-

XMR surged by 4.39% in the last seven days.

The recovery from delisting and regulatory hurdles could push XMR towards $190.

As a researcher with experience in the cryptocurrency market, I have closely observed Monero (XMR) over the past few months and its recent recovery is quite intriguing. While XMR faced delistings from major exchange platforms due to regulatory challenges, it has managed to sustain a recovery in the last month.

Over the past half year, Monero (XMR) has experienced multiple delistings on different cryptocurrency trading platforms. In February, Binance (BNB) made public their intention to remove Monero from their exchange services.

On June 10th, Kraken notified users that they would stop supporting Monero trading in Ireland and Belgium, following similar actions taken in the United Kingdom.

The decision by Kraken and Binance to remove privacy coins like Monero (XMR) from their lists signifies the regulatory hurdles that cryptocurrencies must navigate.

As a crypto investor based in Europe, I’ve noticed the impact of the Anti-Money Laundering Regulation (AMLR) on privacy coins like Monero (XMR). With the implementation of AMLR, these coins have disappeared from various platforms. This delisting has significantly affected XMR’s market growth and price stability for me as an investor.

XMR recovers post delisting

In spite of the unfavorable conditions, XMR has managed to bounce back in the past month. Over the past 30 days, there has been a 12.20% increase in XMR’s value, with a further 4.39% growth observed over the last week.

In the last 24 hrs, XMR’s trading volume has surged by 7.61% to $52M.

As a researcher studying the cryptocurrency market, I’ve noticed a surge in optimism following recent recoveries. One particular crypto analyst, Sebastian, has caught my attention with his prediction for Monero (XMR). He expressed this belief publicly on X (formerly Twitter), stating that Monero is poised for a prolonged price increase, potentially reaching $190.

Monero (XMR) is demonstrating strong market potential, picking up steam around the 20-day moving average at $165. The coin could be headed towards $180 and potentially even $190, highlighting its robustness and significant role within the cryptocurrency landscape.

Crypto | ChartMonkey also shared his long-term projections, stating that,

Based on my analysis, Monero’s price cycle is predicted to reach a breakthrough leading to its all-time high by May 2025. This robust cryptocurrency holds great promise and the potential for outstanding gains. I strongly encourage you to do your own research.

