- Bitcoin struggles to stay above the bull market support band as Q4 approaches.

- Analysis of historical trends suggests a possible rally or further decline in Q4 2024.

As a researcher with a background in cryptocurrencies and market analysis, I’ve closely followed Bitcoin’s price movements and trends throughout the years. The recent dip below the $53,000 mark and subsequent struggle to regain that level has raised concerns about Bitcoin’s performance in Q4 2024.

Last week, the price of Bitcoin [BTC] took a significant downturn, reaching a low of around $53,000 – a figure not seen since February. This decline persisted as we moved into the new week.

Although Bitcoin has regained some ground, currently selling for more than $55,000, it still experiences a 2.4% decrease in value over the last 24 hours. The cryptocurrency is now priced at $55,704, with a recent low of $54,320.

I’ve been closely following Bitcoin’s price action lately, and just recently, well-known crypto analyst Benjamin Cowen shared his insights on social media platform X about the potential implications and future direction of Bitcoin’s price trend as we approach the end of the year.

As a researcher studying the cryptocurrency market, I’ve come across Cowen’s observation that Bitcoin’s recent performance might be a sign of a “summer lull,” a trend seen in past cycles. This means that Bitcoin’s price could experience a downturn during the summer months before potentially rebounding later in the year. However, whether Bitcoin will continue to grow in the last quarter depends on its capacity to recapture and sustain crucial price levels over the upcoming weeks.

Bitcoin’s likely performance in Q4

To gain a clearer perspective on the predictions for the fourth quarter, it’s crucial first to grasp the concept of a Bull Market Support Band (BMSB).

As a crypto investor, I closely monitor the behavior of certain technical indicators to make informed investment decisions. One such indicator I find particularly useful is the one that merges the 20-week simple moving average and the 21-week exponential moving average. In the context of bull markets, this combination becomes a crucial support level for me.

Maintaining a level above this range for an extended period is generally considered a bullish sign, while falling beneath it may indicate bearish trends.

According to Cowen’s analysis, Bitcoin is presently facing a test at its current support level. If past trends continue, Bitcoin’s movements throughout the summer may foreshadow its quarterly results in Q4.

In 2023, I noticed that Bitcoin dipped briefly below its key support level, the BMSB. However, towards the end of the year, I was thrilled to witness a strong rally in its price. This wasn’t an unusual occurrence for me; I had seen similar upward movements after dips below the BMSB in 2013 and 2016.

As a crypto investor, I’ve noticed that Cowen has drawn some intriguing comparisons between past market conditions and the current state of Bitcoin. Specifically, he sees similarities with summer downturns in previous years. For instance, during summers like the one we experienced in 2019, Bitcoin often struggled to break above its major support levels.

Conversely, years that saw a recovery above the BMSB often experienced robust Q4 rallies.

Bitcoin’s efforts to surpass its previous high, the BMSB (Bitcoin Market High), are currently being met with resistance. According to Cowen, this battle could result in either a robust comeback similar to those experienced in 2013 and 2016 or a more subdued recovery like the one observed in Q4 of 2019.

This uncertainty makes the coming weeks crucial for setting the tone for the remainder of the year.

