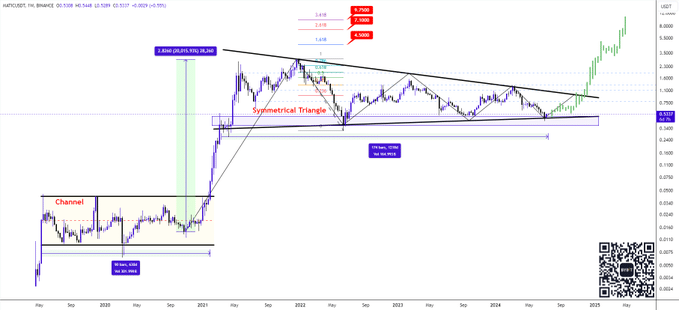

- Polygon’s symmetrical triangle phase hints at a bullish breakout, targeting $4.5 to $9.75.

- Despite recent bearish signals, Polygon’s 24-hour trading volume and TVL reflect strong user engagement.

As a seasoned crypto investor with several years of experience under my belt, I have witnessed the intricacies and complexities of the digital asset market. Polygon (MATIC) has been on my radar due to its impressive historical performance and current technical patterns.

Polygon (MATIC) on the cryptocurrency map has shown intriguing technical signs and price fluctuations lately. Notably, crypto expert Alex Clay identified a period of accumulation, implying promising gains could be on the horizon.

Polygon’s historical track record features two distinct accumulation periods. The initial phase, lasting approximately 630 days, generated an extraordinary 20,000% yield. This phase culminated in a significant price surge, laying the groundwork for MATIC‘s subsequent growth.

At present, MATIC has been forming a symmetrical triangle pattern over the past 1218 days, which typically suggests an upcoming bullish trend shift. Akin to past occurrences.

Alex Clay stated,

Based on our current analysis, there have been 1218 days of price action forming a symmetrical triangle pattern in the market. The potential levels for price reversal or breakout are predicted to be in the range of $4.5 to $7.1, and possibly extending up to $9.75.

At the current moment, Polygon’s total market value was calculated to be around $4.94 billion. Considering all outstanding shares, this figure rose to an estimated valuation of approximately $5.32 billion. The significant trading volume of over $305.77 million during the last 24 hours signified brisk business activity and high liquidity in the market.

As a crypto investor, I can tell you that the Total Value Locked (TVL) on the platform amounted to an impressive $11.50 billion. This figure underscores the significant level of user engagement and trust investors have placed in the platform.

MATIC technical analysis

Based on my expertise in technical analysis, the MATIC chart displays conflicting indicators. Specifically, according to the Bollinger Bands, the price is hovering beneath the middle band, implying a potentially bearish market condition.

The relationship between the MACD line and the signal line indicated bearish momentum for MATIC. Yet, the histogram exhibited a slight positive value, reflecting minimal buying pressure. A possible bullish turnaround for MATIC could be signaled if the MACD surpassed the signal line.

As of the current news update, the Relative Strength Index (RSI) stood at 46.73, which is beneath the neutral mark of 50. This reading implies a bearish outlook as investors’ sentiment is more towards selling rather than buying. Additionally, the RSI isn’t in the oversold region yet, suggesting there might be further potential for price decreases. However, substantial purchasing power could cause the RSI to shift into a bullish zone.

The Alligator indicator depicts the underpart of prices relative to the teeth and jaw line, signaling a dominant bearish trend. As the lines begin to converge, it may indicate a possible halt or shift in the current trend direction.

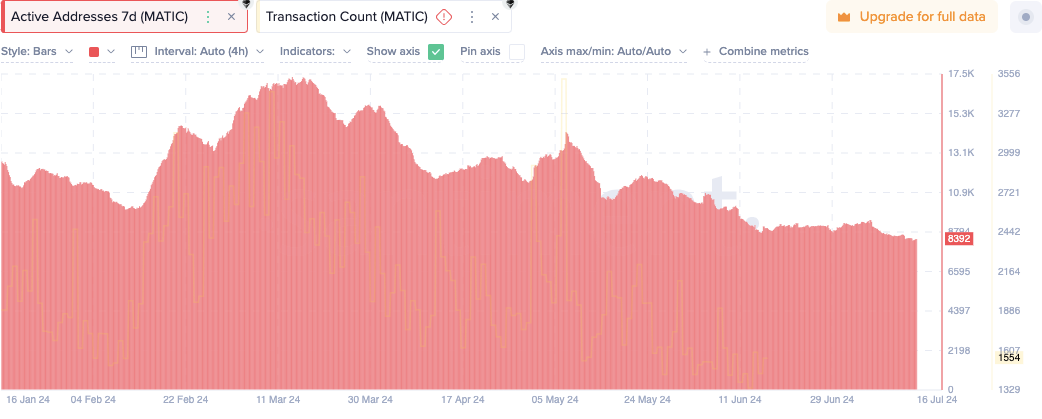

Currently, there are roughly 8,392 active addresses on the network, representing a decline from previous levels. Simultaneously, the number of transactions has dropped to approximately 1,554. The decreasing trends in both metrics suggest that network activity and user engagement have been waning over the past few months.

Read Polygon’s [MATIC] Price Prediction 2024-2025

The value of Polygon has gone through some ups and downs, reaching a high of around $0.555, then dipping to roughly $0.525, and finally settling at about $0.53.

Currently, MATIC is being bought and sold for $0.5284. This represents a decrease of 0.96% from its price during the previous 24 hours. However, there has been a rise of 6.03% in its value over the last seven days.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-07-17 08:08