- POL price consolidates within a descending triangle, with a potential 40% breakout looming.

- Positive metrics, including rising active addresses and declining exchange reserves, favor a bullish outlook.

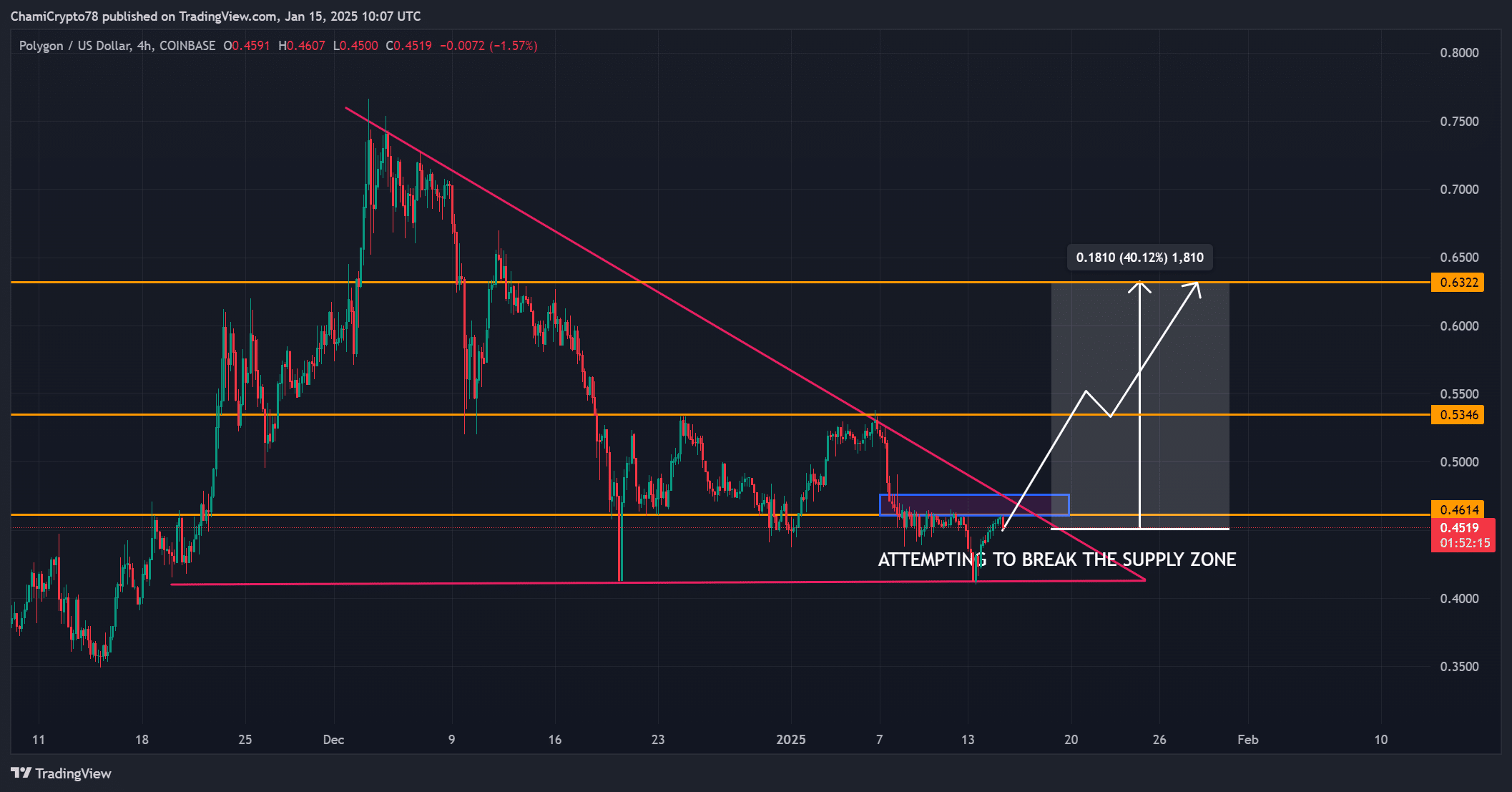

As Polygon‘s price movement approached a significant juncture, it was observed that the token was moving within a descending triangle on its 4-hour chart. The struggle between buyers and sellers is particularly intense in the area spanning from approximately $0.47 to $0.41, as both parties strive for dominance.

Currently, POL is being exchanged at $0.4505, representing a slight 0.02% decrease over the past day. This could signal a potential major shift in the token’s trajectory, as it might surge ahead (bullish move) or dip further (bearish move). Will buyers be able to surmount resistance levels to spark an upward trend, or will sellers drive the prices downwards?

Is the POL price ready to break the supply zone?

