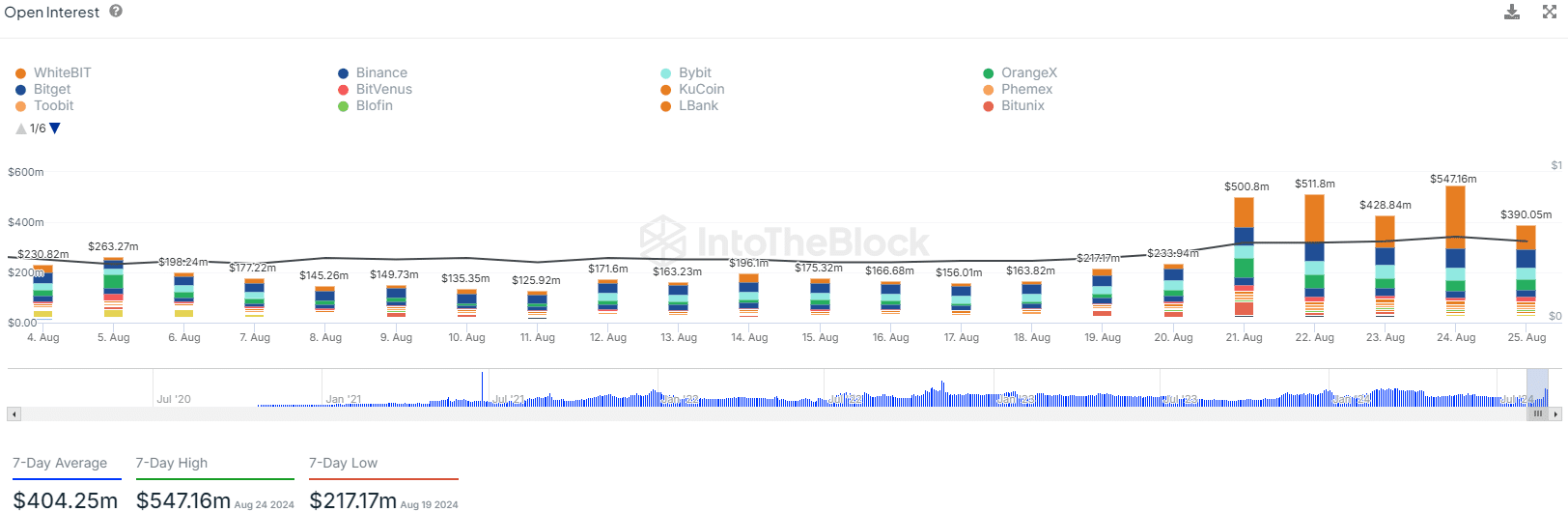

- Polygon saw a sharp increase in Open Interest as speculators clamored to participate in the bullish move.

