-

Polygon network has seen a surge in RWA interest, including a recent ECB trial.

MATIC traction on the price charts has slowed slightly, with $0.51 as a key price level.

As a seasoned crypto investor with a keen interest in Ethereum L2 solutions like Polygon (MATIC), I have witnessed the network’s impressive growth over the past few months. The recent surge in Real World Asset (RWA) interest, including the European Central Bank’s (ECB) trial, has been particularly noteworthy.

Sandeep Nailwal, the founder of Polygon (MATIC), has acknowledged an increasing curiosity among Real World Asset (RWA) investors in the Ethereum (ETH) Layer 2 network. This statement was made following the European Central Bank’s (ECB) recent experiment with bond issuance. In simpler terms, RWAs are real-world entities or organizations that are now expressing greater interest in investing in the Ethereum network’s cheaper and faster Layer 2 solution, which Polygon provides.

It’s heartening to see a large number of decentralized applications (dApps) built on Polygon naturally gaining traction. Notably, Polygon Proof of Stake (PoS) currently ranks second only to Ethereum’s mainnet in terms of the value generated by their respective decentralized workloads (RWA).

Based on the information from RWA.xyz, it appears that the claim was exaggerated. According to their data, Polygon ranked as the fifth largest cryptocurrency network in terms of total market capitalization, with a significant presence in the US tokenized securities market.

Will the RWA interest boost MATIC price?

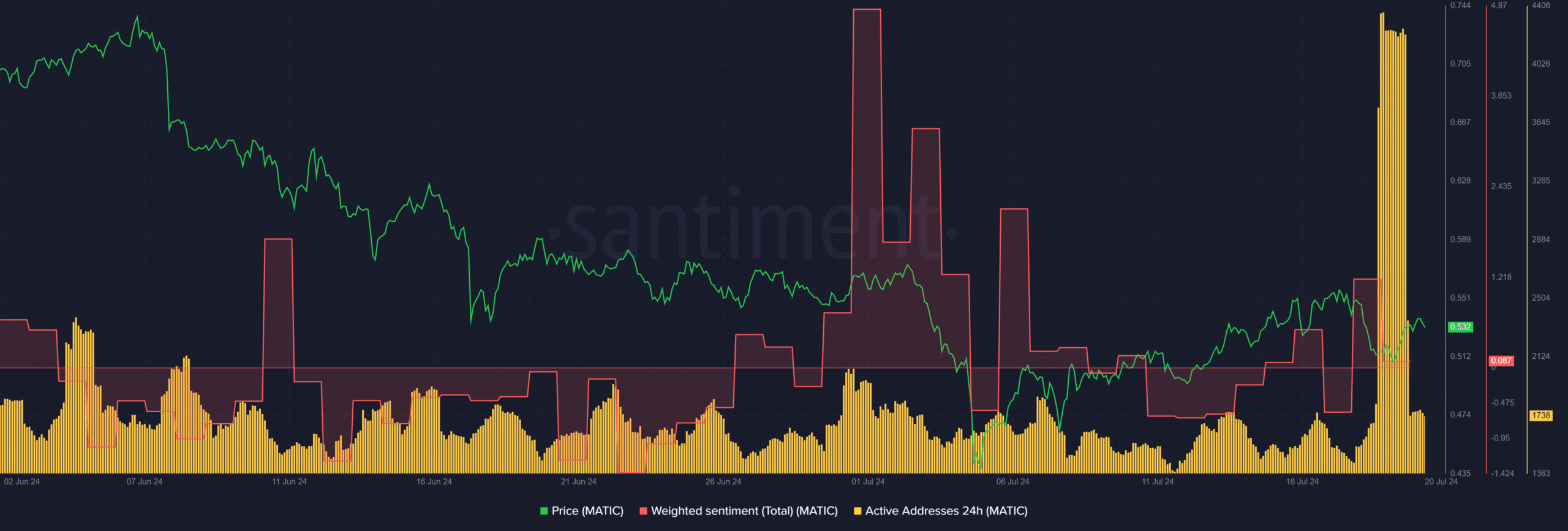

The increasing demand for Decentralized Autonomous Organizations (DAOs) represented by RWA‘s growing popularity led to noteworthy network benefits, evidenced by a significant increase in the number of daily active addresses using MATIC, according to available sentiment data.

