-

MATIC’s price moved marginally over the last seven days.

Market indicators suggested that MATIC might turn bullish.

As a seasoned researcher with a background in blockchain and cryptocurrencies, I’ve seen my fair share of market fluctuations – from the dizzying heights to the crushing lows. Currently, Polygon [MATIC] has been holding steady over the last seven days, but it appears there’s a potential bullish wave brewing on the horizon.

While several cryptos turned bullish last week, Polygon [MATIC] bulls took a side seat.

If MATIC fulfills a significant requirement, there’s a strong possibility that its price will skyrocket in the near future, potentially putting it back among the top 20 cryptocurrencies.

Let’s take a look at what MATIC is cooking.

Polygon investors are at loss

According to data from CoinMarketCap, the value of Matic has seen a slight rise in the past week. This increase is also reflected in its 24-hour price chart.

Currently, as I’m typing this, Matic is being exchanged for approximately $0.4215 per unit, and its total market value surpasses $4 billion, positioning it as the 21st largest cryptocurrency in terms of market capitalization.

Over these past few months, I’ve found myself in a challenging position as an MATIC investor, given the significant decline in value. Data from IntoTheBlock reveals that a meager 2% of us are currently profiting, indicating how tough it’s been for most of us in this digital asset space.

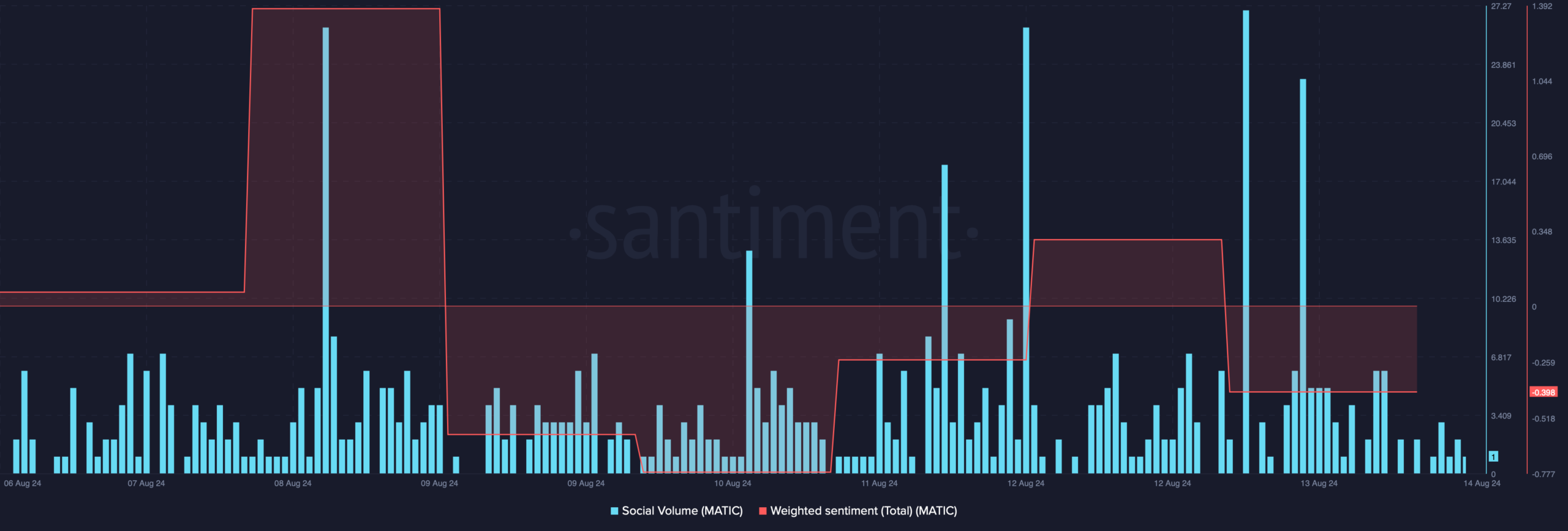

As a researcher, I observed a decline in Polygon’s social metrics, particularly its Weighted Sentiment dipping into the negative territory. This indicates a rise in pessimistic sentiments surrounding the platform.

However, its Social Volume did spike once last week.

However, Ali, a popular crypto analyst, recently posted a tweet that hinted at a MATIC bull rally.

