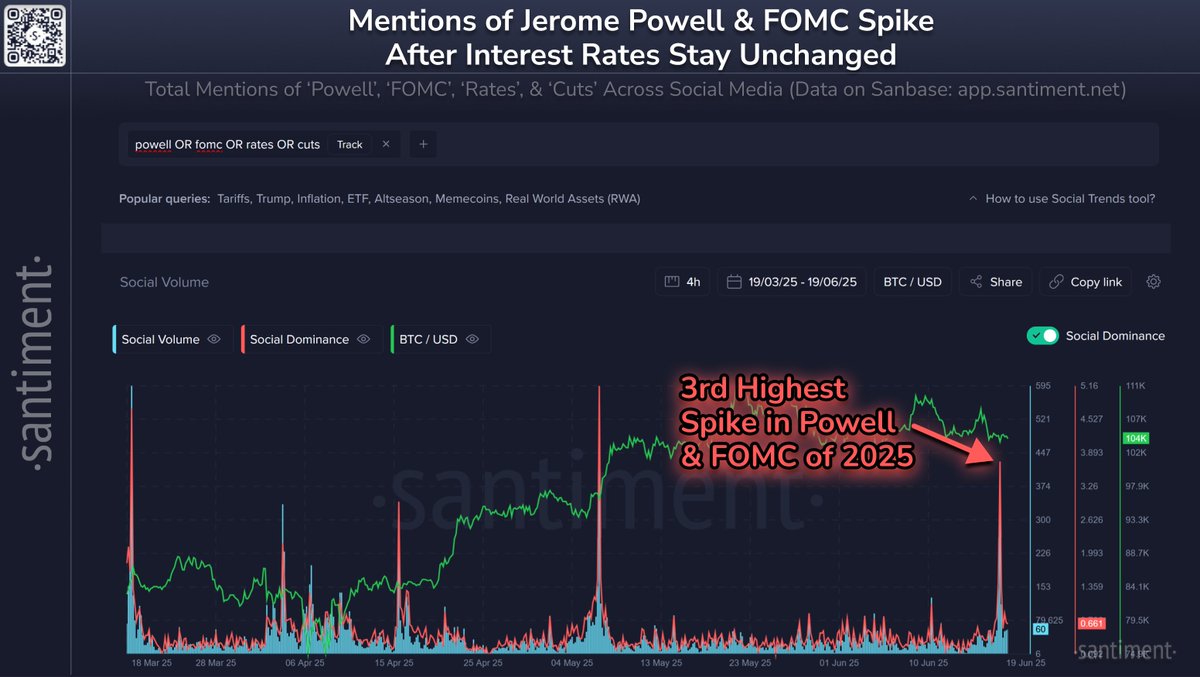

According to data from Santiment, mentions of Powell and the FOMC spiked to their third-highest level in 2025, underlining the heightened attention the issue has drawn among traders and analysts.

At present, Bitcoin trades 6.8% below its May 22 all-time high, while the S&P 500 sits 2.6% under its February 19 peak.

The market reaction suggests that investors are watching the standoff between the Trump administration and the Fed closely, anticipating whether political pressure might translate into accommodative monetary policy.

Trump is expected to maintain pressure on Powell to cut rates in order to stimulate market sentiment and economic growth. However, Powell may resist such political influence and continue advocating a more cautious, data-driven policy based on inflation metrics and broader economic indicators.

For crypto markets, especially Bitcoin, the debate holds key implications. Historically, rate cuts have served as bullish catalysts for digital assets and equities alike. While the Fed’s current stance has paused immediate upside momentum, a reversal could fuel a strong crypto rebound.

With social media already pricing in the possibility of upcoming cuts, the trajectory of crypto assets may soon hinge on whether Powell bends to political demands—or holds the line on monetary tightening.

💸💸💸 Will Powell bow to Trump’s pressure and unleash the crypto bulls? 🐂🐂🐂

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-06-20 14:36