- PolySwarm had a strong short-term bullish momentum and saw high demand.

- A pullback to the range highs would be an ideal buying opportunity.

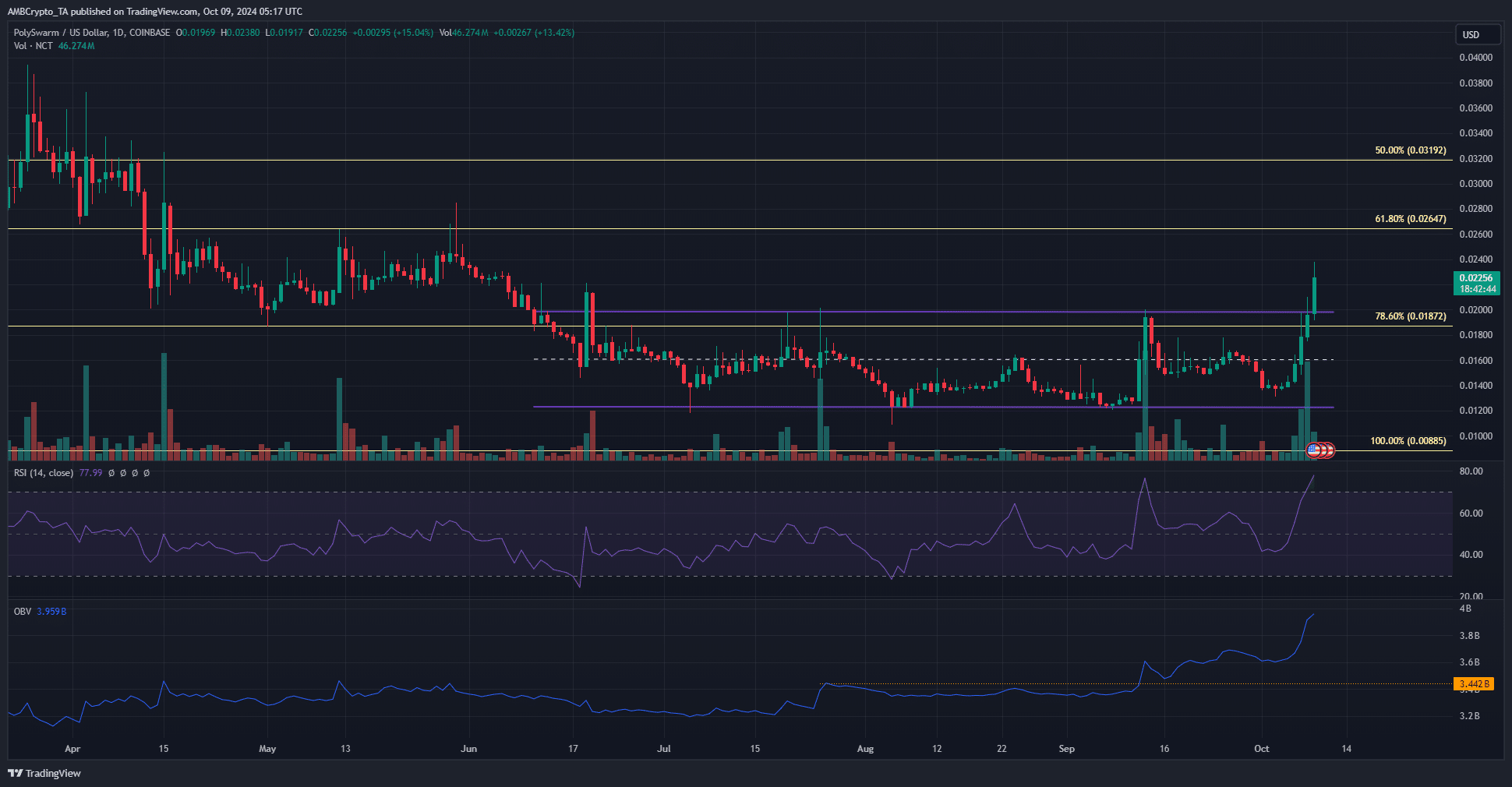

As a seasoned analyst with years of market observation under my belt, I find myself intrigued by the recent surge of PolySwarm [NCT]. The breakout beyond the four-month range highs is a bullish sign that’s hard to ignore, especially given the robust volume we’re seeing.