The latest report about the ECB trial, broadcasted across networks, caused a shift in MATIC‘s Weighted Sentiment to optimistic. Yet, by press time, the metric had moved closer to neutral, potentially dampening market sentiment towards MATIC.

When I composed this text, the number of daily active addresses had taken a downturn as well. This decline in usage might impede any potential price growth by reducing the number of people interacting with the altcoin.

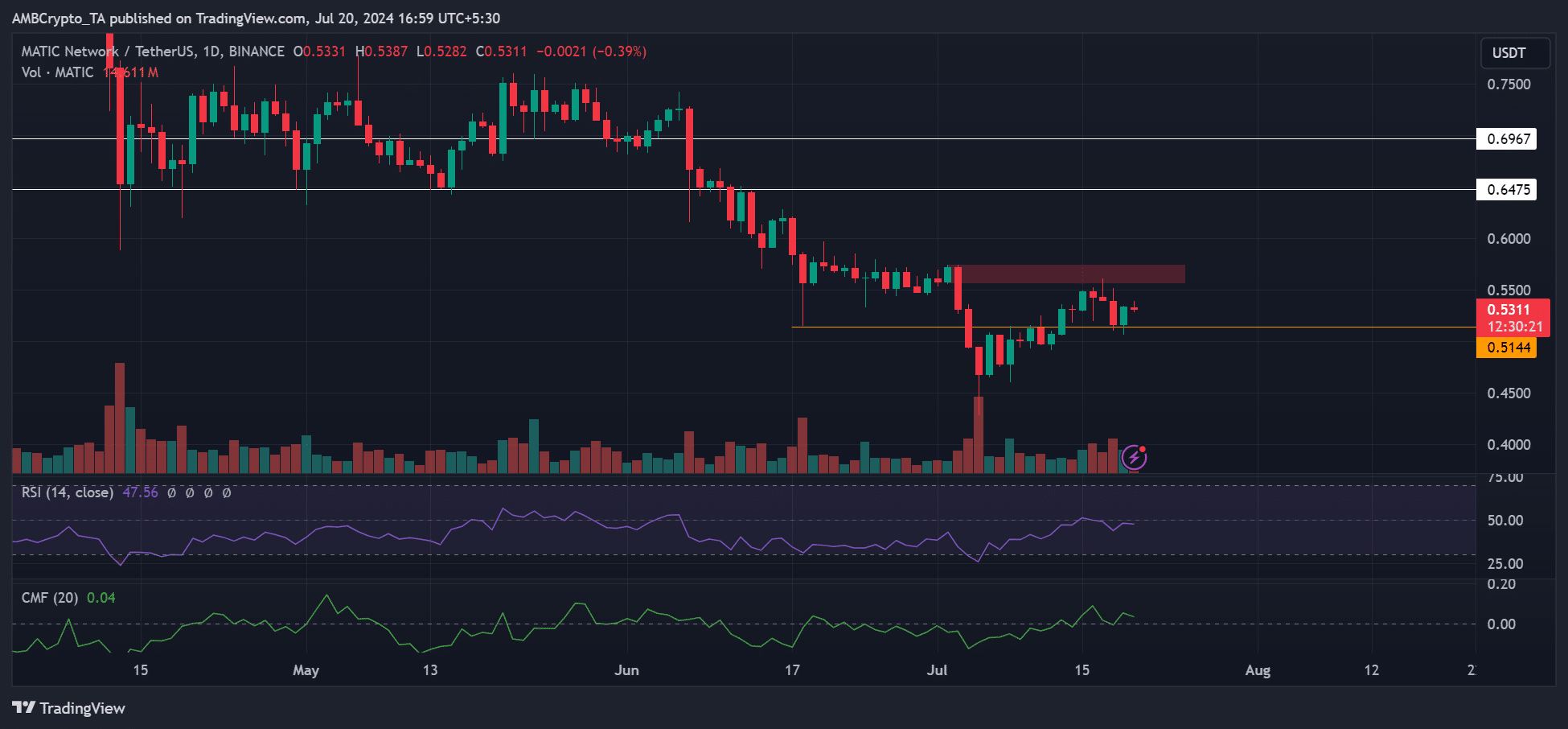

MATIC recovery cooled off

The RSI (Relative Strength Index), which had previously recovered, hadn’t fully regained its vigor, staying beneath the typical threshold of 50. Consequently, the recent uptick in price lacked sufficient buying force to ensure a robust advance.

