- Popcat has hit a new ATH.

- The price could decline if some key metrics do not pick up.

As a seasoned financial analyst with extensive experience in the cryptocurrency market, I have witnessed numerous price surges and subsequent corrections throughout my career. The recent rise of Popcat, a Solana-based memecoin, has piqued my interest due to its meteoric price increase and the accompanying social media buzz.

Recently, there has been a significant increase in the limelight surrounding Popcat in the cryptocurrency sphere. The main catalyst for this development seems to be the intriguing price fluctuations of Popcat. Nevertheless, a closer examination of its trading volume indicates that this newfound buzz might be fleeting.

Popcat’s social metrics spikes

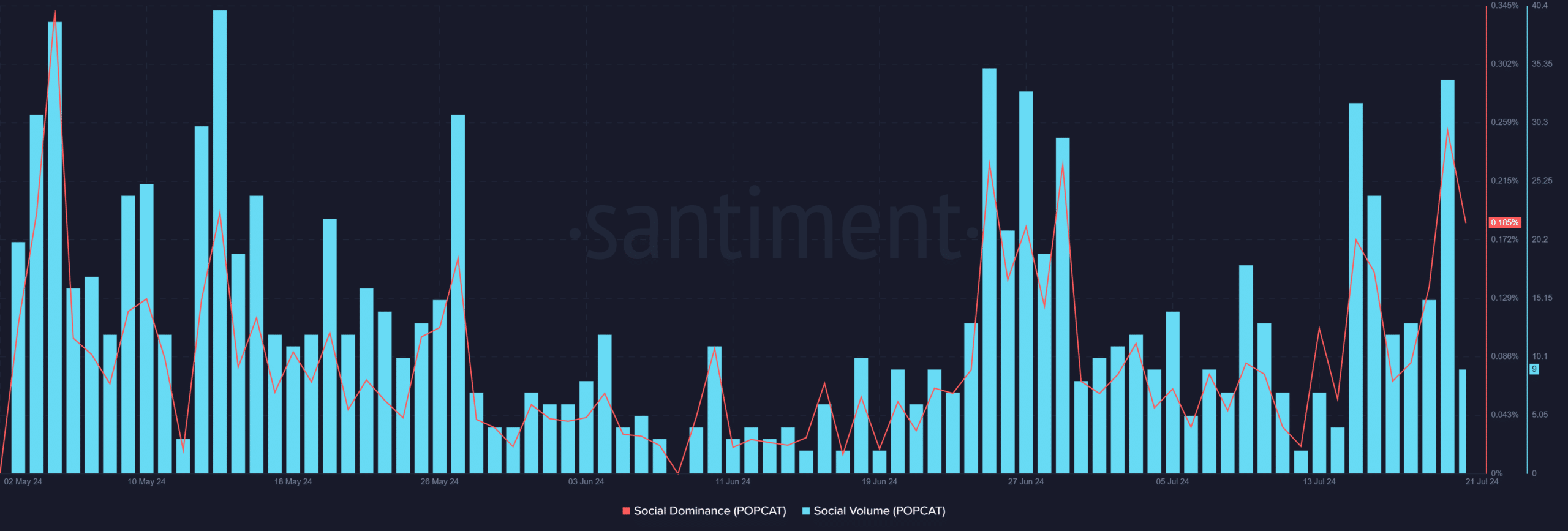

Based on Santiment’s latest report, there was significant interest among traders towards Popcat due to its more than 100% price jump. Concurrently, social media buzz surrounding the asset noticeably heightened.

On July 20th, the social dominance index, indicating the proportion of discourse held on different social media platforms, surpassed 0.25%.

The social dominance at this level was unprecedented since May, indicating a notable surge in both market and public engagement.

Furthermore, there was a significant surge in the number of times Popcat was mentioned on social media, reaching approximately 34 mentions on that particular day.

When social media chatter about a particular asset spikes, it frequently reflects heightened curiosity among traders and investors, leading to greater scrutiny and potential buying activity.

However, it’s important to note that both social volume and social dominance have since declined.

