- Polygon’s revenue fell in Q1.

- This occurred despite the growth in its network usage during that period.

As a researcher with extensive experience in blockchain and cryptocurrency analysis, I find the data presented in Messari’s report on Polygon’s Q1 performance intriguing. The decline in revenue despite increased network activity is a phenomenon that warrants further investigation.

A recent study conducted by Messari revealed that Polygon (MATIC), a Layer-2 scaling platform, experienced a decrease in quarterly earnings from the first to the second quarter.

Despite an increase in network activity on Polygon during the examined timeframe, as indicated by the on-chain data, there was still a notable decrease in generated revenue.

From January 1st to March 31st, our network generated a revenue of $7 million. This is a decrease of 19.3% compared to the $10 million earned during the final quarter of 2023.

As a researcher analyzing financial data, I’ve noticed that Q1’s revenue for Polygon dropped by 42% compared to the $12 million earned in the same quarter of the previous year, 2023.

Surge in network activity

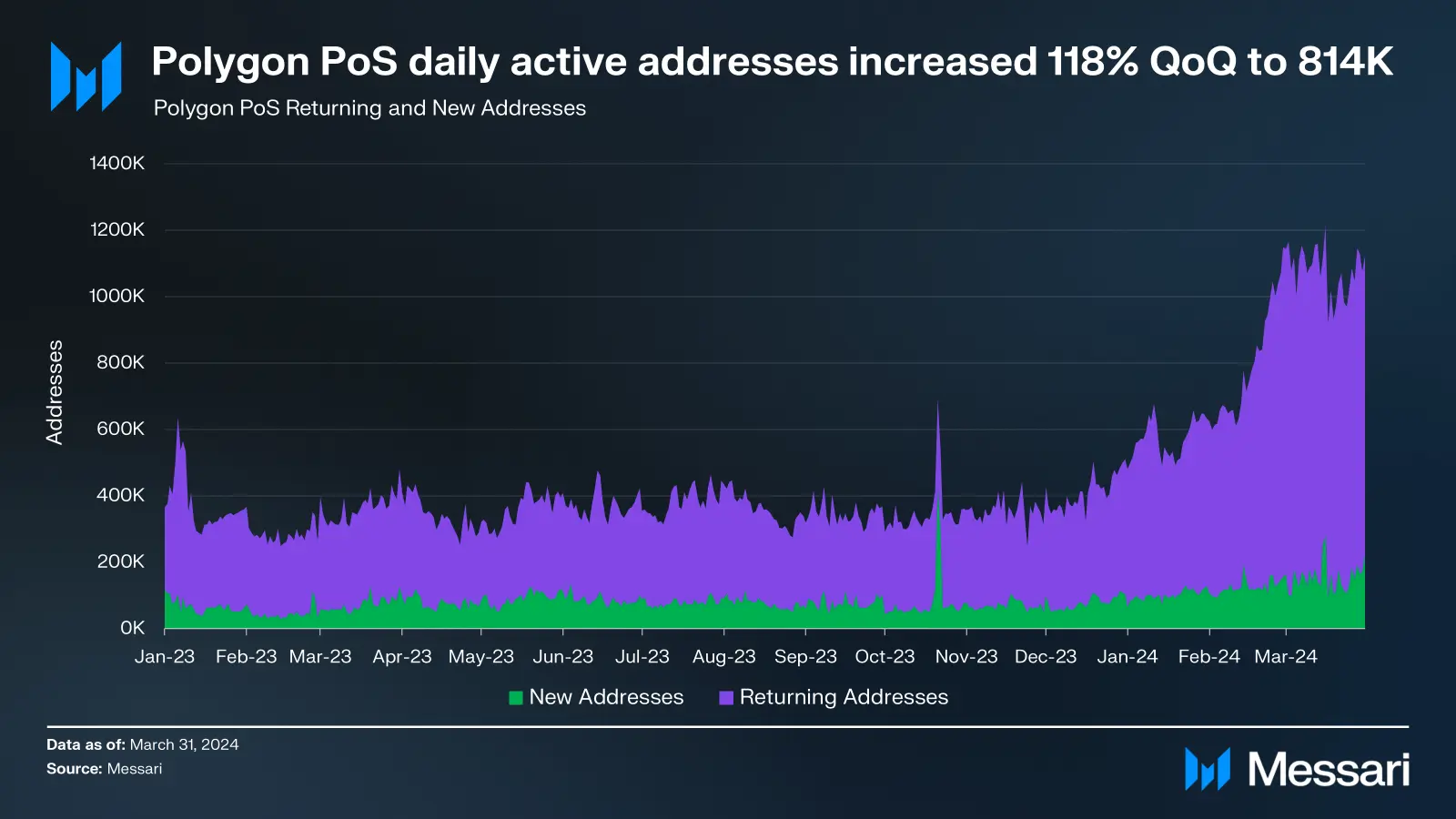

The quarter just passed showed a noticeable increase in activity. Over this time frame, our network averaged approximately 814,000 daily active addresses.

Based on Messari’s findings, there was a significant increase of 118% in the number of daily active addresses on the network during that particular quarter. This figure represented a new high for the past year.

As a researcher examining the trends in Polygon’s user base, I have observed a significant surge in demand for this L2 network. In the recent quarter, an average of 127,400 new addresses were created each day on the Polygon network, representing a robust 69% increase from the previous quarter’s figure of 75,900.

