- Polymarket’s cumulative trading volume crossed $1 billion

- Weekly active users hiked by over 14x as well

As a seasoned researcher with a keen interest in the dynamic world of cryptocurrencies and decentralized platforms, I find myself genuinely impressed by the meteoric rise of Polymarket. With my fingers constantly on the pulse of the crypto-sphere, it’s not every day that we witness a platform like Polymarket crossing the $1 billion cumulative trading volume mark. The surge in weekly active users and monthly active traders is nothing short of phenomenal.

As a crypto investor, I can’t help but marvel at the bustling and largely prosperous year our crypto realm has experienced. Not only did we witness the approval of Bitcoin and Ethereum Spot ETFs, but political figures from both sides of the aisle are increasingly voicing their support for cryptocurrencies. This momentum has undeniably benefited numerous projects in the space, with the popular decentralized prediction platform Polymarket being one notable example.

Individuals utilize Polymarket by trading crypto-backed shares to wager on actual occurrences. As the U.S. election season has heated up over the last half year, an increasing number of people have chosen to make predictions through Polymarket.

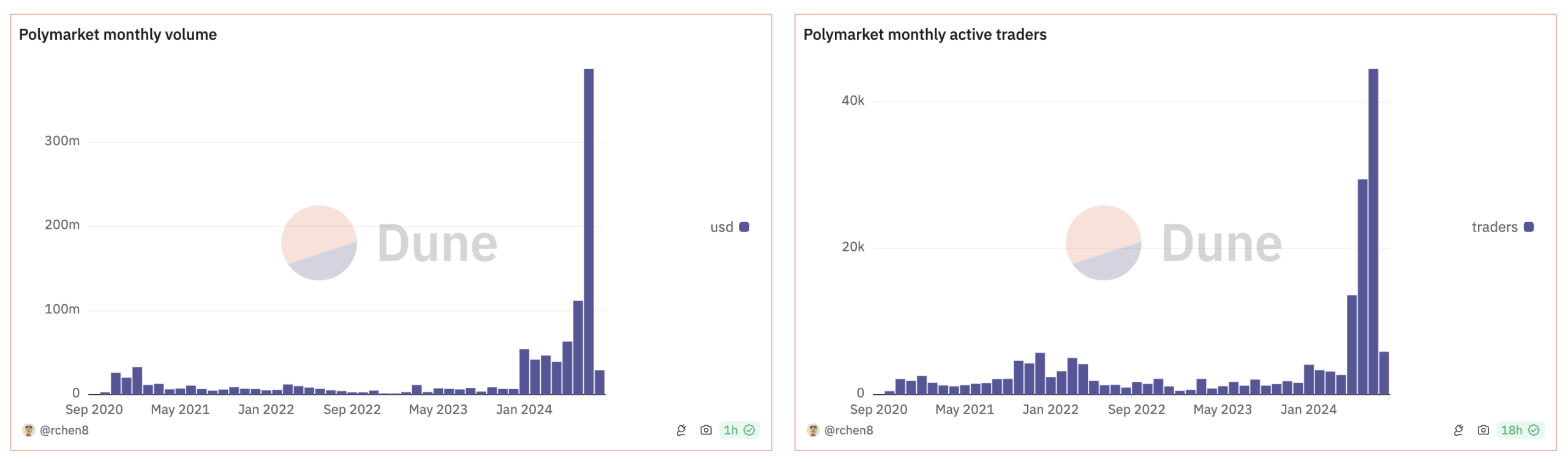

In fact, just recently, it crossed a cumulative trading volume of over $1 billion on the charts, with the month of July alone recording figures of over $387 million.

Beyond that point, some notable changes occurred. The number of monthly active traders increased from 29.4 thousand in June to 44.5 thousand in July. This surge was accompanied by an Open Interest escalation, reaching up to $90 million. Additionally, the weekly active users saw a significant growth, approximately 14 times larger, from approximately 1,400 to over 20,000.

Currently, many analysts are suggesting that the surge in public interest might be related to the ongoing presidential election in the United States. Notably, this assumption seems plausible as over 45% of all trades on Polymarket involve wagers about who will be the next U.S President, making up a significant portion of their total trading volume.

Nevertheless, as stated by ParaFi Capital – one of the major investors in Polymarket – this information might not provide a comprehensive picture. In a widely shared post on platform X, ParaFi Capital suggested that there’s more to the story.