Popcat sees significant pumps

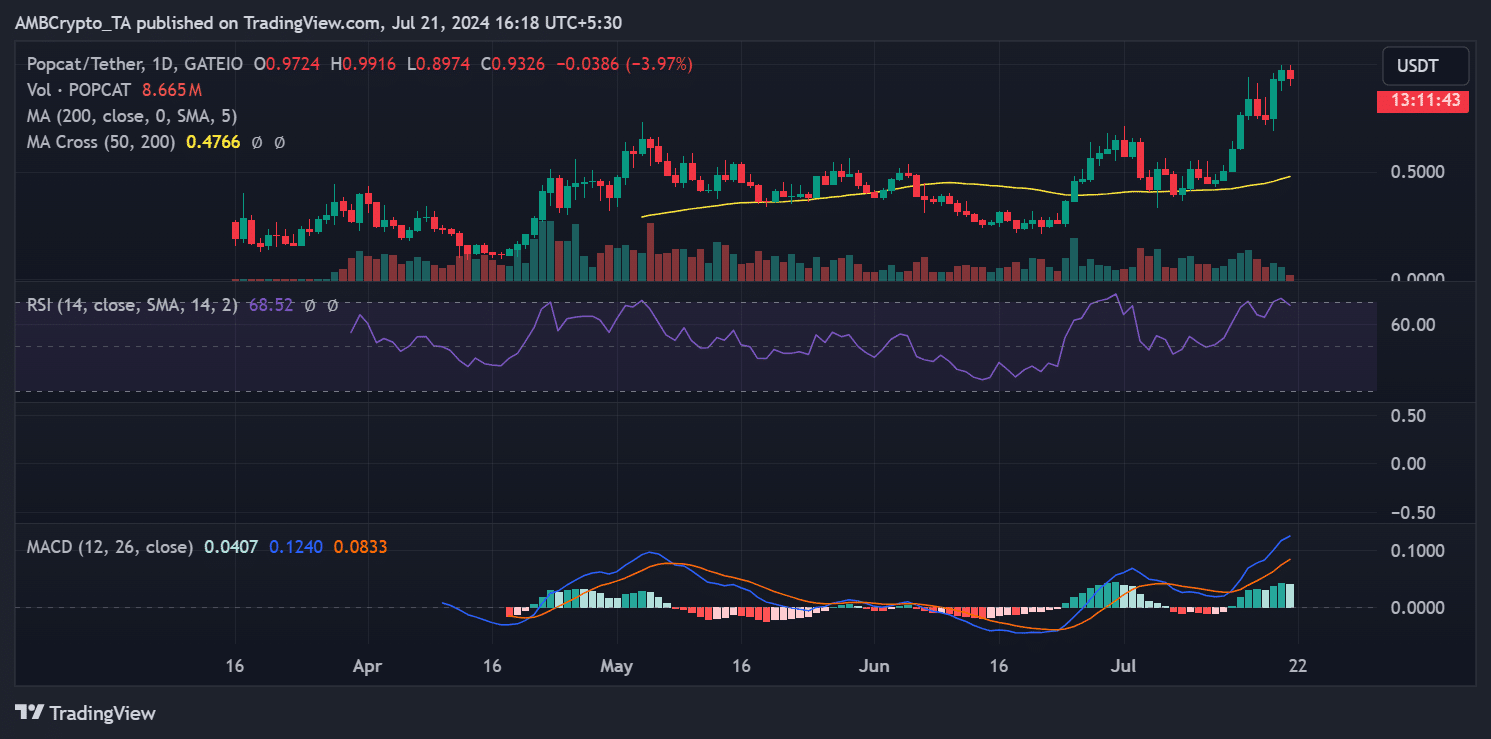

Over the past week, the value of Popcat, a memcoin on the Solana platform, has exhibited notable price fluctuations.

The price experienced a significant boost, starting at over 20% above the previous level and continuing to climb by an extra 25% the next day. This surge brought the price up from approximately $0.5 to over $0.6.

The trend continued throughout the week, reaching a summit of more than $0.9. This signified a weekly growth of over 4%, making it the record-breaking highest point for the memecoin.

Lately, there have been significant changes suggesting a transition. According to the most recent figures, Popcat has seen a drop of more than 4%. Despite this decrease, its value remains just above the $0.9 mark.