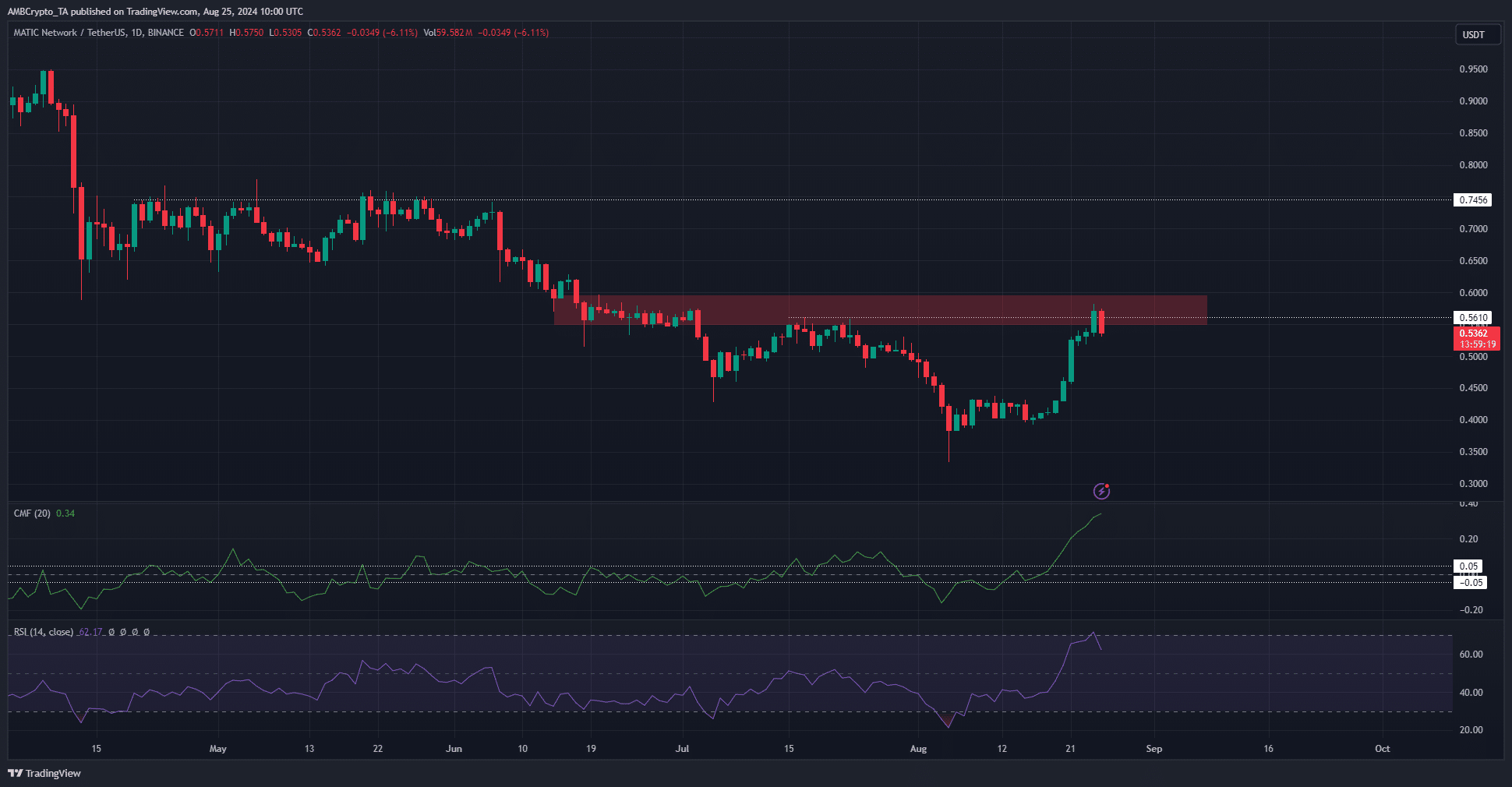

- The failure to break the weekly structure suggested the bears might be dominant hereon.

As a seasoned researcher with years of experience under my belt, I find myself intrigued by the recent surge and subsequent dip in Polygon [MATIC]. The bullish move was undeniably impressive, with the price soaring to new heights and breaking multiple resistance levels. However, the sudden reversal and the high number of underwater holders suggest that we might be witnessing a correction or even the exhaustion of this uptrend.

Last week, the cost of Polygon’s MATIC token surged significantly, setting a robust short-term upward trajectory. The significant barrier at $0.43 was convincingly overcome, and the bulls demonstrated sufficient strength to propel a surge towards the higher timeframe resistance area around $0.58.

This increase in price was followed by a doubling of open interest, suggesting strong bullish enthusiasm. After peaking at $0.5819, the price subsequently dropped by 7.5%, and the open interest also decreased accordingly.

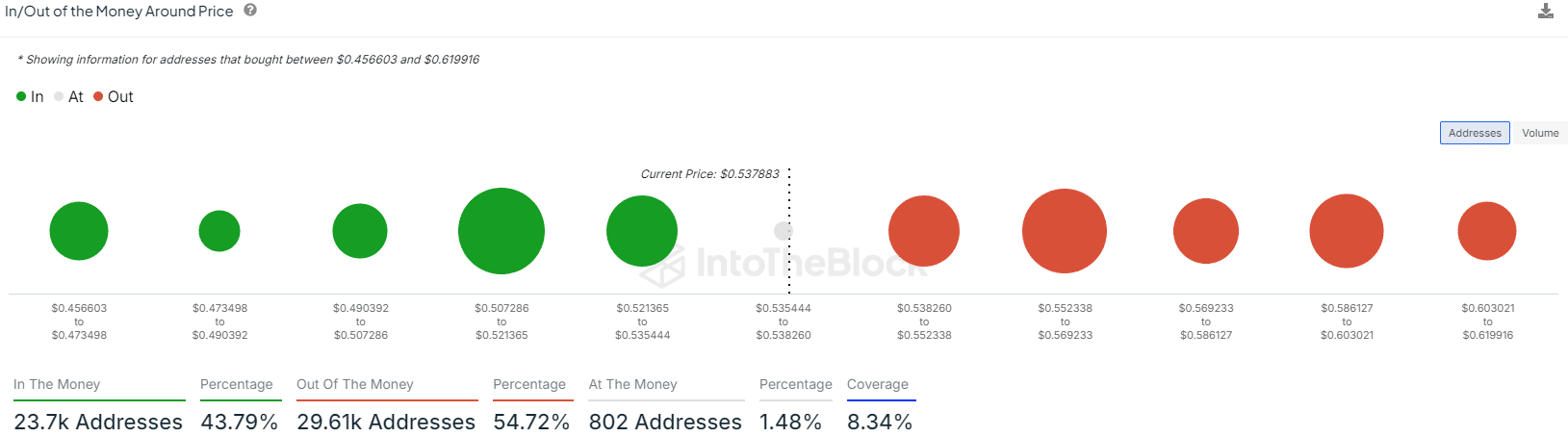

In my analysis, I’ve observed that many Matic investors are yet to realize profits, including those who have held it in the short term. This finding is derived from a recent report I’ve come across.