At the moment of this writing, PolySwarm’s price (NCT) surpassed its four-month high levels. Although the day’s trade has not yet concluded, the substantial trading volume suggests that this upward trend might be hard to reverse.

After examining the on-chain behavior and market trends, AMBCrypto has identified potential upcoming bullish goals. At this point in time, it appears that the prolonged period of consolidation may be drawing to a close.

Should buyers wait for a retest?

Typically, following a range breakout, there’s often a return to test the previous highs as potential support. If there’s a favorable response following this test several days post-breakout, it can be seen as a robust indication that a bullish trend might persist.

As a researcher, I would emphasize the following points that could be valuable to potential investors in NCT: The breakout, if it occurs, may persist, potentially leaving patient investors on the sidelines.

The token has rallied 68% in five days, and the RSI reading of 77 showed overbought conditions.

If there’s no assurance of a price drop, investors might consider purchasing when the price hits $0.02 or even $0.024, provided that the former isn’t reached beforehand without NCT initially reaching $0.02.

As a crypto investor, I’m keeping a close eye on Fibonacci levels as potential resistance points during our upward journey. Breaking through these levels not only boosts my optimism but also seems to draw in more investors, fueling the rally even further.

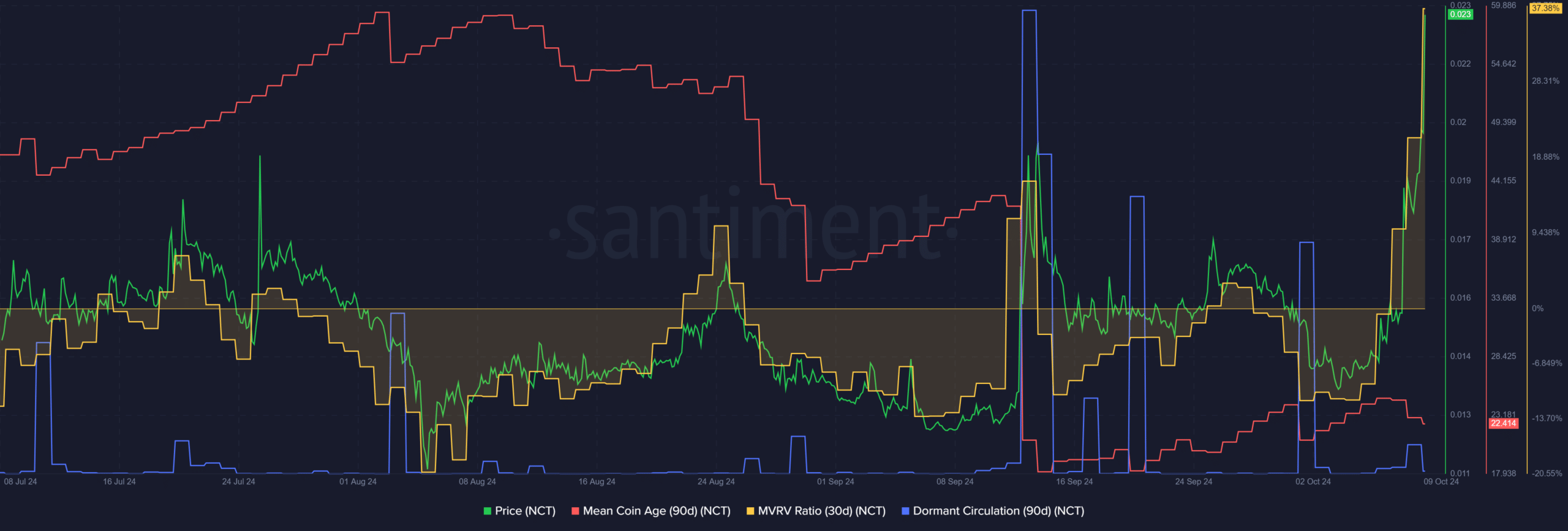

Dormant tokens show selling isn’t yet prevalent

In simpler terms, the average short-term holder has made about a 40% profit over the past 30 days, as indicated by the MVRV ratio. However, the number of coins not in active circulation (dormant circulation) hasn’t shown much activity recently.

This showed that a wave of profit-taking has not commenced.

It seems that the event could happen quite soon, given the pattern of MVRVs tending to decrease back towards zero. Additionally, the average age of coins has been on a decline since August, suggesting a period of distribution before the price breakout.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-09 16:07