Should this event transpire, I, as an analyst, anticipate that investors may observe the token reaching a value of $50. If it does, this significant milestone could potentially enable the token to regain its position among the elite top 20 cryptocurrencies ranked by market capitalization.

However, that bull rally would only take place if Polygon manages to close this week above $0.30.

What to expect from MATIC

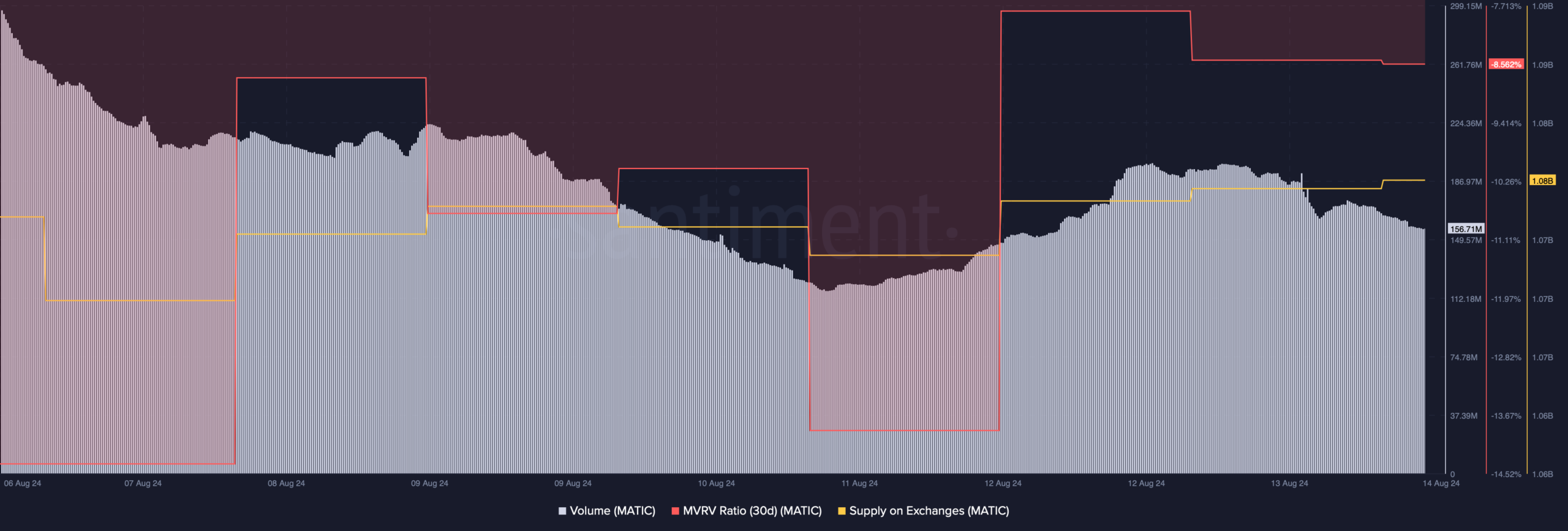

After scrutinizing MATIC‘s on-chain statistics more closely, AMBCrypto aimed to determine the likelihood of it surpassing $0.30. Upon examination, we noticed a decrease in MATIC’s trading activity during the previous week.

A drop in these figures often indicates a possible shift in the current price trajectory. Additionally, an enhancement in the MVRV ratio during the past week serves as another positive indication.

Over the last several days, I’ve observed a slight uptick in the supply of this asset on exchanges. This suggests that there may have been more selling activity than buying, implying a potentially elevated level of selling pressure.

