-

Polygon’s POL migration on September 4th could be the catalyst MATIC needs to break free from its current downtrend.

With MATIC trading near its multi-year low, the upcoming upgrade is a critical test for Polygon’s market resilience.

As a seasoned researcher with years of experience navigating the tumultuous waters of the cryptosphere, I can say that the upcoming POL migration on September 4th for Polygon [MATIC] feels like a much-needed breath of fresh air in this bear market. The token has been under pressure, and trading near its multi-year low is a far cry from its all-time high. However, the potential upgrade could be just what MATIC needs to break free from its current downtrend and potentially pave the way for a substantial rally.

Currently, the cryptocurrency Polygon [MATIC] is facing some turbulence as its value has been consistently decreasing. At the moment of writing, MATIC is being traded at $0.4001. Over the last 24 hours, there’s been a 2.08% decrease in its price and over the past week, it’s dropped by approximately 21.95%.

The current slump mirrors the prevailing negative attitude towards cryptocurrencies, a feeling that has affected numerous digital currencies.

Although there are ongoing difficulties, the shift from MATIC to POL on September 4th is sparking a tentative sense of hope among investors. This change is one element of Polygon’s plan to boost network functionality and effectiveness.

Observers in the market are eagerly waiting to find out if this change will halt the current downturn and enhance Polygon’s standing in the market instead.

Key levels and potential price movement

During its transition to the POL platform, the price of MATIC is holding steady near a significant support point at approximately $0.40 – a level that represents MATIC’s lowest price in years. For MATIC to maintain its immediate market stability, it is essential that this support holds strong.

If the current cost remains steady, the next significant barrier to observe would be around $1.50. Should we surpass this mark, it might open up opportunities for a significant increase, potentially taking us to $3.00. This jump would translate into a potential 100% rise in value.

Based on technical analysis, indicators point towards a potential recovery for MATIC. The Relative Strength Index (RSI) stands at 35.95, suggesting that MATIC might be close to being oversold. This might mean it’s a good time to buy, especially if the transition of POL tokens sparks renewed interest from potential buyers.

