- Jerome Powell spoke about rate cuts as short-term Fed liquidity weakened

- Bitcoin and the broader crypto market have been showing signs of bullish sentiment

As a seasoned researcher with over a decade of experience in financial markets, I have seen my fair share of market fluctuations. The recent statements by Jerome Powell and the subsequent signs of bullish sentiment in the crypto market have piqued my interest.

Jerome Powell’s recent statement has set the stage for significant shifts in the cryptocurrency market. Powell’s indication that “The time has come for policy to adjust” suggests that U.S rate cuts are on the horizon.

In light of this development and the robustness of global liquidity, I anticipate that the U.S Dollar (USD) could see a substantial weakening. With the USD on a potential downtrend, Bitcoin (BTC) and other digital currencies might be primed for impressive growth.

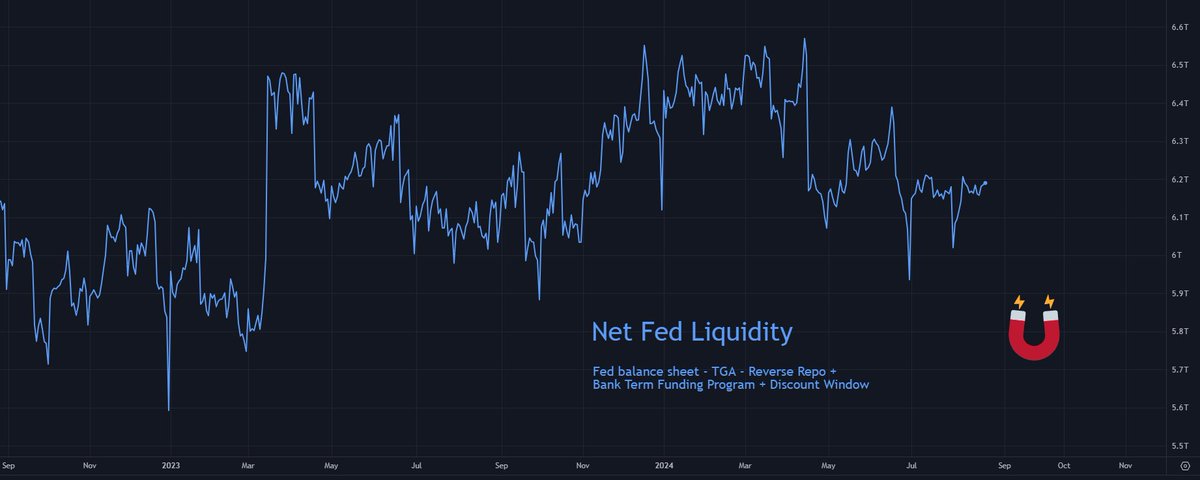

Looking ahead, the Federal Reserve’s near-term liquidity projection remains rather bleak, marking an extension of the downward trend that started in April and persisted over the mid-term period.

The trajectory indicates that the Federal Reserve’s liquidity might dip to a fresh record low by late September, possibly approaching its least abundant state since March 2023.

In times when liquidity decreases and interest rates seem likely to drop, holding Bitcoin in relation to the U.S. dollar becomes more and more beneficial, especially since Bitcoin is gearing up to end its seventh straight monthly period above its record high for 2021.

As Bitcoin’s price continues to stabilize at this elevated point, the foundation of support grows stronger. This stability could pave the way for a significant surge in September, coinciding with the Federal Reserve initiating their interest rate reductions.

Bitcoin’s profitable days

Historically, Bitcoin has often shown impressive returns, with more than 96% of its lifetime proving profitable for investors.

The ongoing historical pattern, combined with the upcoming decrease in the value of the US dollar, strongly suggests an increase in the cost of Bitcoin.

