- Popcat’s $1 breakthrough sparks speculation of a 26% surge, with key resistance at $1.05.

- Bullish signals suggest Popcat could push to $1.3350, but mixed volume data keeps traders cautious.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by Popcat’s [POPCAT] recent performance and subsequent price projections. The coin’s surge past the $1 mark is a testament to its growing appeal in the digital asset space, and the formation of an inverse head-and-shoulders pattern suggests that we might be witnessing a bullish reversal.

Popcat [POPCAT] has surged past the critical $1 mark, with its market cap now surpassing $1 billion. POPCAT is attracting attention due to increased trading activity, which reached a 24-hour volume of $153 million.

Although experiencing some ups and downs lately, Popcat demonstrates its ability to bounce back, with a minimal decrease of 1.02% in value during the past 24 hours, according to Coingecko.

In simpler terms, traders are keeping an eye on Popcat’s market trend as it appears to be gearing up for more growth. The present market situation indicates that the coin might soon burst through its resistance zone ranging from $0.90 to $1. This technical setup could hint at additional price increases.

Inverse head and shoulders pattern indicates bullish reversal

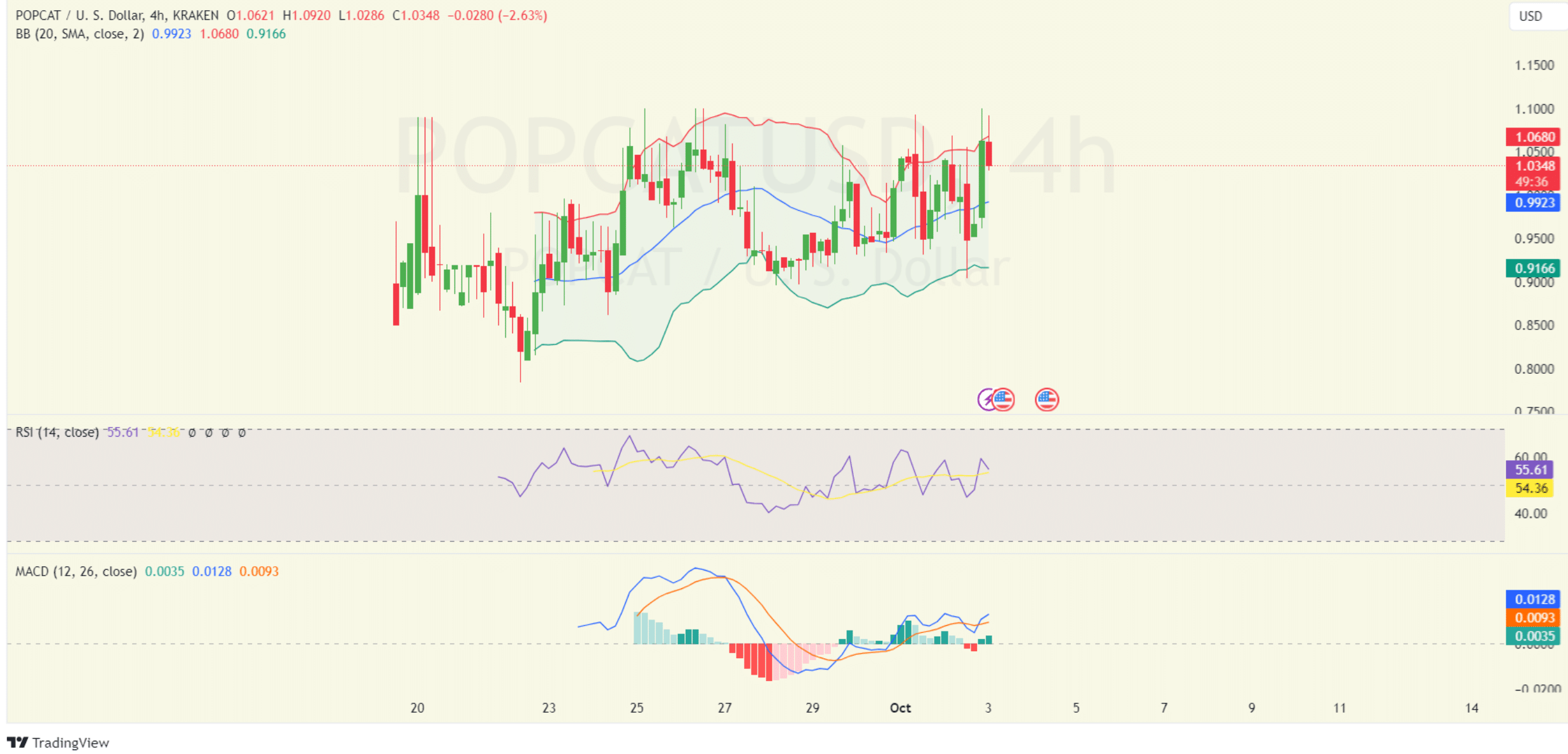

The POPCATUSD chart displays a clear inverse head-and-shoulders pattern, a bullish technical indicator suggesting a potential reversal. The neckline, which is positioned around $1.05, has become a critical resistance point.

Should the price successfully exceed its current point, it might spark a significant upward trend, potentially propelling it towards the subsequent goal of $1.3350. This upward push could equate to approximately a 26% price increase.

If the price doesn’t manage to breach the neckline, a significant support can be found near $0.90 – this is the location where the right shoulder of the chart pattern was formed. This level serves as a protective barrier for traders, enabling them to evaluate the potential risk of a failed breakout.

If Popcat manages to exceed its current resistance level, investors are keeping a close watch on the $1.20 mark as a possible intermediate hurdle. Above this, there’s a possibility of further bullish movement, potentially reaching the $1.3350 goal.

POPCAT indicators suggest further upside potential

Currently, the Bollinger Bands suggest a moderate level of market turbulence, as the price approaches the upper limit at about $1.0680, which could indicate brief overvaluation in the near term.

A pullback toward the middle band at $0.9923 could occur if selling pressure increases.

In simpler terms, the Relative Strength Index (RSI) currently stands at 55.61, slightly above the 50 mark that signals neither a bullish nor bearish trend. This moderate position indicates a relatively optimistic outlook. The RSI hasn’t yet reached overbought territory, so there’s potential for further price increase if buying activity persists.

In simpler terms, when the Moving Average Convergence Divergence (MACD) chart displays a recent bullish intersection, it means that the MACD line has moved over the signal line. This could be an indication of possible increasing market strength or positive trend in the near future.

As a researcher observing the market trends, I’ve noticed the histogram is now displaying green bars, signaling an early surge in bullish sentiment. Yet, it remains crucial for traders to keep a close eye on whether this momentum sustains or weakens in the upcoming days.

Despite technical indicators suggesting possible profits, Coinglass data reveals a 9.75% drop in Popcat’s trading volume, reducing it to approximately $954 million. On the flip side, open interest has grown by 3.94%, reaching an impressive $143 million.

The conflicting signs suggest that traders are still wary, yet they’re receptive to possible price increases as the currency gets near significant resistance points.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-03 22:15