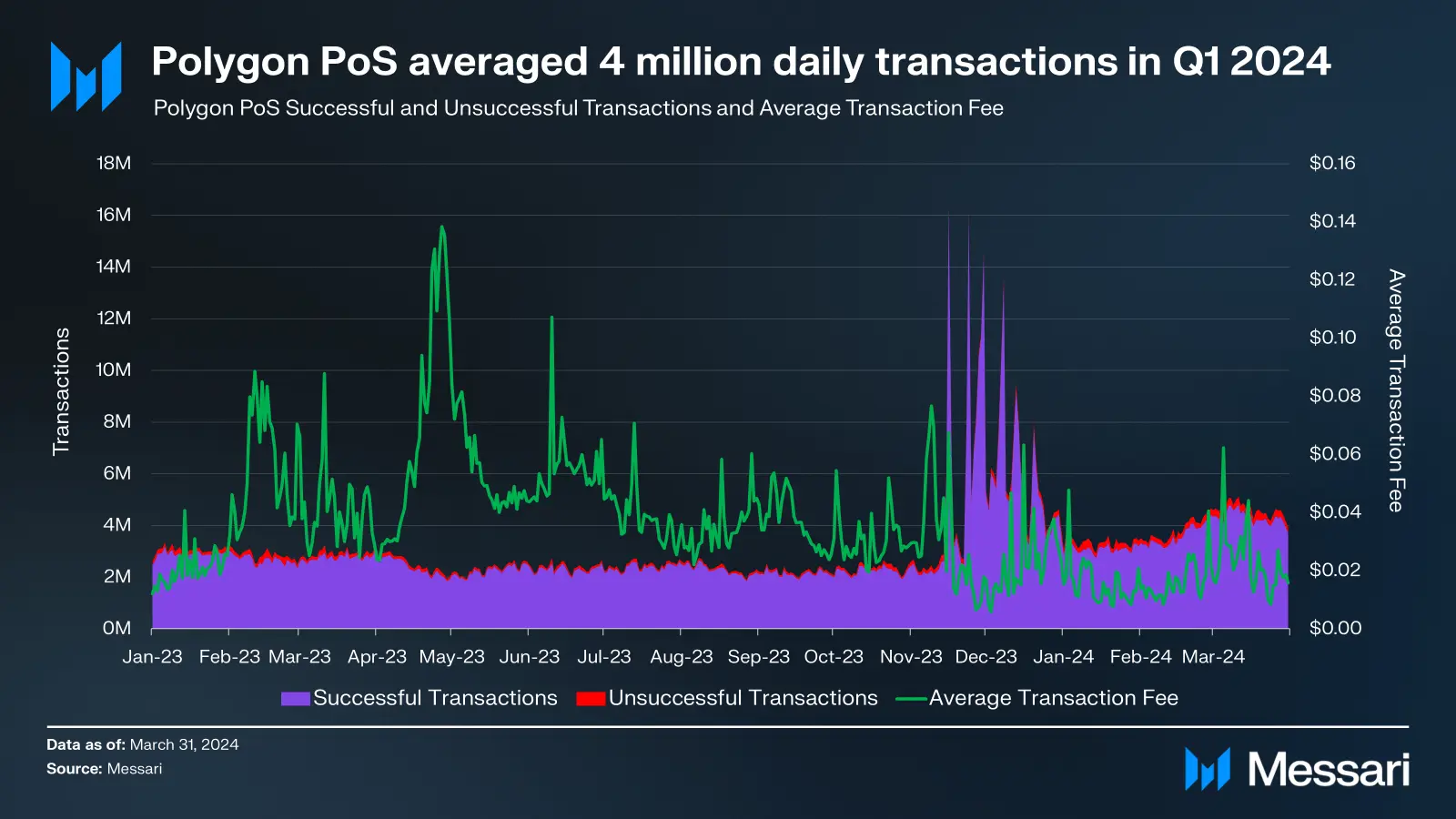

As an analyst, I’ve observed a significant increase in the usage of Polygon’s network during Q1 2024. Consequently, there was a dramatic uptick in the number of transactions executed on it. Specifically, the PoS network recorded approximately 4 million daily transactions on average.

As a crypto investor, I’m excited to share that the Decentralized Finance (DeFi) sector of Polygon’s network experienced significant growth in the first quarter of this year. The total value locked (TVL) in DeFi projects on Polygon reached an impressive $1.4 billion by the end of Q1 2023 – a noteworthy 30% increase from the TVL of $1.1 billion recorded in Q3 2023.

Realistic or not, here’s MATIC’s market cap in ETH terms

On how the DeFi protocols housed within Polygon fared during the quarter in review, Messari noted:

As a researcher studying the decentralized finance (DeFi) landscape on Polygon PoS in Q1 2024, I observed that Aave maintained its leading role with a total value locked (TVL) of $705 million, representing a 35% growth compared to the preceding quarter. Uniswap emerged as a close second, achieving a TVL of $130 million, which represented a substantial 41% increase from the previous quarter.

In the initial quarter of the year, there was a noteworthy increase of 18.4% in the sales volume for Polygon’s non-fungible tokens (NFTs) marketplace.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-05-31 21:11