What fundamentals tell us

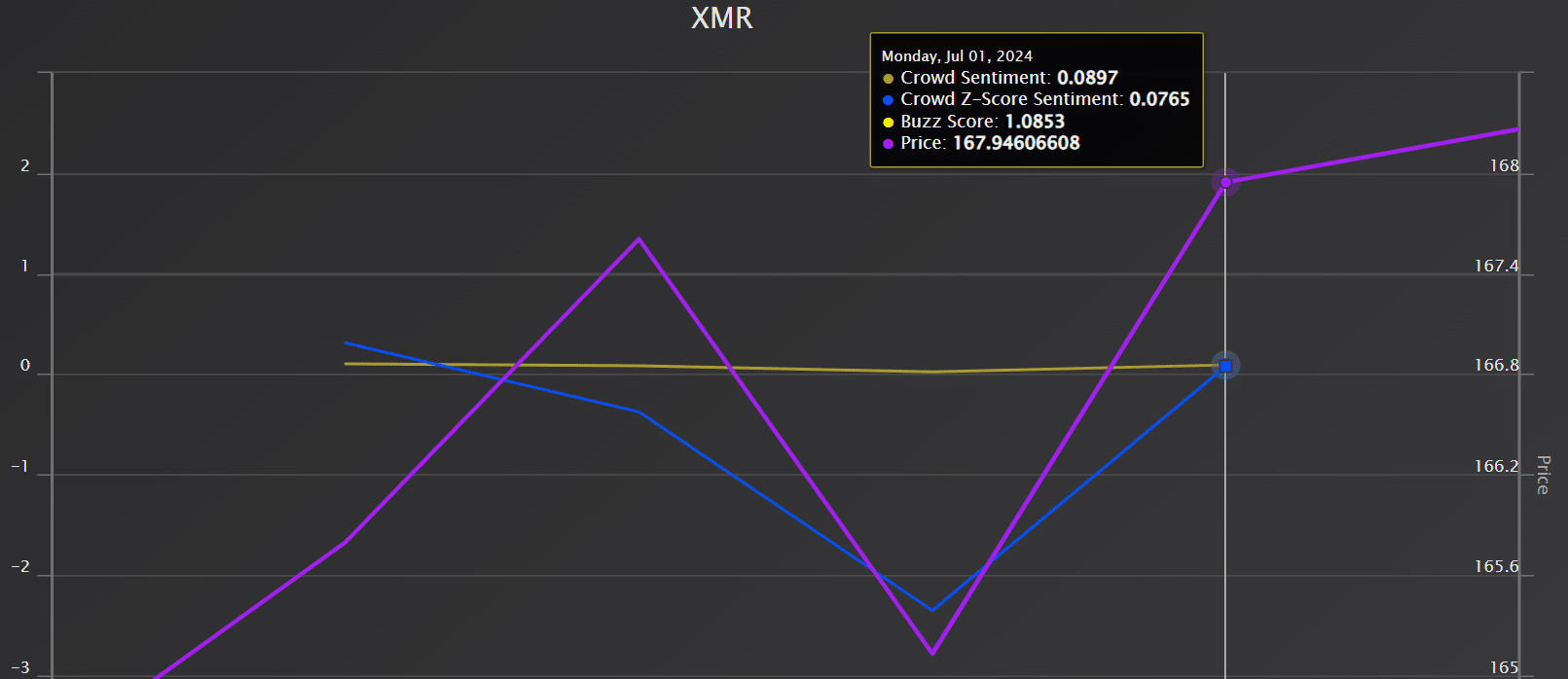

As a researcher analyzing the cryptocurrency market with AMBCypro’s tools, I found that the overall sentiment was optimistic based on Market Prophit’s reading of 0.089 and Buzz’s score of 1.0853 at the given moment.

