- Polygon has extend its recovery to clear August losses

- However, key hurdles can be found at $0.51 and $0.55

As a seasoned crypto investor who has weathered numerous market cycles, I can confidently say that the recent recovery of Polygon (MATIC) is indeed encouraging. However, it’s important to remember that the road to recovery often has its fair share of hurdles, and in this case, those hurdles seem to be at $0.51 and $0.55.

In recent days, Polygon’s MATIC token has stood out as one of the top five exceptional performers in both daily and weekly price trends. Interestingly, since last Friday, MATIC has experienced a surge of almost 20%, while most other cryptocurrencies have been moving sideways.

As a long-time crypto enthusiast with years of experience in the industry, I find the recent announcement by Polygon about changing their native token from ‘MATIC‘ to ‘POL’ quite intriguing. Having followed the project since its early days, I can attest to its impressive growth and potential. This update on September 4th is a significant step forward for Polygon, as it aims to make POL the gas and staking token for their ecosystem.

With these lined-up changes, will MATIC clear its August losses?

MATIC races to clear August losses

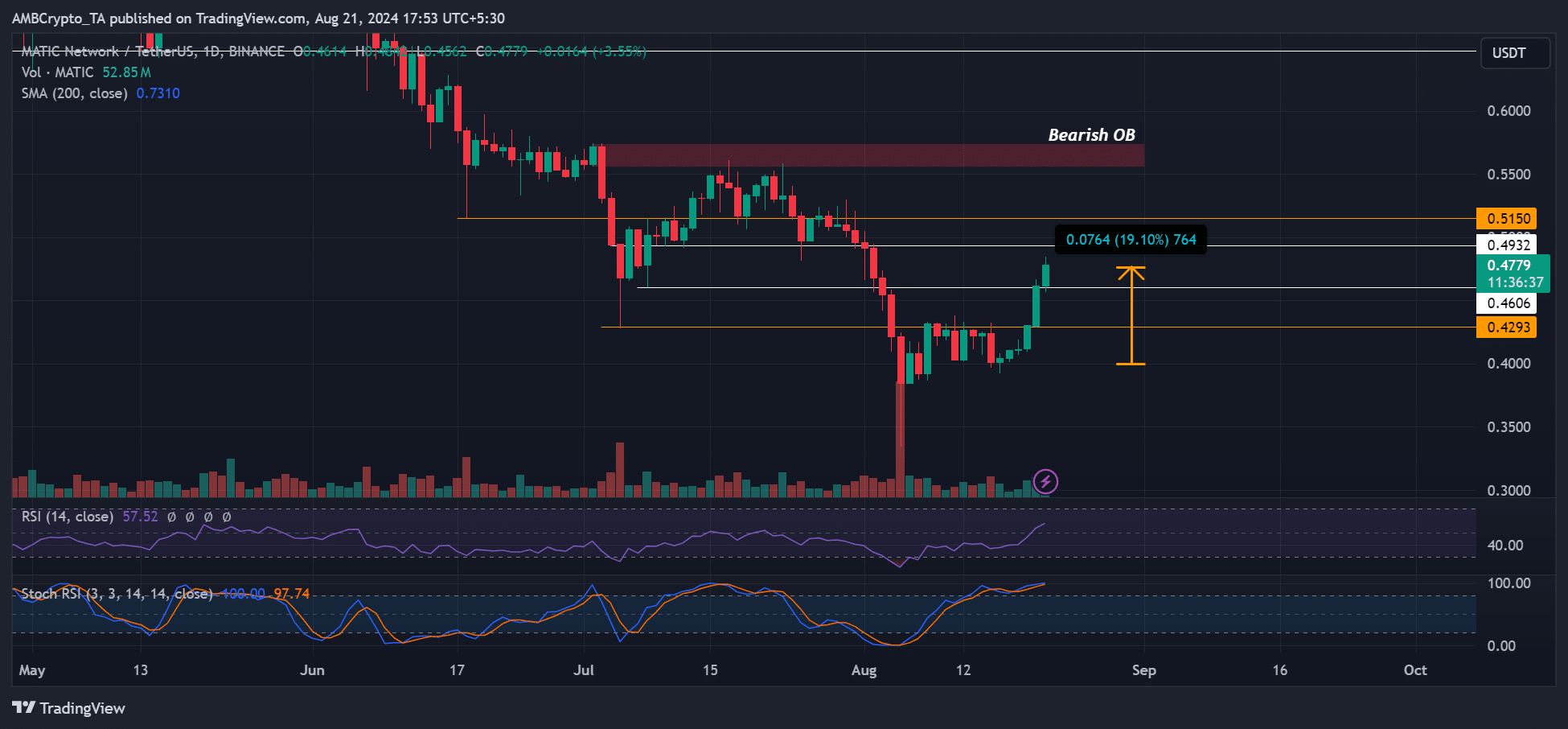

On a daily basis, Matic displayed bullish behavior by surpassing the $0.42 mark. Starting from August 16 (last Friday), Matic initiated a prolonged recovery that yielded approximately 20% growth, as noted at the time of writing. This upturn essentially counteracted most of its losses in August.

Currently, MATIC is valued at approximately $0.47 per token. To reach the potential supply zone at $0.55, it needs to surmount two significant resistance levels – initially at around $0.49 and subsequently at $0.51. With the Relative Strength Index (RSI) demonstrating robust buying activity as it hovers above its average, these price targets seem achievable.

As an analyst, I observed that the Stochastic RSI was running hot, placing it within overbought territory, indicating a potential need for MATIC‘s price rally to cool down. Notably, the $0.46 and $0.42 levels emerged as crucial short-term supports should the rally experience a dip.