The cost of POL is currently stuck within a falling triangle pattern, consistently challenging the $0.47 resistance point. At present, there’s an ongoing effort to breach above this congested area, potentially leading to a significant price surge if successful.

If the price of POL surpasses $0.47, it would suggest a surge in positive market sentiment, potentially leading to a 40% increase and reaching $0.63. Conversely, if POL is unable to maintain its position above $0.41, it may encounter resistance and could revisit lower support zones.

This pivotal battle will decide the token’s immediate trajectory.

What does the rise in active addresses indicate?

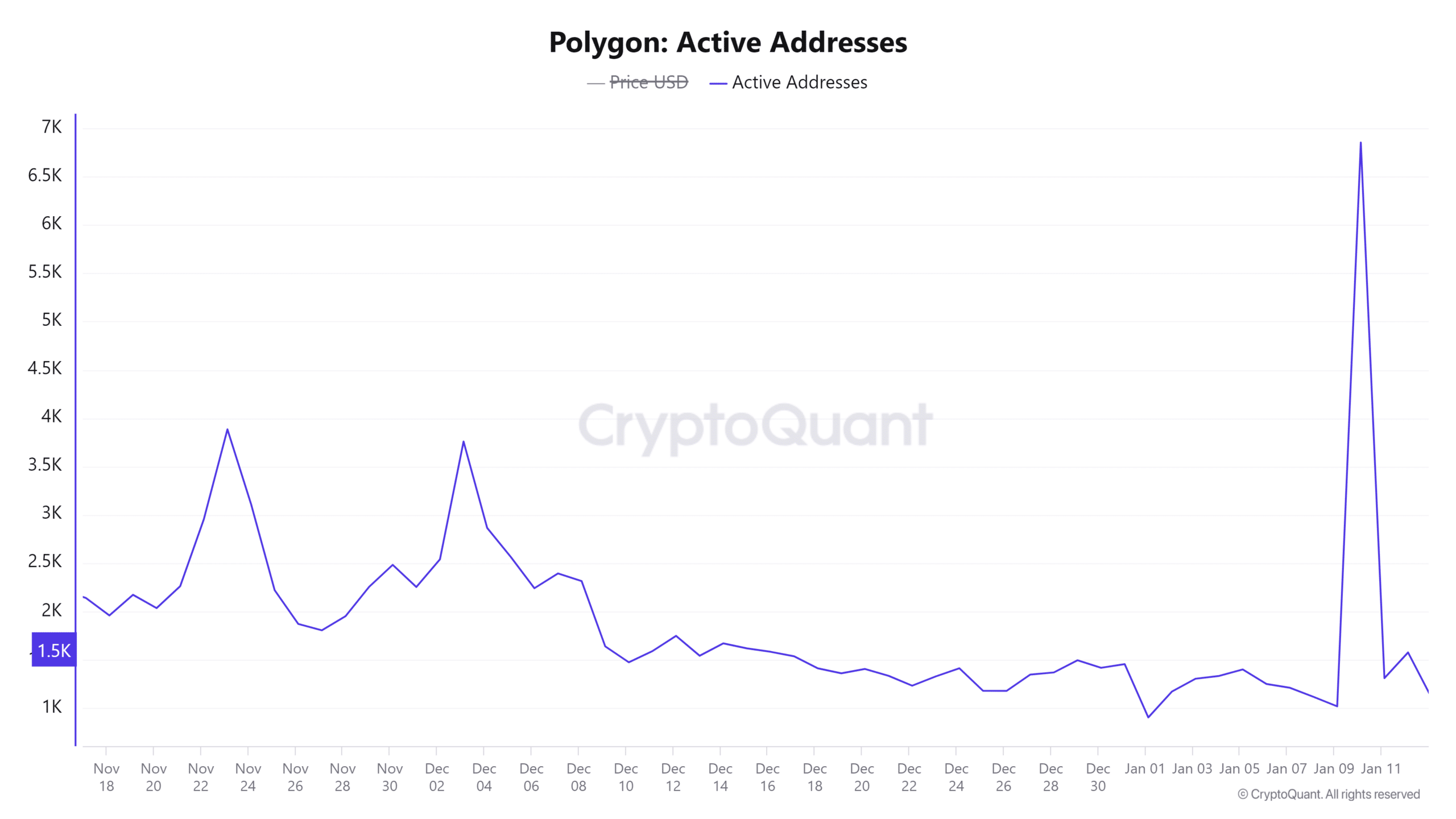

Over the last day, there’s been a 1.17% rise in the count of active addresses. This growth indicates more user interaction, implying a revitalized curiosity towards the network.

An increase in active user accounts typically indicates a surge in interest and possible market expansion. If this pattern persists, it might trigger a strong upward movement (bullish breakout). Yet, to ensure lasting growth and price consistency, continuous engagement is crucial.