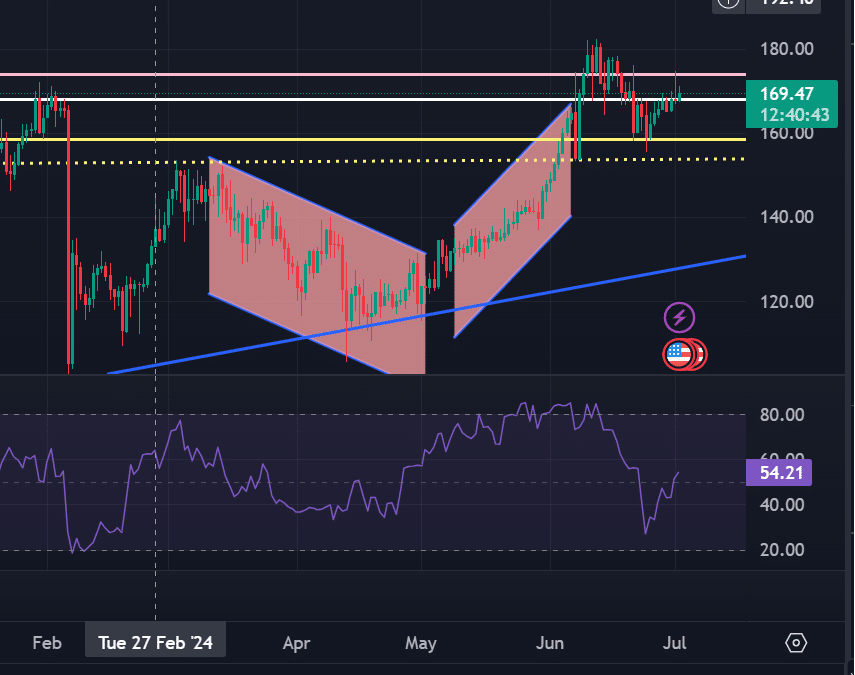

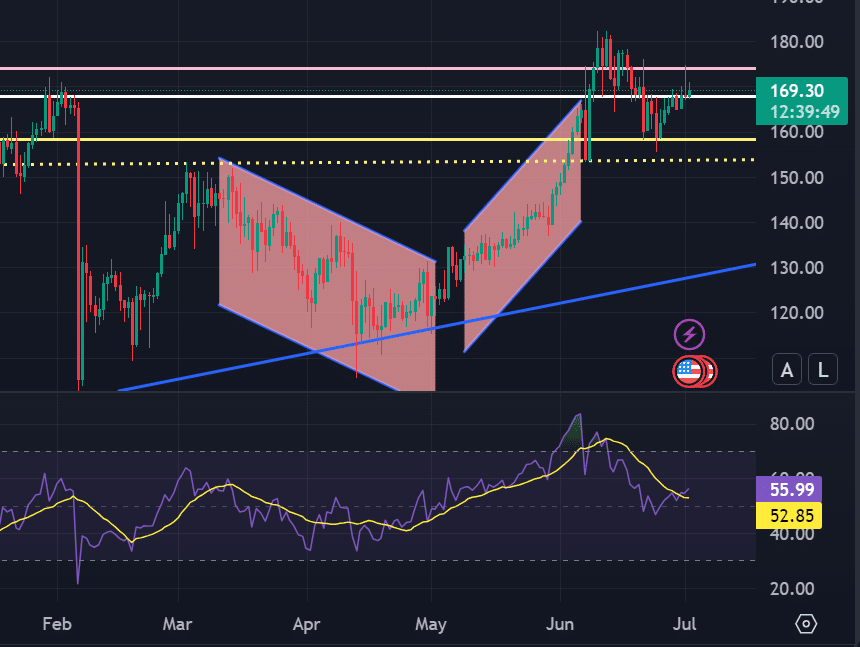

The Money Flow Index (MFI) has also risen from 26 to 54 in the last seven days.

As a crypto investor, I’ve noticed that the rising Money Flow Index (MFI) is a promising sign. This indicator suggests that there’s increasing buying pressure in the market, which in turn shifts the market sentiment towards a bullish outlook. Consequently, more money flows into the altcoin, potentially leading to further price gains.

As a researcher observing the financial markets, I’ve noticed an uptick in the Relative Strength Index (RSI) from 48 to 55 over the last seven days. This persistent rise in RSI suggests that recent gains have been more pronounced than losses, potentially signaling increasing bullish momentum.

