- Popcat has had a bullish structure over the past month.

- The strong momentum and buying pressure gave bulls a good chance to move to $1 soon.

As a seasoned analyst with years of experience in the cryptocurrency market, I must say that the recent surge in Popcat [POPCAT] is quite intriguing. The 34.15% move within the last 24 hours, coupled with the significant increase in volume, suggests a strong bullish sentiment among traders.

Popcat [POPCAT] posted a 34.15% move higher within the past 24 hours of trading, and the volume also climbed appreciably. This came alongside a Bitcoin [BTC] price bounce past the $60k resistance level.

As a researcher studying the memecoin market, I’ve observed that the psychological $1 resistance level proved to be a significant hurdle for its growth in the past. This barrier forced the bullish momentum back in July. Now, considering the current market conditions, I’m curious about how this resistance will impact the ongoing price movements.

Popcat targets based on extension levels

In simple terms, when we examined the Fibonacci levels drawn from the fall in the POPCAT price in late August, it turned out that the 78.6% rebound level was surpassed during the subsequent price spike.

The market structure has been bullish since the final week of August.

Over the last ten days, I’ve noticed a surge in bullish sentiment reflected in the Relative Strength Index (RSI) on my 12-hour chart. Additionally, the On-Balance Volume (OBV) has been steadily climbing, indicating an increase in buying pressure. This combination suggests to me that the market is trending upward, with more buyers entering the crypto space than sellers.

This indicated that the rally was robust and probably wouldn’t stop soon. Next, we could expect challenges at the $1 and $1.18 resistance points, previous peak levels, and the extended Fibonacci levels.

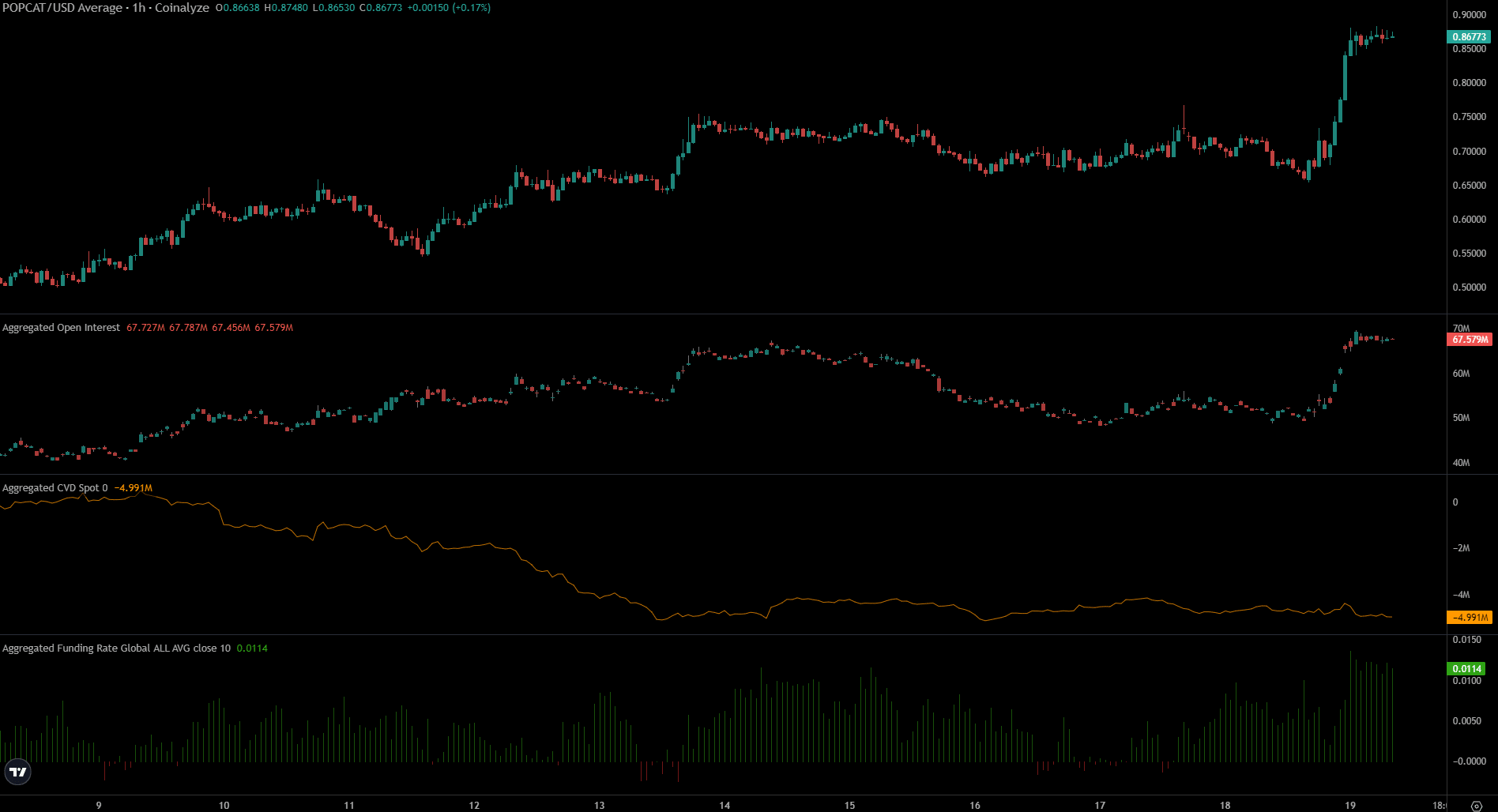

Spot CVD goes against the OBV findings

Lately, a surge amounting to about 23% caused the Open Interest to escalate from $49.2 million to $69 million, indicating robust involvement of bullish traders in the Futures market.

Speculators were eager to go long, hoping to earn some profits from the POPCAT move.

Over the last few days, a substantial Funding Rate seemed to convey the same message. However, the Current Value of Deliverable (CVD) has remained stable for an entire week, which implies that purchases and sales in the spot market have been equally balanced. This equilibrium contradicts the Open Interest (OBV).

However, overall, the buyers have an advantage in the short term.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-09-20 00:07