Current market fundamentals

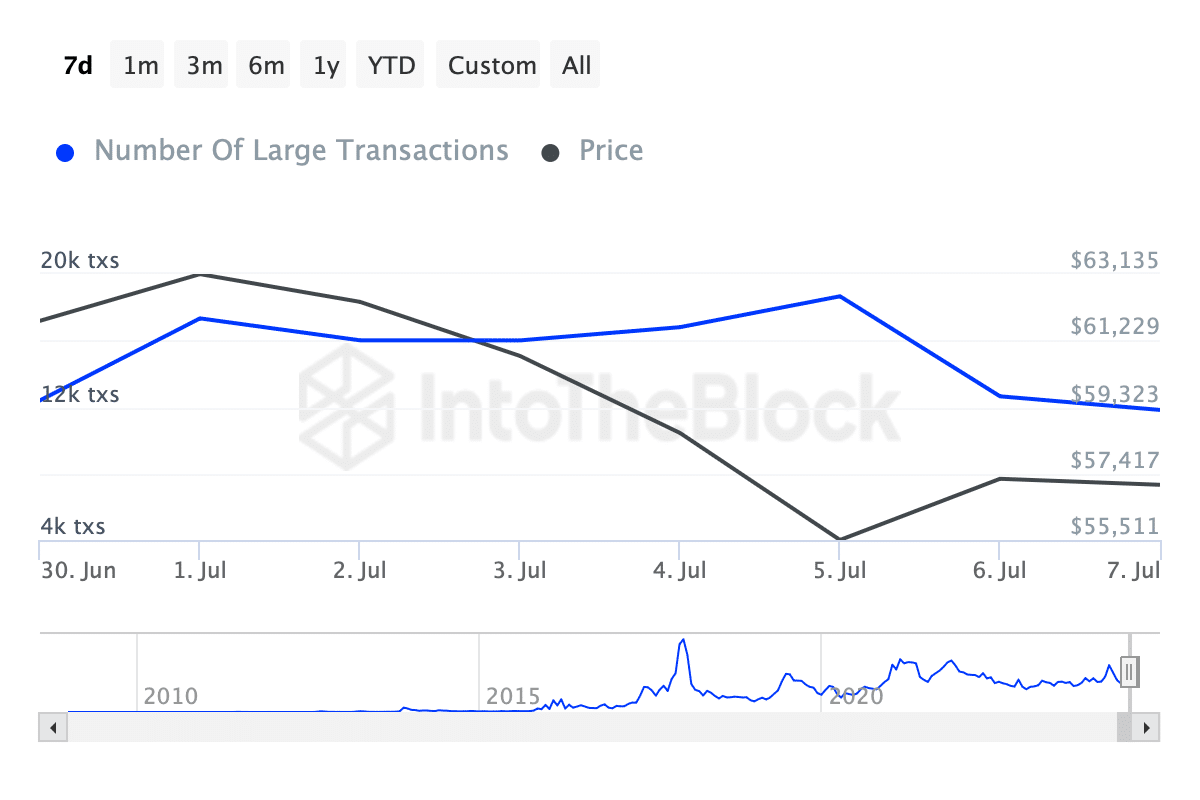

Looking at the core elements of Bitcoin’s activity, there has been a discernible decrease in large-scale transactions involving “whales.” This decline saw a substantial drop from approximately 17,000 whale transactions to below 12,000 within a single week.

A potential explanation for this decline is that it may signal waning enthusiasm from major investors or possibly the initiation of a period of mergers and acquisitions among bigger players in the market.

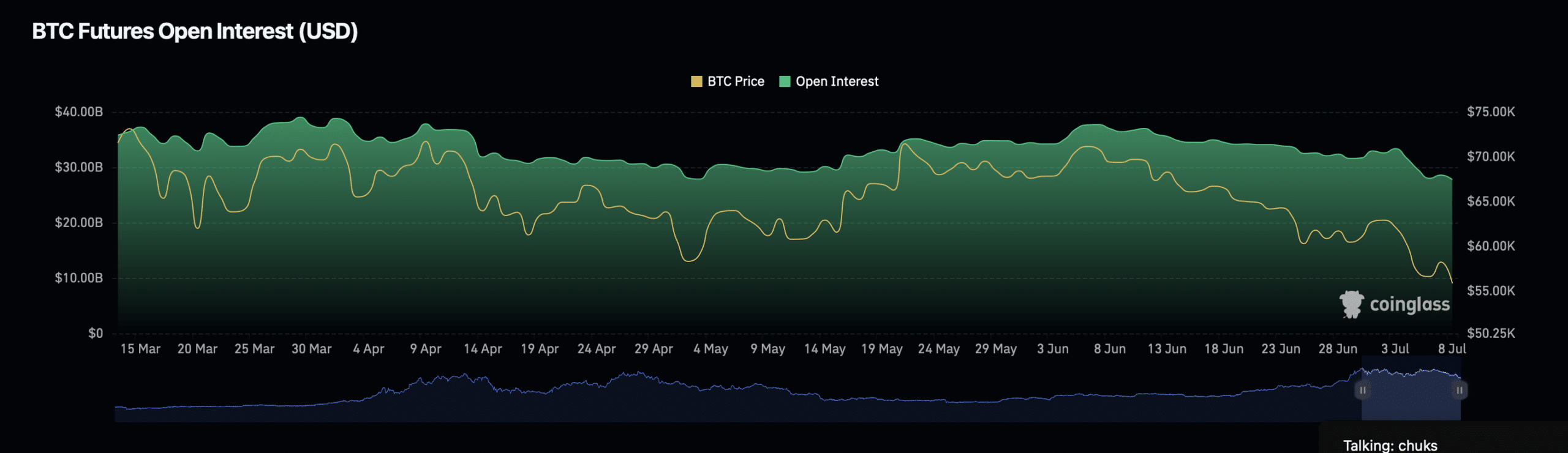

As an analyst, I’ve observed that Bitcoin’s open interest has dipped slightly by 2%, bringing the total to approximately $27.62 billion. Conversely, there’s been a notable surge in open interest volume, which has jumped by nearly 33% to reach around $57 billion.

With a decline in open interests, each trade represents more substantial importance as the number of active positions decreases, yet trading volumes continue to increase.

