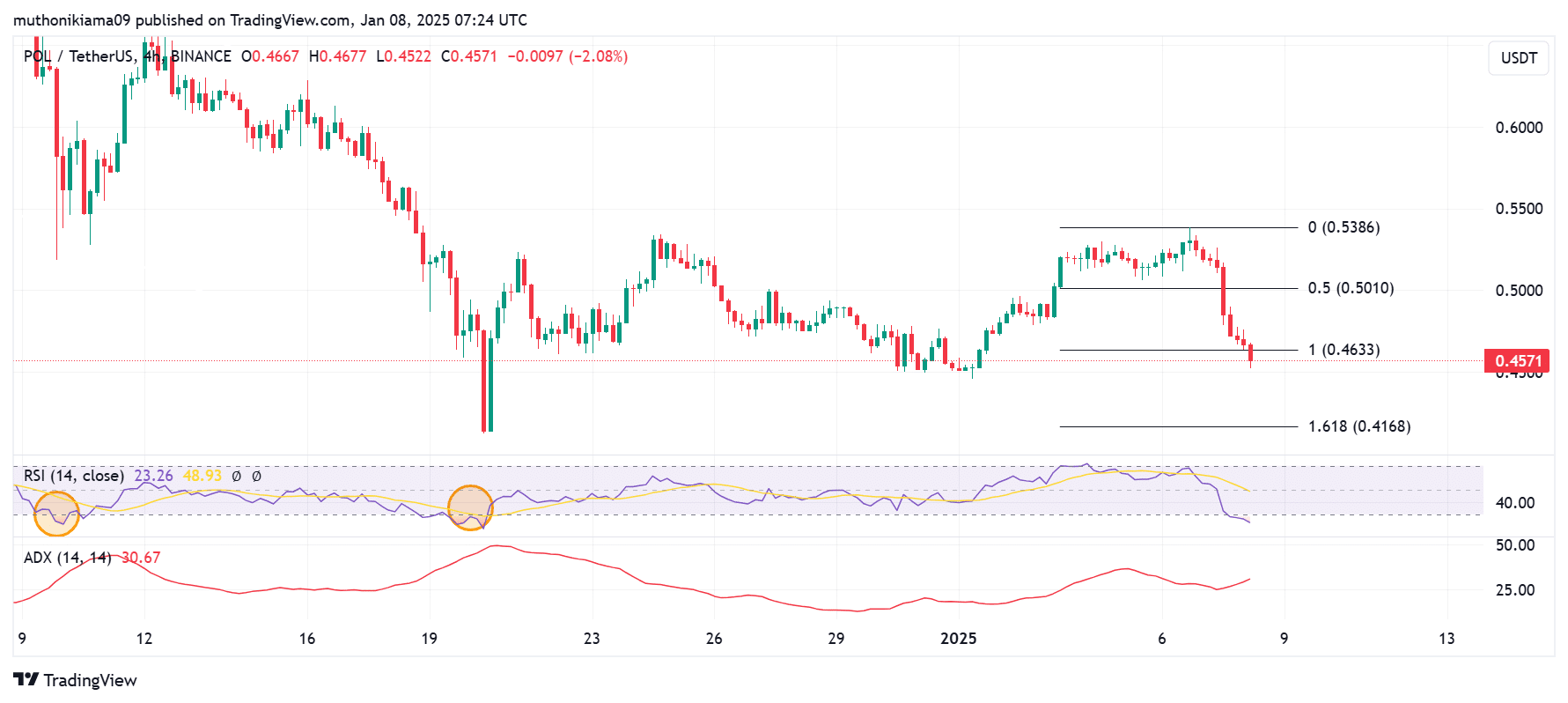

- Polygon’s RSI has reached oversold levels after dropping to 23 amid intense selling pressure.

- 91% of Polygon wallet holders were in losses at press time, suggesting a bearish market sentiment.

At the moment of reporting, Polygon (POL) is experiencing a significant decline, dropping approximately 12% over the past 24 hours and currently trading at around $0.457. This drop has led to a surge in trading activity, with volumes jumping by about 33% to reach roughly $248 million, as reported by CoinMarketCap.

