-

POPCAT’s price surged 8.83% alongside a 47.90% spike in trading volume.

Rising Open Interest and short liquidations suggested a potential for further price volatility and gains.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by the surge of POPCAT [POPCAT]. This cat-themed memecoin has defied expectations and reached a staggering $1 billion market cap, marking a significant milestone in the memecoin realm.

As an analyst, I’m thrilled to highlight that I’ve recently observed Popcat [POPCAT] making a significant splash in the crypto world. It’s fascinating to note that it has achieved the remarkable feat of becoming the first cat-themed memecoin to surpass a market capitalization of $1 billion.

The groundbreaking development has sparked interest among cryptocurrency fans, stirring debate over if POPCAT might spearhead the upcoming surge of popular meme coins. However, the question remains: Can it sustain its pace in a rapidly evolving market?

Right now, I’m seeing that my POPCAT tokens are trading at $1.01, marking an outstanding 8.83% jump in just the past 24 hours. This rapid rise undeniably shows the surging enthusiasm surrounding this token.

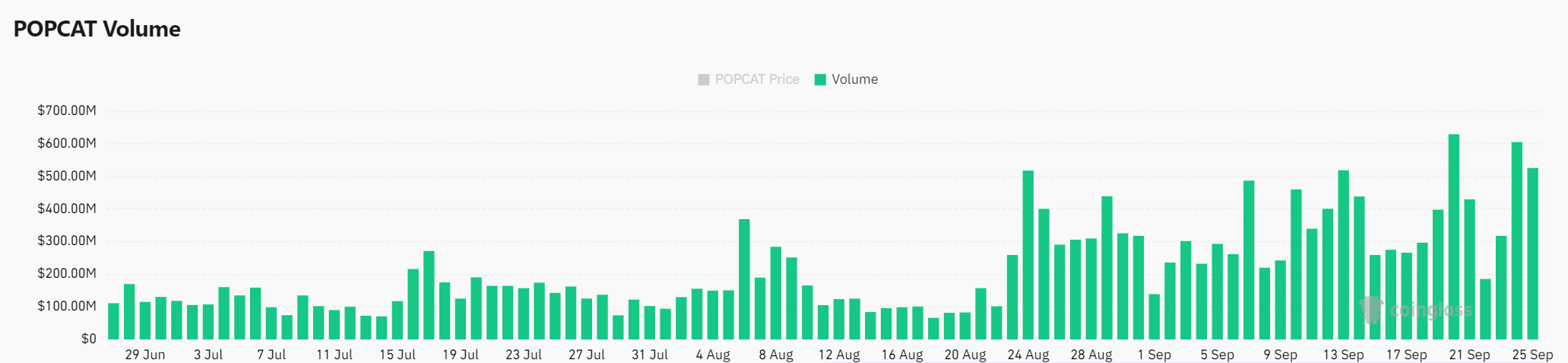

Moreover, data from the blockchain shows a significant surge in POPCAT‘s trading activity, with its volume jumping by an impressive 47.90% over the past day, amounting to approximately $667.89 million as we speak.

Based on my years of trading and market analysis, this significant surge suggests that many investors are scrambling to seize the opportunity presented by POPCAT‘s rising tide. I’ve learned over time that such rapid growth often signals a strong momentum, one that can be quite profitable if acted upon promptly. It’s moments like these that make me appreciate the dynamic nature of the market and the lessons it teaches us about seizing opportunities when they present themselves.

Consequently, a surge in trading might indicate an influx of new investors, possibly pushing the prices further upward.

