-

Despite being close to the opportunity zone, MATIC might struggle to bounce.

The token seems to have fallen into the bear phase, indicating that the price might go lower.

As an experienced analyst, I believe Polygon’s [MATIC] current situation is not ideal for new investors. Despite being near the opportunity zone, the token has fallen into the bear phase and its price might continue to decrease. The negative Sharpe Ratio suggests that the risk of buying MATIC at the current price may not be worth the potential reward.

Traders often believe that Polygon‘s [MATIC] 43.28% price drop presents a good buying chance. However, AMBCrypto cautions that hitting the buy button right now might be risky.

As a crypto investor, I can assure you that the claim about MATIC‘s price history wasn’t made lightly. At present, the token is trading at around $0.60. It’s been quite some time since MATIC reached or exceeded the $1 mark, which last happened in March.

MATIC is on the line

In simpler terms, the Sharpe Ratio led the way for Polygon’s performance evaluation. This ratio helps determine if the potential returns outweigh the associated risks.

The favorable interpretation of the ratio indicates that the potential reward may outweigh the risk for MATIC. Nevertheless, its Sharpe Ratio of -2.16 suggests significant risk.

Purchasing MATIC for $0.60 carries a potential risk that may not outweigh the potential rewards it could bring in the near future.

From a researcher’s perspective, it might be wiser for me to hold off on making large purchases until prices decrease. Nevertheless, I should keep an eye on the Market Value to Realized Value (MVRV) ratio as well. This ratio helps evaluate whether the current market value of my assets is greater or lesser than their realized value when sold. A positive MVRV indicates that the market value is higher than the realized value, while a negative MVRV suggests the opposite. By monitoring this ratio, I can make informed decisions about buying or selling based on market trends.

One way to rephrase this in clear and conversational language is: The MVR Realized Value Ratio (MVRV) helps identify potential buying and selling opportunities based on the profits or losses held by market participants.

Previously, the MVRRealizedValueRatios falling within the range of -14% to -28% have been indicative of favorable buying opportunities prior to price growth.

In October 2023, the price of ratio experienced a decrease of 17.60%. However, the following month, November, saw a significant increase in Polygon’s price from 0.51 to 0.94.

In January, the price of the token saw a significant increase, rising from $0.73 to $1.27 within a relatively short timeframe of just under three months.

Are bears now in control?

As an analyst, I’ve been observing MATIC‘s market behavior closely. Based on my analysis, there’s a possibility for the token’s price to increase in the future. However, before that uptrend materializes, it’s important to note that the value of MATIC might experience a dip first, potentially down to around $0.57.

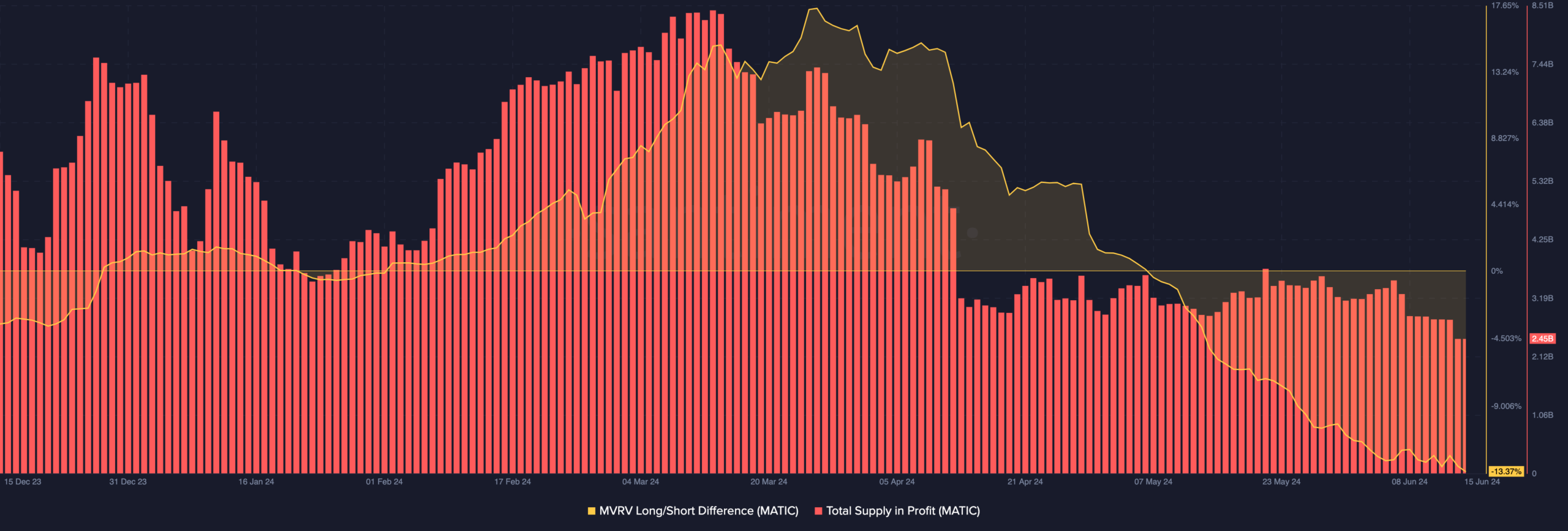

Additionally, AMBCrypto examined the MVRV (Money Value Received) Long/Short Difference. By using this indicator, investors can discern whether a particular cryptocurrency is experiencing a bear market or a bull run.

As a researcher studying the dynamics of cryptocurrency markets, I would interpret a reading below 0 as indicating that a particular token has moved into bearish territory. Conversely, if the Long/Short difference surpasses 1, it suggests that the cryptocurrency is experiencing robust growth in the bull market.

The token issued by Polygon experienced a decline of 13.37% in value. This signifies that bears have been predominantly driving the price trend recently. If this trend persists, it’s possible that the token’s value will further diminish.

As a crypto investor, I’ve noticed that the buying demand for MATIC is increasing, which could potentially reverse its current downtrend. Despite this, the total circulating supply of MATIC in profit has significantly decreased from a high of 8.45 billion to the current 2.45 billion.

Many individuals held the token, but they had not yet realized profits. Their fate in the current market downturn hinges upon the price trends of MATIC.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Solo Leveling Arise Amamiya Mirei Guide

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Avowed Update 1.3 Brings Huge Changes and Community Features!

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

2024-06-16 13:11