In simple terms, the value of Polygon has dropped approximately 33% over the past month due to a downward trend, often referred to as “bearish pressure.

As a crypto investor, I’ve noticed that my wallet’s performance has taken a significant hit recently, as the proportion of my wallets showing a loss has skyrocketed to an alarming 91%.

When a large number of investors experience financial losses with their digital wallets, this can lead to a pessimistic outlook on the market, causing prices to drop even more. Additionally, these investors may decide to offload their holdings to limit their losses, which intensifies the selling pressure.

As these bearish conditions persist, are there signs of a recovery, and could this trend reverse?

RSI shows Polygon is oversold

On the four-hour chart for the altcoin, Polygon’s Relative Strength Index (RSI) indicates that the token might be undervalued as it has reached an oversold state. The RSI value has fallen to 23, its lowest point since mid-December.

In simpler terms, when the Relative Strength Index (RSI) indicates that an asset is oversold, it often signals an upcoming rise or correction in its price. Historically, this pattern has been observed with the cryptocurrency POL, which tends to initiate a rally whenever the RSI reaches levels suggesting the asset is oversold. Therefore, based on these observations, the altcoin might be gearing up for an upturn or recovery.

However, the Average Directional Index (ADX) is yet to confirm the end of the downtrend.

Indeed, the ADX line is increasing, suggesting that the current downward trend in POL may be intensifying, potentially causing its price to fall towards the 1.618 Fibonacci level, which is approximately $0.416.

But should the selling pressure decrease while investors view the oversold Relative Strength Index (RSI) as a favorable buying opportunity, this might trigger a bullish turnaround, potentially driving the price up to $0.538.