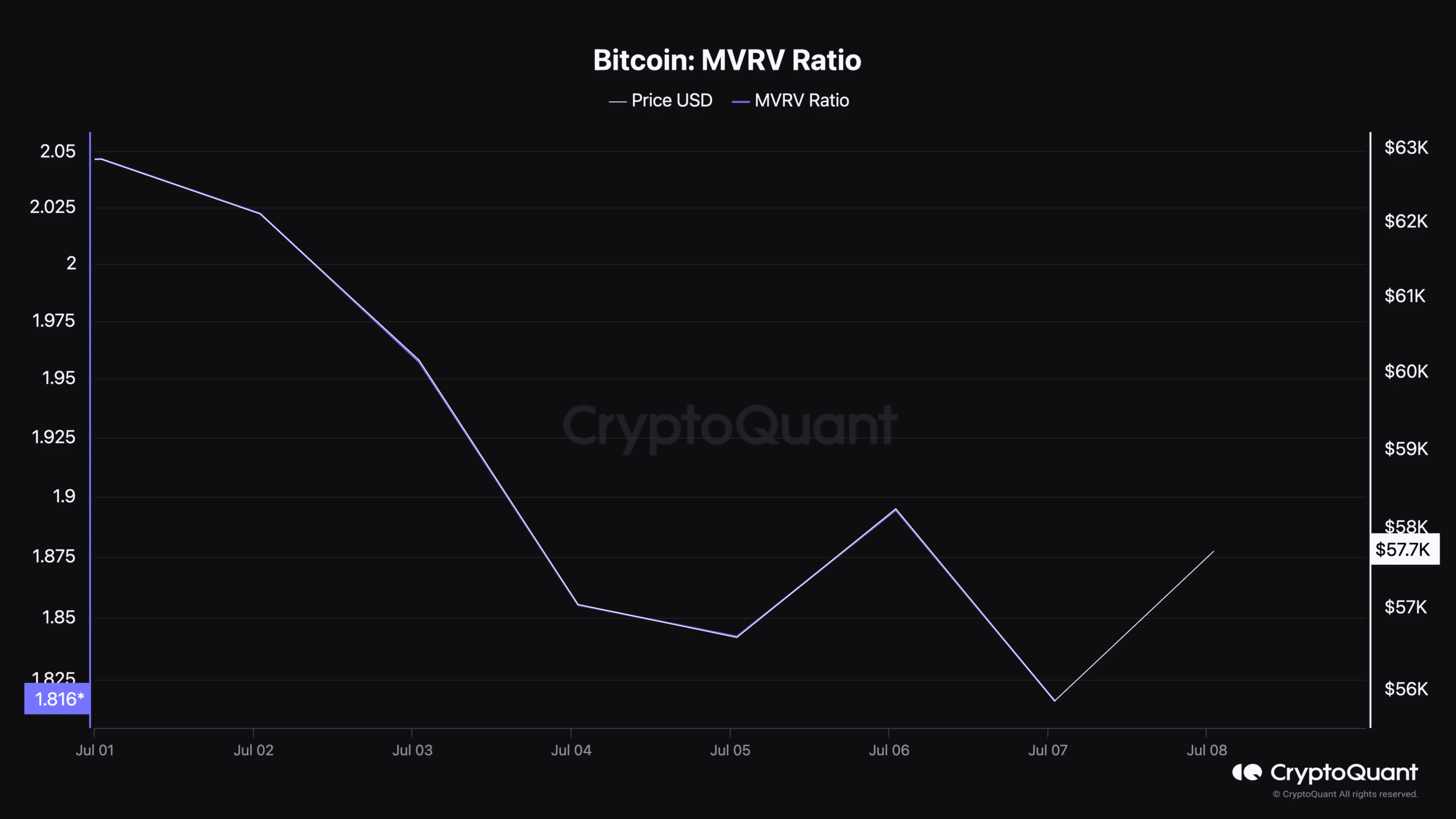

Additionally, the Market Value to Realized Value (MVRV) ratio for Bitcoin presently registers at 1.816, indicating a profitable market situation.

As a researcher studying financial markets, I would interpret a ratio greater than one as an indicator that the average investor is currently making a profit. This observation could imply that even amidst recent price declines, the general market sentiment might still be optimistic.

As Q4 approaches, the market remains at a critical juncture.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

As an analyst, I believe that Bitcoin’s ability to surpass key technical thresholds holds significant influence over the market trend in the imminent future. A successful rebound could pave the way for an impressive rally, marking the beginning of a new bullish phase. Alternatively, if Bitcoin fails to regain these critical levels, we may witness extended consolidation, indicating a more drawn-out period of price stability.

AMDCrypto has indicated in their latest report that the price of Bitcoin may have hit its lowest point, as a rise in on-chain realized losses suggests an impending Bitcoin rally is near.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-07-08 23:36