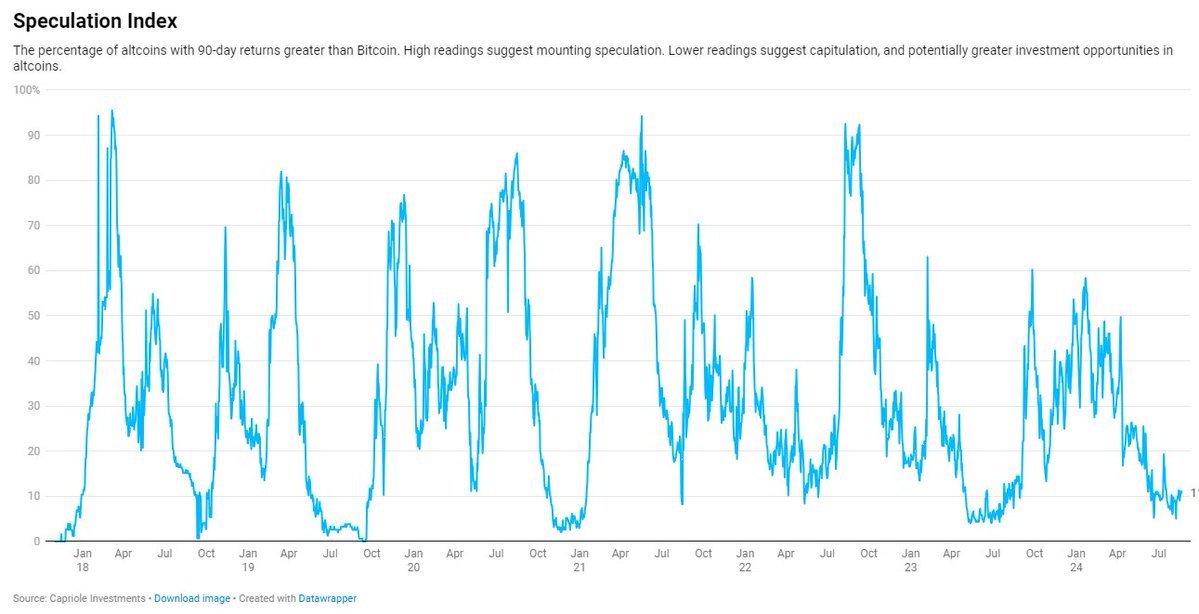

The Altcoin Speculation Index

Yet, it’s not just Bitcoin that stands to gain from the Federal Reserve’s decisions. It’s highly probable that the entire cryptocurrency market, encompassing significant alternatives such as Ethereum, Binance Coin (BNB), Solana, and Ripple (XRP), will experience a positive impact.

Currently, the Altcoin Speculation Index – at its minimum since mid-2023 – suggests that altcoin prices might have reached their lowest point. Translated, this index could be hinting at a potential period of growth as the US dollar weakens.

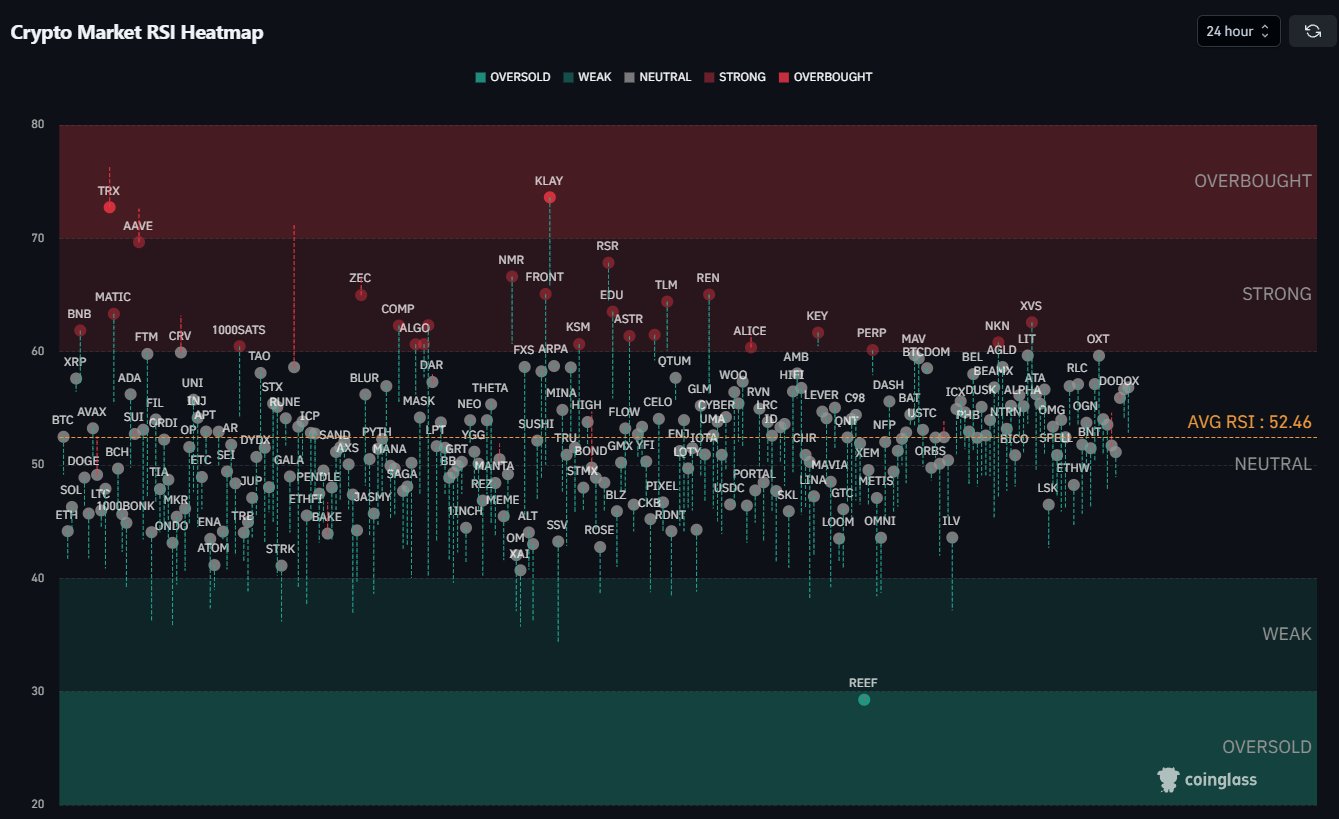

Crypto market RSI heatmap

It’s important to note that the overall cryptocurrency market seems to be displaying indications of improvement as well. The latest Crypto Market RSI Heatmap has shifted from an oversold state to neutral, which could imply that we might witness a resurgence in the market soon.

In simpler terms, the daily Relative Strength Index (RSI) has risen above the 50 mark, suggesting a strong momentum in the market that could potentially lead to more growth, but may start to show signs of being overbought soon.

With the Federal Reserve indicating possible interest rate reductions and a growing global liquidity, conditions appear favorable for an uptick in Bitcoin and the wider cryptocurrency market. This could present profitable opportunities for investors in various sectors.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-24 15:03