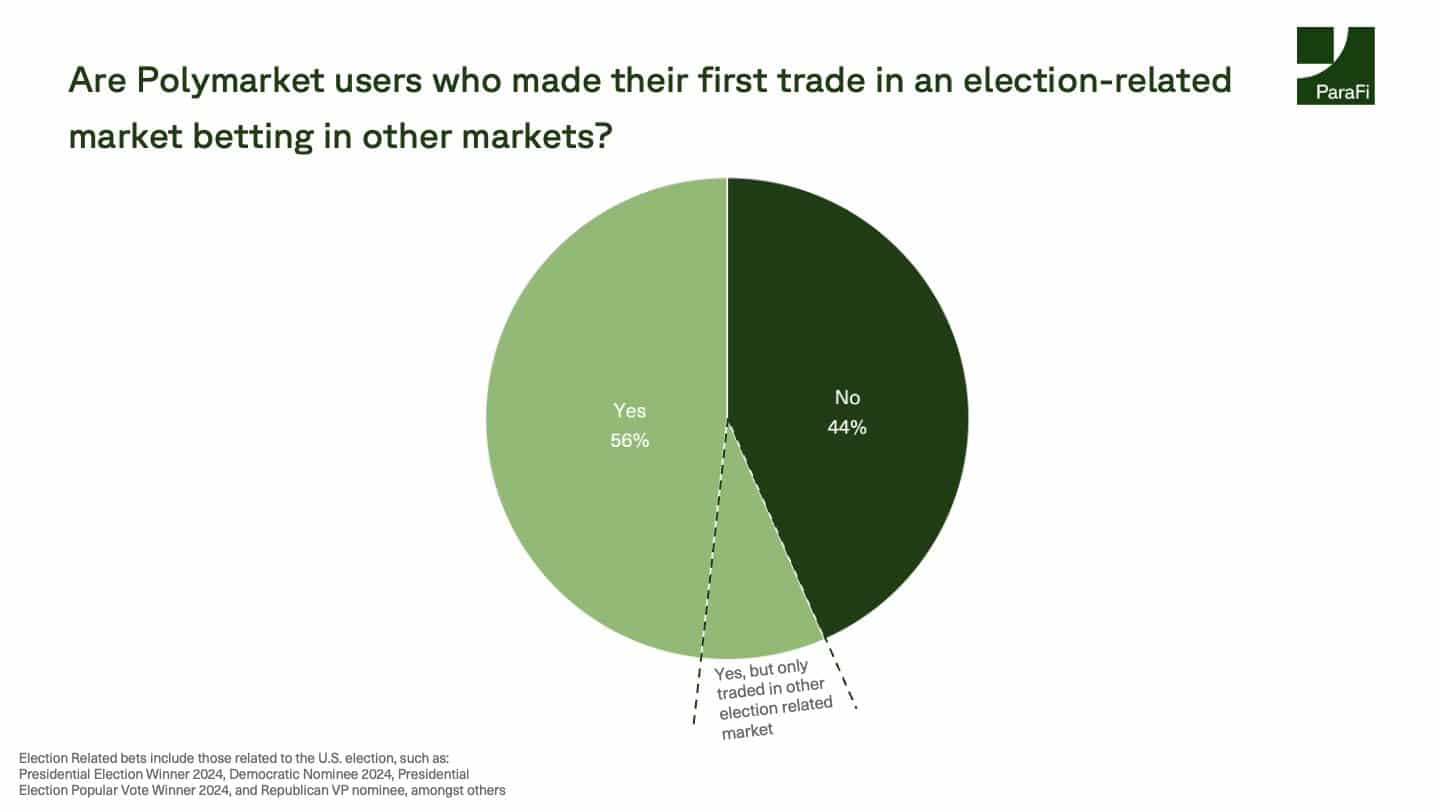

As a crypto investor, I’ve noticed that out of the nearly 70,000 total Polymarket users, only about 42% of us dipped our toes into trading for the first time in election-related markets. The remaining 58%, roughly 40,000 users, initially chose to trade in various non-election markets such as culture, business, science, and macro topics.

Also,

In my research, I discovered that out of more than 28,000 individuals who initially placed a wager in an election-related market, approximately 56% of them proceeded to engage in trading activities within a distinct market.

Over the past few months, trading volumes related to election events and other real-life happenings, such as the SEC’s decision on the Spot Ethereum ETF, have significantly increased. For instance, the approval process for this ETF triggered a surge of $13 million in total trading volume.

In this context, additional markets involve wagers on various topics such as the number of medals won during the Olympics, statistics regarding Taylor Swift’s engagement, and speculations about the potential release date of GPT-5.

In simpler terms, although the popularity of Polymarket has increased significantly during this election period, it’s important to note that these political events haven’t solely determined the platform’s trading volumes in recent months.

It’s noteworthy that due to the recent achievements of this platform, its leaders are examining various approaches, with a focus on monetization strategies. One approach they’re currently investigating involves introducing charges on the platform.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-08-03 01:01