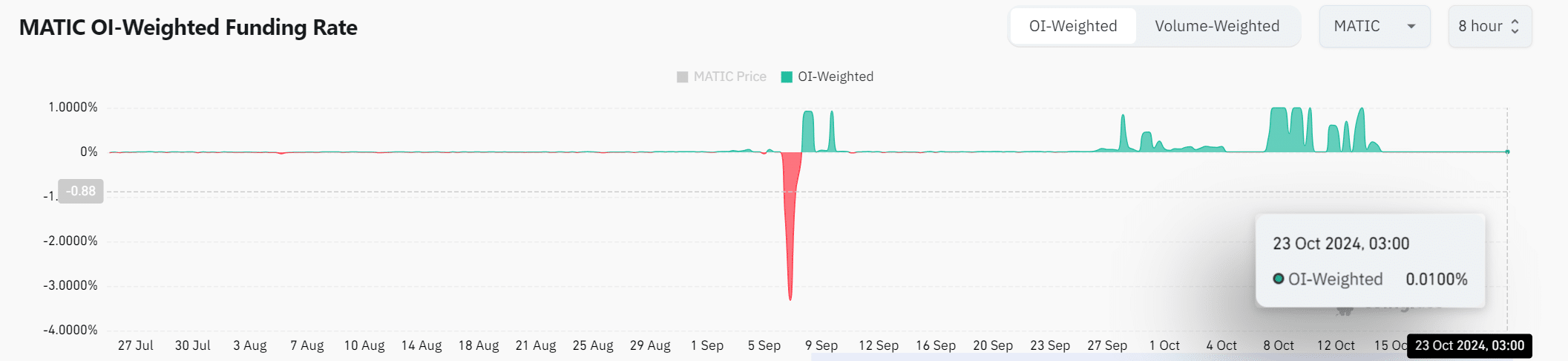

POL OI-weighted funding rate: Neutral but with potential

In the futures market, the POL OI-weighted funding rate remains unchanged at 0.0100%, implying a balanced situation where neither buyers (bulls) nor sellers (bears) are currently driving the market significantly.

On the other hand, adjustments to this funding rate might suggest a change in trend direction, becoming particularly noteworthy when they line up with an uptick in optimistic investment strategies among seasoned investors.

It’s quite evident that Polygon is optimistic, particularly when viewed from a high-level investor standpoint. The crucial factor here, though, is whether the price will surpass the resistance level at $0.4477.

Should the trend for POL continue to escalate, it could lead to substantial growth opportunities. But before that happens, it’s crucial to exercise caution since the current situation shows signs of a holding pattern where the price isn’t moving much higher yet.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-10-23 21:11