Does the transaction count confirm market activity?

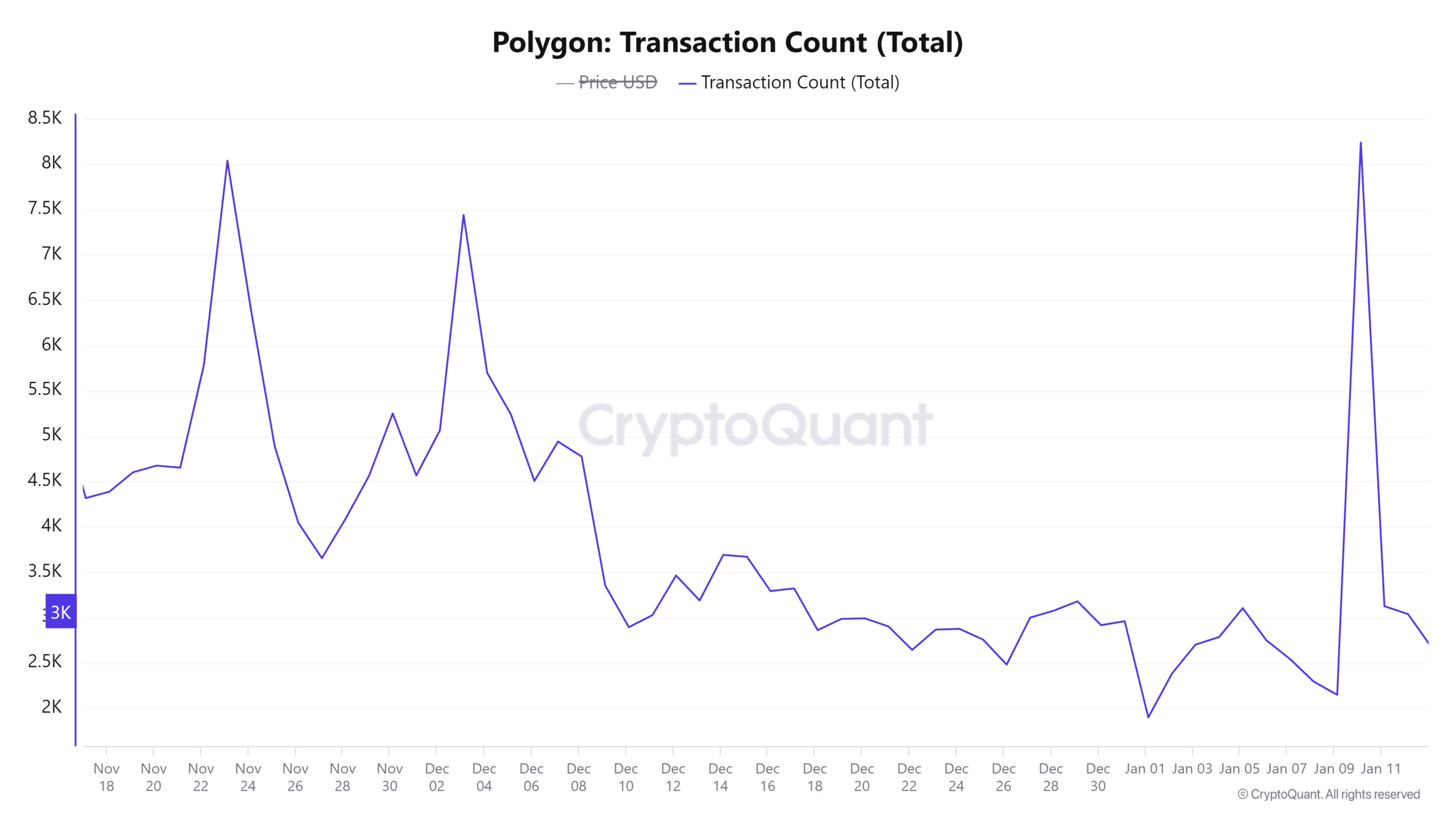

Over the past day, I’ve noticed a 1.3% surge in the number of transactions on the POL network, reaching a total of 2,886. This increase suggests steady network activity and indicates a growing interest from users.

Moreover, a rise in transaction frequency might point towards growing acceptance, boosting optimistic views. If transaction numbers persist at current levels or keep increasing, this trend may strengthen the chances of surpassing the critical resistance threshold.

Why is the exchange reserve declining?