A small decrease in price might be explained by typical market adjustments after significant price increases.

An alternate expression for the given statement could be: The RSI value of Popcat, currently at approximately 70, indicates that it may be overbought based on this particular technical analysis.

Not enough volume to back up the trend

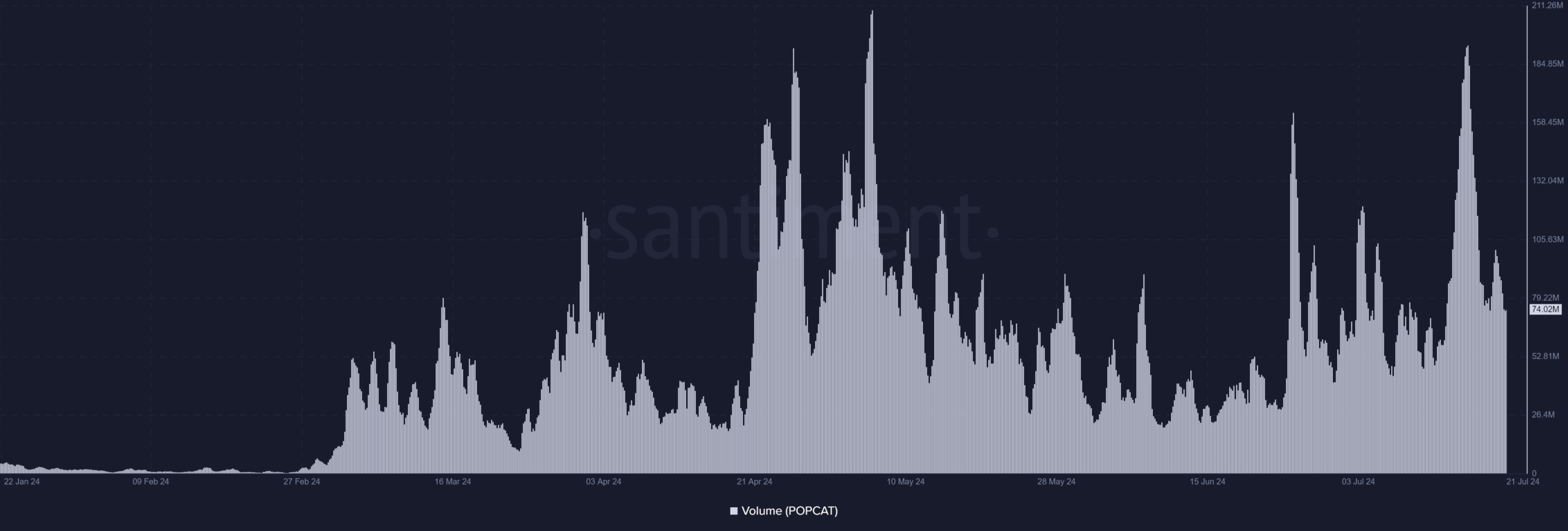

Examining Popcat’s trading activity on Santiment uncovers potential red flags regarding its current price movements.

As a crypto investor, I’ve noticed that the price of Popcat has hit a new record high, which is exciting news. However, upon closer inspection, I’ve seen that the trading volume hasn’t kept pace with this price growth. This discrepancy raises some concerns and suggests potential weaknesses in the current price rally.

Based on my extensive experience in financial markets and analysis, I’ve observed that volume trends can provide valuable insights into market behavior. On the 20th of July this year, as the trading session came to a close, I noted with interest that the recorded volume stood approximately at $98 million. This figure was significantly lower than the surge we had witnessed earlier in the week, when the volume had exceeded $193 million.

The trading activity has dropped significantly to around $74 million currently. This decrease in transaction volume, especially with prices reaching their pinnacle, might serve as a cautionary sign.

Normally, a price hike that is considered healthy is often accompanied by robust trading activity or rising transaction numbers. This indicates that there is significant buyer demand and market momentum.

If the cost rises yet the sales volume declines, this could be a sign that there isn’t sufficient buying demand to support the price hike, increasing the likelihood of a price correction or downturn.

In this situation, the cost of Popcat could potentially decrease more if the number of transactions fails to increase.

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-07-22 06:16