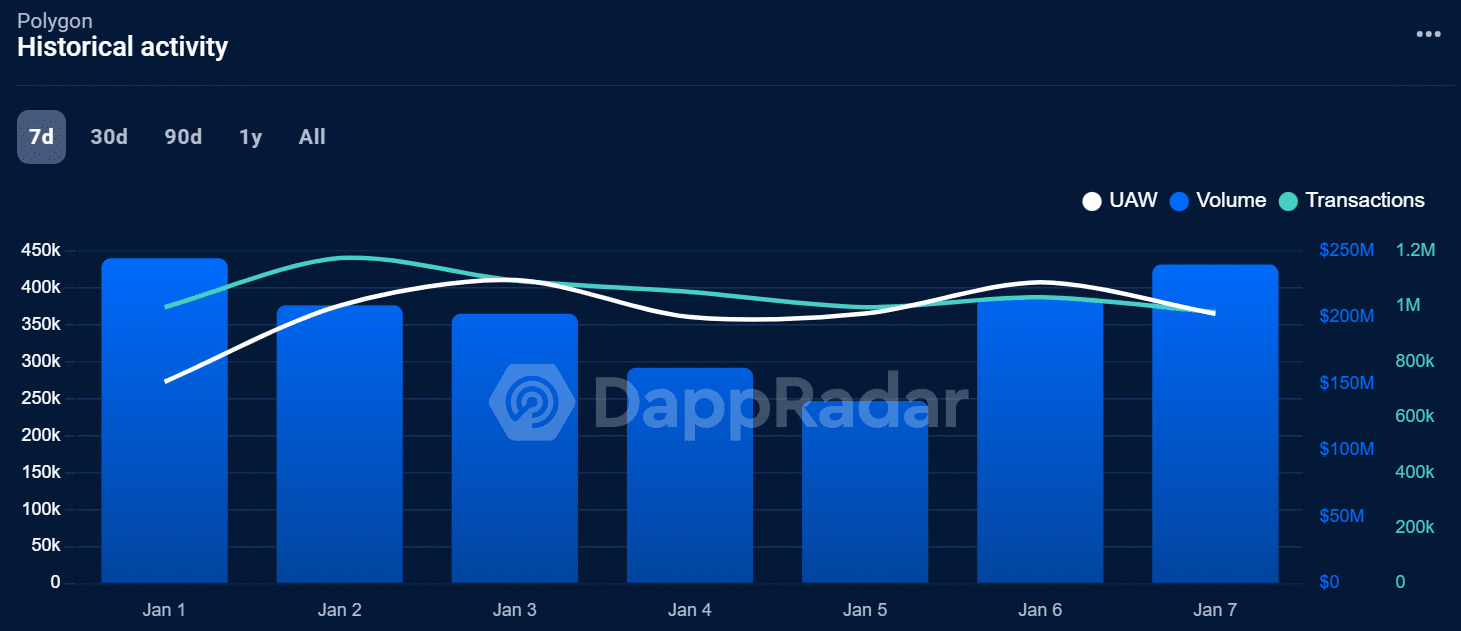

dApp activity surges

According to data from DappRadar, the usage of decentralized applications (dApps) on the Polygon network has experienced a substantial rise. Within just a few hours, these dApp volumes surged by 18% to reach an impressive $244 million, marking their highest point in six days.

Despite the rise, the value of transactions fell below $1 million, and the count of Unique Active Wallets (UAWs) decreased as well.

Furthermore, it appears that Polygon’s monthly decentralized application (dApp) volumes are currently 37% lower than usual, indicating a potentially pessimistic long-term perspective.

Read Polygon’s [POL] Price Prediction 2025–2026

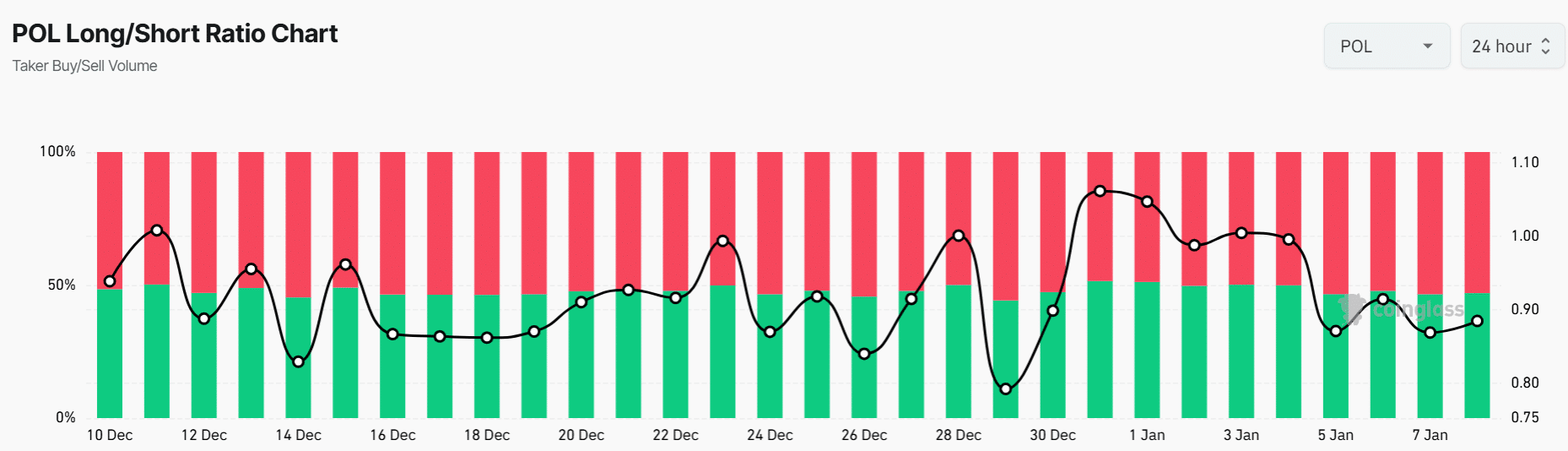

Long/Short Ratio shows bearish momentum

At the current moment, the Long/Short Ratio from Polygon suggested a negative trend, as the ratio had fallen to 0.885, signifying that there were marginally more short positions compared to long positions, implying bearish momentum.

Short sellers often amplify their wagers during downward market trends. Yet, an accumulation of short positions may escalate the likelihood of a short-squeeze incident, prompting compulsory purchase actions.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2025-01-08 19:03