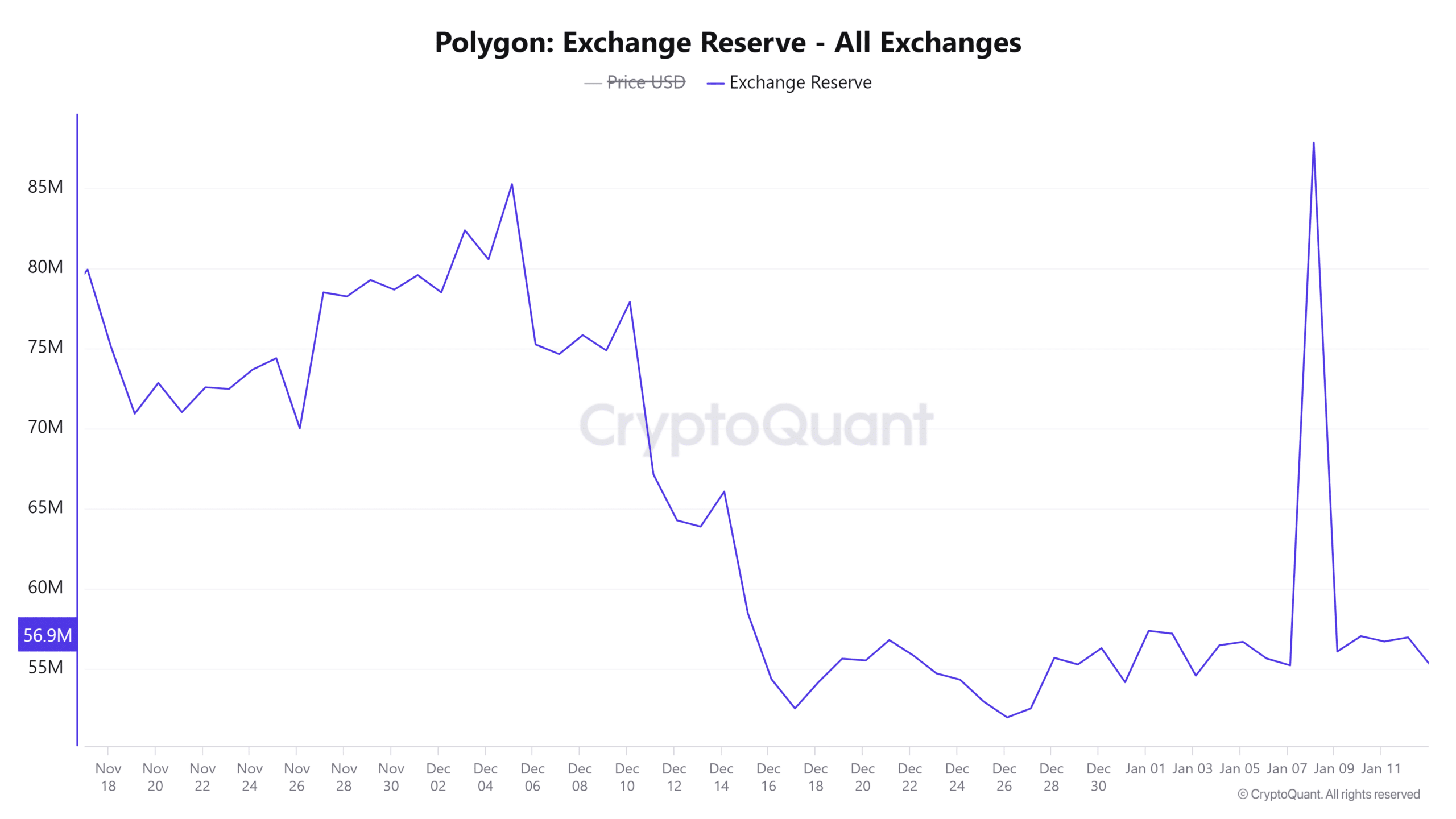

The reserve held for exchanges decreased by 1.23%, currently totalling 56.9 million units. A decrease in the exchange reserve might mean that there are fewer tokens readily available for trade, potentially hinting at long-term investors hoarding or accumulating the tokens.

As a crypto investor, I’ve observed that when reserves are lower, it typically means there’s less selling pressure in the market. This can certainly foster an environment conducive to a price spike. Yet, if demand starts dwindling, this accumulation trend might not automatically trigger immediate growth. Instead, it could take time for the market conditions to shift and for the upward momentum to materialize.

Conclusion: Will POL soar or sink?

At a crucial point, the price movement of Polygon shows signs of significant change. An uptick in active users and transactions, along with a decrease in exchange holdings, indicates a robust possibility for growth.

As I observe the market trends, it seems plausible that if bulls manage to surge beyond the resistance at $0.47, a significant upward trend toward $0.63 becomes increasingly probable. Conversely, should the bulls fail to maintain control above this level, there’s a potential for bearish influence to take over, leading us downward. At present, my focus remains fixed on the supply zone for further insights into the market’s direction.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

2025-01-16 17:47