Furthermore, the Chaikin Money Flow (CMF) indicator showed higher-than-normal readings yet remained close to its balance point. This signifies that there were more buying forces at play recently, but their momentum has slowed down or plateaued.

Based on the given readings, it appears that the MATIC token may face challenges surmounting the resistance level and price ceiling at approximately $0.55 (denoted by red).

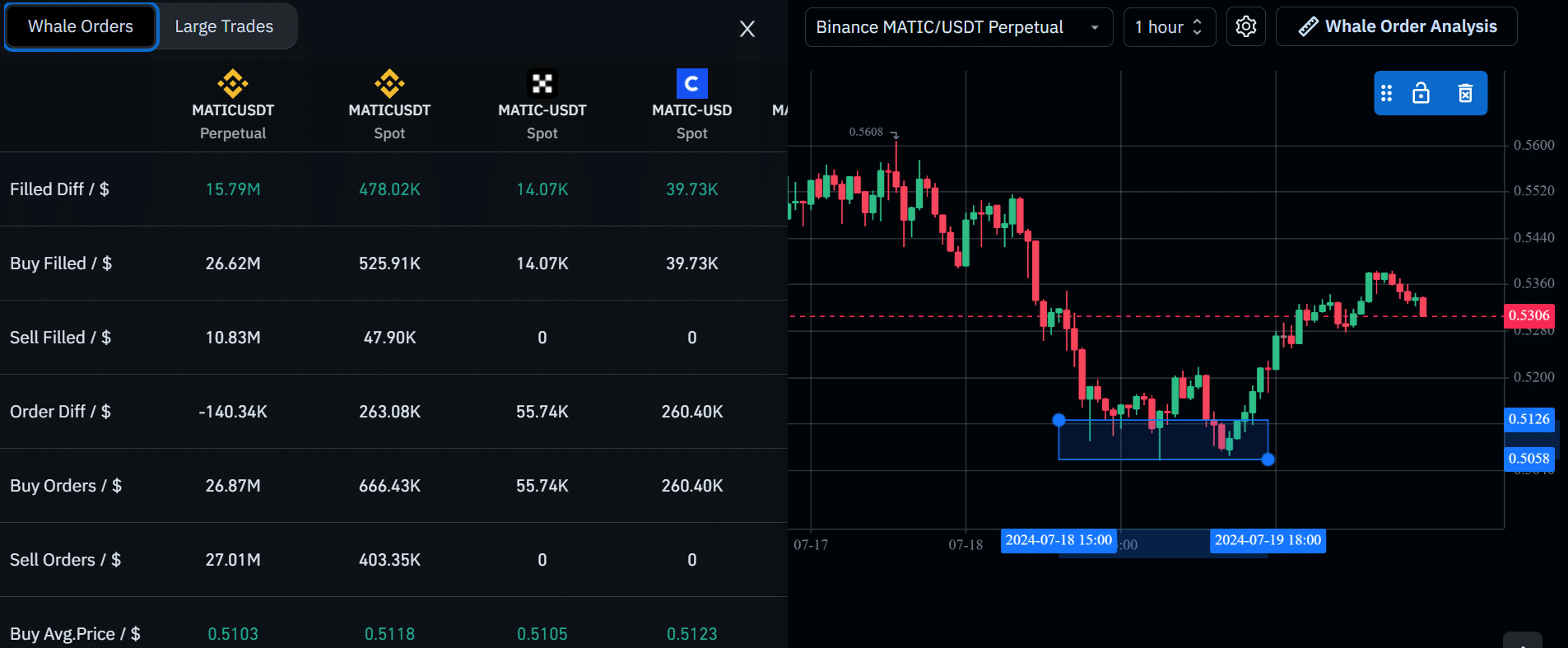

The $0.51 mark held significant importance as a point of demand for investors, as evidenced by both the chart analysis and whale order information.

At a price of $0.51, approximately $26 million worth of buy orders were recorded in the derivatives section of Binance exchange. Furthermore, there was a significant increase in demand for MATIC in the spot market, with over half a million dollars’ worth of bids at that price level.

With whales showing significant interest and the price of MATIC reaching a substantial volume at $0.51, this level became essential for any investor in Matic Network (MATIC) seeking to enter the market.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-07-21 10:15