- POPCAT declined by 16.4% in the last 24 hours.

- With sellers dominating the market, downward pressure has persisted, risking a dip to a 2-month low.

As an experienced analyst with years of market observation under my belt, I must say that the current state of Popcat [POPCAT] is reminiscent of a rollercoaster ride – albeit one without the thrilling highs and lows you’d hope for. The 16.4% decline over the past 24 hours is a stark reminder of the market’s volatile nature, and if the trend continues, we might be in for a bumpy ride to a 2-month low.

In the last 24 hours, memecoins like Popcat [POPCAT], built on the Solana [SOL] platform, have also experienced a significant drop in value due to the overall decline in altcoins.

As such, Popcat has experienced a decline over the past three days.

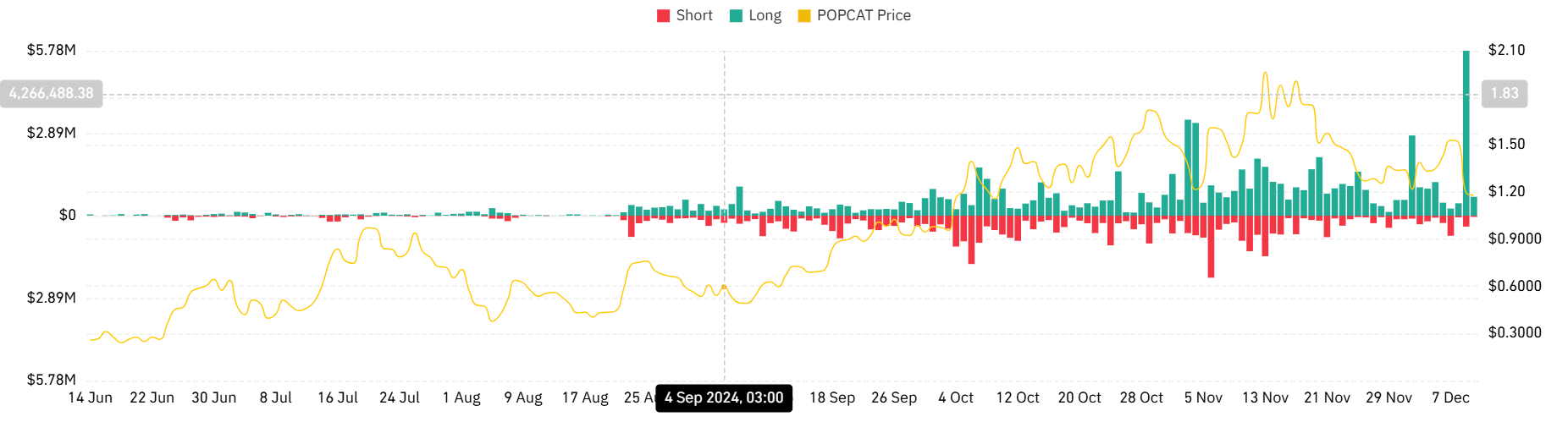

Following a peak at $1.6, Popcat has been under continuous selling pressure, reaching a low of $0.98.

Currently, as I’m typing this, Popcat is being exchanged for $1.17 following a 16.40% drop in daily trading. It’s also worth noting that the memecoin has experienced a 8.53% decrease on a weekly basis and a more substantial 18.62% drop over the past month.

Under significant pressure, the present market situation might lead to a continued fall for the memecoin.

Popcat sees sell pressure

At the present moment, as per AMBCrypto’s assessment, Popcat is undergoing significant downward trends due to heightened selling activity.

Over the last 24 hours, Popcat showed a downward trend on its Relative Strength Index (RSI), indicating a bearish crossover. This negative shift can be attributed to continuous selling activity among investors, who are trying to offload shares to limit their potential losses.

In a market where sellers hold significant control, it implies they may be uncertain or pessimistic about its future direction, potentially indicating a possible downward trend in prices.

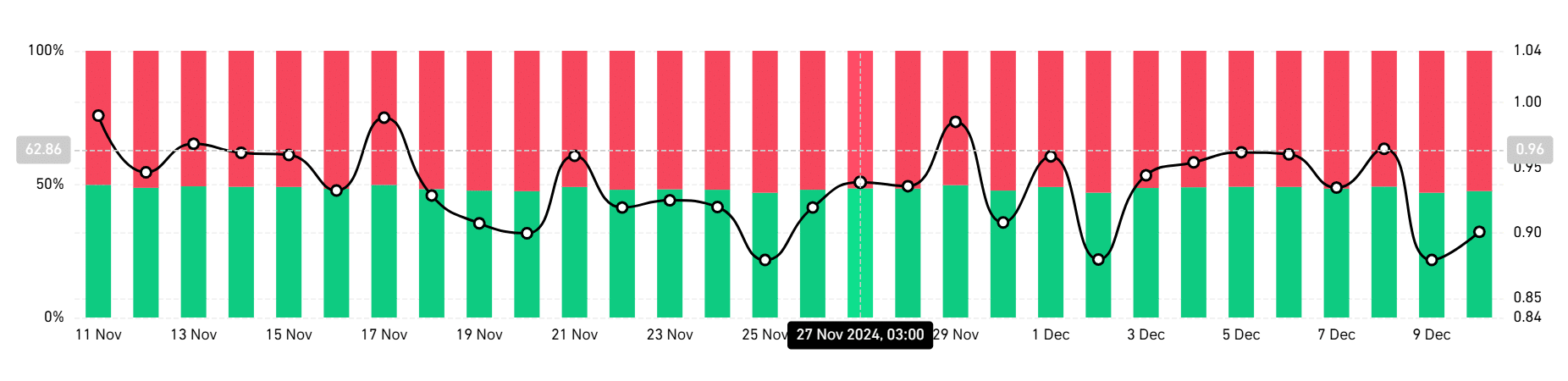

The occurrence is reinforced by the prevalence of investors adopting a short selling strategy, as indicated by the Long/Short Ratio showing that about half (52%) of all market positions are being held short.

This implies that most traders are bearish and expect prices to decline.

Over the last three days, there’s been a drop in Popcat’s total amount of outstanding derivative contracts (Open Interest) per exchange, decreasing from $119.9 million down to $74.5 million.

Such a decrease suggests that existing investors are exiting their positions to minimize additional losses, whereas potential newcomers are hesitant about entering the market.

Over the past day, a staggering $6 million was liquidated from long-position investors, causing many to exit their investments due to market pressure. As a result, a strong negative outlook on the market prevailed among the majority of investors.

Read Popcat’s [POPCAT] Price Prediction 2024–2025

Amidst increased selling pressure, Popcat could see more decline on its price charts.

If this belief is valid, Popcat could fall to its 2-month low of $0.90. Dropping below that point might lead to further decline to approximately $0.86. However, if there’s a change in trend, Popcat may recover and reach around $1.30 again.

Read More

2024-12-10 22:47