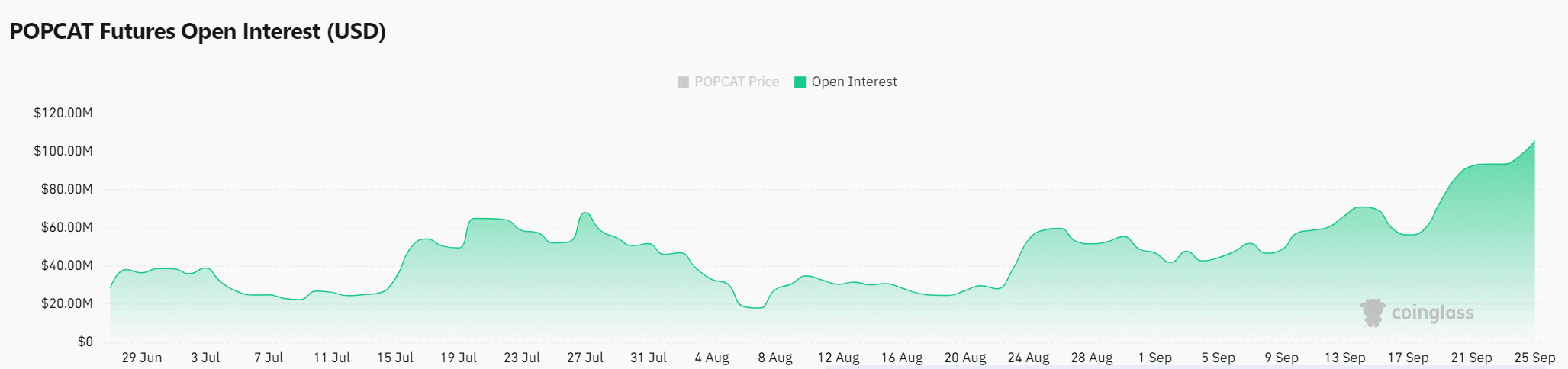

Open Interest climbs

Additionally, Open Interest for POPCAT increased by 11.05% over the past day, amounting to $105.65 million at the time of publication. This growth indicates an uptick in open contracts, as more traders are entering into both long and short positions.

The increase in Open Interest usually signals upcoming major price fluctuations, implying that the asset POPCAT might experience more market turbulence as investors prepare for potential profits.

As a result, the increasing Open Interest might ignite another price surge, further boosting the token’s remarkable upward trend.

What risks are traders facing?

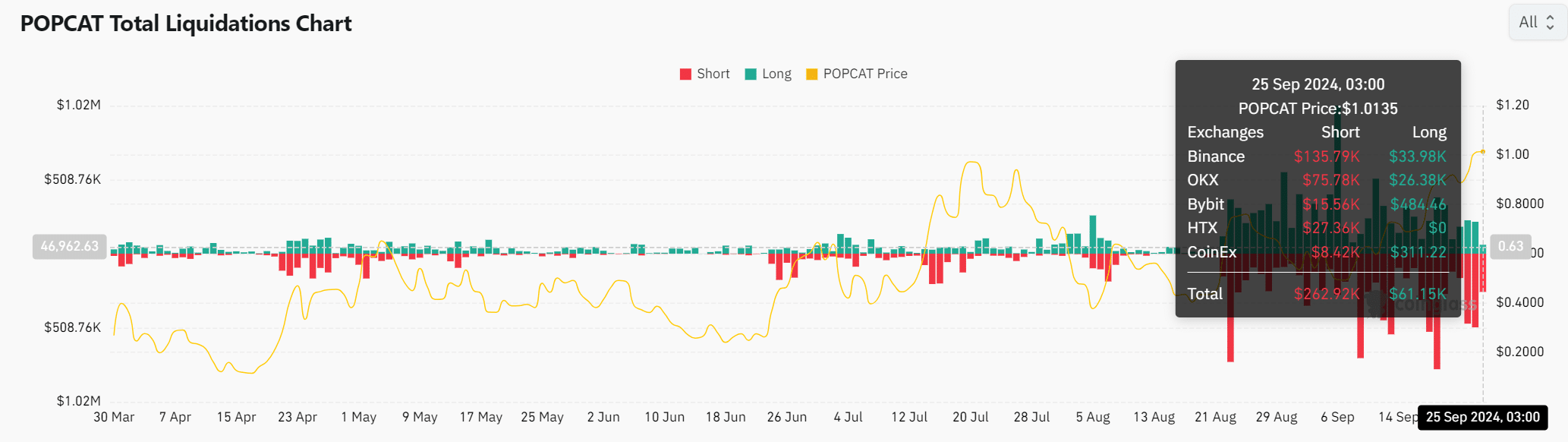

Moreover, it’s worth noting that on September 25th, POPCAT recorded liquidations totaling approximately $262,920. A significant portion of these liquidations were from short positions on platforms such as Binance and OKX.

This suggests that short sellers were caught off guard by the token’s price surge.

As more shorts get liquidated, this can create a cascading effect, driving the price higher.

As a researcher, I would advise caution when dealing with large liquidation volumes. These volumes can potentially amplify market volatility, increasing the chance of sudden, significant price adjustments – a risk that traders should be mindful of.

Is POPCAT primed for a memecoin rally?

Based on its impressive milestones like reaching a $1 billion market capitalization and experiencing a significant daily price increase, as well as an uptick in trading volume and Open Interest, it seems clear that POPCAT‘s momentum is rapidly growing.

Therefore, POPCAT will likely continue to rise, potentially igniting a broader memecoin rally.

However, while the signs are overwhelmingly positive, traders should consider the inherent risks, as liquidation-driven volatility could present sudden challenges.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-26 00:39