-

WIF and POPCAT have both reached significant milestones while defending crucial support lines.

However, only one can lead in the next cycle. Which memecoin will it be?

As a seasoned crypto investor with a knack for deciphering market trends, I find myself intrigued by the dance between WIF and POPCAT. Having navigated through multiple bull runs and bear markets, I’ve learned to appreciate the resilience and adaptability of the memecoins.

In the last 24 hours, the digital currency Dogecoin, which previously held a value of $2 as support, unexpectedly increased by 4%, bucking the market turbulence caused by Bitcoin remaining below $64,000 and its subsequent consolidation.

As I delve into my analysis, it appears that POPCAT momentarily touched a staggering $1 billion market capitalization, but subsequently dipped slightly to $968 million. Interestingly, despite this dip, bulls have been unable to maintain the $1 level as a defensive strategy. However, WIF continues to lead, and AMBCrypto suggests that POPCAT is gradually gaining ground on it.

Looking towards October as a potential period for Bitcoin’s price surge, also known as “Uptober,” which memecoin based on Solana could take the helm in the upcoming market cycle?

A razor-thin margin between the two

Following a challenging phase with no significant upward movement since late August, WIF experienced a recovery around mid-September, skyrocketing by 45% to reach $2.15 on the daily chart.

Conversely, just like Bitcoin during early September, the price of POPCAT surged dramatically, reaching $1.0194 at the moment of reporting, marking a significant increase of 102%.

Remarkably, POPCAT showed more strength during market drops, reaching a fresh all-time high of $1.0768 on the 25th of September.

Source : Coinalyze

Presently, POPCAT is at a vital level of resistance. If buyers can’t maintain this position, there might be a decline towards approximately $0.38. On the flip side, further growth could result in a new all-time high.

In a similar fashion, WIF has experienced significant expansion recently, as buyers have driven its value upward by approximately 20% over the last three days. This growth is clearly visible in the extended green bars on the daily price graph.

There is a catch

According to AMBCrypto, the recent surge in WIF is due to a tactical move by active traders on the spot market, who are buying aggressively in an attempt to force out a large number of short sellers.

Although this is a positive development, there’s a risk it might turn against them if these traders shift towards the distribution stage, a scenario that seems more probable now.

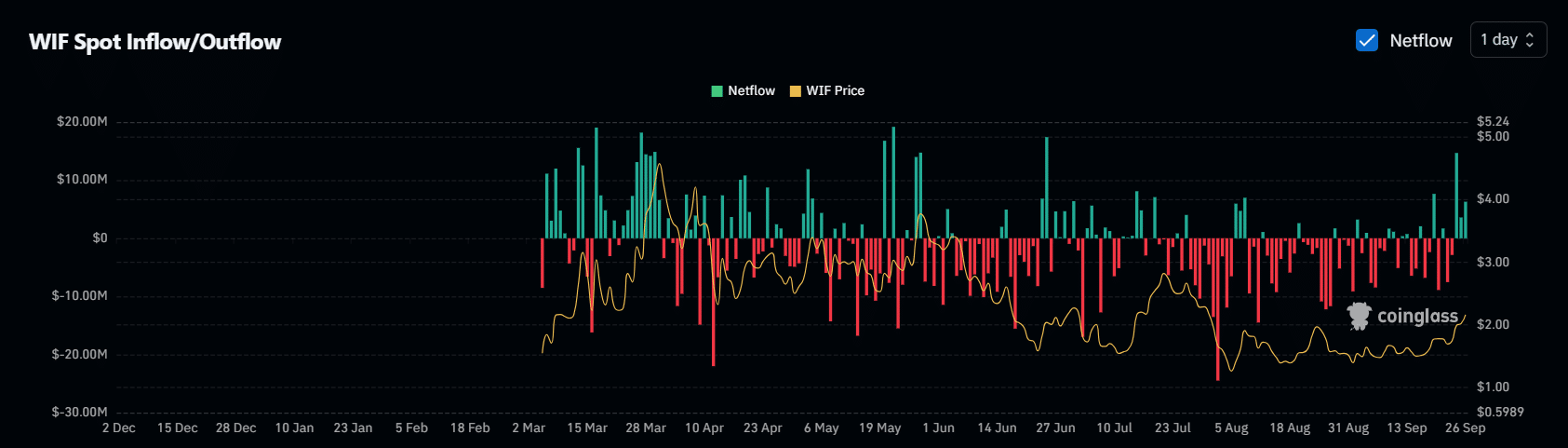

Source : Coinglass

After hitting its lowest point at $1.26 in early August, there has been a significant increase in withdrawals from WIF exchanges, totaling approximately $30 million, presenting a good chance to buy low (buy-the-dip). Now trading at $2.16, many of these initial withdrawals have resulted in profits, suggesting that WIF might be nearing exhaustion. This is hinted by a fresh rise in net inflows, which have climbed to a three-month peak of $15 million. If this trend continues, it could signal a possible reversal for WIF, potentially redirecting liquidity towards POPCAT.

