- Popcat has surged by 41.8% in 30 days.

- The memecoin seemed to be losing momentum, with bears attempting to gain control.

After closely monitoring the cryptocurrency market for over a decade now, I must admit that the recent surge of Popcat [POPCAT] has been quite intriguing. However, my analysis suggests that it might be time to buckle up as we seem to be witnessing a potential shift in momentum.

In the last month, memecoins have seen substantial growth. Notably, Popcat [POPCAT] has consistently been among the coins with the highest increases during this period.

Currently, when I’m typing this, Popcat is being traded at approximately $1.47. Over the last seven days, there has been a 10.60% rise in its value, and it has seen a significant surge of 41.80% on the monthly charts.

Over the last two days, there’s been a significant drop in the value of the memecoin. It started at $1.68 but has fallen to $1.47, representing a decrease of approximately 12.5%.

The significant disadvantage hints at a possible change in market attitude. Consequently, it’s worth pondering – could this be a shift in market opinion?

Is Popcat losing upward momentum?

According to AMBCrypto’s analysis, Popcat seemed to be losing its current momentum.

Notably, the memecoin’s Directional Movement Index (DMI), the downtrend trend was gaining strength.

In reality, the value of -DI (which is a selling pressure indicator) at 35.4 exceeded the buying pressure indicator +DI at 23. This suggests that sellers were gaining control, leading to prices either falling or halting their upward movement.

When the DMI is set like this, it signals that the market is either in a downtrend or entering one.

Moreover, it’s worth noting that Popcat’s Relative Strength Index has dropped from 65 to 57 recently. Meanwhile, its Moving Average stands at 59. This suggests that the current momentum could be losing strength, potentially indicating an upcoming reversal.

Another market indicator to consider is the Advance decline Ratio (ADR). This metric has remained below 1 for the past two days to settle at 0.71.

If the Average Directional Movement Rate (ADR) drops below 1, this often means that there have been more price declines compared to rises in the recent past. Such a scenario typically suggests growing pessimism, implying that bears might be gaining an upper hand.

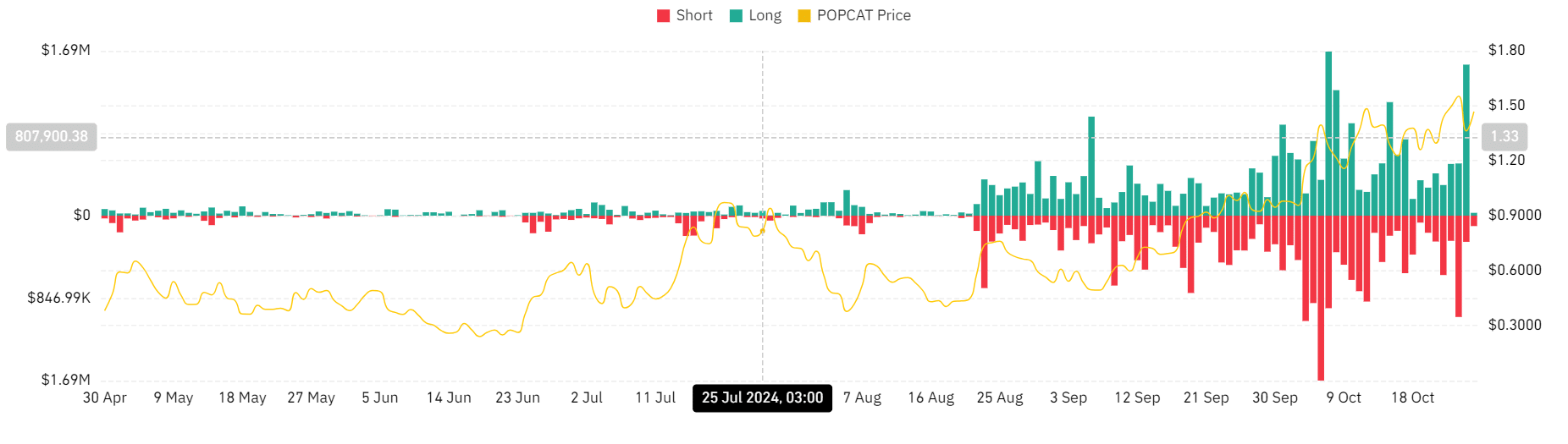

The change in market feelings is also supported by the fact that there has been a significant increase in total closures or “liquidations.” In the last seven days, these liquidations for long positions have risen dramatically, reaching an impressive peak of $1.55 million within the past 24 hours.

An increase in liquidations, whether for short or long positions, not just suggests market volatility, but it also underscores a decrease in investor confidence within the market.

Read Popcat’s [POPCAT] Price Prediction 2024–2025

As a crypto investor, when I see that others are reluctant to pay higher fees to maintain their positions, it seems they might not be fully convinced about the long-term potential of their investments.

If bears take over the market, the price of Popcat may drop down to $1.2. Conversely, if the bulls reclaim control, the memecoin could shatter its $1.5 resistance level, potentially reaching a new all-time high (ATH).

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-27 02:15