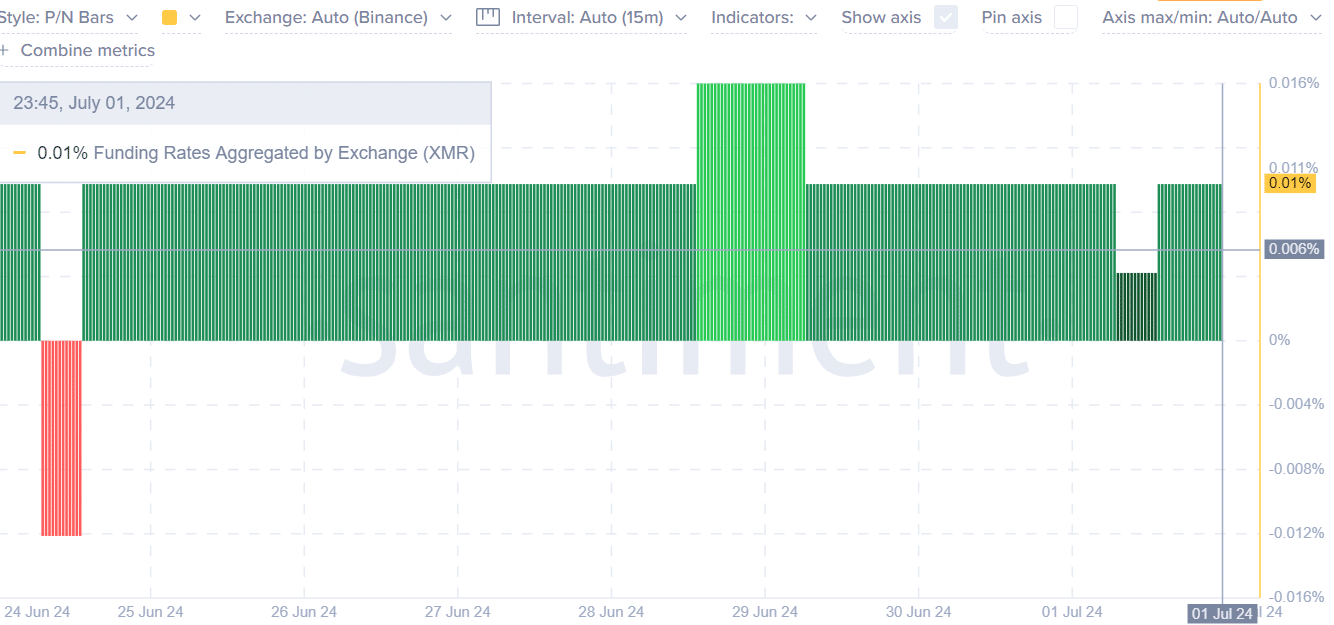

As a cryptocurrency analyst, I have observed that the sentiment surrounding Monero (XMR) has been generally positive over the past week based on the aggregate Funding Rates across various exchanges.

At the current moment, the average funding rate for XMR, as calculated across exchanges, stood at 0.01. This figure indicates that investors are ready to pay an additional fee to maintain long positions on the cryptocurrency market, thereby expressing faith in its potential price increase.

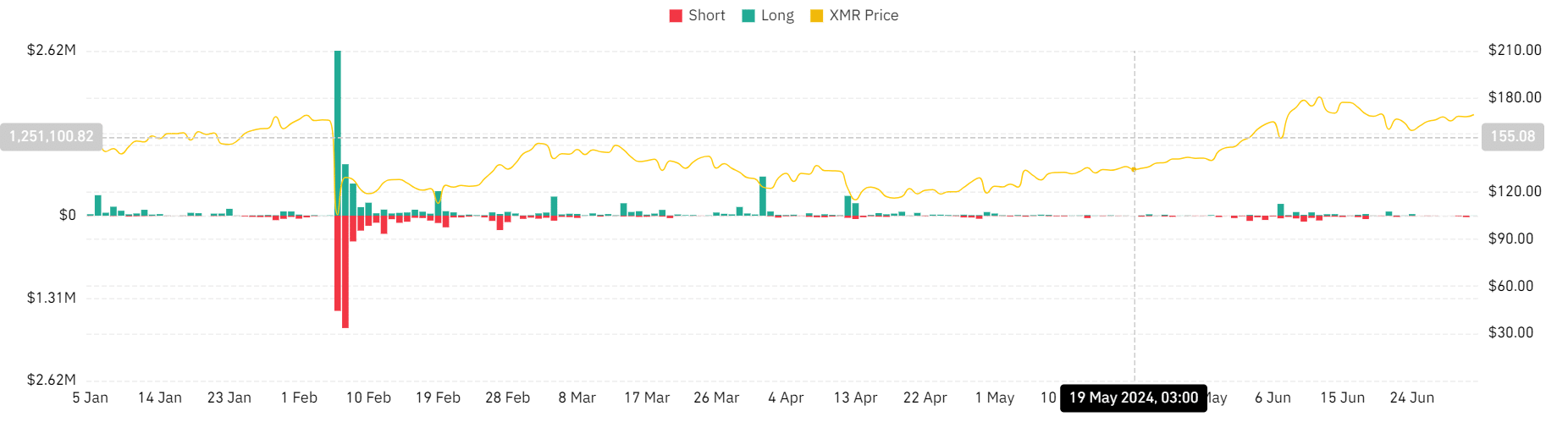

As a researcher studying market data from Coinglass, I’ve observed that XMR has shown minimal liquidation for both buyers holding long positions and sellers with short positions.

At the given moment, there were fewer instances of assets being sold off due to negative market conditions, indicating that long position investors remained committed. Meanwhile, the number of investors taking short positions was scant.

Read Monero’s [XMR] Price Prediction 2024-25

Can XMR sustain the recovery?

As a researcher observing the cryptocurrency market, I’ve noticed XMR trading at a price of $169.03 at this moment in time. This figure represents an uptick following the breach of the previous resistance level situated at $168. The breakout suggests further upward momentum towards the next substantial resistance area, which lies approximately around the $174 mark.

If XMR‘s price trend is optimistic, it may hit $179 in the near future. On the other hand, if the market experiences a downturn, XMR’s price could drop down to its crucial support level at $158.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-07-03 06:32