A crucial road ahead for POPCAT

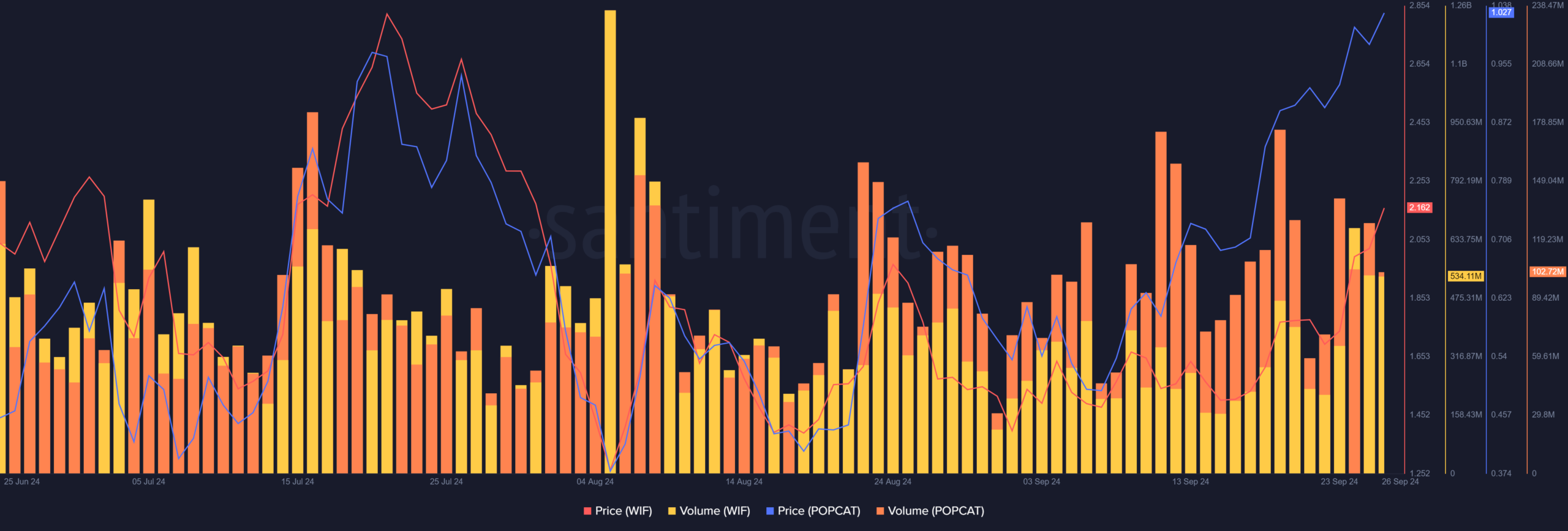

Initially, the price of POPCAT generally followed the trend of WIF‘s price, but during the early September surge, POPCAT saw a notable increase, suggesting an escalating fascination with this memecoin.

Source : Santiment

Furthermore, it’s worth noting that Worldwide Investment Fund’s (WIF) trading volume has reduced by half since its peak in August at $1 billion. Interestingly, upon closer inspection, Popcat’s trading volume saw an uptick from $104 million to $127 million the very next day.

As an analyst, I’m pointing out that POPCAT has set its sights on the leadership position held by WIF. Given the current circumstances, it appears that WIF might struggle (falter). In such a scenario, POPCAT could potentially seize this opportunity for a takeover, strengthening its own position in the market.

As an analyst, I would feel more assured about my bullish perspective if I observe that the market holds its ground at the $1 support level, and I keep a keen eye on the trades executed by WIF during this period.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- ANKR PREDICTION. ANKR cryptocurrency

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- The Boys season 4: Release date, cast, trailer and latest news

- Pauly Shore Honors “One of a Kind” Richard Simmons After His Death

2024-09-26 16:08