Market participants might hinder continued MATIC gains

Approximately 54.72% of the addresses purchasing MATIC within the range of $0.456 to $0.62 ended up incurring a loss on their investment.

Such a jump in price, say, between $0.552 and $0.569, could trigger a wave of selling because investors who are “underwater” (owing more than their investment is currently worth) would look to sell at breakeven point.

To the south, the psychological $0.5 region is likely to see increased buying activity.

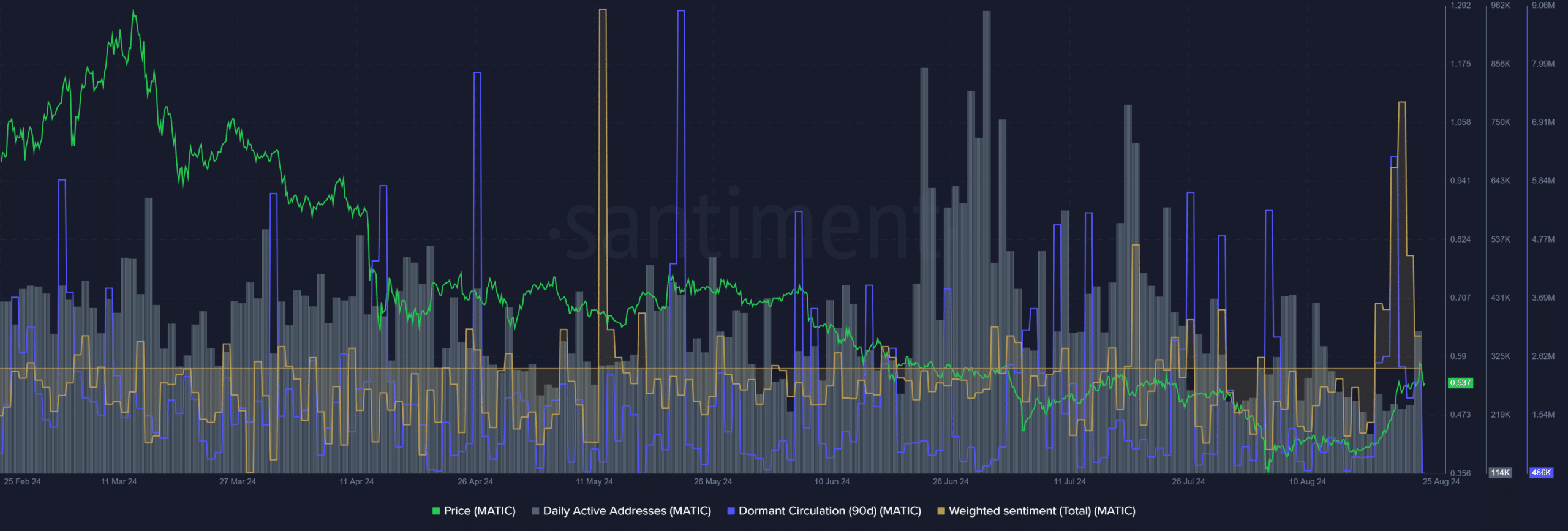

According to AMBCrypto’s analysis, the number of daily active addresses on the network has been decreasing over the last month. This suggests a possible decrease in network usage and token demand.

On August 21st, the sudden increase in dormant circulation indicated a potential caution sign for buyers, while the weighted sentiment peaked at its highest level since May due to the price surge.

Typically, a rapid succession of trading activity like this suggests that a large-scale buying or selling event might be imminent. This potential event could cause the prices to drop.

Another reason MATIC’s uptrend might be exhausted

As an analyst, I observed a bullish market structure emerge following our latest movement, with technical indicators leaning towards the advantage of buyers.

Realistic or not, here’s MATIC’s market cap in BTC’s terms

But the $0.56-$0.58 zone was a key weekly resistance that MATIC faced rejection at in recent hours.

Based on current market trends, it’s expected that prices may stabilize between roughly $0.56 and $0.58 for a while, during which they might be redistributed. After this period of stability, there could be a potential drop in prices, possibly reaching around $0.50 or even $0.45.

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-08-26 07:03