Short-term MATIC holders up 8%

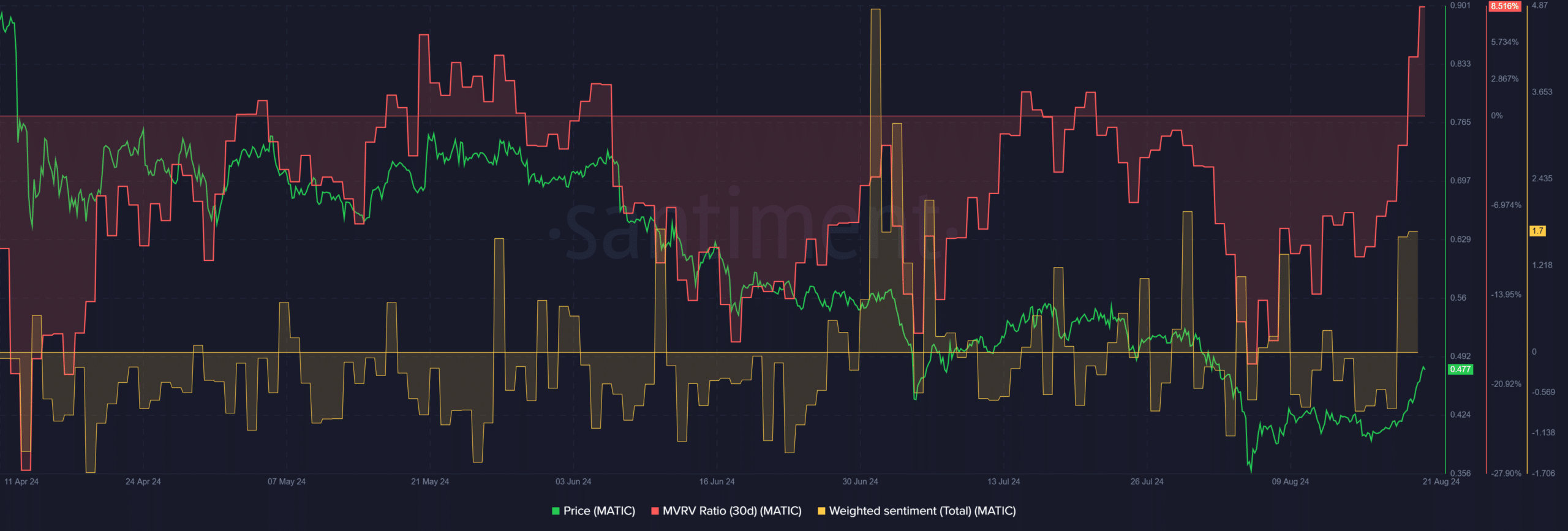

It’s worth noting that MATIC was one of the coins that showed optimistic market feelings when this text was penned down, evident from the rise in positive sentiment. In simpler terms, there has been a general anticipation among investors that the token could perform well.

Following the latest price surge, it turned out that MATIC buyers over the last 30 days were sitting on a 8% increase in their investment, representing unrealized profits. In other words, they hadn’t cashed out yet but stood to make a profit of 8%.

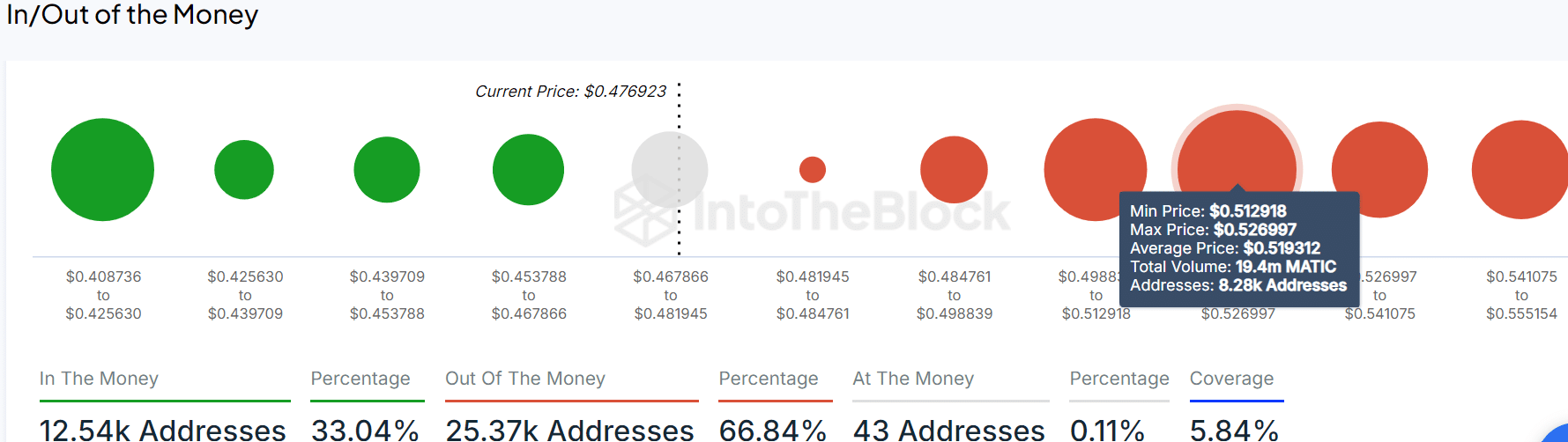

As a crypto investor, I found myself in a position where the altcoin appeared to be overvalued due to its recent surge. This could potentially trigger profit-taking, making it essential to keep an eye on the overhead resistance levels. These levels might signal a reversal, as per data from IntoTheBlock. Interestingly, only about one-third of the addresses involved in this altcoin were in profit after the upswing, which adds another layer of caution to my investment strategy.

Most users with around 8,000 accounts, who collectively own close to 20 million Matic tokens, have experienced losses with values ranging from $0.51 to $0.52. This suggests that if the prices reach these levels again, they would break even. Given this possibility, it’s plausible that they might consider selling their holdings due to the temptation of recouping their initial investment.

In simpler terms, if MATIC attempts to recover, it might encounter resistance around $0.51 or $0.55. These levels may encourage sellers to step in and potentially halt the recovery process.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-22 09:11