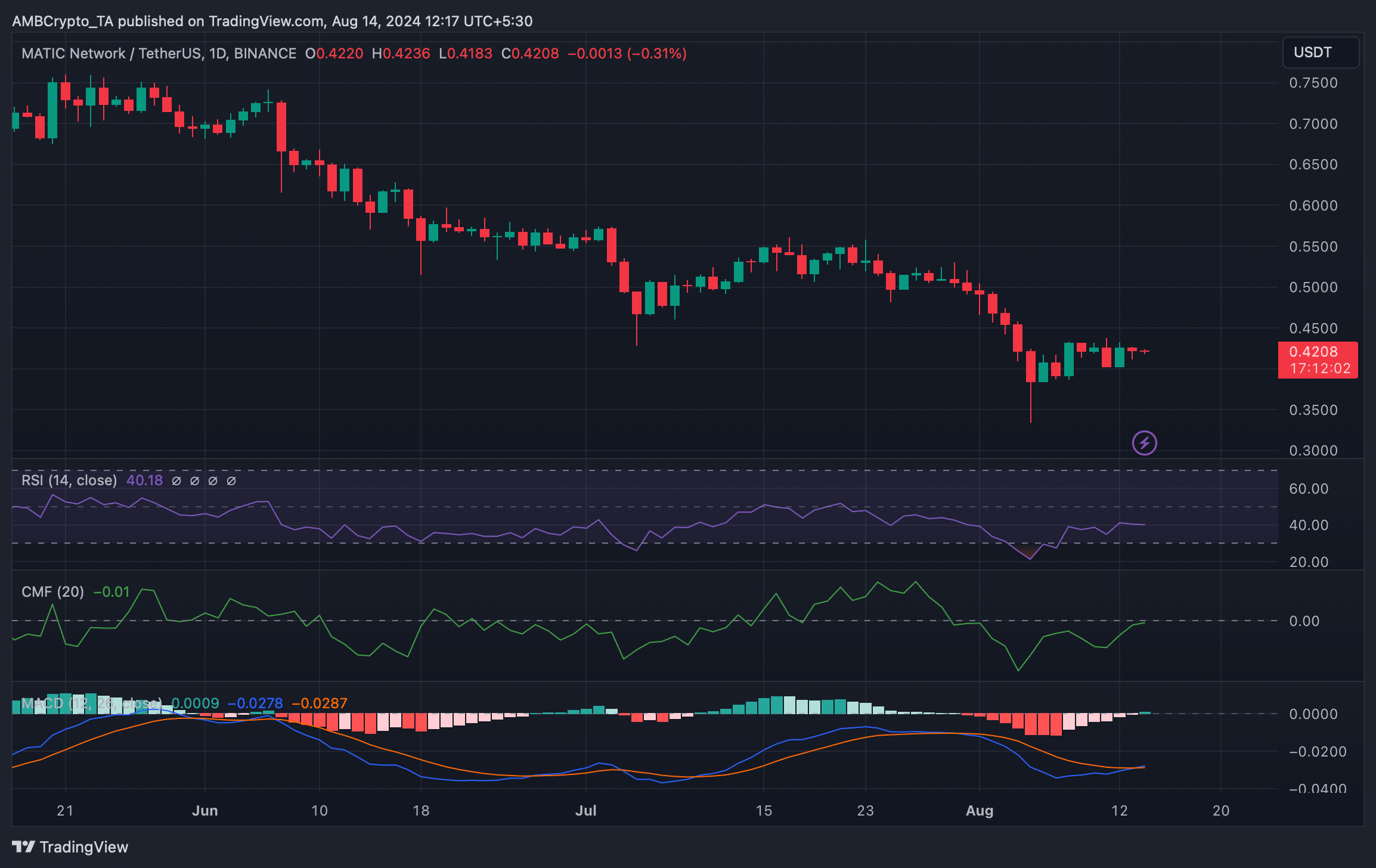

Later, AMBCrypto examined Polygon’s daily chart to identify any market signals suggesting potential trends. The technical tool Moving Average Convergence Divergence (MACD) showed a bullish crossing.

The Chaikin Money Flow (CMF) showed a positive increase, indicating potential price growth. However, at the moment of printing, the Relative Strength Index stood at 40, suggesting a downward trend.

Read Polygon’s [MATIC] Price Prediction 2024-25

Should a bull market occur, it’s possible that Polygon’s price could climb up to $0.44 within the next few days. This potential rise might serve as an initial step towards reaching $50 in the forthcoming months.

As a crypto investor, I’m keeping an eye on Matic. If the bears take control, it could potentially drop to around $0.38. Regardless of market conditions, it seems probable that the token will end up closing at a price above $0.30.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- The Battle Royale That Started It All Has Never Been More Profitable

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

- Your Friendly Neighborhood Spider-Man Boss Teases Surprising Doc Ock Detail

- How to get tickets to see Kendrick Lamar and SZA on their Grand National world tour

- Best Axe Build in Kingdom Come Deliverance 2

- Meghan’s Sweet Kids Tribute in Latest Vid!

2024-08-14 12:08