MVRV ratio and on-chain signals

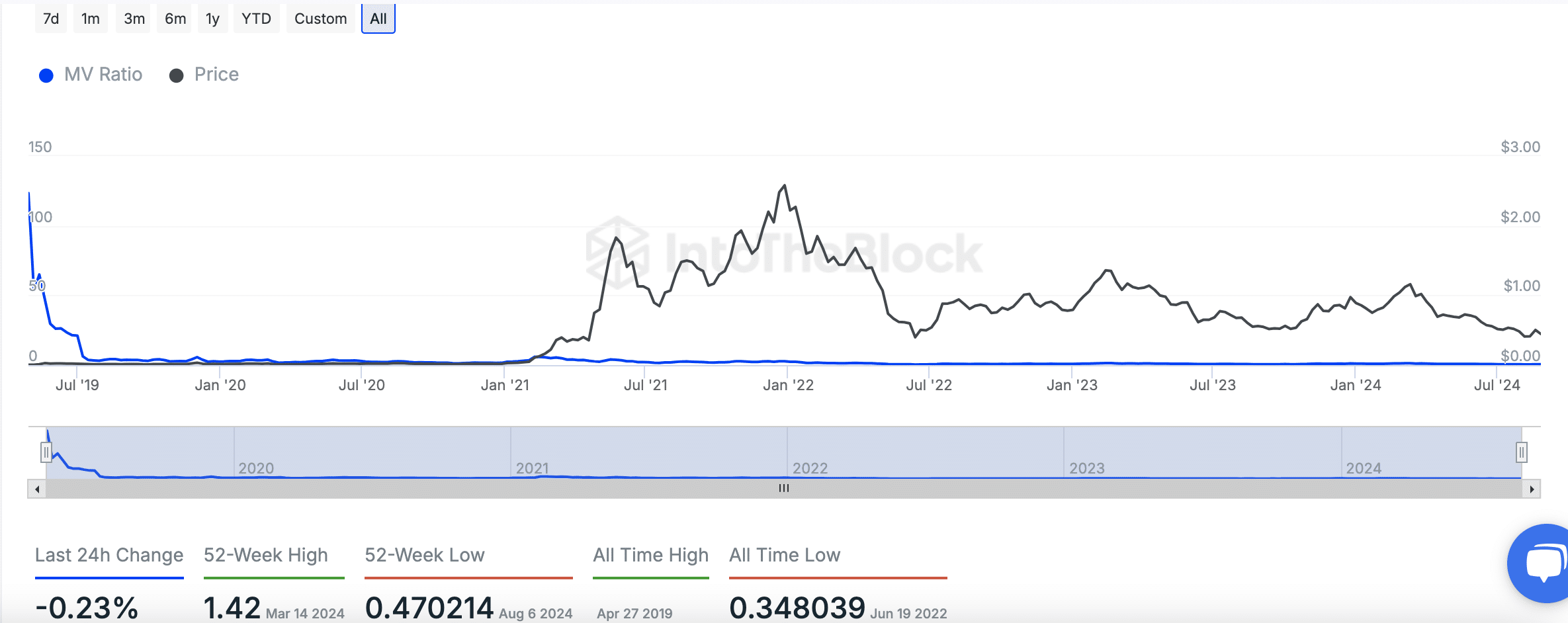

Over time, the Market Value to Realized Value (MVRV) ratio for MATIC has experienced significant ups and downs. Following a steep drop in mid-2019, this ratio has generally stayed fairly consistent.

Recently, it has hovered close to zero, reflecting minimal profitability for MATIC holders.

Currently, at the moment of reporting, the MVRV ratio stands at approximately -0.23%. This suggests that recent investors have seen only minor returns, and with such a low figure, it’s reasonable to infer that there might be limited prospects for immediate price growth.

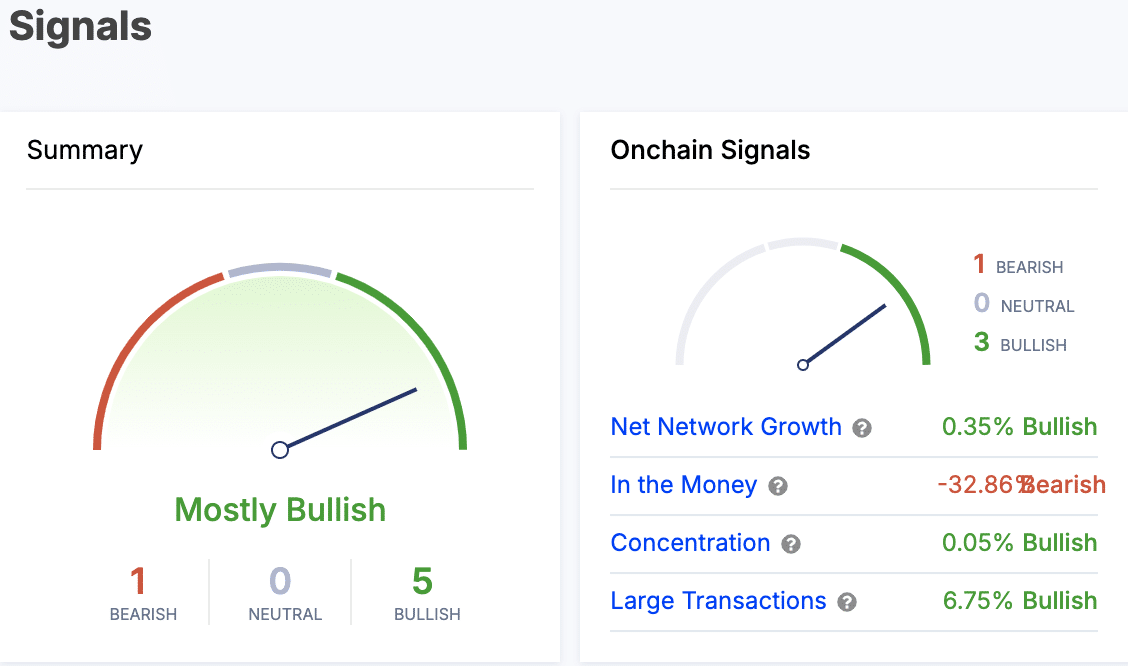

Additionally, as per IntoTheBlock’s data, the on-chain signs for MATIC are predominantly positive, with three bullish signals. This is indicated by a 0.35% increase in network growth, suggesting more users joining the Polygon network, and a 6.75% rise in large transactions, demonstrating increased activity on the network.

At the current moment, the “In the Money” measure stood at -32.86%, indicating a predominantly pessimistic outlook. This suggests that numerous investors are incurring losses.

DeFi activity on Polygon

As reported by DefiLlama, the current total value locked in DeFi protocols on the Polygon network amounts to approximately $876.12 million. This amount signifies the overall capital invested across these decentralized finance platforms on the Polygon network.

Moreover, it’s worth noting that the market value of stablecoins on the Polygon network amounts to a substantial $2.026 billion, suggesting a high level of engagement within the system.

Over the past day, a substantial number of 576,621 active users have been connected to the network, indicating high levels of user interaction. As we move closer to the POL migration, we’ll carefully observe these statistics to evaluate how the upgrade affects the network’s overall vitality and expansion.

The upcoming POL migration represents a pivotal moment for Polygon.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Solana – Long or short? Here’s the position SOL traders are taking

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

2024-09-03 11:37